So you want to own Canadian land eh? https://twitter.com/cap_zay/status/1336363540488314881

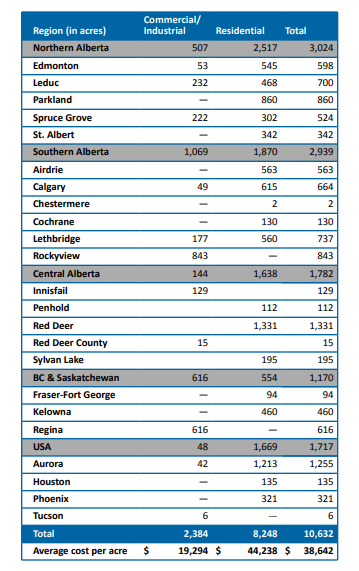

Melcor Developments $MRD.TO owns ~11,000 acres (below is just the raw land).

EV is ~$530 M, so the land is valued at $48,000/ac.

Here is something I wrote about it last year: http://www.canadianvaluestocks.com/melcor/

EV is ~$530 M, so the land is valued at $48,000/ac.

Here is something I wrote about it last year: http://www.canadianvaluestocks.com/melcor/

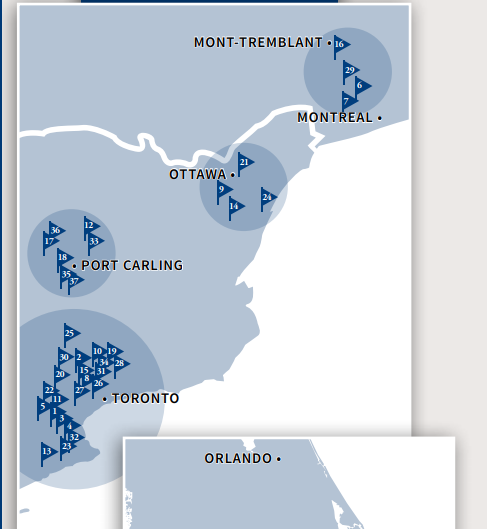

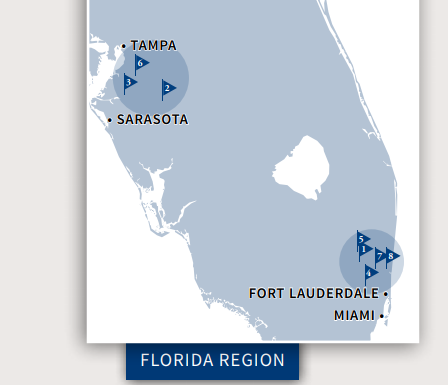

TWC Enterprises $TWC.TO owns ~10,000 acres of golf courses.

EV is $470 M, valuing the land at $47,000/ac.

TWC is run by Rai Sahi, about whom I wrote this (which includes the story of how he bought this land): http://www.canadianvaluestocks.com/rai-sahi/

EV is $470 M, valuing the land at $47,000/ac.

TWC is run by Rai Sahi, about whom I wrote this (which includes the story of how he bought this land): http://www.canadianvaluestocks.com/rai-sahi/

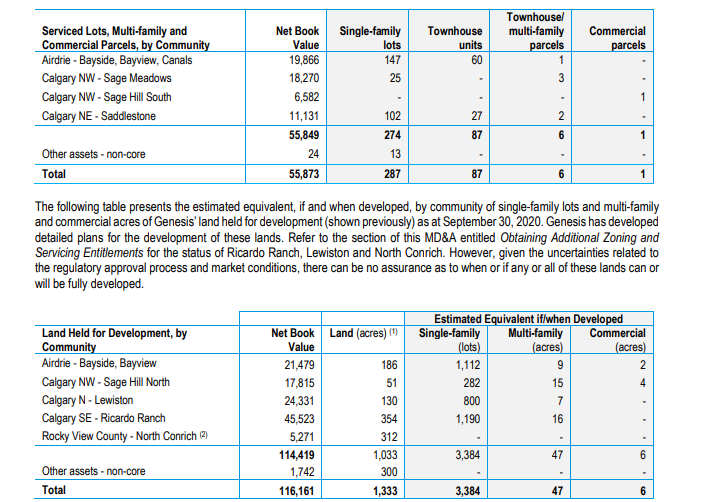

Genesis Land Development $GDC.TO owns something like 1700 acres (estimating single family lots/ac) all in the Calgary area.

EV ~$98 M, valuing the land at $58,000/ac

EV ~$98 M, valuing the land at $58,000/ac

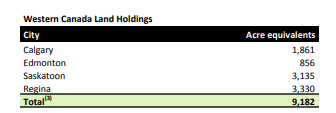

Dream Unlimited $DRM.TO owns 9200 acres in Western Canada.

EV is around $1.6 B, valuing the land at $172,000/ac.

I write about Dream constantly, and most recently wrote this: http://www.canadianvaluestocks.com/dream-unlimited-2/

EV is around $1.6 B, valuing the land at $172,000/ac.

I write about Dream constantly, and most recently wrote this: http://www.canadianvaluestocks.com/dream-unlimited-2/

It's important to note that with the exception of Genesis, the above all have a lot of valuable assets in addition to their land.

Melcor owns ~$37 M of $MR.UN, it owns a few golf courses (not counted in its land), and it has an asset management business.

TWC has a $66 M stake in $APR.UN, and its golf course operations are still profitable (it gets paid to hold the land while it appreciates).

Dream owns $575 M of $D.UN and $MPCT.UN, it owns Arapahoe Basin, real estate, Ontario land/developments not included in its land inventory above, and it has a growing asset management business.

There are also different kinds of land banks - mining project generators own a tonne of land, as do the lumber companies - but those are a very different thesis than the companies mentioned.

And there are REITs that own a lot of land but the value is mostly tied to buildings. For instance $SRU.UN owns 3500 acres of land, but with an EV of like $8.5 B, you're buying the real estate first and foremost.

Even so, the retail REITs do own a lot of land - think of the parking lots at malls and shopping centres. SmartCentres and Riocan $REI.UN both have plans to develop over 25 M sq. ft of new space to give you an idea.

Crombie $CRR.UN and Choice $CHP.UN, same story.

Crombie $CRR.UN and Choice $CHP.UN, same story.

If you're interested in owning land (Duddy Kravitz anyone?), the TSX offers you a wide variety of land, available at attractive valuations in a liquid form.

Read on Twitter

Read on Twitter