Below is a thread by @TuurDemeester from 2 years ago reposted with his blessing for those who can no longer see the thread:

"1/ People often ask me why I’m so “against” Ethereum. Why do I go out of my way to point out flaws or make analogies that put it in a bad light?"

"1/ People often ask me why I’m so “against” Ethereum. Why do I go out of my way to point out flaws or make analogies that put it in a bad light?"

"2/ First, ETH’s architecture & culture is _opposite_ that of Bitcoin, and yet claims to offer same solutions: decentralization, immutability, SoV, asset issuance, smart contracts,…

Second, ETH is considered a crypto ‘blue chip’, thus colors perception of uninformed newcomers."

Second, ETH is considered a crypto ‘blue chip’, thus colors perception of uninformed newcomers."

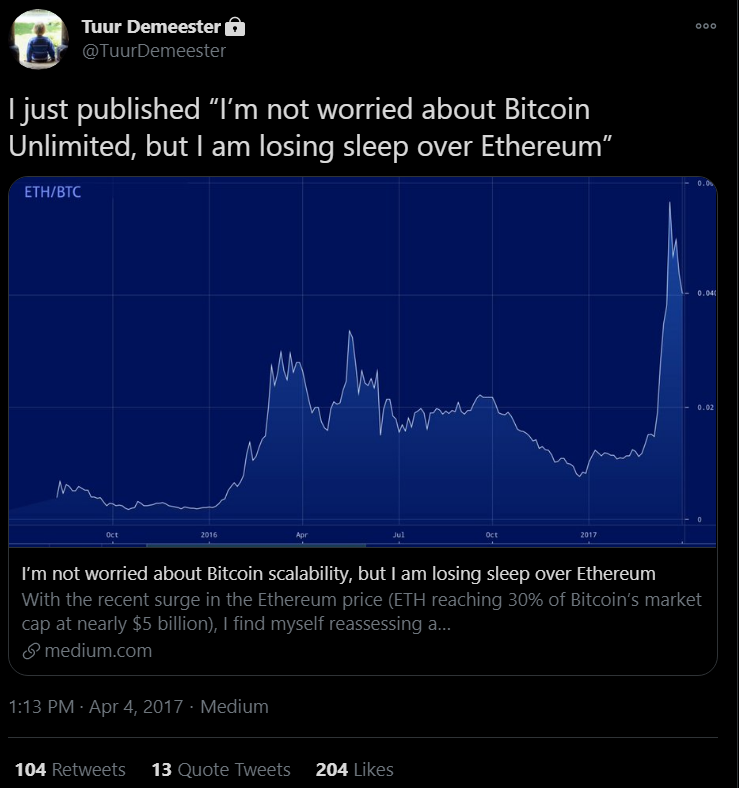

"3/ I've followed Ethereum since 2014 & feel a responsibility to share my concerns. IMO contrary to its marketing, ETH is at best a science experiment. It’s now valued at $13B, which I think is still too high."

"4/ I agree with Ethereum developer Vlad Zamfir that it’s not money, not safe, and not scalable." https://twitter.com/VladZamfir/status/859070189698265088

"5/ To me the first red flag came up when in our weekly hangout we asked the ETH founders about to how they were going to scale the network. (We’re now 4.5 years later, and sharding is still a pipe dream.)"

"6/ Despite strong optimism that on-chain scaling of Ethereum was around the corner (just another engineering job), this promise hasn’t been delivered on to date." https://blog.ethereum.network/devcon1-presentations-2448a8e07c3d

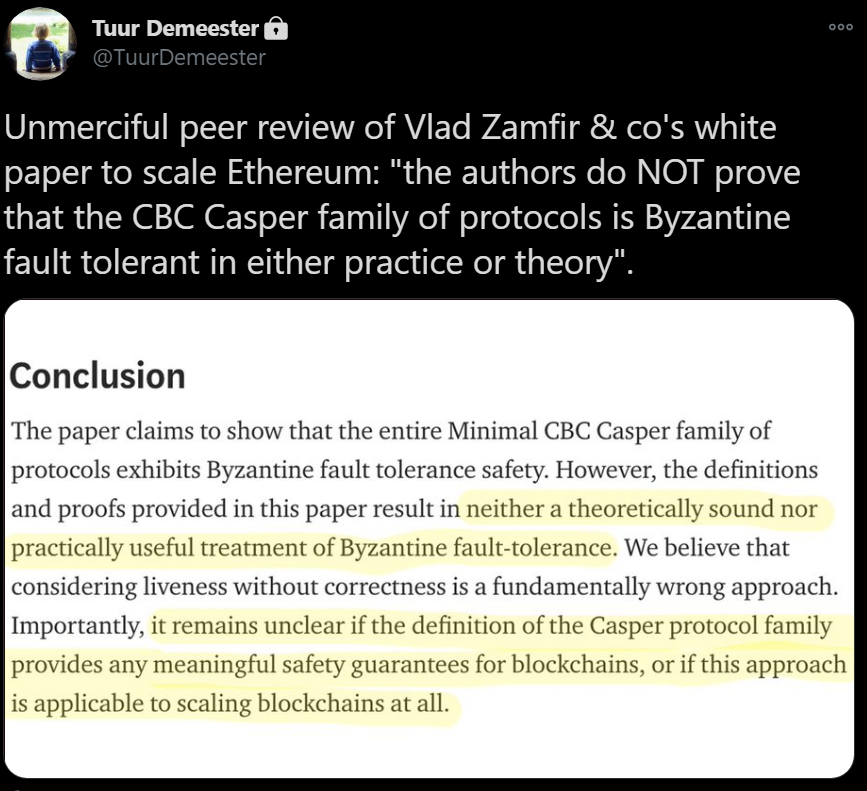

"7/ Recently, a team of reputable developers decided to peer review a widely anticipated Casper / sharding white paper, concluding that it does not live up to its own claims."

"8/ On the 2nd layer front, devs are now trying to scale Ethereum via scale via state channels (ETH’s version of Lightning), but it is unclear whether main-chain issued ERC20 type tokens will be portable to this environment." https://blog.coinfund.io/the-state-of-state-channels-2018-edition-f5492134ab96

"9/ Compare this to how the Bitcoin Lightning Network project evolved:" https://twitter.com/starkness/status/980120074777452546

"10/ Bitcoin’s Lightning Network is now live, and is growing at rapid clip." https://twitter.com/lopp/status/1077200836072296449

"12/ However, upon closer examination it was the recycling of some stale ideas, and the project went nowhere:" https://twitter.com/peterktodd/status/895562065091248128

"13/ The elephant in the room is the transition to proof-of-stake, an “environmentally friendly” way to secure the chain. (If this was the plan all along, why create a proof-of-work chain first?)"

"14/ For the uninitiated, here’s a good write-up that highlights some of the fundamental design problems of proof-of-stake. Like I said, this is science experiment territory." https://hugonguyen.medium.com/proof-of-stake-the-wrong-engineering-mindset-15e641ab65a2

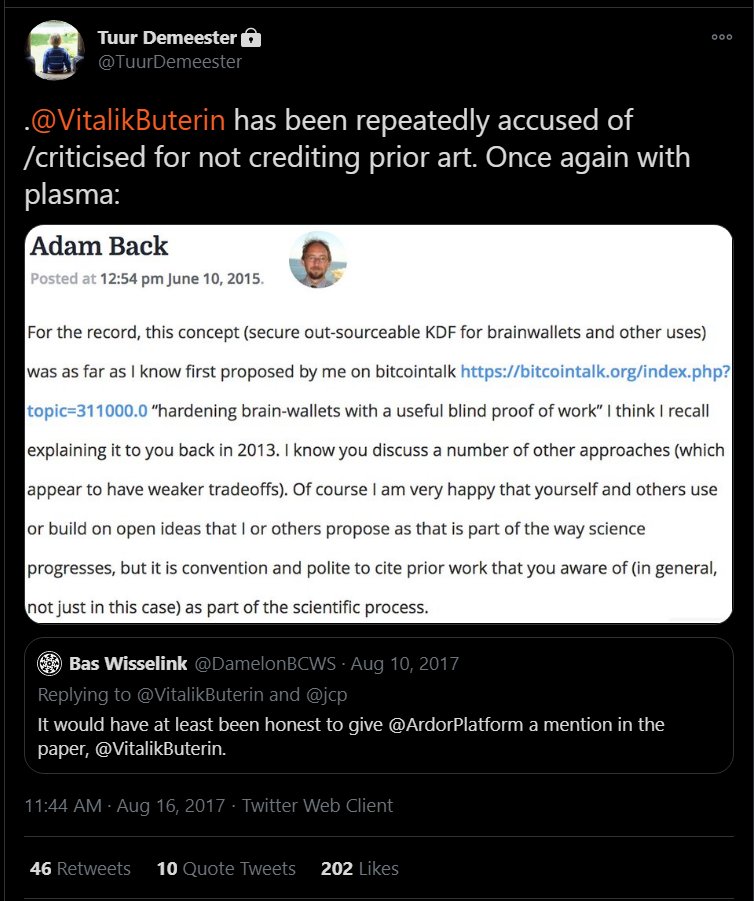

"15/ Also check out this thread about how Proof of Stake blockchains require subjectivity (i.e. a trusted third party) to achieve consensus: https://forum.blockstack.org/t/pos-blockchains-require-subjectivity-to-reach-consensus/762?u=muneeb and this thread on r/Bitcoin:" https://www.reddit.com/r/Bitcoin/comments/59t48m/proofofstake_question/

"16/ Keep in mind that Proof of Stake (PoS) is not a new concept at all. Proof-of-Work actually was one of the big innovations that made Bitcoin possible, after PoS was deemed impractical because of censorship vulnerability." https://medium.com/swlh/the-untold-history-of-bitcoin-enter-the-cypherpunks-f764dee962a1

"17/ Over the years, this has become a pattern in Ethereum’s culture: recycling old ideas while not properly referring to past research and having poor peer review standards. This is _not_ how science progresses."

"18/ One of my big concerns is that sophistry and marketing hype is a serious part of Ethereum’s success so far, and that overly inflated expectations have lead to an inflated market cap."

"19/ Let’s illustrate with an example."

"19/ Let’s illustrate with an example."

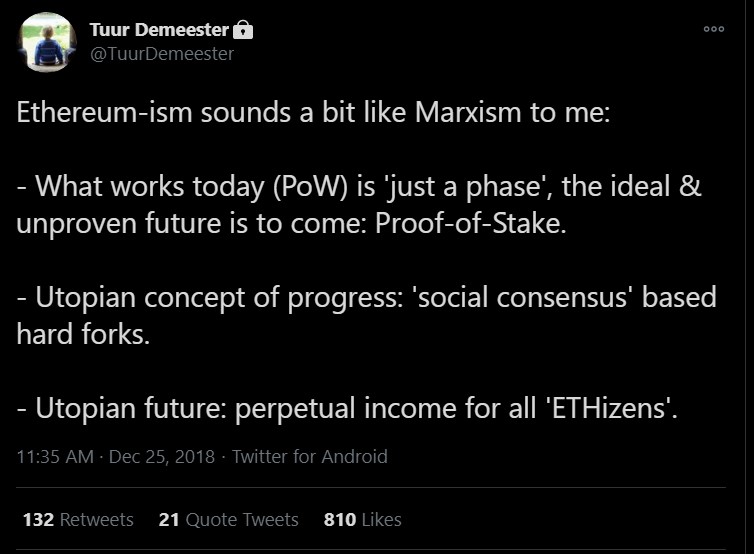

"20/ A few days ago, I shared a critical tweet that made the argument that Ethereum’s value proposition is in essence utopian."

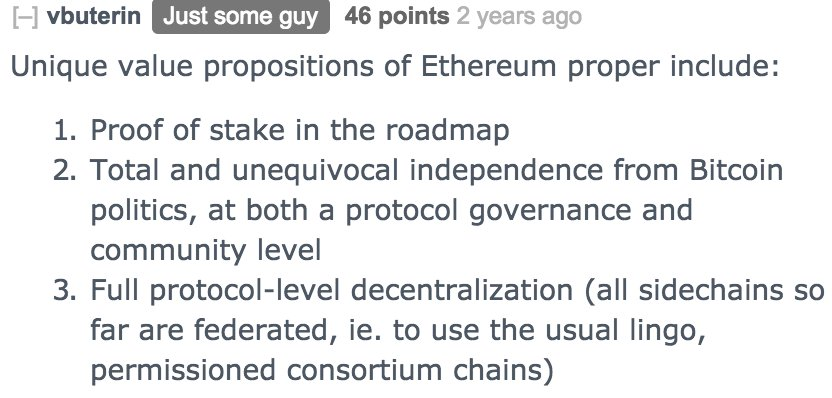

"21/ I was very serious about my criticism. In fact, each one of the three points addressed what Vitalik Buterin has described as “unique value propositions of Ethereum proper”." https://www.reddit.com/r/ethereum/comments/5jk3he/how_to_prevent_the_cannibalism_of_ethereum_into/dbgujr8/

"22/ My first point, about Ethereum developers rejecting Proof-of-Work, has been illustrated many times over By Vitalik and others. (See earlier in this tweetstorm for more about how PoS is unproven.)" https://twitter.com/VitalikButerin/status/1077548790272405504

"23/ My second point addresses Ethereum’s romance with the vague and dangerous notion of ‘social consensus’, where disruptive hard-forks are used to ‘upgrade’ or ‘optimize’ the system, which inevitably leads to increased centralization. More here:" https://medium.com/@tuurdemeester/critique-of-buterins-a-proof-of-stake-design-philosophy-49fc9ebb36c6

"24/ My third point addresses PoS’ promise of perpetual income to ETHizens. Vitalik is no stranger to embracing free lunch ideas, e.g. during his 2014 ETH announcement speech, where he described a coin with a 20% inflation tax as having “no cost” to users."

"25/ In his response to my tweet, Vitalik adopted my format to “play the same game” in criticizing Bitcoin. My criticisms weren't addressed, and his response was riddled with errors. Yet his followers gave it +1,000 upvotes!" https://twitter.com/VitalikButerin/status/1077710720924434432

"26/ Rebuttal:

- BTC layer 1 is not “just a phase”, it always will be its definitive bedrock for transaction settlement.

- Soft forking digital protocols has been the norm for over 3 decades—hard-forks are the deviation!

- Satoshi never suggested hyperbitcoinization as a goal."

- BTC layer 1 is not “just a phase”, it always will be its definitive bedrock for transaction settlement.

- Soft forking digital protocols has been the norm for over 3 decades—hard-forks are the deviation!

- Satoshi never suggested hyperbitcoinization as a goal."

"27/ This kind of sophistry is exhausting and completely counter-productive, but it can be very convincing for an uninformed retail public."

"28/ Let me share a few more inconvenient truths."

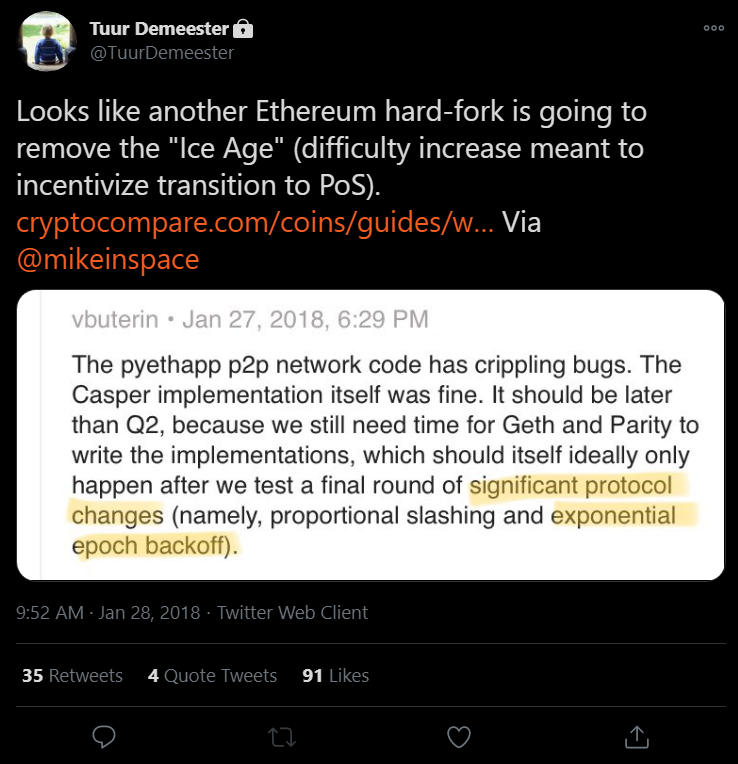

"29/ In order to “guarantee” the transition to PoS’ utopia of perpetual income (staking coins earns interest), a “difficulty bomb” was embedded in the protocol, which supposedly would force miners to accept the transition." https://ethereum.stackexchange.com/questions/323/what-is-the-difficulty-bomb-and-what-is-the-goal-of-it

"30/ Of course, nothing came of this, because anything in the ETH protocol can be hard-forked away. Another broken promise."

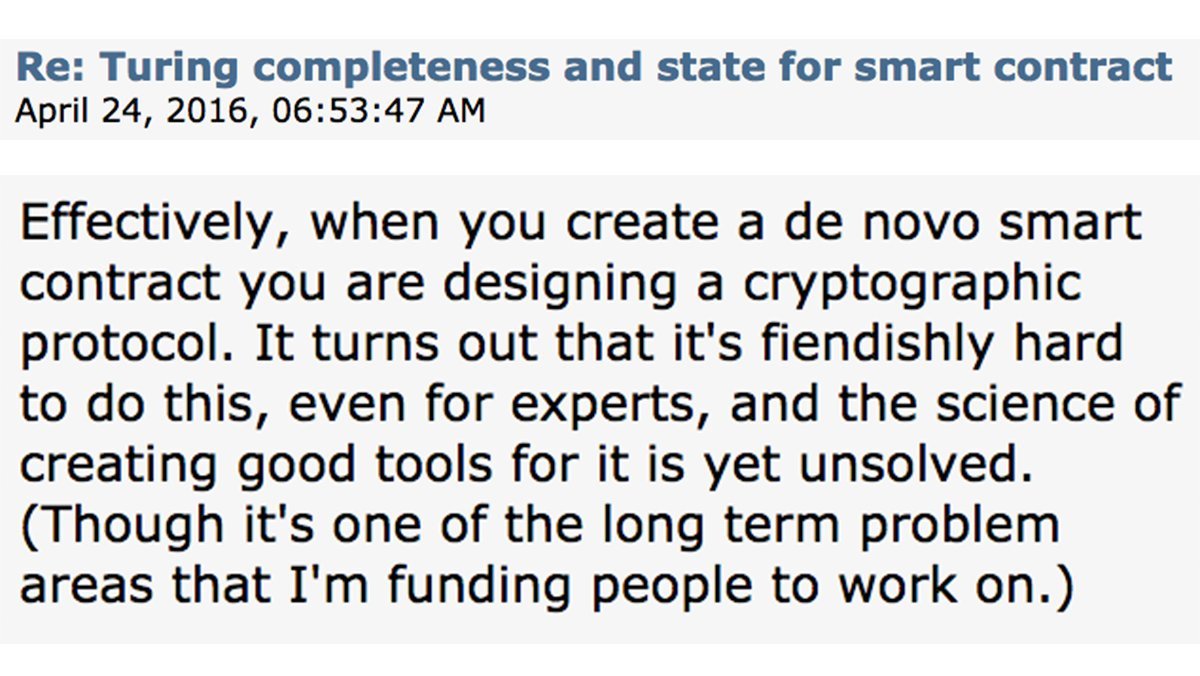

"31/ Another idea that was marketed heavily early on, was that with ETH you could program smart contract as easily as javascript applications."

"32/ This was criticized by P2P & OS developers as a reckless notion, given that every smart contracts is actually a “de novo cryptographic protocol”. In other words, it’s playing with fire." https://bitcointalk.org/index.php?topic=1427885.msg14601127#msg14601127

"33/ The modular approach to Bitcoin seems to be much better at compartmentalizing risk, and thus reducing attack surfaces. I’ve written about modular scaling here:" https://medium.com/@tuurdemeester/bitcoin-digital-gold-or-digital-cash-both-382a346e6c79

"34/ Another huge issue that Ethereum has is with scaling. By putting “everything on the blockchain” (which stores everything forever) and dubbing it “the world computer”, you are going to end up with a very slow and clogged up system." https://twitter.com/ChristopherA/status/883874266944491520

"35/ By now the Ethereum bloat is so bad that cheaply running an individual node is practically impossible for a lay person. ETH developers are also imploring people to not deploy more smart contract apps on its blockchain."

"36/ As a result, and despite the claims that running a node in “warp” mode is easy and as good as a full node, Ethereum is becoming increasingly centralized."

"37/ Another hollow claim: in 2016, Ethereum was promoted as being censorship resistant…"

http://ow.ly/qW49302Pp92

http://ow.ly/qW49302Pp92

"38/ Yet later that year, after only 6% of ETH holders had cast a vote, ETH core devs decided to endorse a hard-fork that clawed back the funds from a smart contract that held 4.5% of all ETH in circulation. More here:" https://medium.com/@tuurdemeester/why-im-short-ethereum-and-long-bitcoin-aee5b1c198fd

"39/ Other potential signs of centralization: Vitalik Buterin signing a deal with a Russian government institution, and ETH core developers experimenting with semi-closed meetings:" https://twitter.com/coindesk/status/902892844955860993 https://twitter.com/hudsonjameson/status/1069646446629130240

"40/ Another red flag to me is the apparent lack of relevant expertise in the ETH development community. (Check the responses…)"

"41/ For a while, Microsoft veteran Lucius Meredith was mentioned as playing an important role in ETH scaling, but now he is likely distracted by the failure of his ETH scaling company RChain." https://blog.ethereum.org/2015/12/24/understanding-serenity-part-i-abstraction/ https://cryptoinsider.com/rchain-facing-troubled-waters/

"42/ Perhaps the recently added Gandalf of Ethereum, with his “Fellowship of Ethereum Magicians” [sic] can save the day, but imo that seems unlikely:" https://decryptmedia.com/2018/12/07/greg-colvin-ethereum-developer-interview/

"43/ This is becoming a long tweetstorm, so let’s wrap up with a few closing comments."

"44/ Do I have a conflict of interest? ETH is a publicly available asset with no real barriers to entry, so I could easily get a stake. Also, having met Vitalik & other ETH founders several times in 2013-’14, it would have been doable for me to become part of the in-crowd."

"45/ Actually, I was initially excited about Ethereum’s smart contract work - this was before one of its many pivots."

"46/ Also, I have done my share of soul searching about whether I could be suffering from survivor’s bias."

"47/ Here’s why Ethereum is dubious to me: rather than creating an open source project & testnet to work on these interesting computer science problems, its founders instead did a securities offering, involving many thousands of clueless retail investors."

"48/ Investing in the Ethereum ICO was akin to buying shares in a startup that had “invent time travel” as part of its business plan. Imo it was a reckless security offering, and it set the tone for the terrible capital misallocation of the 2017 ICO boom."

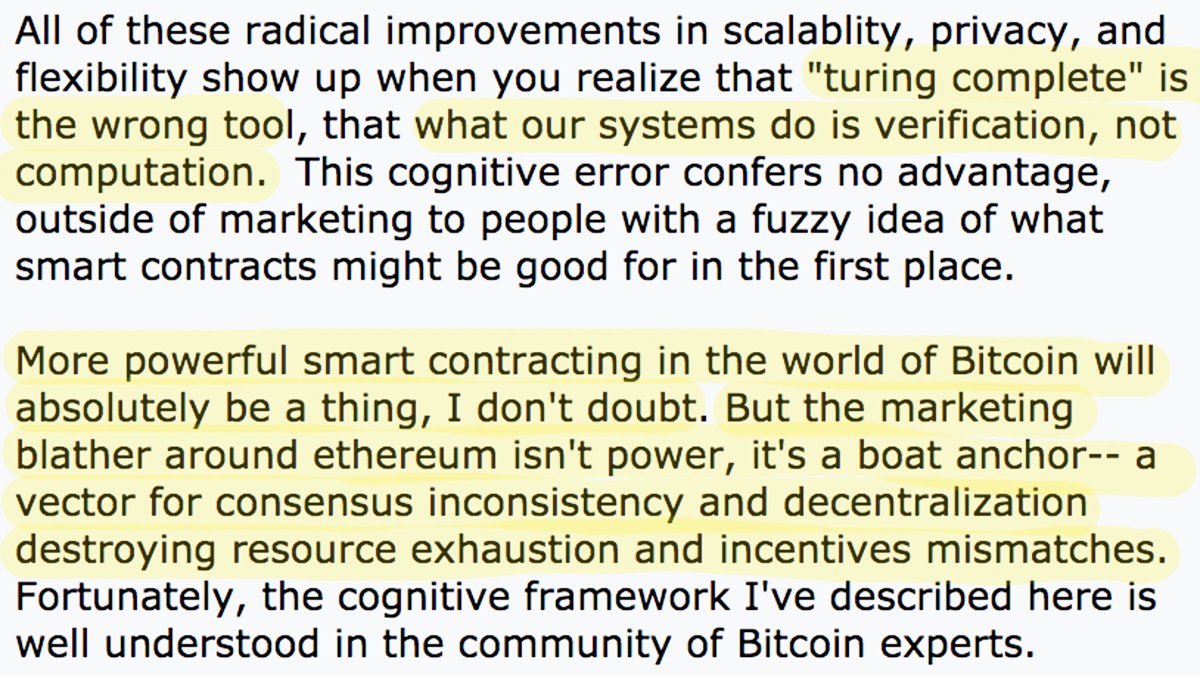

"50/ I’ll close with a few words from Gregory Maxwell from 2016:" https://bitcointalk.org/index.php?topic=1427885.msg14601127#msg14601127

Thanks again to @TuurDemeester for agreeing to have this re-posted. Here's a link to the original thread for those that can still see it:

https://twitter.com/TuurDemeester/status/1078687258952257537

https://twitter.com/TuurDemeester/status/1078687258952257537

Read on Twitter

Read on Twitter