Long awaited $FISV investor day took place today. The 5 hr long deep dive, 100+ pg presentation did not disappoint!

Some initial reflections here to augment prior musings, more to come

TLDR: 22x fwd P/E is very reasonable for a long runway to compounding FCF/share at 15%+ https://twitter.com/BlueToothDDS/status/1322396593358839808

Some initial reflections here to augment prior musings, more to come

TLDR: 22x fwd P/E is very reasonable for a long runway to compounding FCF/share at 15%+ https://twitter.com/BlueToothDDS/status/1322396593358839808

1) Before diving into detail on the various businesses/growth vectors, it’s important to focus on the value creation model that $FISV has utilized to deliver 420x+ returns for shareholders since its founding 35 yrs ago

2) This value creation model has contributed to 35 consecutive years of double-digit EPS growth

The last time $FISV shared this (in 2017) the growth algorithm targeted ~11-18% FCF/share growth, where earnings convert 100%+ to FCF deployed for capital return and accretive M&A

The last time $FISV shared this (in 2017) the growth algorithm targeted ~11-18% FCF/share growth, where earnings convert 100%+ to FCF deployed for capital return and accretive M&A

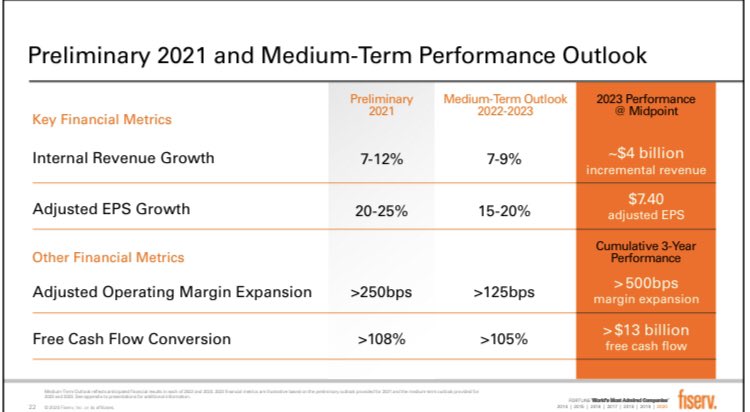

3) Fast forward to today and the outlook $FISV is committing to here is impressive on all levels

High single digit compounded revenue growth + 500+ bps margin expansion + 105%+ FCF conversion = $13B+ of cumulative FCF over next 3 yrs and a $7.40 EPS in 2023 at midpoint of guide

High single digit compounded revenue growth + 500+ bps margin expansion + 105%+ FCF conversion = $13B+ of cumulative FCF over next 3 yrs and a $7.40 EPS in 2023 at midpoint of guide

4) Is this medium term guide believable?

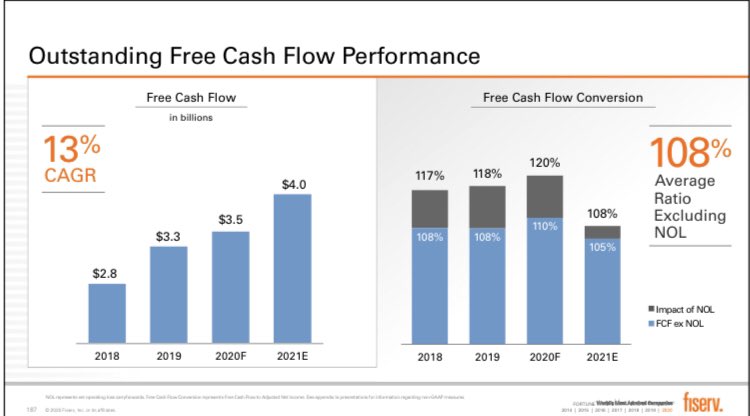

Here’s what $FISV has actually delivered the past few yrs, inclusive of 2021 guide midpoint: 4% organic compounded revenue growth + 480bps margin expansion + 108% FCF conversion (115%+ including NOL benefit) = 16% EPS CAGR and $13B+ FCF

Here’s what $FISV has actually delivered the past few yrs, inclusive of 2021 guide midpoint: 4% organic compounded revenue growth + 480bps margin expansion + 108% FCF conversion (115%+ including NOL benefit) = 16% EPS CAGR and $13B+ FCF

5) It’s amazing how the $FISV growth algorithm turns “mid-single digit” top line growth into compounding EPS at “mid-teens”

A large driver is redeployment of FCF to shrink share count and do accretive M&A

In the 3 yrs prior to FDC merger, 154% of FCF went to these 2 uses

A large driver is redeployment of FCF to shrink share count and do accretive M&A

In the 3 yrs prior to FDC merger, 154% of FCF went to these 2 uses

6) There’s some concern the FDC leverage would limit its ability to return FCF

The $30B+ over the next 5 yrs (FCF + add’l debt capacity) that $FISV earmarked towards capital return and opportunistic M&A should put that bear argument to rest

By next yr, leverage is back to < 3x https://twitter.com/BlueToothDDS/status/1298826588935643137

The $30B+ over the next 5 yrs (FCF + add’l debt capacity) that $FISV earmarked towards capital return and opportunistic M&A should put that bear argument to rest

By next yr, leverage is back to < 3x https://twitter.com/BlueToothDDS/status/1298826588935643137

7) For context, $30B is nearly 40% of the current $FISV!

Remember, just few weeks ago FISV upped its buyback authorization to 10% of outstanding shares

Even if only 25% is repurchased over the next 5 yrs (in line with historical pace), that leave $10B for future accretive M&A https://twitter.com/BlueToothDDS/status/1329576507342196736

Remember, just few weeks ago FISV upped its buyback authorization to 10% of outstanding shares

Even if only 25% is repurchased over the next 5 yrs (in line with historical pace), that leave $10B for future accretive M&A https://twitter.com/BlueToothDDS/status/1329576507342196736

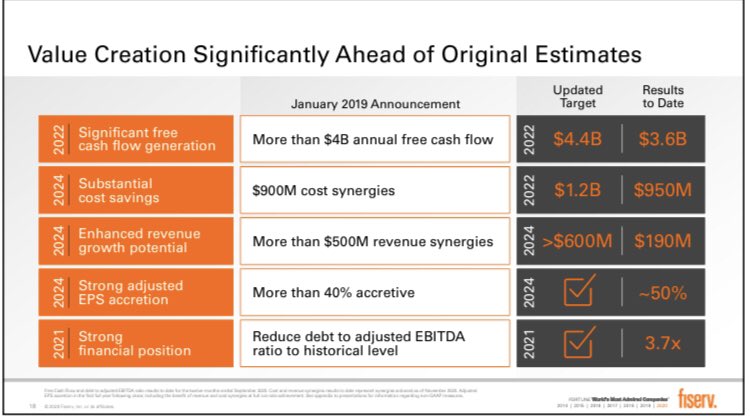

8) And speaking of M&A, $FISV gave an update on how things are tracking on the FDC integration

Despite an unplanned for global pandemic, both the level and pace of synergy realization from the combination of legacy FISV and FDC are far exceeding original expectations https://twitter.com/BlueToothDDS/status/1298826581633314816

Despite an unplanned for global pandemic, both the level and pace of synergy realization from the combination of legacy FISV and FDC are far exceeding original expectations https://twitter.com/BlueToothDDS/status/1298826581633314816

9) $FISV raised revenue synergy targets by 20% to $600M, 1/3 of those already actioned and the remainder phasing in over the medium term guidance period to add tailwind to the 7-9% revenue growth outlook (~10%+ of the ~$4B incremental revenue in 2023 at midpoint of guide)

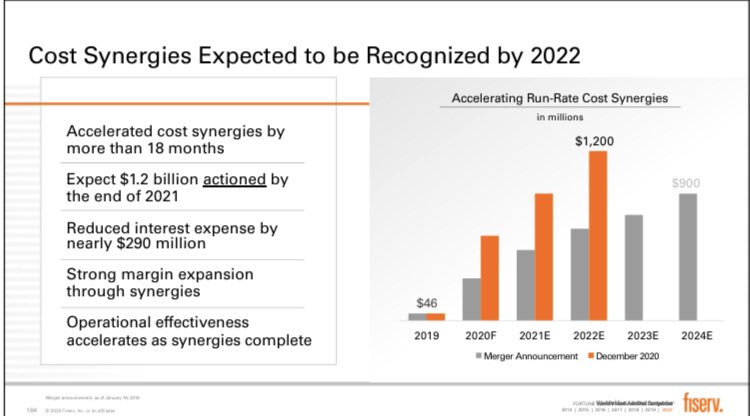

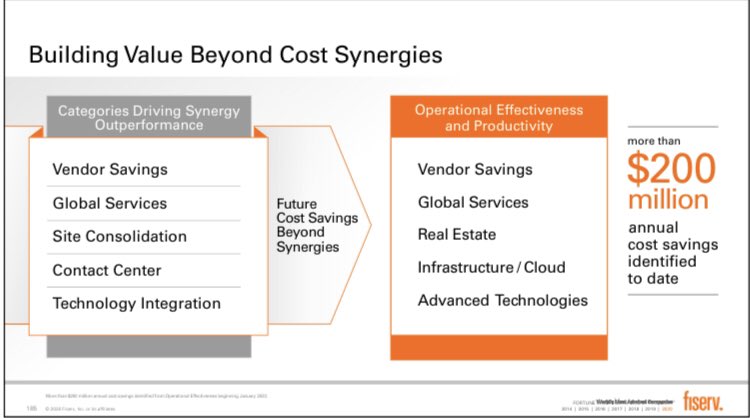

10) More impressive is $FISV capture of cost synergies. Not only was the target increased by 1/3, but now the full $1.2B cost takeout will be fully realized 2 yrs ahead of schedule

This doesn’t include the other $290M interest savings already captured from refinancing FDC debt

This doesn’t include the other $290M interest savings already captured from refinancing FDC debt

11) $FISV has a strong track record of operating lean and efficiently

In additional to the increased $1.2B of cost synergies, an incremental $200M of additional cost take out is now identified

These actions combine to fuel the 500+ bps margin expansion opportunity through 2023

In additional to the increased $1.2B of cost synergies, an incremental $200M of additional cost take out is now identified

These actions combine to fuel the 500+ bps margin expansion opportunity through 2023

12) $FISV has both operational levers ($0.6B revenue synergies, $1.4B combined cost synergies + add’l cost take out) and financial levers ($30B+ deployable FCF) to support 15-20% compounded FCF/share growth

... and this is all before underlying business momentum, let’s dive in!

... and this is all before underlying business momentum, let’s dive in!

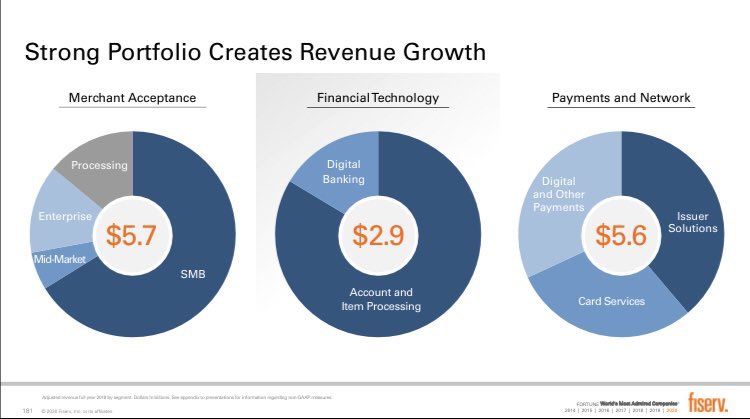

13) $FISV recently provided new insights into the composition of — and more importantly, the growth engines within — each of its 3 operating segments

Have linked all my prior and subsequent deep dives on each operating segment back to this thread, so they’re all in one place https://twitter.com/BlueToothDDS/status/1235745371005083649

https://twitter.com/BlueToothDDS/status/1235745371005083649

Have linked all my prior and subsequent deep dives on each operating segment back to this thread, so they’re all in one place

https://twitter.com/BlueToothDDS/status/1235745371005083649

https://twitter.com/BlueToothDDS/status/1235745371005083649

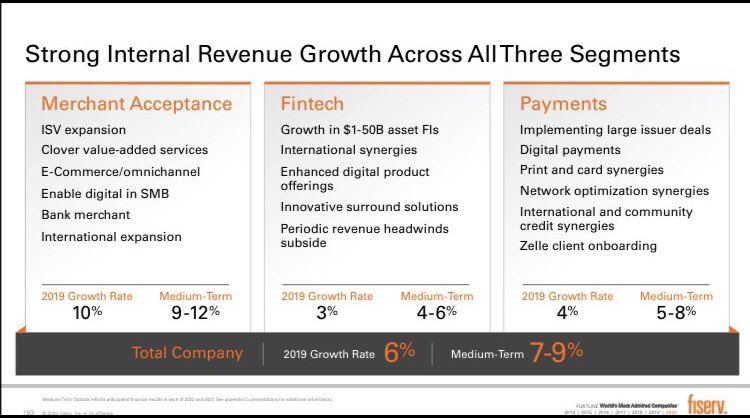

14) Merchant (~40% of $FISV revenue): this segment faces the most competition/disruption, but 9-12% medium term growth outlook certainly looks achievable — particularly with its 2 growth engines (Clover + Carat) now ~40% of segment revenue and growing 20%+

Why? Deep dive here https://twitter.com/BlueToothDDS/status/1337643323499147265

Why? Deep dive here https://twitter.com/BlueToothDDS/status/1337643323499147265

15) FinTech (~20% of $FISV revenue): core account processing and digital banking arm of legacy Fiserv with a more than reasonable 4-6% growth outlook

While it’s the smallest segment, this is the “glue” that ties things together

Why? Deep dive here https://twitter.com/BlueToothDDS/status/1339437463341772802

While it’s the smallest segment, this is the “glue” that ties things together

Why? Deep dive here https://twitter.com/BlueToothDDS/status/1339437463341772802

16) Payments & Network (~40% of $FISV revenue): lots of moving parts but this is where the most synergies and growth optionality can be found, with 2 highly complementary and strategic pieces of legacy FISV/FDC now merged together; 6-8% growth outlook

Why? Deep dive here https://twitter.com/BlueToothDDS/status/1344670553043513347

Why? Deep dive here https://twitter.com/BlueToothDDS/status/1344670553043513347

17) With sizable opportunities across all 3 segments, $FISV has multiple irons on the  to drive top line acceleration to 7-9% growth over the medium term

to drive top line acceleration to 7-9% growth over the medium term

Remember, its “growth algorithm” only needs mid-single digit growth to continue compounding FCF/share at double digits plus

to drive top line acceleration to 7-9% growth over the medium term

to drive top line acceleration to 7-9% growth over the medium termRemember, its “growth algorithm” only needs mid-single digit growth to continue compounding FCF/share at double digits plus

18) For those following along, thanks for all your feedback/questions

This is my last post on $FISV for a while (not much more to say)

TLDR: very reasonably priced for resiliency with long runway to compounding FCF/share at least double digits and likely 15%+ over medium term https://twitter.com/BlueToothDDS/status/1336552076013400065

This is my last post on $FISV for a while (not much more to say)

TLDR: very reasonably priced for resiliency with long runway to compounding FCF/share at least double digits and likely 15%+ over medium term https://twitter.com/BlueToothDDS/status/1336552076013400065

Read on Twitter

Read on Twitter