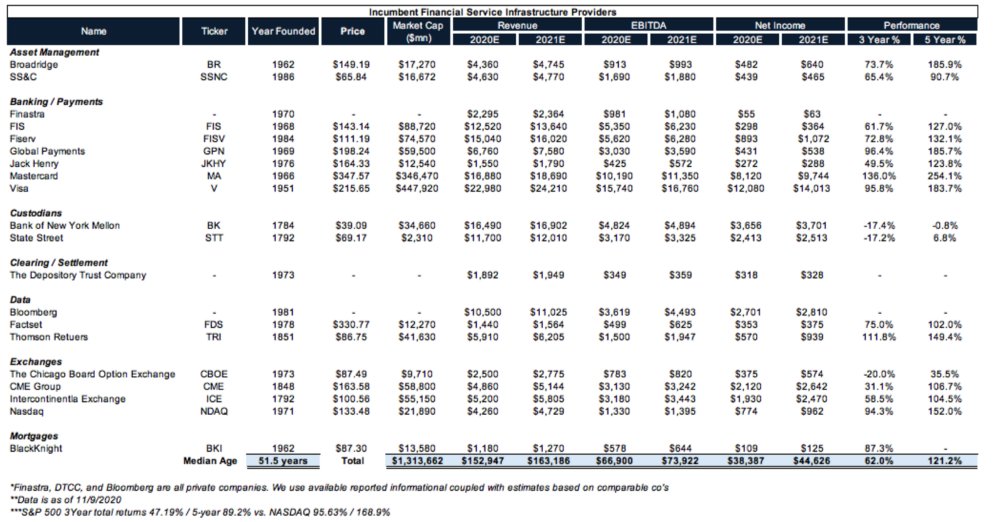

0/ We've highlighted FinTech infrastructure co's like BR, FIS, JKHY, MA, V, ICE, NDAQ, etc. as companies w/ a variety of moats that have led to dominant mkt share & outperformance despite being 50+ years old on avg.

$FISV had their investor day yesterday and laid out the why.

$FISV had their investor day yesterday and laid out the why.

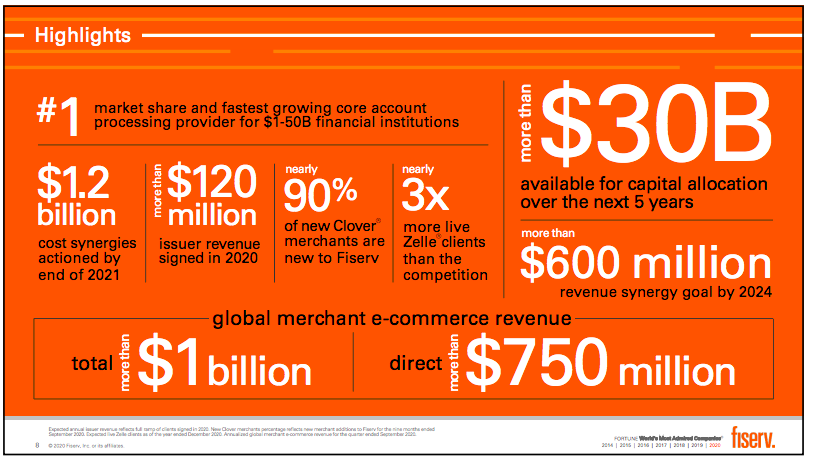

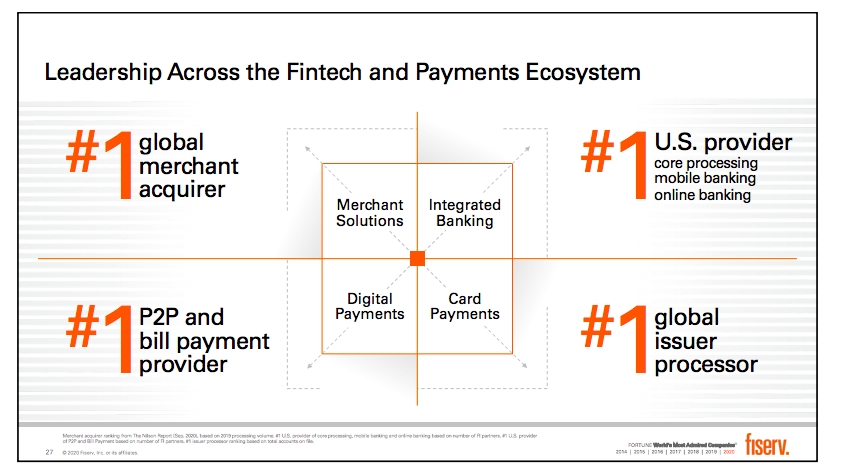

1/ $FISV highlights the fact that they have #1 market share in core accounting processing for $1-$50B FI’s; they are doing $1.0B in global e-Commerce revenue, and have more than $30B available for capital allocation over the next 5 years (read more M&A for FinTech co's)

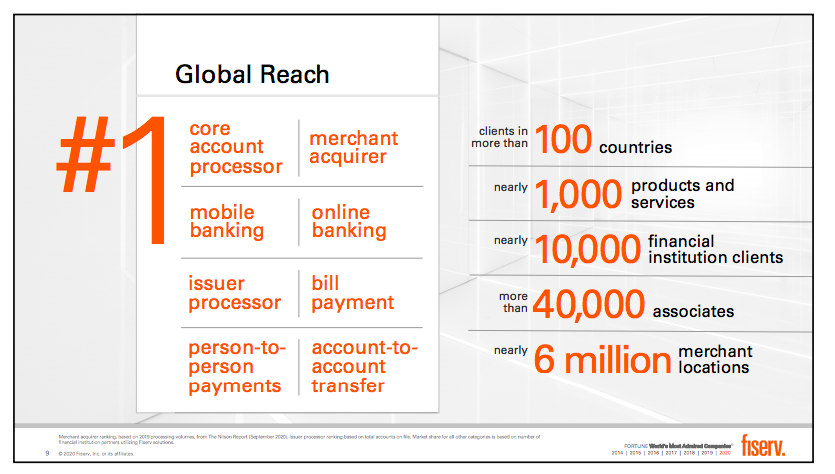

2/ They have global reach with clients in more than 100 countries, more than 1,000 products & services, 10,000+ FI clients, & 6M merchant locations.

All while being #1 as a core account processor, merchant acquirer, bill pay, P2P payments, etc...

All while being #1 as a core account processor, merchant acquirer, bill pay, P2P payments, etc...

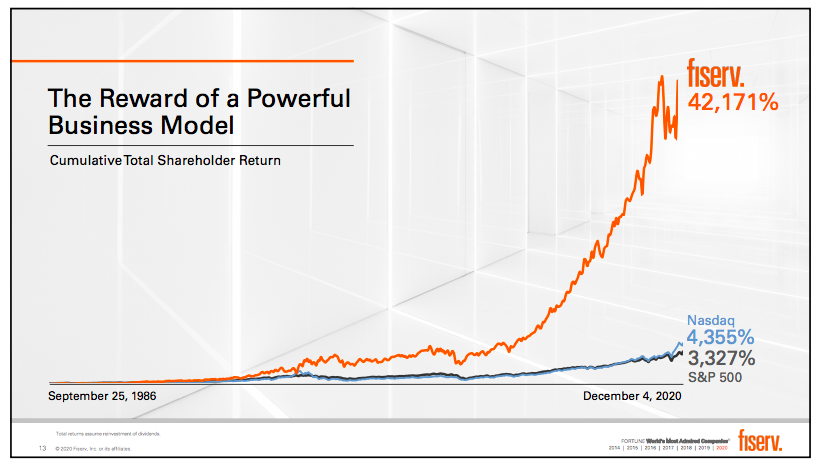

3/ This business model + market positioning has led to incredibly strong outperformance since inception ~35 years ago with cumulative $FISV shareholder returns of +42,171% vs. the $SPY at 3,327% & Nasdaq at 4,355%.

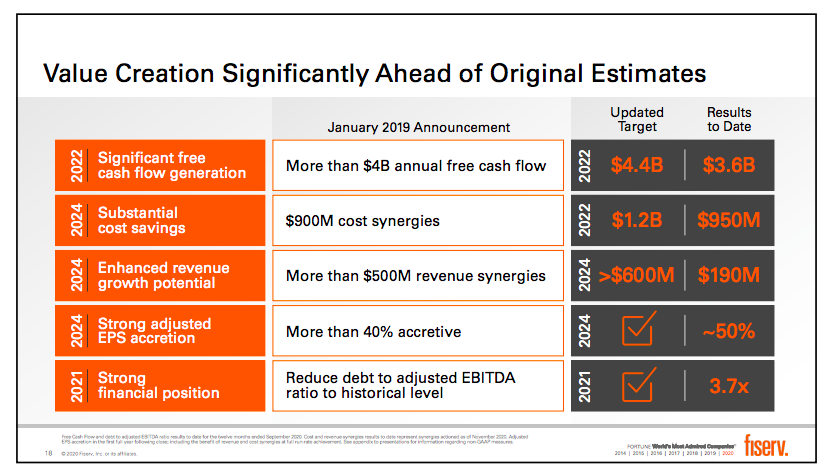

4/ $FISV has grown via a series of acquisitions over the past 30 years most recently the $22B tie up w/ First Data.

They highlight the progress on the deal & new goals post integration.

M&A is a skill & FISV has it financially; tech integration leaves something to be desired

They highlight the progress on the deal & new goals post integration.

M&A is a skill & FISV has it financially; tech integration leaves something to be desired

5/ They highlight 4 key pillars (all of which they claim #1 market share)

(i) Merchant Solutions

(ii) Integrated Banking

(iii) Digital Payments

(iv) Card Payments

(i) Merchant Solutions

(ii) Integrated Banking

(iii) Digital Payments

(iv) Card Payments

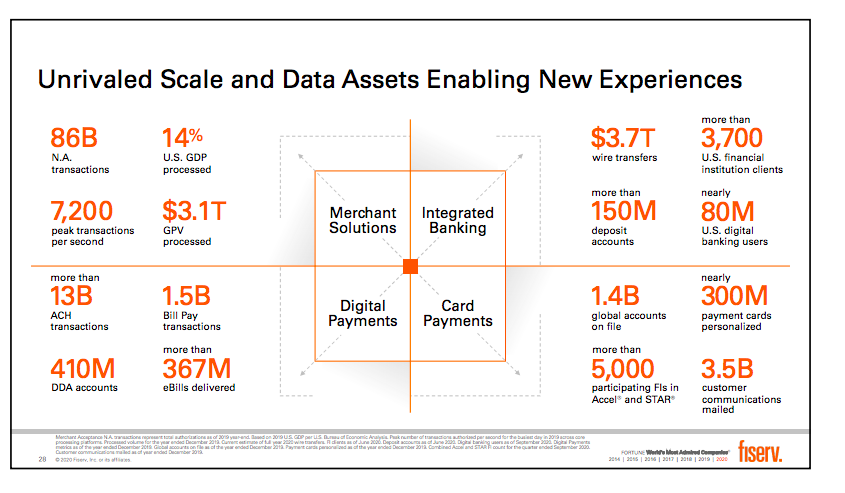

6/ Given the unparalleled size & scale they have unique access to data which should in theory inform new products / use-cases for their end clients.

They conduct more than 12,000 financial tx / second & reach nearly ~100% of US households

They conduct more than 12,000 financial tx / second & reach nearly ~100% of US households

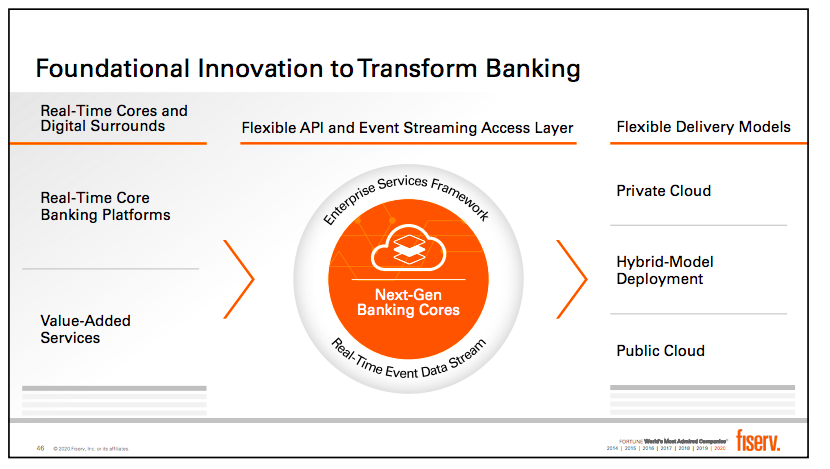

7/ In 2020 even the leader in FinTech infrastructure boasts about being "nearly all in the cloud" which shows how far the industry has to go.

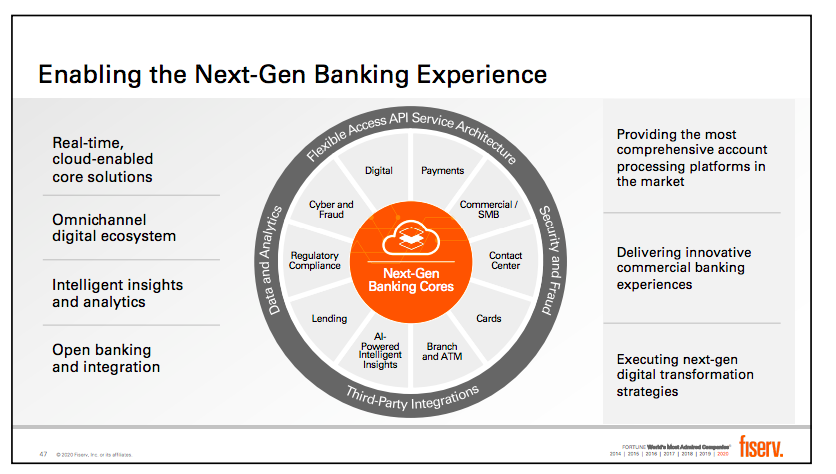

8/ $FISV is very much focused on the future of banking / open banking which requires multi-industry distribution of financial services / products enabled by cloud & open APIs

9/ The Next-Gen Banking core requires:

(i) Flexible API Service Architecture

(ii) Security & Fraud Tools

(iii) Third Party Integrations

(iv) Data & Analytics

This is a slide I imagine a number of BaaS companies look to emulate in future decks.

(i) Flexible API Service Architecture

(ii) Security & Fraud Tools

(iii) Third Party Integrations

(iv) Data & Analytics

This is a slide I imagine a number of BaaS companies look to emulate in future decks.

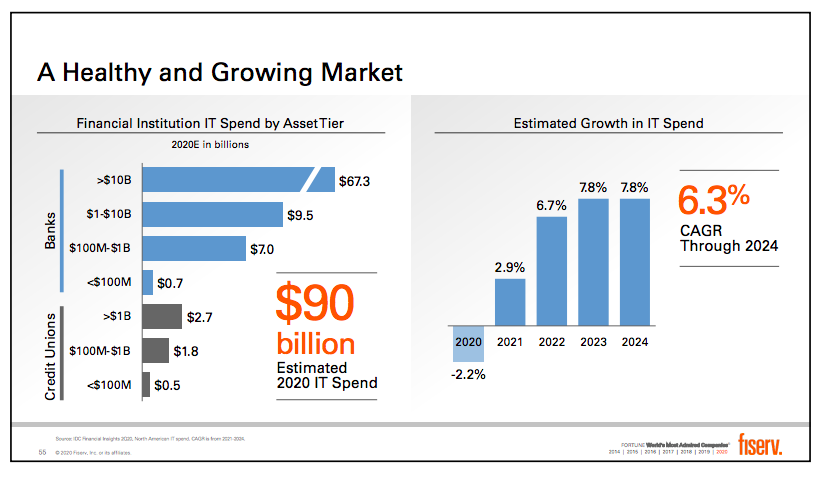

10/ $FISV also provided some healthy market share data.

They believe $90B was spent in '20 by Financial Institution on IT which is projected to grow at a 6.3% CAGR through '24.

For those that believe FinTech B2B infrastructure is saturated thats a portion of the pie

They believe $90B was spent in '20 by Financial Institution on IT which is projected to grow at a 6.3% CAGR through '24.

For those that believe FinTech B2B infrastructure is saturated thats a portion of the pie

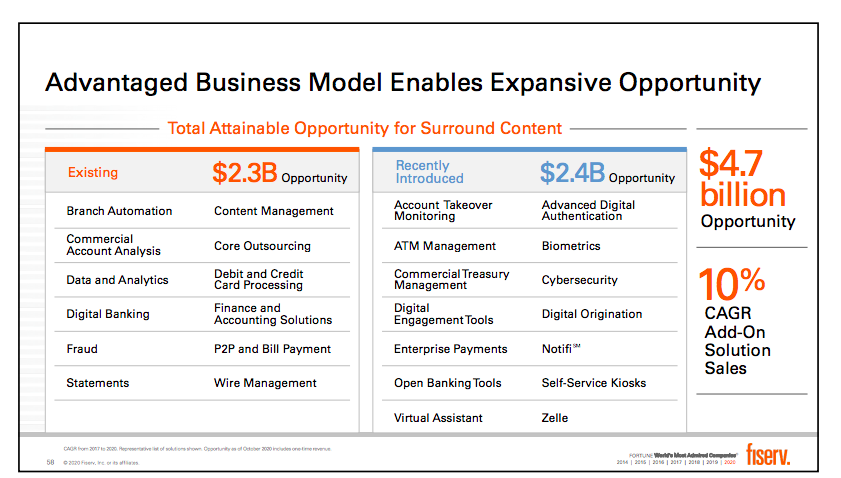

11/ $FISV has their own land & expand strategy and sees another $4.7B of opportunity for add-on solutions.

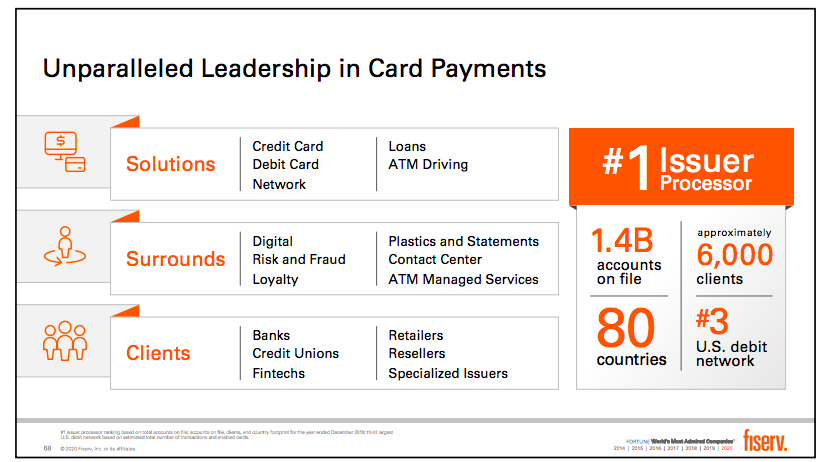

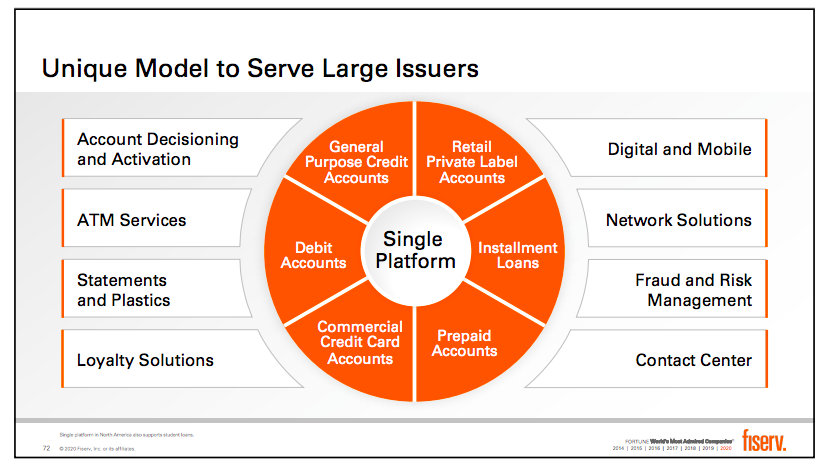

12/ $FISV is the #1 issuer processor with unparalleled leadership in card payments. They have 1.4B accounts on file across 6,000 clients, and 80 countries.

With talks of @Marqeta going public next year this will be an interesting comp for this business line.

With talks of @Marqeta going public next year this will be an interesting comp for this business line.

13/ They highlight their model is for large issuers w/ a single platform that delivers debit, commercial cc, prepaid, installment loans, private label, & general purpose accounts.

This is part of the oppty co's like Marqeta & Galileo saw $FISV won't entertain the startup.

This is part of the oppty co's like Marqeta & Galileo saw $FISV won't entertain the startup.

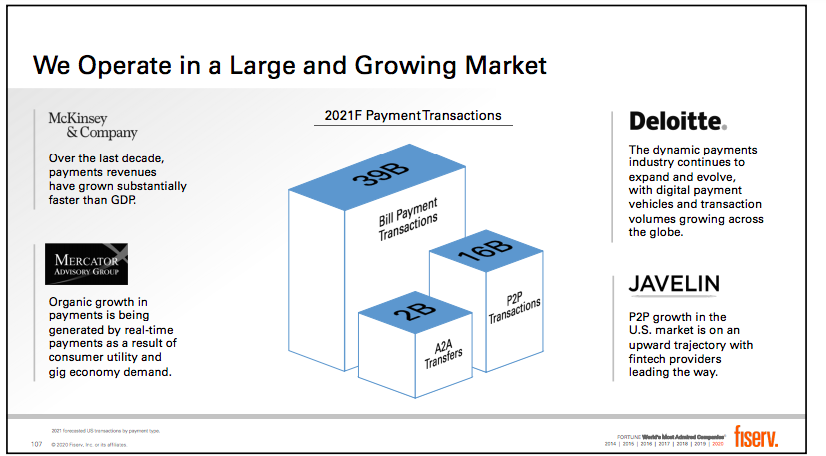

14/ On the payment side $FISV highlights the growth in payment revenue, RTP, Bill Payment, P2P transactions, and A2A transfers all as part of a large but ever growing mkt opportunity.

15/ $FISV pegs a $1.0B+ revenue opportunity for digital payments. Their NOW Network currently serves 7 of the top 10 U.S. financial institutions.

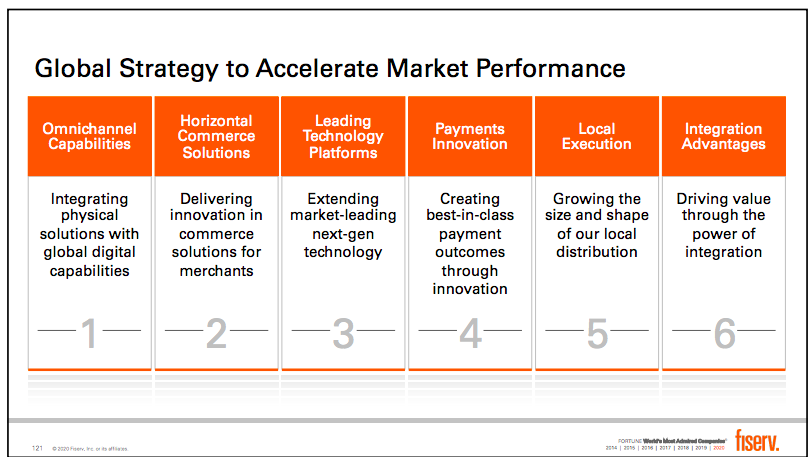

16/ $FISV's growth plans for payments are focused on:

(i) Omnichannel Capabilities

(ii) Horizontal Commerce Solutions

(iii) Leading Technology

(iv) Payments Innovation

(v) Local Execution

(vi) Integration Advantages

(i) Omnichannel Capabilities

(ii) Horizontal Commerce Solutions

(iii) Leading Technology

(iv) Payments Innovation

(v) Local Execution

(vi) Integration Advantages

17/ Besides growth domestically there are significant opportunities ex-US in APAC, LatAm, India, and SE Asia, all areas where $FISV has a strong market presence & will continue to invest / buy given the growth pot'l.

18/ Like most companies in this market $FISV talks up their recurring revenue opportunity as subscriptions are eating the world ( @pipe)

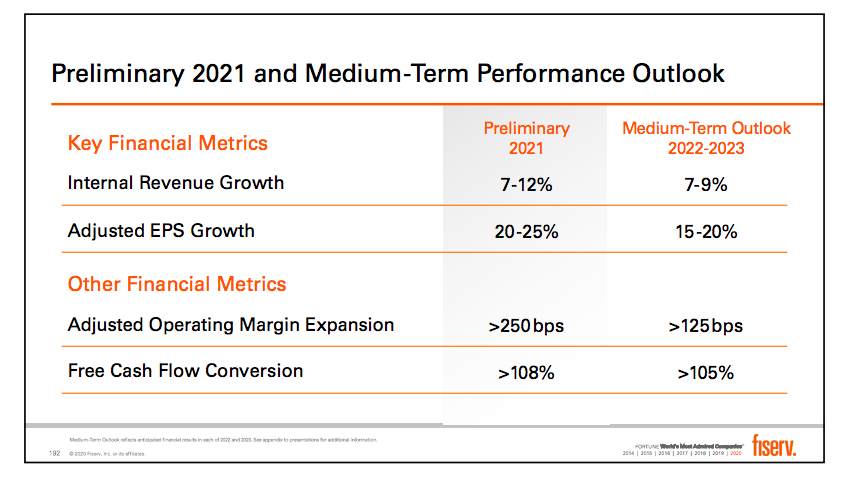

19/ $FISV expects to grow top line at 7-9% / year and EPS at 15-20% / year.

Yet it currently trades at ~22.5x EPS and 16.5x EV/EBITDA effectively market multiples.

Yet it currently trades at ~22.5x EPS and 16.5x EV/EBITDA effectively market multiples.

Read on Twitter

Read on Twitter