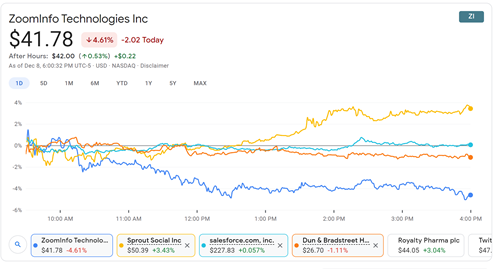

1. $ZI: $41.7, (+4.45% YTD), 52WH $64.4, 52WL $30.83, FY20 Rev $465M, (+58%), FY20EPS $0.31, (-34%) $ZI helps B2B marketing and sales professionals find target customers, leads and accounts. They build and manage a proprietary cloud database and sell them on a subscription basis

2. $ZI: ZoomInfo (founded 2000) is the name DiscoverOrg took after it acquired the company in 2019. DiscoverOrg was founded in 2007 by CEO Henry Schuck.

3. $ZI DiscoverOrg Historical Revenues:

2012: $10m

2013: $20m

2014: $25m ← PE Deal (TA Associates buys 50%+ for $25m)

2015: $40m

2016: $55m

2017: $70m

2018: $165m ← PE Deal (Carlyle buys 30% TA Associates Stake)

2019: $325m ← Acquired main competitor, ZoomInfo

2012: $10m

2013: $20m

2014: $25m ← PE Deal (TA Associates buys 50%+ for $25m)

2015: $40m

2016: $55m

2017: $70m

2018: $165m ← PE Deal (Carlyle buys 30% TA Associates Stake)

2019: $325m ← Acquired main competitor, ZoomInfo

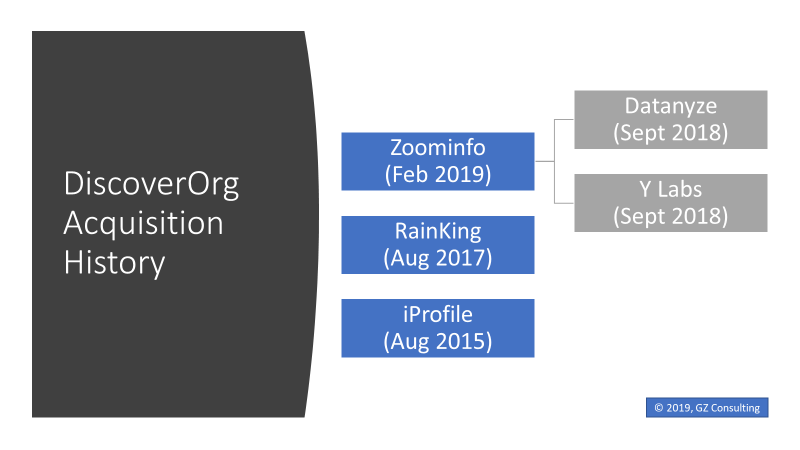

4. $ZI: $ZI has a history of acquisitions: RainKing (2017), ZoomInfo(2019), DataNyze (2019), Everstring (2020), iProfile (2015)

$ZI was held by private equity TA Associates, The Carlyle Group, and 22C Capital.

$ZI was held by private equity TA Associates, The Carlyle Group, and 22C Capital.

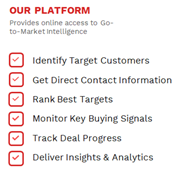

5. Customer Problem: E.g., 1 A marketer wants to target SMB companies in New York. Wants a list of all companies, by size to export it to $CRM or $HUBS and then place ads on LinkedIn ( $MSFT) for a target campaign Before $ZI, getting this list was hard and expensive

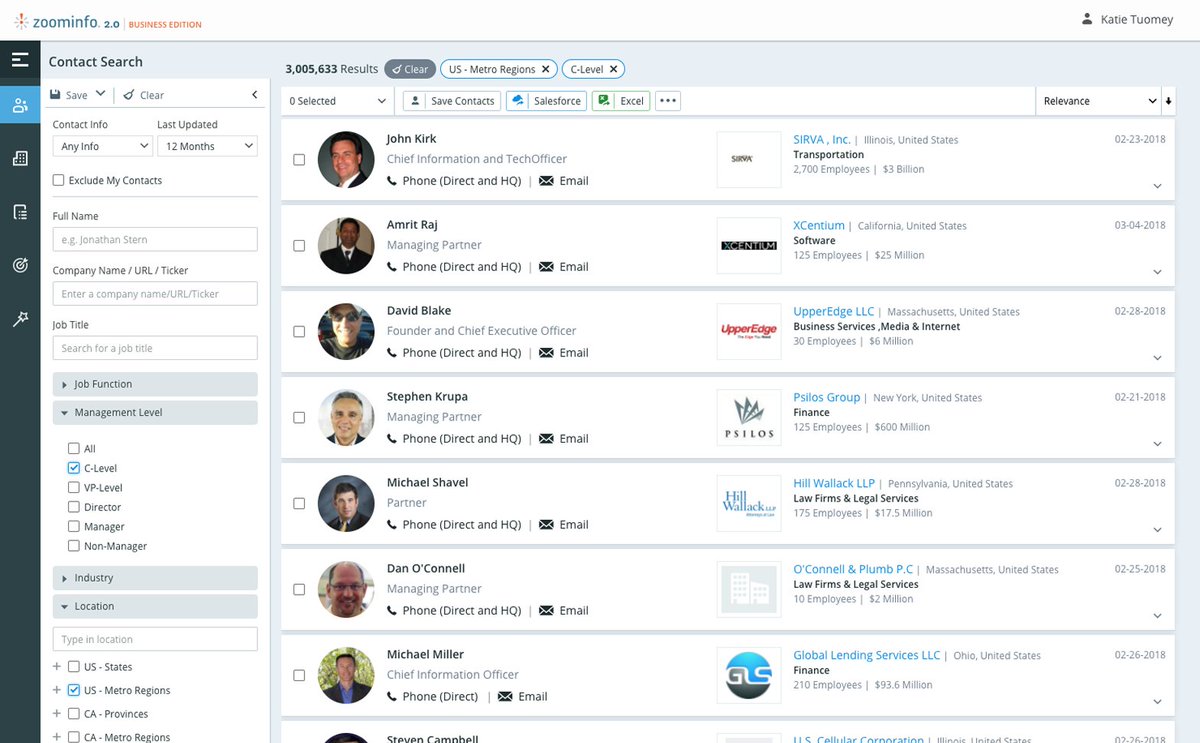

6. $ZI: Customer problem 2: E.g., 2 Salesperson, wants to know who the CIO’s in territory with more than 2000 employees are. Search for those on $ZI, get email or contact and send them messages. Before $ZI, most sales people would Google and manually create target lists

7. $ZI: Product: ZoomInfo takes data from multiple sources, curates, cleanses and then applies ML/AI to make it easy to search, review and export.

8. $ZI: Product: Now, sales and marketing can search, filter and view prospects in one place. This makes them more productive, reducing time to sales, increasing revenue and lowering cost of customer acquisition

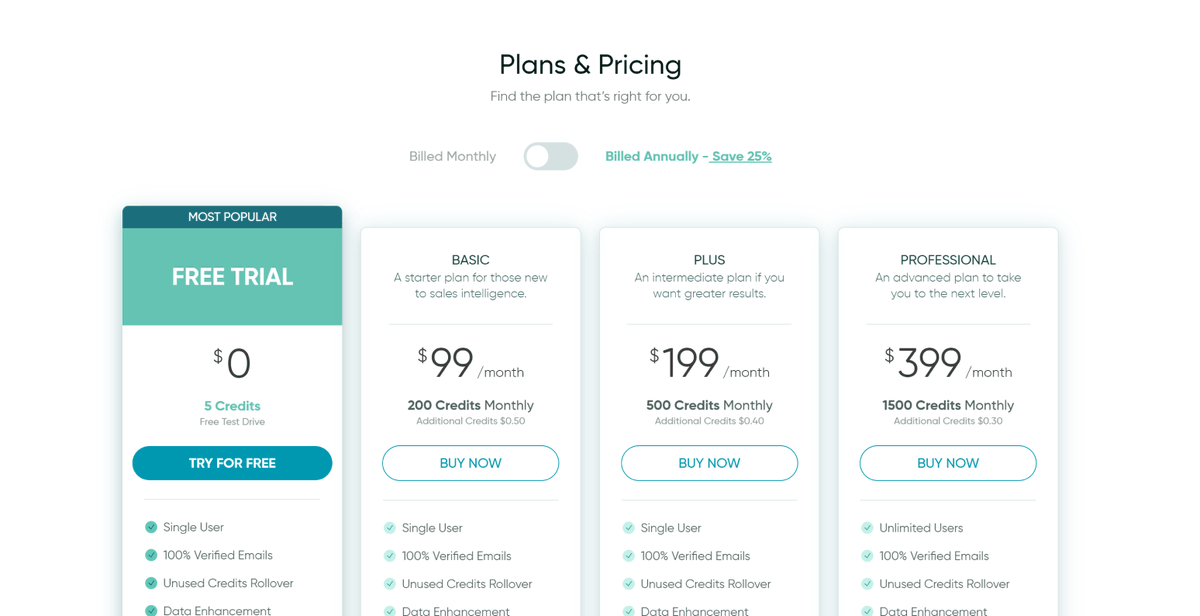

9. $ZI: Customers: 70K WW customers with about 400K seats later, pay ~$10K (or less depending on discounts)

10: $ZI: Market: The claim by $ZI is that their TAM is $24B - $30B. I did a bottoms up analysis and the SAM is closer to $8B -$12B. Still big, but I can be convinced otherwise. Without data and detailed breakdown I am going to assume $10B

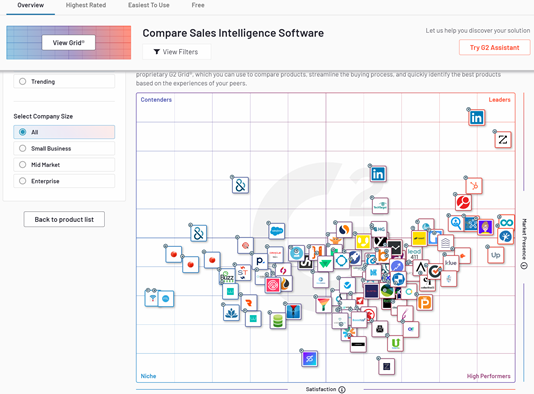

11. $ZI: Competitors: There are 100's of competitors for sales & marketing leads databases, the top 5 $ZI competes with are: $DNB Dun and Brad Street, $MSFT (Linkedin Sales Navigator), Clearbit (private), UpLeads (private) and Database USA.

12. $ZI: Competitors: $DNB is roughly 4X the size of $ZI in revenue, but lower in market cap. If you compare peers for stock performance, $ZI is in the middle of the pack. $ZI went IPO in Jul 2020

13: $ZI: Differentiation: While no company can offer a truly “comprehensive” B2B database, ZI is impressive with 59M business email addresses and 37M direct dials in the US. Globally 113M business emails and 59M direct dials. $ZI claims to verify 204,000 contacts to its DB daily

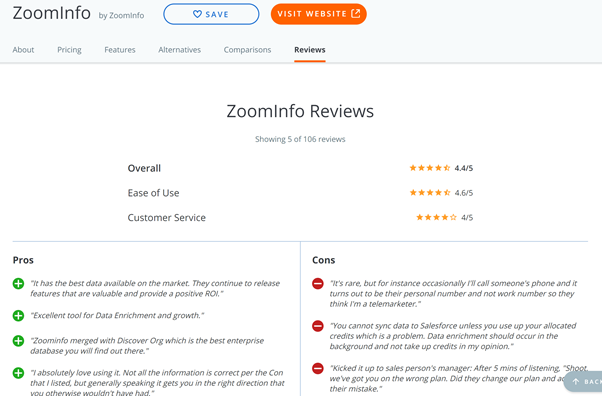

14: $ZI: Customers seem to love the product. Reviews at a strong 4.5/5 overall. Personally when I was heading sales my sales people swore by it.

15. $ZI Moats: Ease of use, Integration with CRM systems, Comprehensive database, Manual + AI/ML algorithms. Database accuracy is key and my research indicates they have work to do here. It is 90% accurate, which is a killer for sales people

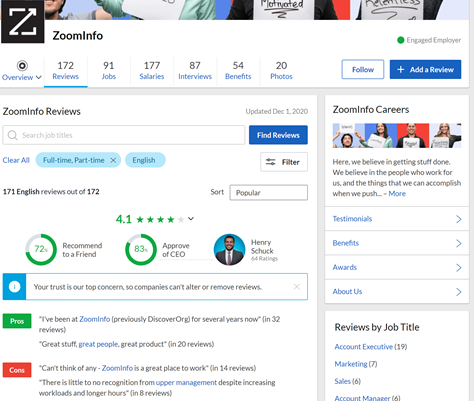

16. $ZI: Employees seem to mostly like @HenryLSchuck (disclosure: we are "LinkedIn connects"). In terms of CEO appreciation on Glassdoor, he is in the 80th percentile.

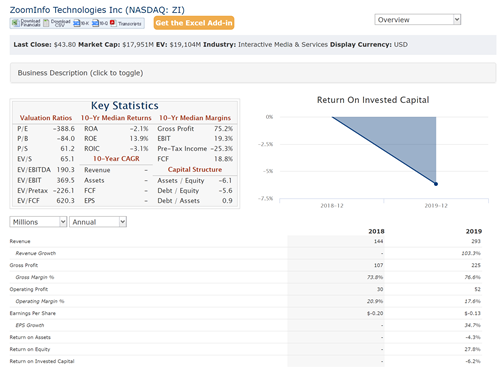

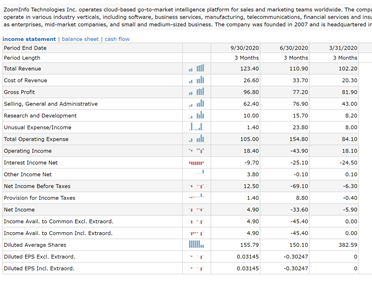

17: $ZI: Financials: Strong rev growth(+50% YoY, low debt, good metrics and middle of the pack gross margins (70%)

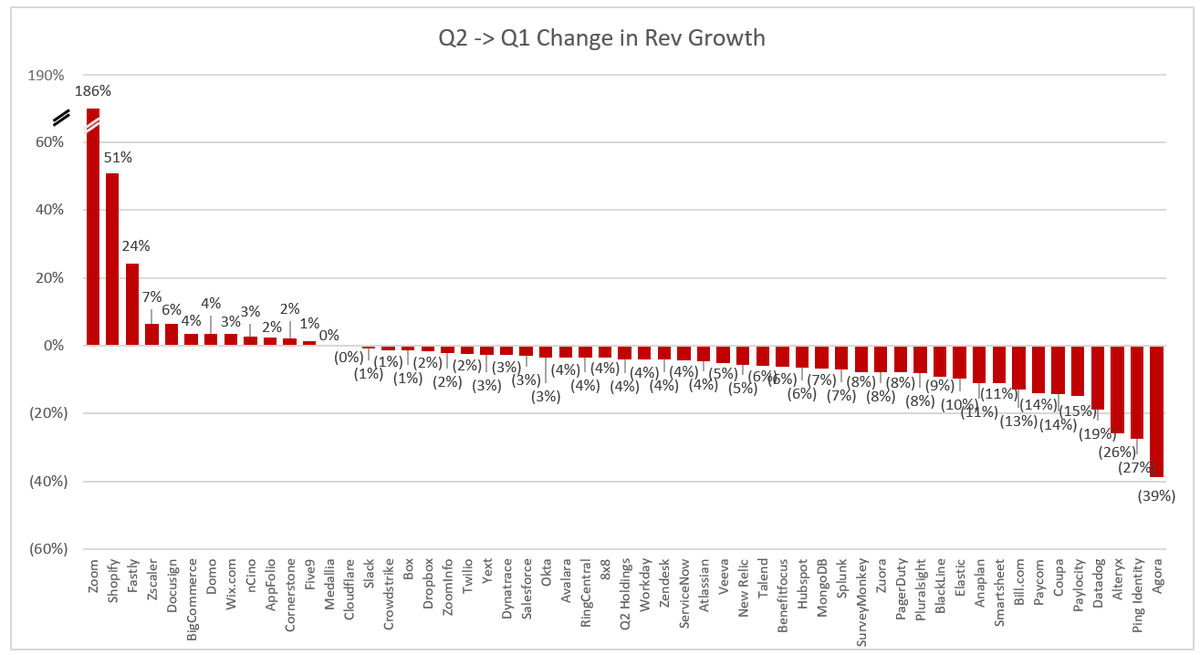

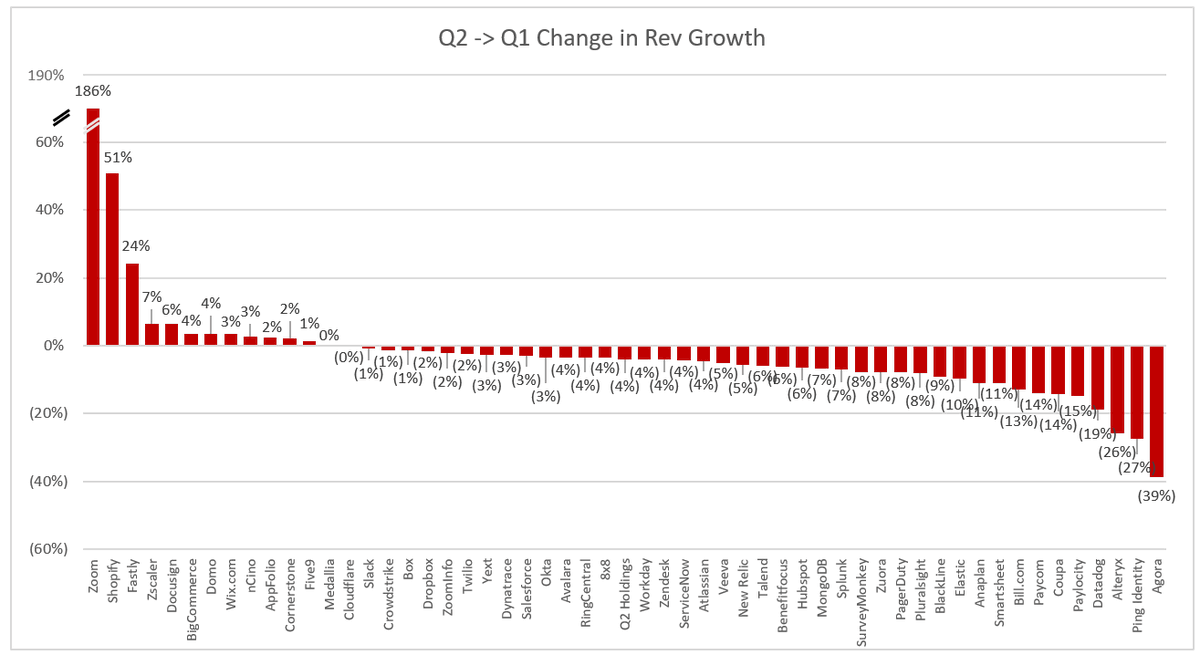

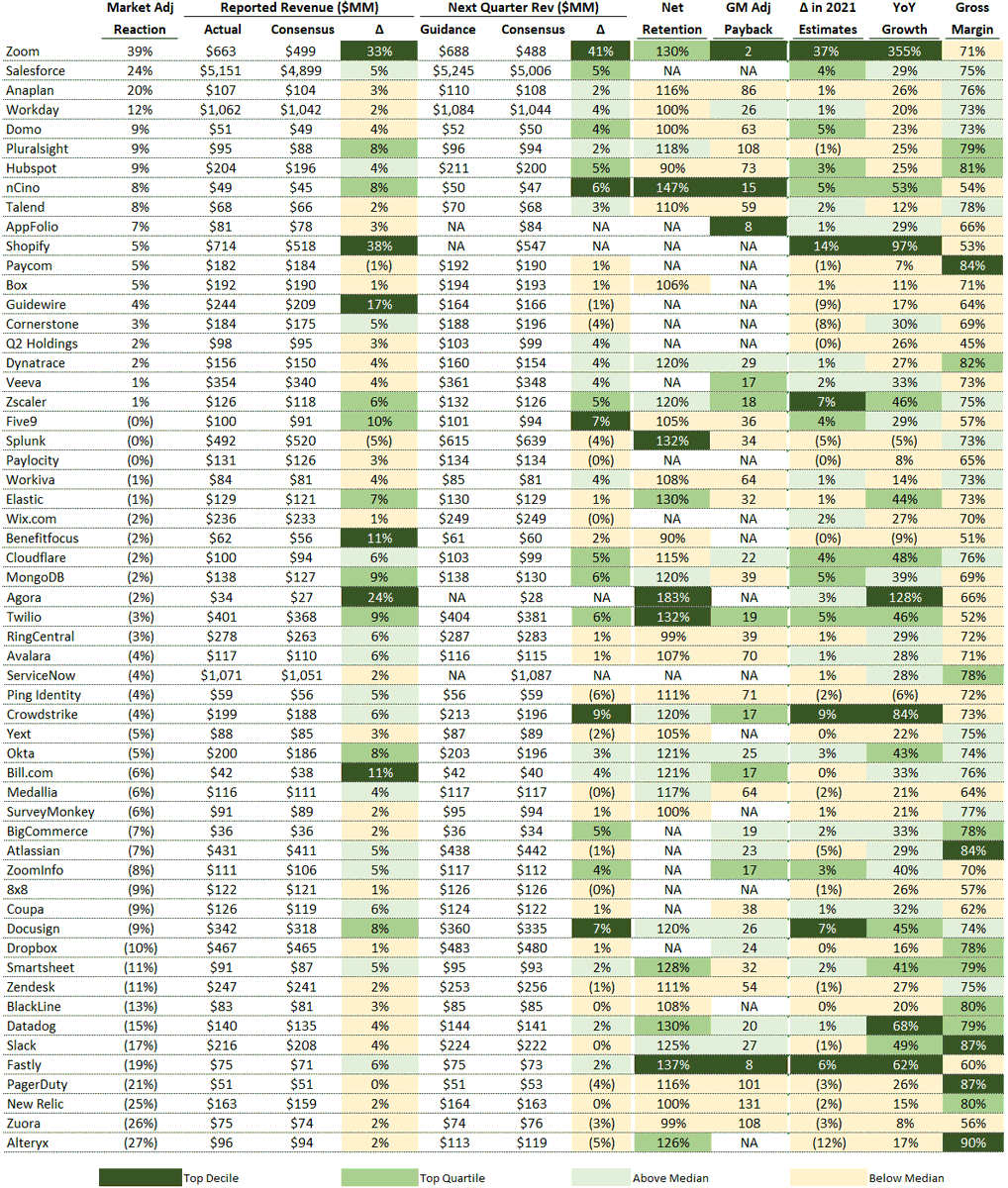

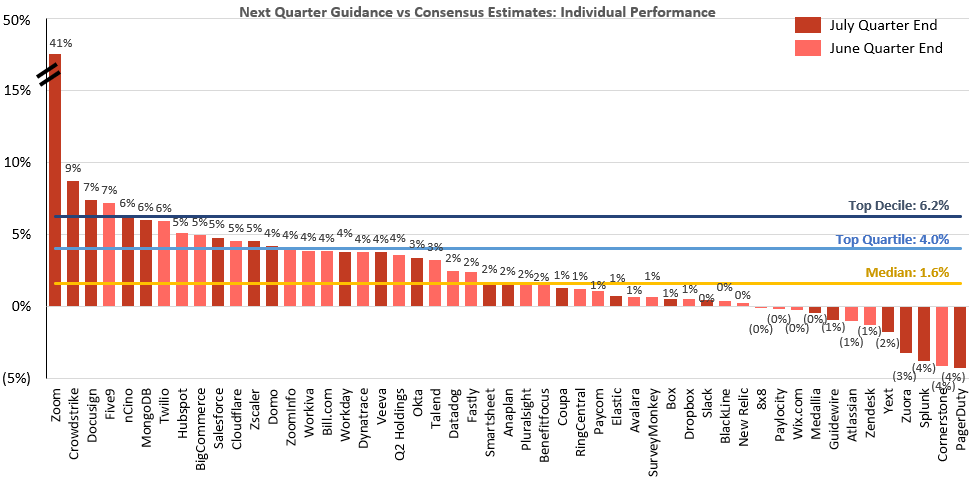

18. $ZI: SaaS metrics: ht: @jaminball Summary: They are in the 75th percentile in every metric. Which is not great, but not bad either.

19: $ZI: Quarterly revenue performance: Consistent beat and raise for the last 2 quarters. Strong tailwinds for growth in B2B sales and marketing

Read on Twitter

Read on Twitter