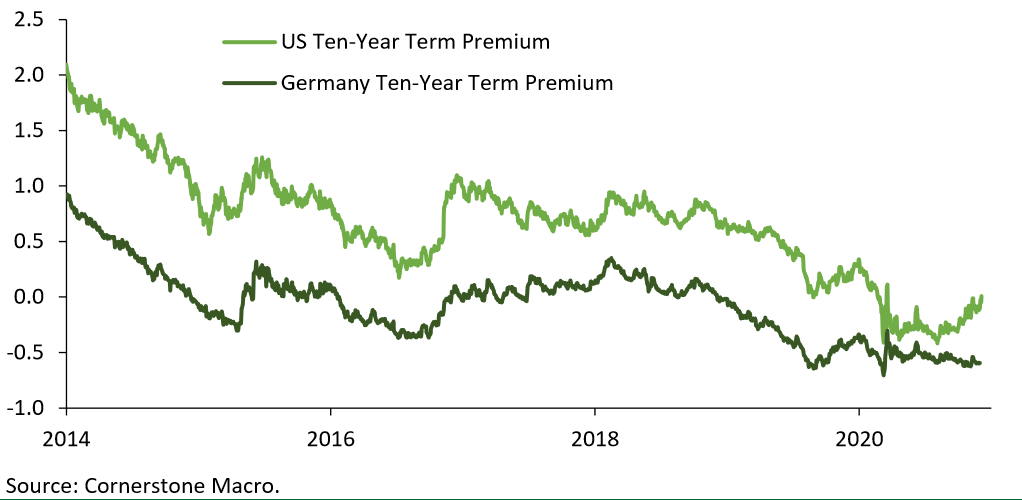

1/5 Significant divergence of late between US and German term premiums.

Hard not to interpret it as the (at least partial) result of the difference between #ECB easing commitment (pedal to the metal) and #Fed reluctance to do the same.

Hard not to interpret it as the (at least partial) result of the difference between #ECB easing commitment (pedal to the metal) and #Fed reluctance to do the same.

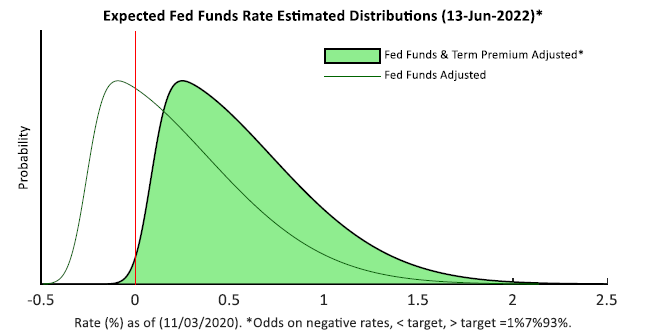

2/5 US term premiums have declined relative to Germany's at short maturities, but they remain much higher (lines below are the difference between the two).

The difference should be much smaller (~0) if the market was very confident the Fed was going keep the FFR at zero for yrs.

The difference should be much smaller (~0) if the market was very confident the Fed was going keep the FFR at zero for yrs.

3/5 This is consistent with what @jbensondurham has been harping on for a while - that ED options price in relatively high odds of an early liftoff.

4/5 One can say that vaccines and prospects for fiscal stimulus counsel prudence to the #Fed. But vaccines affect US and EZ the same. And fiscal stimulus has been significant in the EZ as well. It seems to me that the #ECB is more committed to its policy course.

5/5 From this I conclude that #Fed communication has left something (or more) to be desired.

How are we supposed to believe (among other things) that the Fed is committed to overshooting the inflation target if doubts about early rate hikes are allowed to linger and grow?

How are we supposed to believe (among other things) that the Fed is committed to overshooting the inflation target if doubts about early rate hikes are allowed to linger and grow?

Read on Twitter

Read on Twitter