$AI IPO +135%

$AI IPO +135%

Develops a SaaS tool that enables enterprises to easily process and analyse data

Develops a SaaS tool that enables enterprises to easily process and analyse data Counts the US Air Force, Shell and Koch Industries as it clients

Counts the US Air Force, Shell and Koch Industries as it clients Sales grew 71% YoY and reached $ 157m for FY20

Sales grew 71% YoY and reached $ 157m for FY20Here is an EASY thread

http://C3.ai $AI was founded in 2009 and provided a software for energy management  It quickly expanded and now provides an enterprise AI software

It quickly expanded and now provides an enterprise AI software

The software works as an SaaS and can be deployed in the cloud on AWS, Azure, GCP, IBM Cloud or on-premise

on AWS, Azure, GCP, IBM Cloud or on-premise

It quickly expanded and now provides an enterprise AI software

It quickly expanded and now provides an enterprise AI softwareThe software works as an SaaS and can be deployed in the cloud

on AWS, Azure, GCP, IBM Cloud or on-premise

on AWS, Azure, GCP, IBM Cloud or on-premise

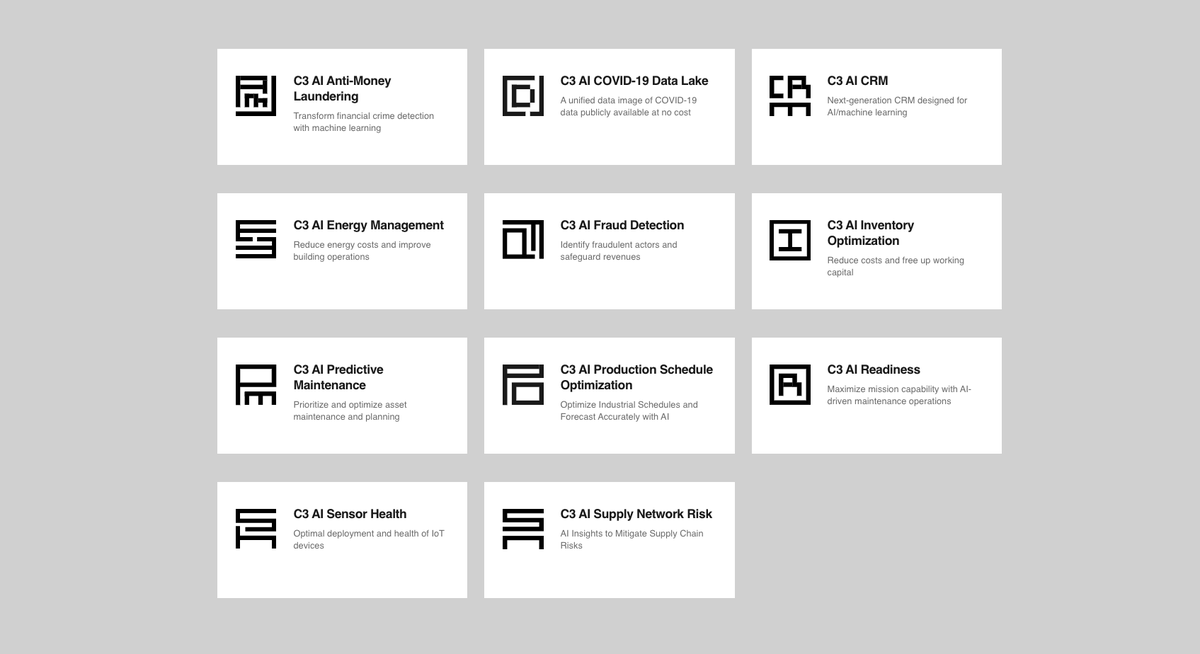

$AI uses machine learning  to help companies with predictive maintenance, fraud detection, anti-money laundering, inventory optimisation and predictive CRM

to help companies with predictive maintenance, fraud detection, anti-money laundering, inventory optimisation and predictive CRM

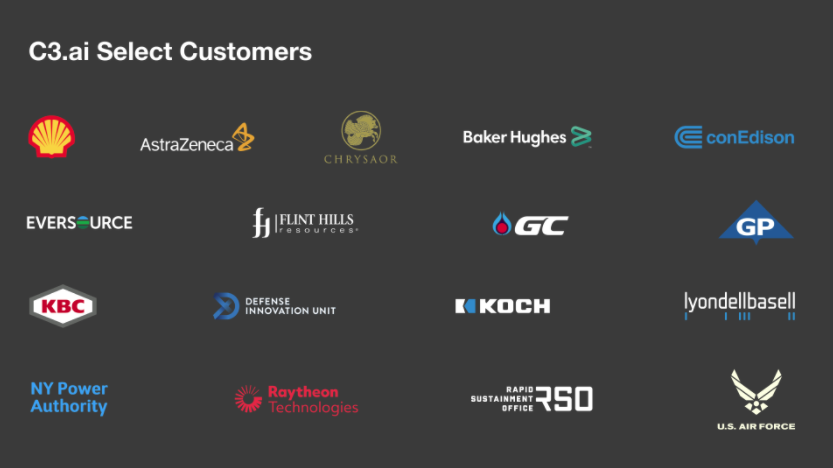

This software is now used by private and public clients such as 3M, Shell, the US Air Force, Raytheon

This software is now used by private and public clients such as 3M, Shell, the US Air Force, Raytheon

to help companies with predictive maintenance, fraud detection, anti-money laundering, inventory optimisation and predictive CRM

to help companies with predictive maintenance, fraud detection, anti-money laundering, inventory optimisation and predictive CRM This software is now used by private and public clients such as 3M, Shell, the US Air Force, Raytheon

This software is now used by private and public clients such as 3M, Shell, the US Air Force, Raytheon

For example  The US Air Force uses http://C3.AI ’s software to predict engine failures before they occur by gathering and processing vast amounts of aircraft data

The US Air Force uses http://C3.AI ’s software to predict engine failures before they occur by gathering and processing vast amounts of aircraft data

The US Air Force uses http://C3.AI ’s software to predict engine failures before they occur by gathering and processing vast amounts of aircraft data

The US Air Force uses http://C3.AI ’s software to predict engine failures before they occur by gathering and processing vast amounts of aircraft data

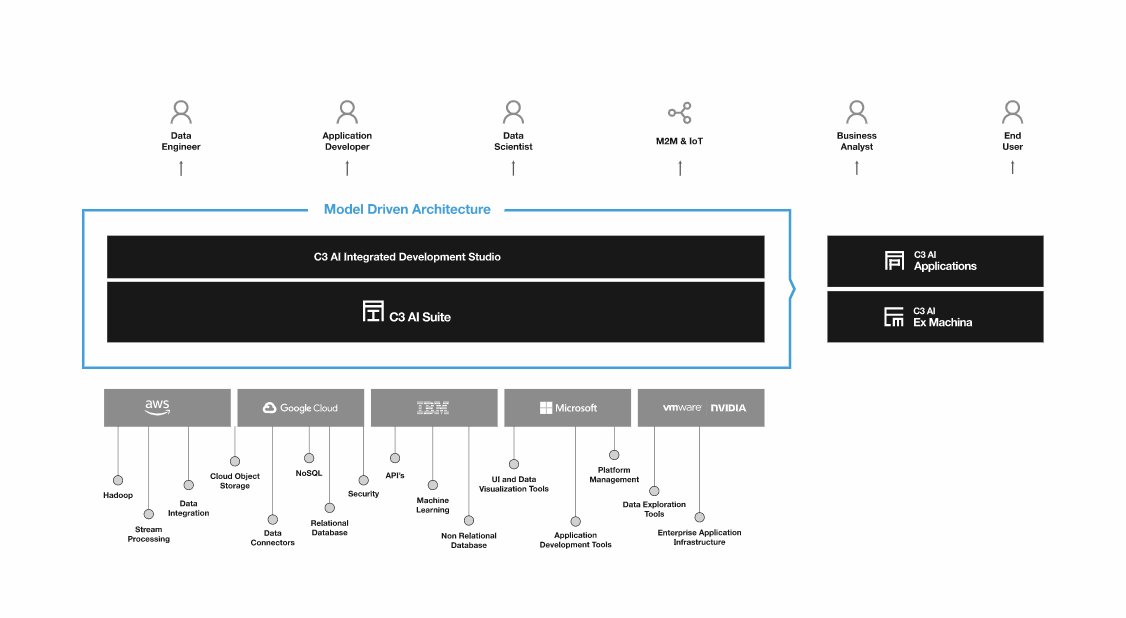

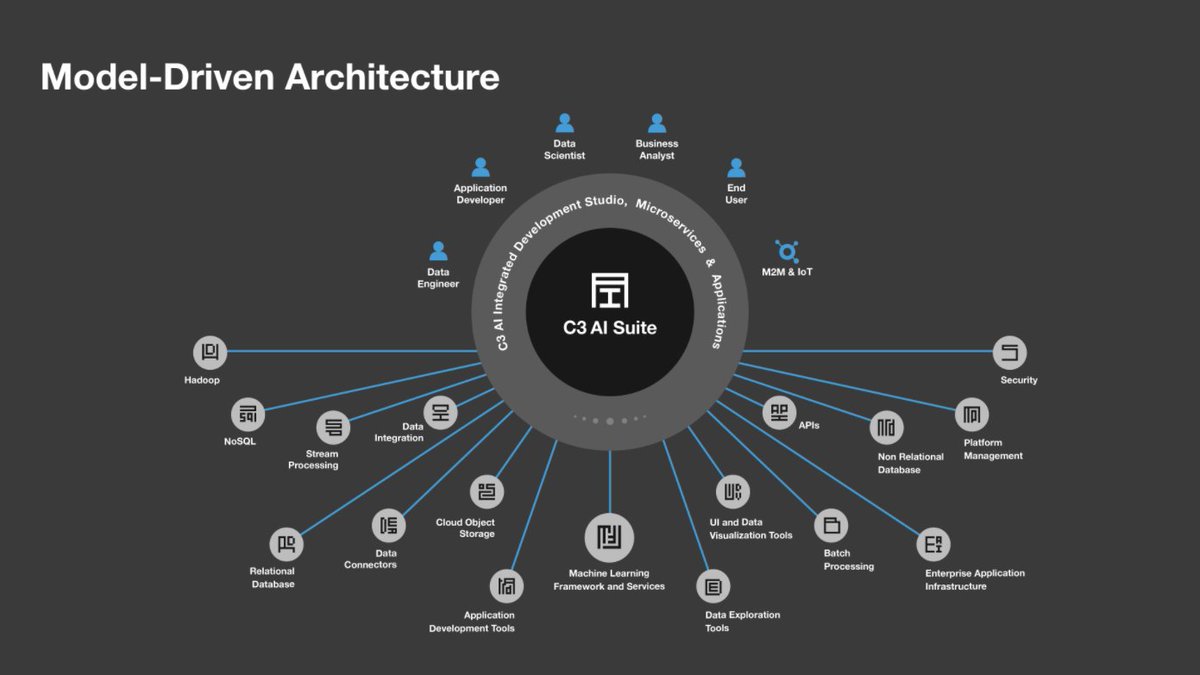

C3 AI Suite

C3 AI SuiteThis acts as a layer on top of the underlying infrastructure (databases, servers, API’s, visualisation tools)

It enables users to interact with the C3 AI Suite and build their own applications instead of having to write lengthy code

It enables users to interact with the C3 AI Suite and build their own applications instead of having to write lengthy code

http://C3.AI provides thousands of pre-built models that can be modified and extended, and developers can create their own models as well

http://C3.AI provides thousands of pre-built models that can be modified and extended, and developers can create their own models as well

From C3 AI’s website:

“These prebuilt, extensible models encompass a vast range of entities, including business objects (customer, order, contract, etc.), physical systems and subsystems (engine, boiler, chiller, compressor, etc.), computing resources...

“These prebuilt, extensible models encompass a vast range of entities, including business objects (customer, order, contract, etc.), physical systems and subsystems (engine, boiler, chiller, compressor, etc.), computing resources...

... and services (database, stream processing, etc.) – anything at all that an application requires, can be represented as a model in the model-driven architecture” https://c3.ai/c3-ai-suite/model-driven-architecture/

Simply put, the C3 AI Suite help developers build their own data processing and machine learning pipelines

Simply put, the C3 AI Suite help developers build their own data processing and machine learning pipelines This is done by limiting the amount of code developers need to write as they can rely on $AI ’s built-in models

This is done by limiting the amount of code developers need to write as they can rely on $AI ’s built-in models

CR AI Applications

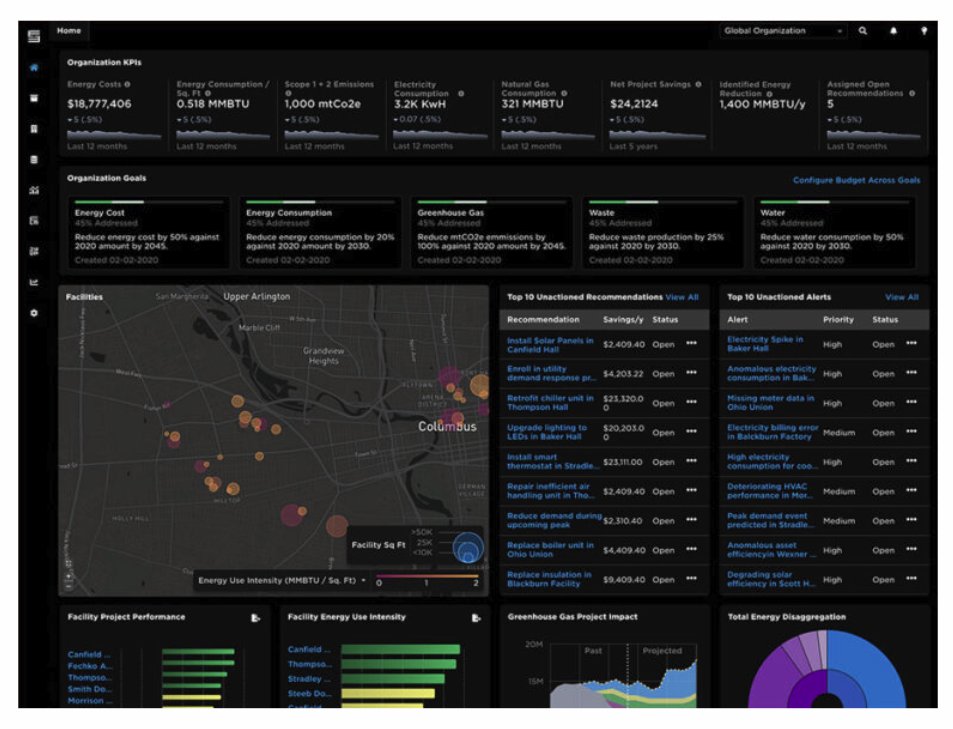

CR AI ApplicationsThese are pre-built SaaS applications for rapidly addressing high-value use cases such as anti-money laundering, fraud detection, energy management

These applications have been built by http://C3.ai on top of the their CR AI Suite and enable enterprises to plug their data and play with a live dashboard

These applications have been built by http://C3.ai on top of the their CR AI Suite and enable enterprises to plug their data and play with a live dashboard

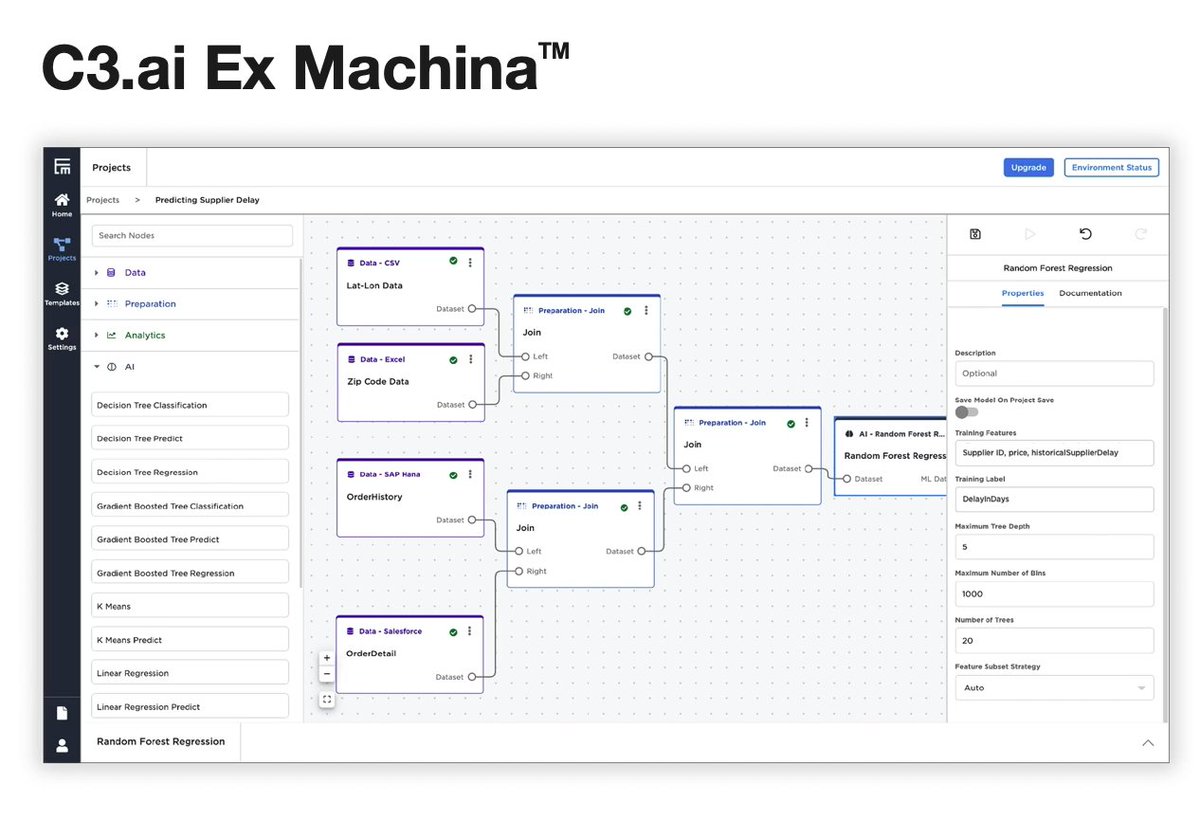

C3 AI Ex Machina

C3 AI Ex MachinaIt allows business analysts, data analysts, and data scientists to rapidly develop AI analytics on big data in a visual interface

This is a click-and-select, drag-and-drop data analysis tool that enables users to connect, process, visualise & analyse data

This is a click-and-select, drag-and-drop data analysis tool that enables users to connect, process, visualise & analyse data

Good  But why are these tools important?

But why are these tools important?

Can’t corporates just have their own developers process the data?

Can’t corporates just have their own developers process the data?

“C3 AI Suite and C3 AI Applications allow organizations to dramatically simplify and accelerate Enterprise AI adoption”

But why are these tools important?

But why are these tools important?  Can’t corporates just have their own developers process the data?

Can’t corporates just have their own developers process the data?“C3 AI Suite and C3 AI Applications allow organizations to dramatically simplify and accelerate Enterprise AI adoption”

“Compared to the structured programming approach that most organizations typically attempt, we estimate that our model-driven architecture speeds development by a factor of 26, while reducing the amount of code that must be written by up to 99%”

Great! So what’s the market for these tools

The total addressable market for $AI is set to grow by 12% / year over the 2020 - 2024 period, going from $ 174B to $ 271B

for $AI is set to grow by 12% / year over the 2020 - 2024 period, going from $ 174B to $ 271B

The total addressable market

for $AI is set to grow by 12% / year over the 2020 - 2024 period, going from $ 174B to $ 271B

for $AI is set to grow by 12% / year over the 2020 - 2024 period, going from $ 174B to $ 271B

This market can be further split in 3

Enterprise AI Software growing at 24% / year over the same period from $ 18B to $ 44B according to IDC

Enterprise AI Software growing at 24% / year over the same period from $ 18B to $ 44B according to IDC

Enterprise Infrastructure Software growing at 7% / year over the same period from $ 63B to $ 82B according to Gartner

Enterprise Infrastructure Software growing at 7% / year over the same period from $ 63B to $ 82B according to Gartner

Enterprise AI Software growing at 24% / year over the same period from $ 18B to $ 44B according to IDC

Enterprise AI Software growing at 24% / year over the same period from $ 18B to $ 44B according to IDC Enterprise Infrastructure Software growing at 7% / year over the same period from $ 63B to $ 82B according to Gartner

Enterprise Infrastructure Software growing at 7% / year over the same period from $ 63B to $ 82B according to Gartner

Enterprise Applications (analytics, business intelligence and CRM) growing at 12% / year over the same period from $ 93B to $ 145B according to Gartner

Enterprise Applications (analytics, business intelligence and CRM) growing at 12% / year over the same period from $ 93B to $ 145B according to Gartner

Who is the figure behind $AI ? Well, no one less than Tom Siebel, founder of Siebel Systems (CRM tool that merged with Oracle)

Some of his awards

Entrepreneur of the Year – EY, 2018 and 2017

Entrepreneur of the Year – EY, 2018 and 2017

100% CEO approval rating – Glassdoor, 2017

100% CEO approval rating – Glassdoor, 2017

Top 10 CEOs of 2000 – IBD

Top 10 CEOs of 2000 – IBD

Some of his awards

Entrepreneur of the Year – EY, 2018 and 2017

Entrepreneur of the Year – EY, 2018 and 2017 100% CEO approval rating – Glassdoor, 2017

100% CEO approval rating – Glassdoor, 2017 Top 10 CEOs of 2000 – IBD

Top 10 CEOs of 2000 – IBD

What is the Pitch for $AI?

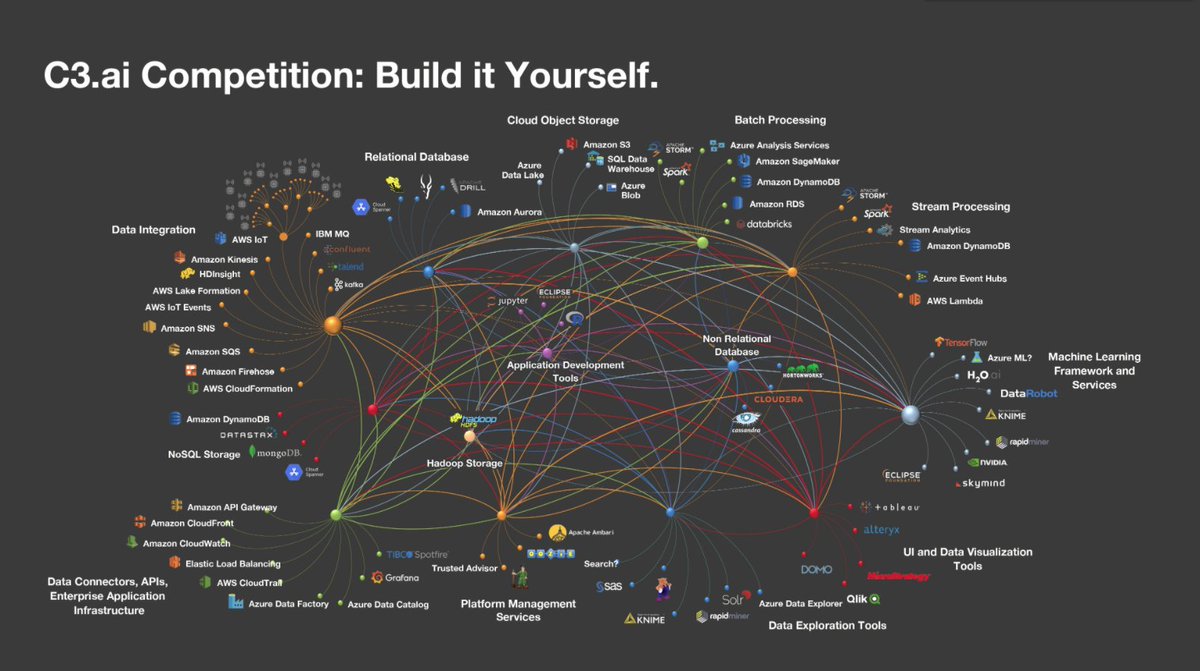

Let’s say you are a large retailer and want to make best use of your data to improve your operations

Let’s say you are a large retailer and want to make best use of your data to improve your operations

Well, you start and quickly stumble in front of the many systems, libraries, data stores and many more other tools that build the data ecosystem

Well, you start and quickly stumble in front of the many systems, libraries, data stores and many more other tools that build the data ecosystem

Let’s say you are a large retailer and want to make best use of your data to improve your operations

Let’s say you are a large retailer and want to make best use of your data to improve your operations Well, you start and quickly stumble in front of the many systems, libraries, data stores and many more other tools that build the data ecosystem

Well, you start and quickly stumble in front of the many systems, libraries, data stores and many more other tools that build the data ecosystem

What’s your first idea? Let’s build our own solution!

You set up your data bases, servers, data exploration tools… and more!

You set up your data bases, servers, data exploration tools… and more!

You quickly realise that this is not really the plug and play solution you were hoping for…

You quickly realise that this is not really the plug and play solution you were hoping for…

You set up your data bases, servers, data exploration tools… and more!

You set up your data bases, servers, data exploration tools… and more! You quickly realise that this is not really the plug and play solution you were hoping for…

You quickly realise that this is not really the plug and play solution you were hoping for…

Now, what about a single tool that is complex enough to provide flexibility

Now, what about a single tool that is complex enough to provide flexibility  But simple enough so that data scientist, analysts and developers can use?

But simple enough so that data scientist, analysts and developers can use? Here is http://C3.ai : Integrates with all the tools / vendors and is able to support different clouds

Here is http://C3.ai : Integrates with all the tools / vendors and is able to support different clouds

What’s more?

$MSFT and Koch Industries intend to purchase $ 150m worth of shares at IPO price

$MSFT and Koch Industries intend to purchase $ 150m worth of shares at IPO price

At the midpoint of the proposed range, $AI would command a fully diluted market value of $ 4.3B

At the midpoint of the proposed range, $AI would command a fully diluted market value of $ 4.3B

$MSFT and Koch Industries intend to purchase $ 150m worth of shares at IPO price

$MSFT and Koch Industries intend to purchase $ 150m worth of shares at IPO price At the midpoint of the proposed range, $AI would command a fully diluted market value of $ 4.3B

At the midpoint of the proposed range, $AI would command a fully diluted market value of $ 4.3B

Financial Check

Financial Check

Sales reached $ 157m in FY20 up from $ 92m a year earlier (71% YoY growth)

Sales reached $ 157m in FY20 up from $ 92m a year earlier (71% YoY growth) Cost of sales stood at $ 38m, leaving a Gross Margin of 75% (down from 79% a year earlier)

Cost of sales stood at $ 38m, leaving a Gross Margin of 75% (down from 79% a year earlier) Operating expenses stood at $ 189m up from $ 97m a year earlier

Operating expenses stood at $ 189m up from $ 97m a year earlier

OpEx stood at 121% of sales, down from 125% a year earlier

OpEx stood at 121% of sales, down from 125% a year earlier Company has around $ 115m in cash and plans to raise $ 504m in order to fund its operations (working capital, OpEx and CapEx)

Company has around $ 115m in cash and plans to raise $ 504m in order to fund its operations (working capital, OpEx and CapEx)

COVID Hit

COVID Hit

Sales were only up 16% YoY to $ 40.4m for the Q ended July 31

Sales were only up 16% YoY to $ 40.4m for the Q ended July 31 COVID had an adverse impact on $AI as its clients (large corporates) re-prioritised and sales took longer to close

COVID had an adverse impact on $AI as its clients (large corporates) re-prioritised and sales took longer to close

Certainly as $AI clients are large banks and oil & gas companies which have been hit hard by the pandemic

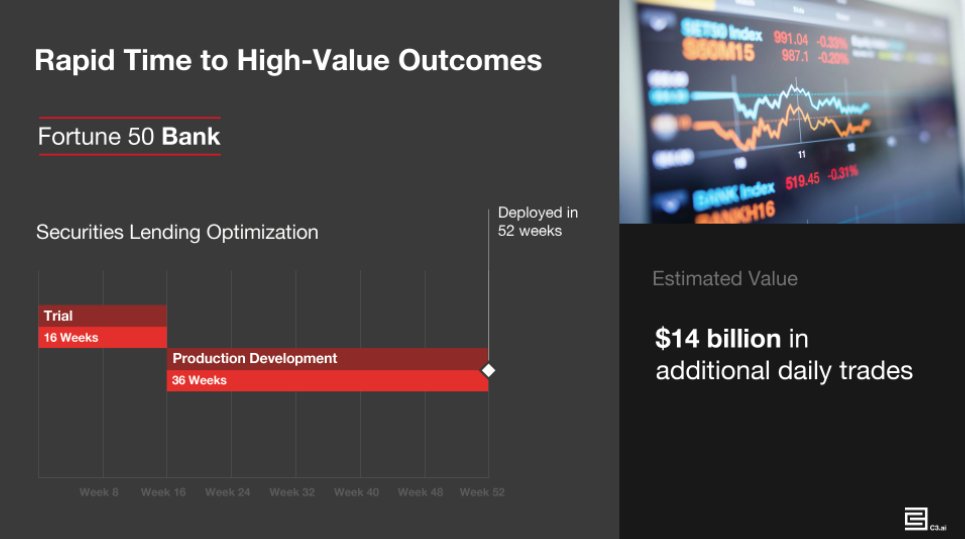

Moreover, the software take quite some time to be up and running

Moreover, the software take quite some time to be up and running

Moreover, the software take quite some time to be up and running

Moreover, the software take quite some time to be up and running

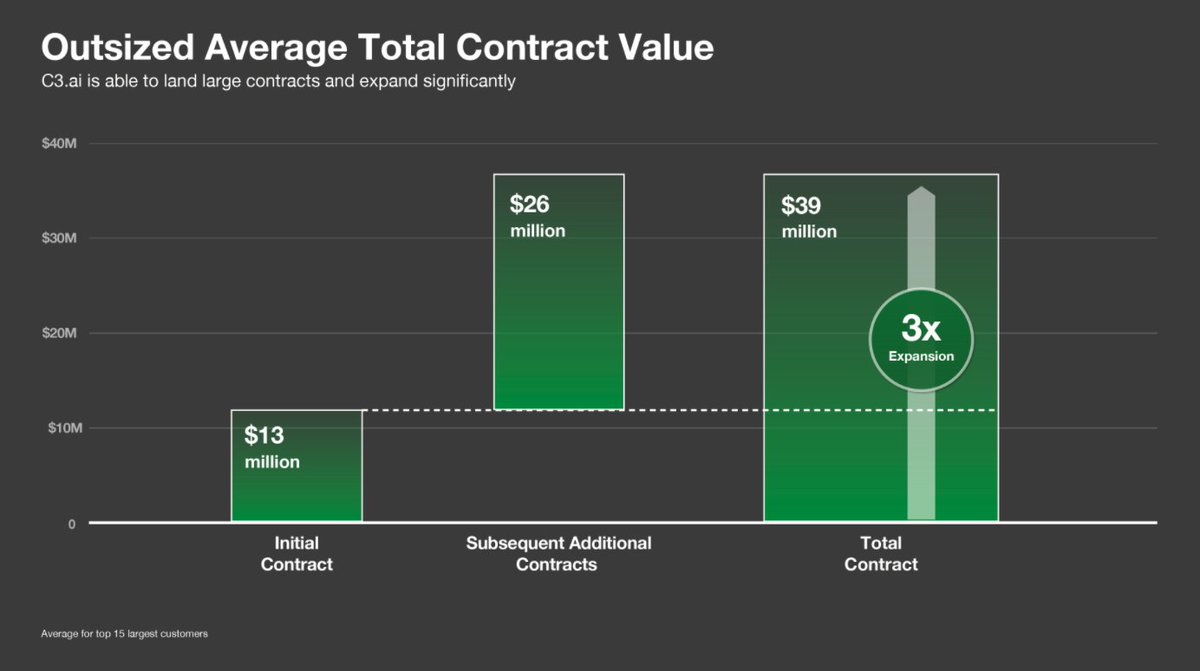

But their land and expand model provides significant up-sell opportunities

Their TOP15 customers spent on average 2 time their initial contract’s value in subsequent purchases

Their TOP15 customers spent on average 2 time their initial contract’s value in subsequent purchases

Their TOP15 customers spent on average 2 time their initial contract’s value in subsequent purchases

Their TOP15 customers spent on average 2 time their initial contract’s value in subsequent purchases

THE BOTTOM LINE

THE BOTTOM LINE

$AI has designed a software that easily helps enterprises extract and process data in order to produce actionable insights

$AI has designed a software that easily helps enterprises extract and process data in order to produce actionable insights Market for data tools is growing fast, certainly as larger corporate clients kick start their AI initiatives

Market for data tools is growing fast, certainly as larger corporate clients kick start their AI initiatives

Tom Siebel’s vision is to turn $AI into the aggregating software that sits at the confluence of data tools and insights

Tom Siebel’s vision is to turn $AI into the aggregating software that sits at the confluence of data tools and insights Replicating what happened with CRM software in the 2000 - 2020, but now to data processing and analysis as corporates enter the AI age

Replicating what happened with CRM software in the 2000 - 2020, but now to data processing and analysis as corporates enter the AI age

The software has a long deployment times, which decreased sales efficiency during the pandemic and could be supplanted by a faster competitor

The software has a long deployment times, which decreased sales efficiency during the pandemic and could be supplanted by a faster competitor We wait on the sidelines for now as $AI started trading at around $100 a share, reducing the risk / reward potential

We wait on the sidelines for now as $AI started trading at around $100 a share, reducing the risk / reward potential

We will review $AI ’s post-COVID growth rates at the next earnings calls and buy if company returns to hyper-growth mode

We will review $AI ’s post-COVID growth rates at the next earnings calls and buy if company returns to hyper-growth mode

$DASH is on our watchlist

$DASH is on our watchlist  To Be Reviewed SOON

To Be Reviewed SOON

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ S1 Filling

✑ Crunchbase

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter