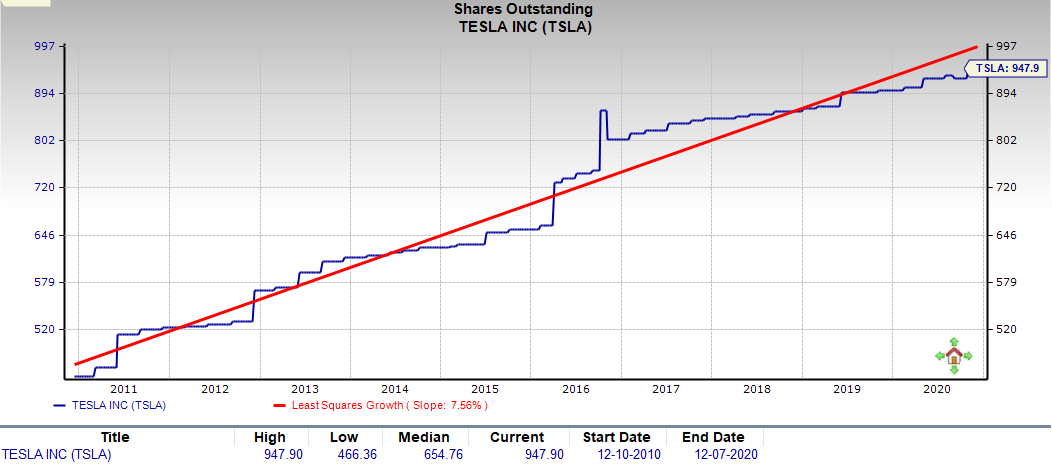

Here's what "But its only a 1% equity raise" looks like over 10 years. It made sense up until 1H19, but since then, $TSLA cash flow has been sufficient to support even aggressive growth capex while leverage risk is at ATL.

Not happy with this lack of stewardship of the equity.

Not happy with this lack of stewardship of the equity.

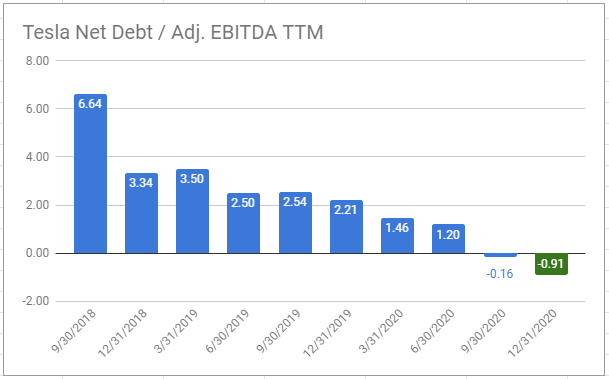

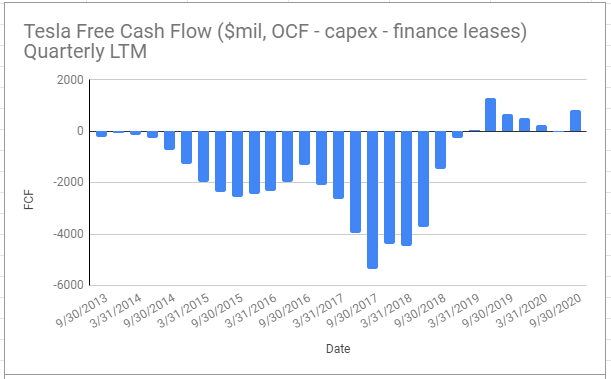

Tesla already has an incredibly underleveraged balance sheet - one that now has cash that exceeds the entire debt load of the company, and 1/3 of that total debt about to be extinguished because they're deeply ITM converts - with positive free cash flow.

The combo of 1) extremely underleveraged balance sheet, and 2) positive FCF means that issuing equity actually destroys value.

If Tesla needed additional funding, debt markets are very cheap right now.

This ATM basically signals that mgmt believes Tesla stock is overvalued.

If Tesla needed additional funding, debt markets are very cheap right now.

This ATM basically signals that mgmt believes Tesla stock is overvalued.

Read on Twitter

Read on Twitter