Now, even as the #CoronavirusVaccine dominates the headlines, we should take heed on the three detrimental 'undercurrents' that are converging to a 'Perfect Storm':

1) Financial instability.

2) Economic fragility.

3) Political uncertainty.

Thread. 1/24

@GnSEconomics

1) Financial instability.

2) Economic fragility.

3) Political uncertainty.

Thread. 1/24

@GnSEconomics

In June 2013, we warned on the detrimental effects of the prolonged low int. rate envir.

"The long-term effects of the zero-bound on the financial markets are not known. What is known, is that extended periods of monetary easing may lead to bubbles." 2/

https://gnseconomics.com/wp-content/uploads/2013/07/Q-review-2_2013.pdf

"The long-term effects of the zero-bound on the financial markets are not known. What is known, is that extended periods of monetary easing may lead to bubbles." 2/

https://gnseconomics.com/wp-content/uploads/2013/07/Q-review-2_2013.pdf

We were not particularly worried about the situation in 2013, but in June 2016 we were:

"...fraudulent behavior, indebtedness, persistent macroeconomic imbalances, and major mispricing of risks are usually present before major financial disruptions." 3/

https://gnseconomics.com/wp-content/uploads/2012/03/Q-review-2_2016.pdf

"...fraudulent behavior, indebtedness, persistent macroeconomic imbalances, and major mispricing of risks are usually present before major financial disruptions." 3/

https://gnseconomics.com/wp-content/uploads/2012/03/Q-review-2_2016.pdf

We continued:

"The onset of an economic crisis usually requires a trigger, that is, an event that suddenly and abruptly changes the expectations of individuals and market participants for the worse."

"Unconventional means of the central banks have pushed the risks..." /4

"The onset of an economic crisis usually requires a trigger, that is, an event that suddenly and abruptly changes the expectations of individuals and market participants for the worse."

"Unconventional means of the central banks have pushed the risks..." /4

"...of several asset classes to the far ends of probability distribution, indicating that the risks of these assets have become, in practice, invisible.

Asset prices have been known to over-shoot in booms-and-busts, but this time central banks, not markets,..." /5

Asset prices have been known to over-shoot in booms-and-busts, but this time central banks, not markets,..." /5

"...are under-pricing the risks.

This makes the situation considerably more worrisome than before, because the decisions of central banks are hard to predict and they are subject to political pressure."

This summarizes our current reality quite nicely. Those who have... 6/

This makes the situation considerably more worrisome than before, because the decisions of central banks are hard to predict and they are subject to political pressure."

This summarizes our current reality quite nicely. Those who have... 6/

...ridiculed the 'market bears' have not understood that the politicized responses of central bankers and desperate governments, and their effects, have been extremely difficult to predict.

Practically all the measures applied after 2017, have been utterly exceptional...7/

Practically all the measures applied after 2017, have been utterly exceptional...7/

... in the history of central banking.

Observing objectively, we have been in a new financial crisis since the turn of 2018/2019 or since September 2019. Financial history will decide the date.

This has led many to argue that we have reached a 'New Normal' but we haven't. 8/

Observing objectively, we have been in a new financial crisis since the turn of 2018/2019 or since September 2019. Financial history will decide the date.

This has led many to argue that we have reached a 'New Normal' but we haven't. 8/

We are in a something very different.

In June 2013, we also warned that:

"It is possible that the banking sector and the world economy were be saved by using too strong methods in 2008. As a consequence of this, it is also possible that the world economy..." 9/

In June 2013, we also warned that:

"It is possible that the banking sector and the world economy were be saved by using too strong methods in 2008. As a consequence of this, it is also possible that the world economy..." 9/

"...is more like zombie economy, where unprofitable banks and companies are kept alive with easy money and rescue packages from the governments.

This kind of an environment is extremely sensitive to shocks or market disturbances, and this is a reason to be worried..." /10

This kind of an environment is extremely sensitive to shocks or market disturbances, and this is a reason to be worried..." /10

"...although there is no reason to panic, yet."

While there was no reason to panic on the growing fragility of the world #economy in 2013, now there most surely is.

#Centralbanks have resuscitated the global economy into a fragile zombie.

The list of the market... 11/

While there was no reason to panic on the growing fragility of the world #economy in 2013, now there most surely is.

#Centralbanks have resuscitated the global economy into a fragile zombie.

The list of the market... 11/

...bailouts by central bankers is painfully long, even when we account only the bailouts after 2008.

Especially after the market rout of late 2018/early 2019, central bank meddling in the financial markets has become 'endemic'. 12/ https://gnseconomics.com/2020/12/07/are-we-in-a-new-normal/

Especially after the market rout of late 2018/early 2019, central bank meddling in the financial markets has become 'endemic'. 12/ https://gnseconomics.com/2020/12/07/are-we-in-a-new-normal/

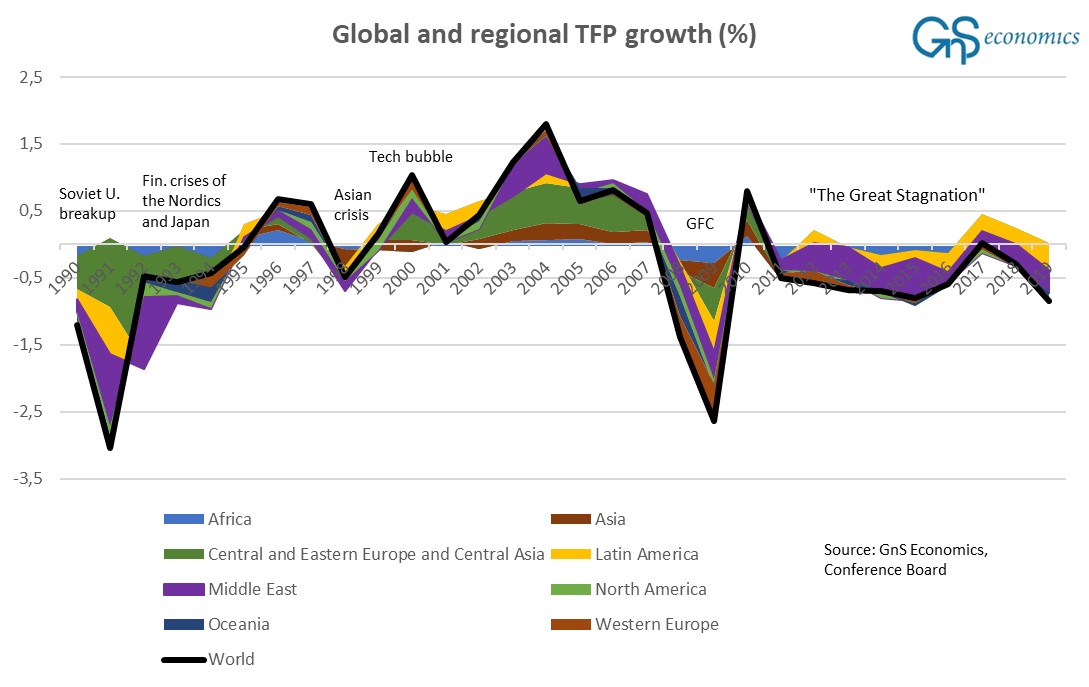

The endemic ultra-low rates policy has seriously damaged the foundations of economic growth by decimating the risk-and-reward relationship in the capital markets and by undermining the process of 'creative destruction' which has guided the relentless rise in our... 13/

...living standards for the past 200+ years.

Central banks have become a menace to the #economy .

What makes the situation more troubling, and worrisome, is the failure of the current political elite. /14 https://gnseconomics.com/2020/10/08/the-destruction-of-the-world-economy-by-the-central-banks/

Central banks have become a menace to the #economy .

What makes the situation more troubling, and worrisome, is the failure of the current political elite. /14 https://gnseconomics.com/2020/10/08/the-destruction-of-the-world-economy-by-the-central-banks/

I have been watching the deterioration of #democracy in Finland with disbelief. I once considered #Finland to be the stronghold of democracy.

Our PM @MarinSanna and our FinMin @VanhanenMatti have pushed the democratic process into the gutter by undermining... 15/

Our PM @MarinSanna and our FinMin @VanhanenMatti have pushed the democratic process into the gutter by undermining... 15/

...the Constitution and denying Finnish citizens the ability to have their say in considering the #RecoveryFund of the EU.

But, the deterioration of political integrity has become a global phenomenon, and the political divisions are hardening, e.g., in Europe and the US. 16/

But, the deterioration of political integrity has become a global phenomenon, and the political divisions are hardening, e.g., in Europe and the US. 16/

In the letter sent to our Deprcon subscribers on the 28th of Nov, we warned that:

"Financial fragility and political tensions, which are running very high, can lead to sudden financial crashes, political turmoil, and heavy-handed responses by the authorities." 17/

"Financial fragility and political tensions, which are running very high, can lead to sudden financial crashes, political turmoil, and heavy-handed responses by the authorities." 17/

And that:

"These in turn can lead to unknown ramifications in the U.S., but also in Europe."

We are not there yet, but the growing distrust towards ruling political institutions in Europe and the US should worry everyone. 18/ https://gnseconomics.com/deprcon-service2/

"These in turn can lead to unknown ramifications in the U.S., but also in Europe."

We are not there yet, but the growing distrust towards ruling political institutions in Europe and the US should worry everyone. 18/ https://gnseconomics.com/deprcon-service2/

How fast will the political divisions reach a boiling point in the US and in Europe, is difficult to predict, but the trends are steep, currently.

So, what central bankers, in "co-operation" with the political leaders, have created is a recipe for a 'Perfect Storm'. 19/

So, what central bankers, in "co-operation" with the political leaders, have created is a recipe for a 'Perfect Storm'. 19/

Just consider, when political tensions converge with the emerging banking crisis, the Flood of corporate bankruptcies and with skyrocketing unemployment.

We could witness a complete collapse of the global economy, financial system and social structures.

KABOOM! 20/

We could witness a complete collapse of the global economy, financial system and social structures.

KABOOM! 20/

And the thing is that we would not need to be here.

Just by letting the instabilities and structural imbalances to cancel out through an European banking crisis and partial breakup of the euro in 2011-2013, and recession of China in 2015-16, everything that is coming... 21/

Just by letting the instabilities and structural imbalances to cancel out through an European banking crisis and partial breakup of the euro in 2011-2013, and recession of China in 2015-16, everything that is coming... 21/

...could have been avoided.

But, our incompetent and scared central bankers and political leaders failed to lead us to safety and prosperity.

Instead they created a 'facade' of economic recovery and political stability, which is likely to implode in a catastrophic way. 22/

But, our incompetent and scared central bankers and political leaders failed to lead us to safety and prosperity.

Instead they created a 'facade' of economic recovery and political stability, which is likely to implode in a catastrophic way. 22/

Now, we are at cross-roads.

One road takes us to renewed growth and prosperity through "Reset and Recovery", while the other pushes us back to slavery and to a "Global Dystopia".

And, this is a choice we cannot bypass. 23/ https://gnseconomics.com/2020/11/11/into-the-global-economic-dystopia/

One road takes us to renewed growth and prosperity through "Reset and Recovery", while the other pushes us back to slavery and to a "Global Dystopia".

And, this is a choice we cannot bypass. 23/ https://gnseconomics.com/2020/11/11/into-the-global-economic-dystopia/

We will map out the endgame (Aftermath) -scenarios of the #CoronavirusPandemic in the December issue of our Q-Review published next week.

Godspeed!

/End

#economy #Crisis https://gnseconomics.com/2020/11/07/end-of-the-year-offer-for-new-q-review-subscribers/

Godspeed!

/End

#economy #Crisis https://gnseconomics.com/2020/11/07/end-of-the-year-offer-for-new-q-review-subscribers/

Read on Twitter

Read on Twitter