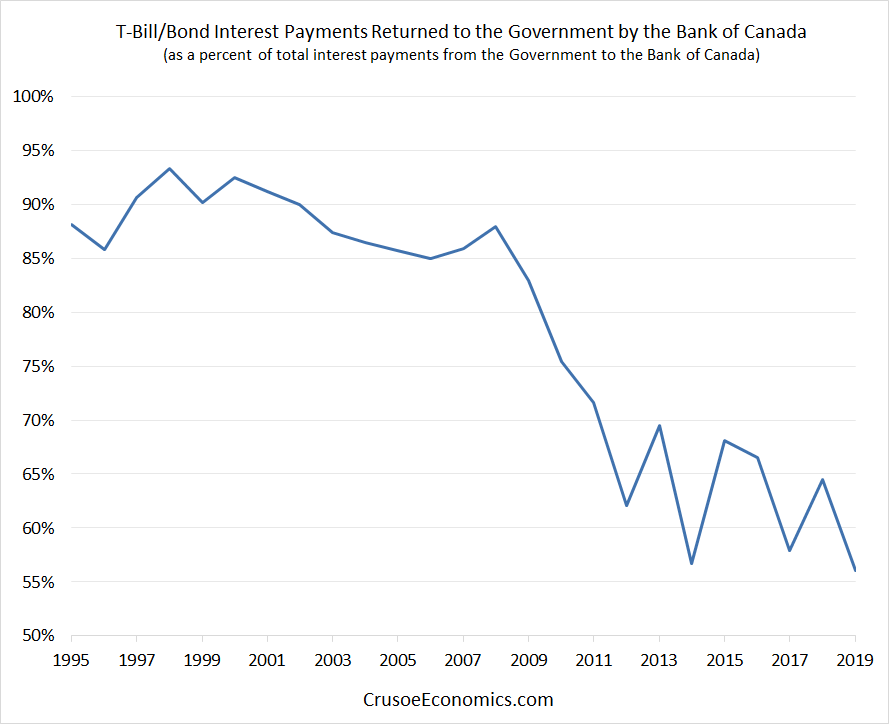

1/ Looking at the relationship between the BoC and the GoC with respect to debt "funding" has shown some pretty interesting results. The following graphs shows the percentage of interest paid by the GoC to the BoC that effectively gets returned back to the GoC as BoC profits.

2/ We know that the BoC remits its profits to the GoC and that those payments are often said to simply return GoC interest payments back to the government. This was largely true until the GFC, but after 2008, the percent of interest that was returned to the GoC fell sharply.

3/ I imagine the sharp drop in interest rates to be one of the main culprits. Ultimately the BoC is a profit-generating entity that earns profits on the spread between its liabilities (bank reserves) and its assets (GoC bonds/bills). As the spreads narrowed, BoC profits fell.

4/ I wrote about that a while ago. Here's the post https://crusoeeconomics.com/2020/12/03/how-the-bank-of-canada-funds-government-spending/

5/ But it seems there's also another contributing factor that reduced BoC profits that were returned to the GoC - the BoC's own pension plan! It seems the low interest rate environment has not been especially kind on the liability side of the plan.

6/ Falling interest rates lower the discount rate of the pension plan, increasing the present value of its future liabilities (ie. what it owes collecting pensioners). The BoC thus covers the increase in pension liabilities by returning less of its bond interest back to the GoC.

7/ So the narrative of "out one pocket and into the other" isn't really accurate these days. The BoC purchasing GoC debt is certainly lowering the overall cost of funds to the government, but not to the extent that people think.

Read on Twitter

Read on Twitter