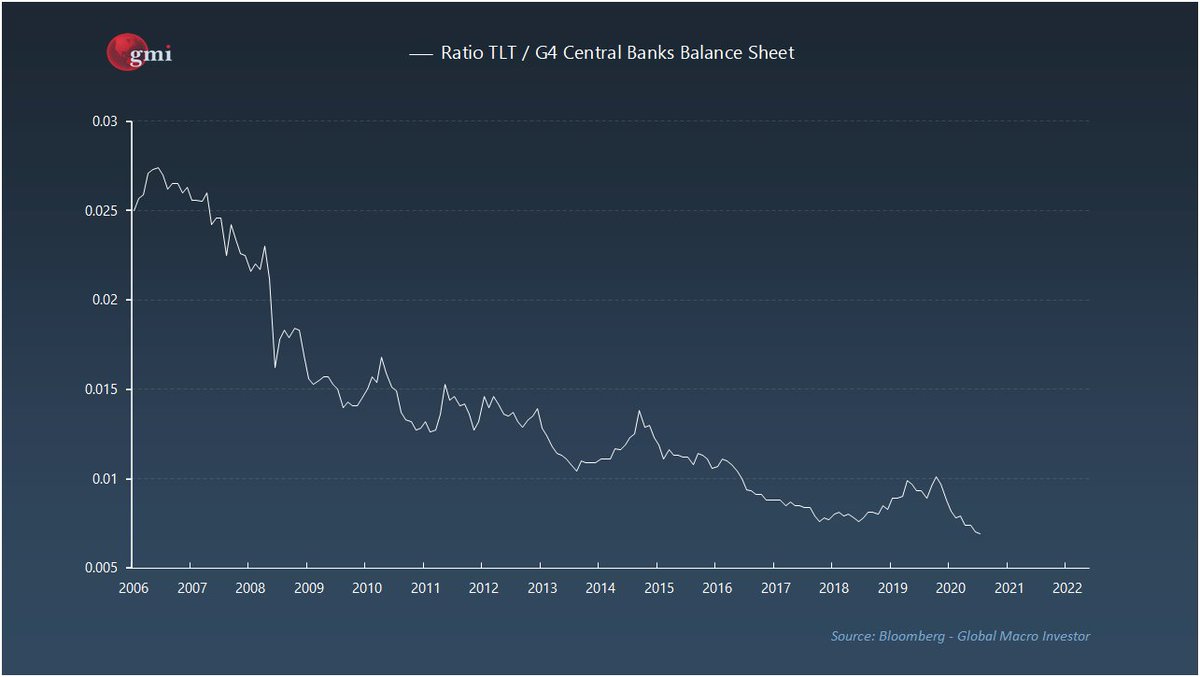

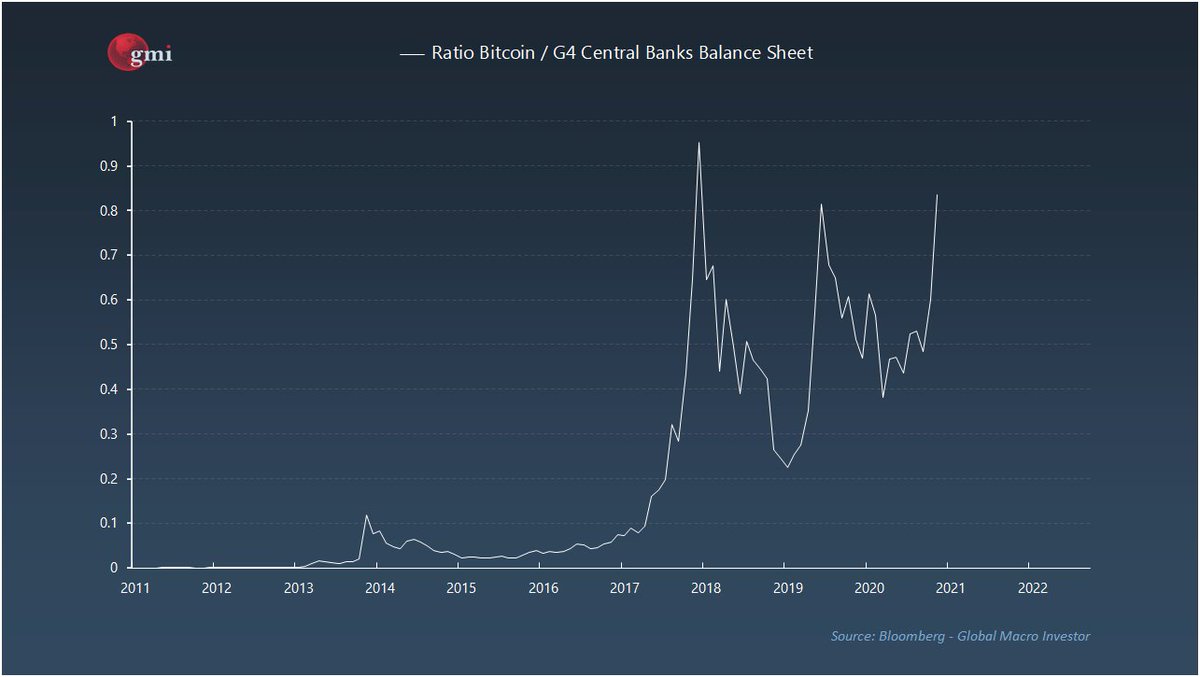

So, if the hypothesis that key driver of asset prices is the devaluation of fiat currency it pays to look at assets against G4 Central bank balance sheets as the denominator, to determine what is a store of value.

Here is the G4 balance sheet - 2009 was when it all started.

Here is the G4 balance sheet - 2009 was when it all started.

Gold - it has not done a good job at offsetting the devaluation of fiat money...it has halved vs the G4 balance sheet.

US Equities, much as we all have figure out, have basically maintained their value and have offset monetary growth since 2009, (one of the reasons causing valuations to soar).

Global equities have underperformed due to dollar strength in a "best of a bad bunch" of fiat currencies.

But only bitcoin as an asset has ENORMOUSLY outperformed fiat monetary debasement, as it has the twin killer benefits of store of value plus call option on the future... #Bitcoin  #irresponsiblylong

#irresponsiblylong

#irresponsiblylong

#irresponsiblylong

Read on Twitter

Read on Twitter