0/

Corporations invest their assets to generate income on idle funds. Some like $MSTR shot to fame for investing the company's cash in $BTC.

As DeFi embraces DAOs, treasury management is evolving for decentralized organizations.

A thread https://www.delphidigital.io/reports/a-look-into-public-defi-treasuries/

https://www.delphidigital.io/reports/a-look-into-public-defi-treasuries/

Corporations invest their assets to generate income on idle funds. Some like $MSTR shot to fame for investing the company's cash in $BTC.

As DeFi embraces DAOs, treasury management is evolving for decentralized organizations.

A thread

https://www.delphidigital.io/reports/a-look-into-public-defi-treasuries/

https://www.delphidigital.io/reports/a-look-into-public-defi-treasuries/

1/

Most companies retain a majority of their profits, paying a piece to shareholders as dividends

Retained earnings are invested to protect the company's purchasing power and to make a little extra cash apart from the company's core operations

Most companies retain a majority of their profits, paying a piece to shareholders as dividends

Retained earnings are invested to protect the company's purchasing power and to make a little extra cash apart from the company's core operations

2/

Enter DAOs: with decentralized orgs governing crypto protocols, the community is responsible for running the treasury and ensuring there are sufficient assets to fund the protocol's needs

A few DeFi projects have already made progress here

Enter DAOs: with decentralized orgs governing crypto protocols, the community is responsible for running the treasury and ensuring there are sufficient assets to fund the protocol's needs

A few DeFi projects have already made progress here

3/

$YFI is 100% issued with community consensus for no further token issuance

As a result, @iearnfinance's vaults charge fees (0.5% withdrawal fee, 5% performance fee) to use the protocol. These fees are split between governance participants and the protocol's treasury.

$YFI is 100% issued with community consensus for no further token issuance

As a result, @iearnfinance's vaults charge fees (0.5% withdrawal fee, 5% performance fee) to use the protocol. These fees are split between governance participants and the protocol's treasury.

4/

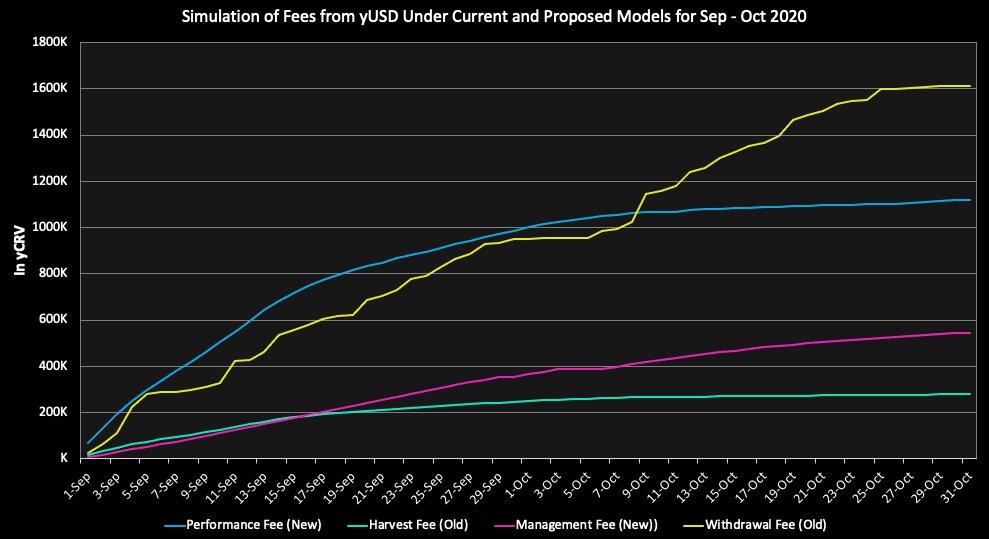

yEarn is changing its fee structure to a 20% performance fee, split between the treasury, governance, and vault strategy creators; and a 2% mgmt fee

Here's a simulation of fees accrued to the yUSD vault under the new and old fee regimes:

yEarn is changing its fee structure to a 20% performance fee, split between the treasury, governance, and vault strategy creators; and a 2% mgmt fee

Here's a simulation of fees accrued to the yUSD vault under the new and old fee regimes:

5/

Long story short:

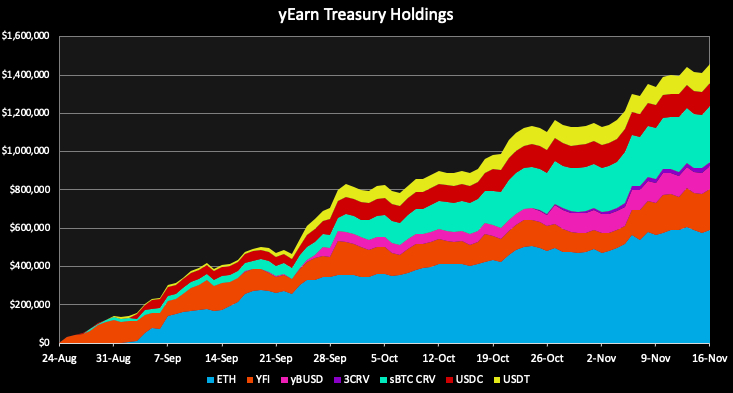

yEarn's development and operations are funded by diverting a portion of protocol revenue to the treasury

Given the variety of assets used in yVaults, the treasury's assets are automatically diversified among stablecoins, BTC, ETH, and other assets.

Long story short:

yEarn's development and operations are funded by diverting a portion of protocol revenue to the treasury

Given the variety of assets used in yVaults, the treasury's assets are automatically diversified among stablecoins, BTC, ETH, and other assets.

6/

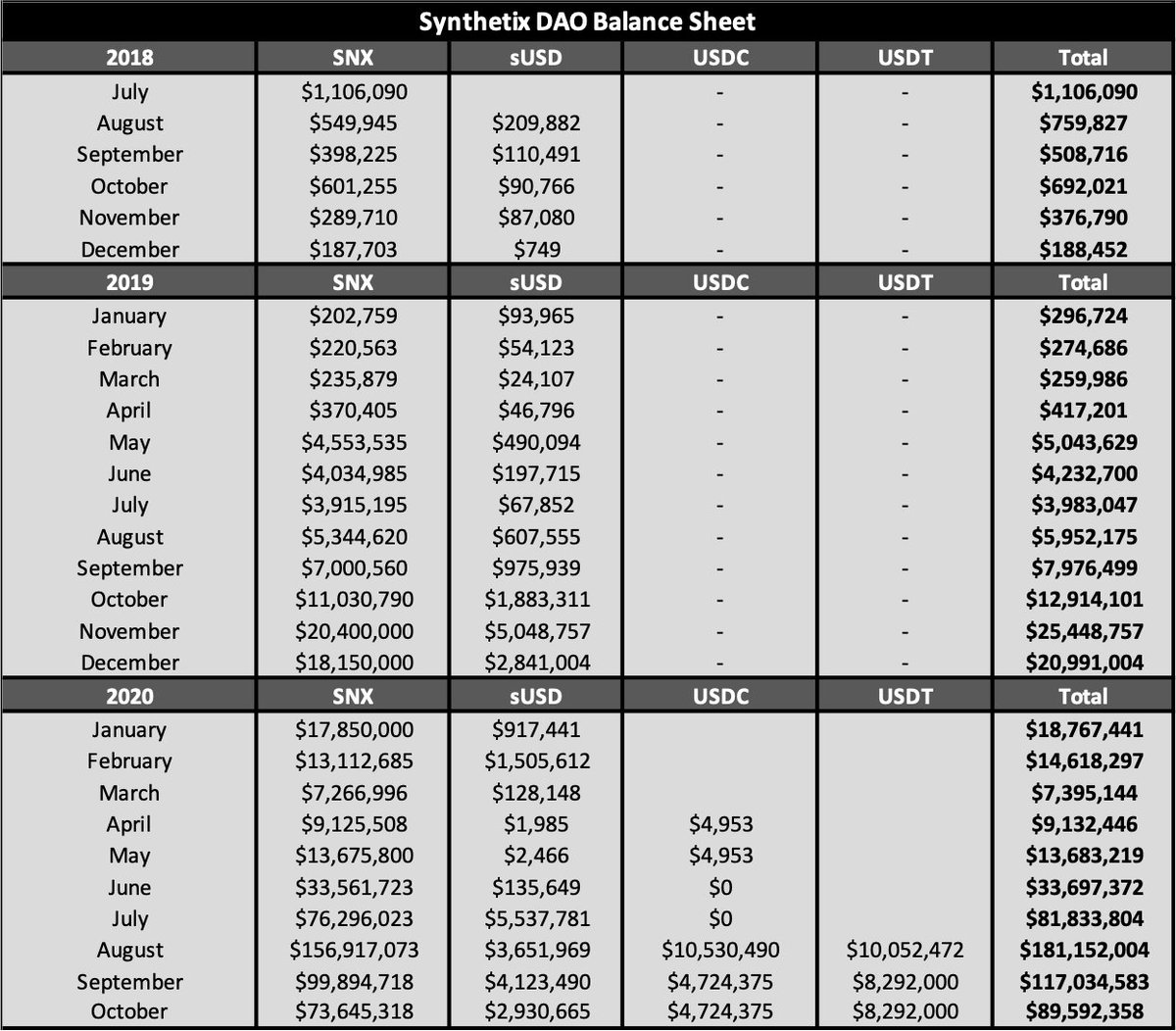

@synthetix_io has one of the largest treasuries of any DeFi project. The main SynthetixDAO address boasts over $150 million in assets

The treasury uses the Synthetix protocol to grow in value

@synthetix_io has one of the largest treasuries of any DeFi project. The main SynthetixDAO address boasts over $150 million in assets

The treasury uses the Synthetix protocol to grow in value

7/

The address, funded with 5 mn $SNX in 2018, has been able to accrue more SNX via staking rewards. The $ growth of the address over time is astounding and is a result of SNX's price appreciation in 2019-20

The address, funded with 5 mn $SNX in 2018, has been able to accrue more SNX via staking rewards. The $ growth of the address over time is astounding and is a result of SNX's price appreciation in 2019-20

8/

$SNX stakers also receive fees in $sUSD from traders who pay to use Synthetix

If @synthetix_io grows to a large enough scale, the DAO may be able fund itself from fees alone

$SNX stakers also receive fees in $sUSD from traders who pay to use Synthetix

If @synthetix_io grows to a large enough scale, the DAO may be able fund itself from fees alone

9/

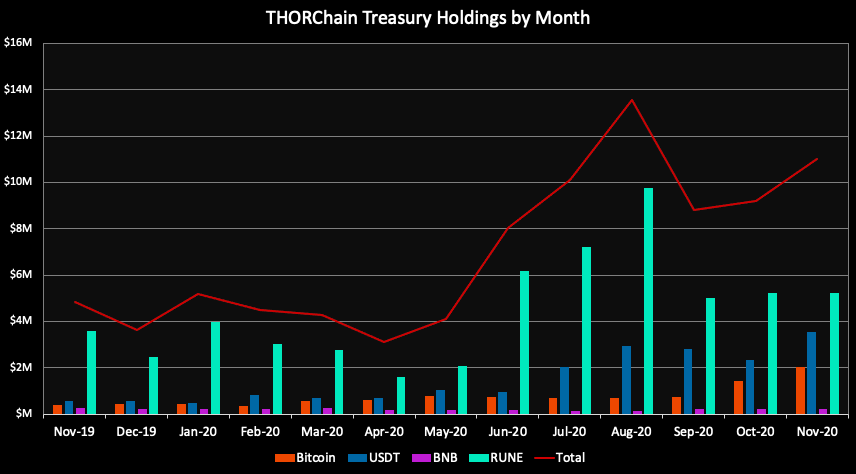

Perhaps the only major non-Ethereum DeFi project with a public treasury, @thorchain_org has disclosed in-depth treasury info since the project's inception

But there's something different about THORChain's treasury

Perhaps the only major non-Ethereum DeFi project with a public treasury, @thorchain_org has disclosed in-depth treasury info since the project's inception

But there's something different about THORChain's treasury

10/

Unlike most DeFi projects who are embracing on-chain governance, @thorchain_org eventually aims to become fully autonomous

In essence, the treasury exists solely to fund the protocol's development. When THORChain becomes autonomous, the treasury will be dissolved.

Unlike most DeFi projects who are embracing on-chain governance, @thorchain_org eventually aims to become fully autonomous

In essence, the treasury exists solely to fund the protocol's development. When THORChain becomes autonomous, the treasury will be dissolved.

11/

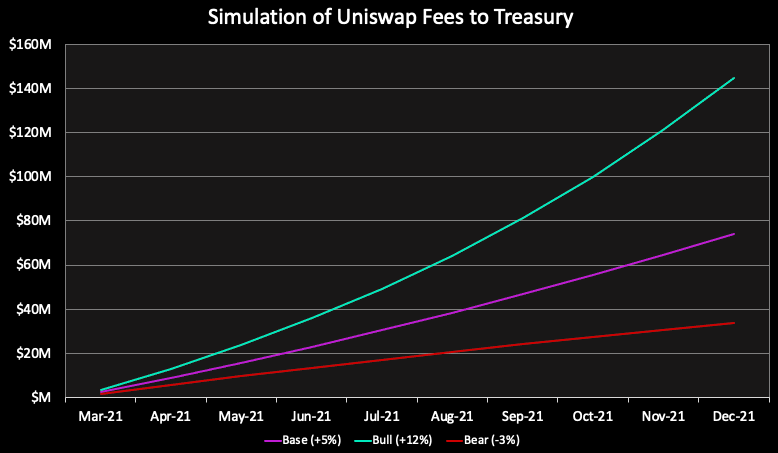

Finally, we have $UNI

It's well known that Uniswap governance has access to a switch that diverts 1/6th of all LP fees to a community treasury

The massive amount of potential cash flows makes @UniswapProtocol's treasury one of the more interesting to analyze

Finally, we have $UNI

It's well known that Uniswap governance has access to a switch that diverts 1/6th of all LP fees to a community treasury

The massive amount of potential cash flows makes @UniswapProtocol's treasury one of the more interesting to analyze

12/

I used some fairly ambitious assumption to see how this new fee would impact $UNI's treasury

Alongside the 43% $UNI allocation the treasury gets, the existence of revenues via fees promises to make Uniswap the best funded and largest DeFi treasury

I used some fairly ambitious assumption to see how this new fee would impact $UNI's treasury

Alongside the 43% $UNI allocation the treasury gets, the existence of revenues via fees promises to make Uniswap the best funded and largest DeFi treasury

13/

A well managed treasury ensures a protocol can fund itself through tough times

And as DeFi trends towards on-chain governance, ensuring treasuries have ample firepower to spend and manage is something founders need to actively think about

A well managed treasury ensures a protocol can fund itself through tough times

And as DeFi trends towards on-chain governance, ensuring treasuries have ample firepower to spend and manage is something founders need to actively think about

14/

The actual report goes further in depth, you can read it here: https://www.delphidigital.io/reports/a-look-into-public-defi-treasuries/

The actual report goes further in depth, you can read it here: https://www.delphidigital.io/reports/a-look-into-public-defi-treasuries/

Read on Twitter

Read on Twitter