$550m unsecured $MSTR convertible at 0.75%...who is buying this?

Started wondering who has increased ownership in the stock since June and found something interesting...

(1/6) https://twitter.com/TheBlock__/status/1336663319911014400

Started wondering who has increased ownership in the stock since June and found something interesting...

(1/6) https://twitter.com/TheBlock__/status/1336663319911014400

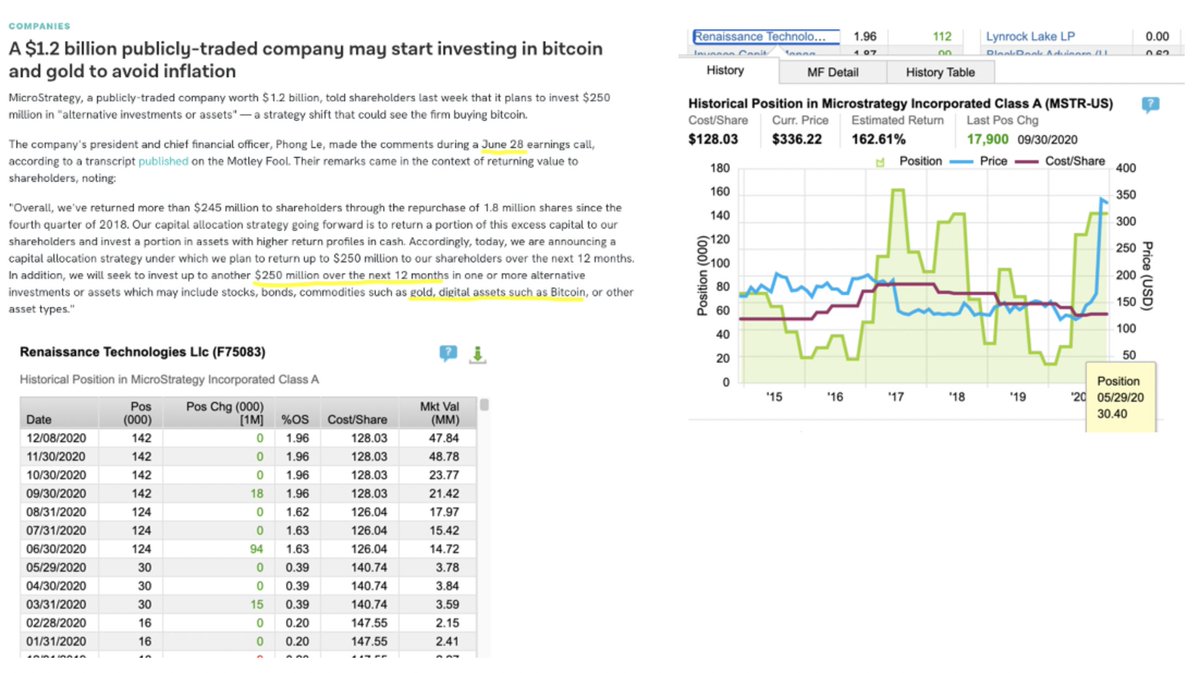

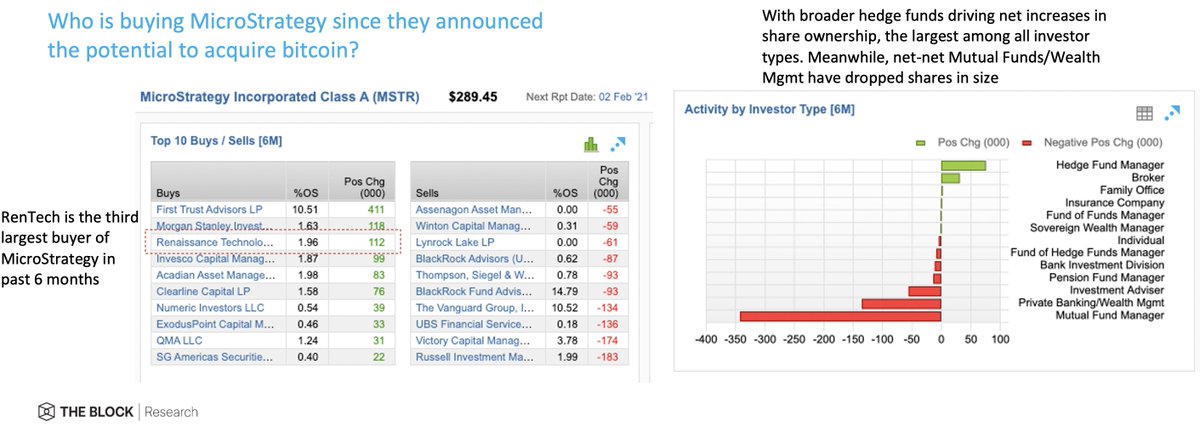

The third largest buyer of $MSTR in last 6 months is RenTech

Interestingly, they upped their position size by +4x in June, assuming in response to MicroStrategy CFO remarks on June 28th earnings call that the firm may allocate treasury into bitcoin...

(2/6)

Interestingly, they upped their position size by +4x in June, assuming in response to MicroStrategy CFO remarks on June 28th earnings call that the firm may allocate treasury into bitcoin...

(2/6)

A reminder in March, RenTech included for first time in an ADV Form the permission "to enter into bitcoin futures transactions..limiting trading activity to CME"

Unclear if they have engaged w/ CME, but $MSTR has clearly offered exposure

(3/6) https://www.theblockcrypto.com/post/62322/75-billion-hedge-fund-renaissance-technologies-is-eyeing-the-bitcoin-futures-market

Unclear if they have engaged w/ CME, but $MSTR has clearly offered exposure

(3/6) https://www.theblockcrypto.com/post/62322/75-billion-hedge-fund-renaissance-technologies-is-eyeing-the-bitcoin-futures-market

So who is buying $MSTR post its BTC treasury plan? The clear standout is hedge funds. In contrast, mutual funds/pension/wealth mgmt have all netnet sold shares

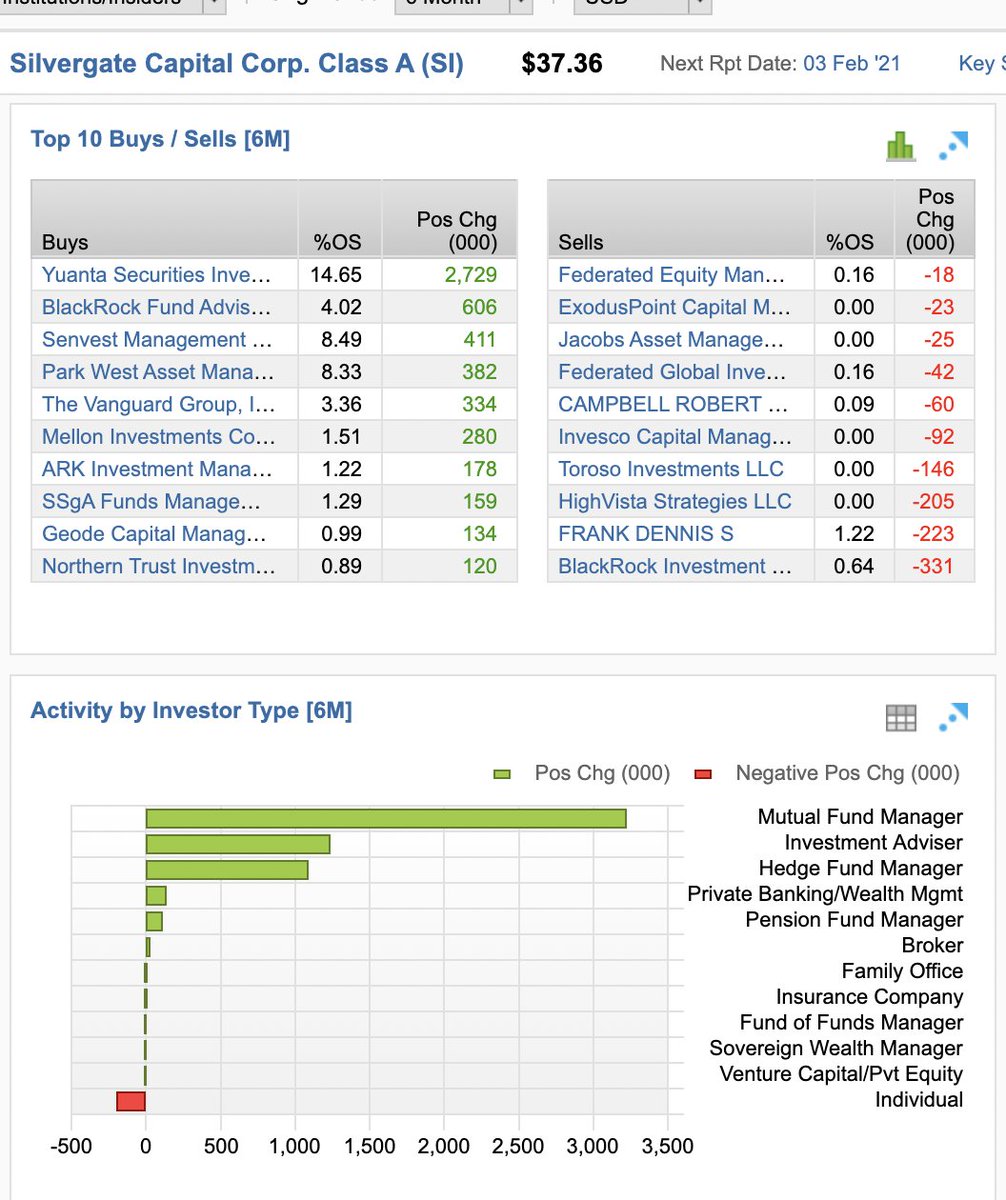

What's interesting is buy activity around pure-play public "crypto" co Silvergate $SI tells a very diff story...

(4/6)

What's interesting is buy activity around pure-play public "crypto" co Silvergate $SI tells a very diff story...

(4/6)

...regarding Silvergate, it helps that the stock is also up +150% since June, but with impressive fundamentals to boot. Still, interesting to see mutual funds as the largest net buyer of Silvergate and the largest net seller of MicroStrategy

(5/6) https://twitter.com/_RJTodd/status/1320834310119841793

(5/6) https://twitter.com/_RJTodd/status/1320834310119841793

Anyways, all this is to say the bulk of net inflows into MicroStrategy as a backdoor quasi bitcoin ETF is coming from hedge funds

Will be interesting to see who ends up filling MicroStrategy's convertible offering, but prob going to be a fund

(fin)

Will be interesting to see who ends up filling MicroStrategy's convertible offering, but prob going to be a fund

(fin)

Read on Twitter

Read on Twitter