1/8 Thread I reacted to the JPM projections earlier and many have asked why do I consider this to be total bullshit. Here is a detailed analysis that debunks these gross attempts to manipulate the opinion into believing a wall of demand is about to hit equities. https://twitter.com/themarketear/status/1336662116397420545

2/8 Here is the estimates table. If one does without the various small variations that are riddled with inaccuracies the $ 1 tn. estimate is basically - 500 bn of supply and + 500 bn of incremental retail demand.

3/8 Supply: Equity total supply is : IPOs + Secondaries + Prefs + Net insider selling. I will deal with insider selling next. First corporate supply. 2020 YTD is the highest supply ON RECORD with $ 339 bn second after $ 306 bn. These peaks are attained at peak valuation.

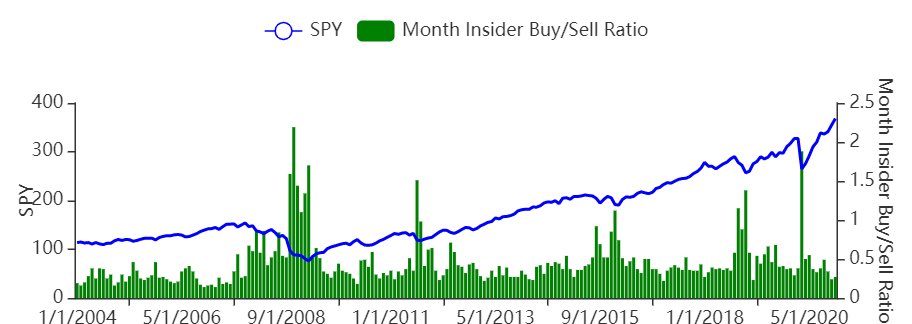

4/8 Corporate issuers are issuing max amounts of equity because they know better. The largest supply drop on record was 2001 and it was only $ 120 bn. Insiders are also in peak supply mode. Insider’s Buy/Sell ratio is 0,25, the lowest on record at par with 07.

5/8 Net Insider Supply is estimated this year around $ 30 bn and that is a double from recent years average. They also know better. But even if it reverts back to average, that’s a $ 15 bn delta. So max potential delta if market crashes is $ 135 bn less supply.

6/8 on the demand side, retail are all in already. Here are some statistics to show it:

2020 total traded volume on all exchanges should be close to $ 5.75 tn. vs $ 3.9 tn. in ‘19. Retail share of that is $ 1.6 tn. vs $ 0.4 tn. in ‘19. That’s already + $ 1.2 tn. of cash into eq

2020 total traded volume on all exchanges should be close to $ 5.75 tn. vs $ 3.9 tn. in ‘19. Retail share of that is $ 1.6 tn. vs $ 0.4 tn. in ‘19. That’s already + $ 1.2 tn. of cash into eq

Read on Twitter

Read on Twitter