Stock Market Portfolio

Weekly Update

Weekly Update

Attached thread is last weeks update

Keep scrolling to see this week’s update!

Note: short term movements are meaningless. The purpose of these updates is to demonstrate accountability for my strategy & correct portfolio management https://twitter.com/fisavvydad/status/1333422551469600770

Weekly Update

Weekly Update

Attached thread is last weeks update

Keep scrolling to see this week’s update!

Note: short term movements are meaningless. The purpose of these updates is to demonstrate accountability for my strategy & correct portfolio management https://twitter.com/fisavvydad/status/1333422551469600770

Overview:

Start point: £7,451

Vs

End point: £7,509

The portfolio has been all over the place this week, but still finishing up +£58 overall

The markets are showing some signs of resistance imo but still on a run right now with positive vaccine news

Let’s see the insights...

Start point: £7,451

Vs

End point: £7,509

The portfolio has been all over the place this week, but still finishing up +£58 overall

The markets are showing some signs of resistance imo but still on a run right now with positive vaccine news

Let’s see the insights...

This hasn’t changed much!

Still happy with my diversification

Would ideally like to be holding more cash, but there have been a couple of opportunities I couldn’t pass up that required me to dive into my reserves!

Let’s see the yearly ROI...

Still happy with my diversification

Would ideally like to be holding more cash, but there have been a couple of opportunities I couldn’t pass up that required me to dive into my reserves!

Let’s see the yearly ROI...

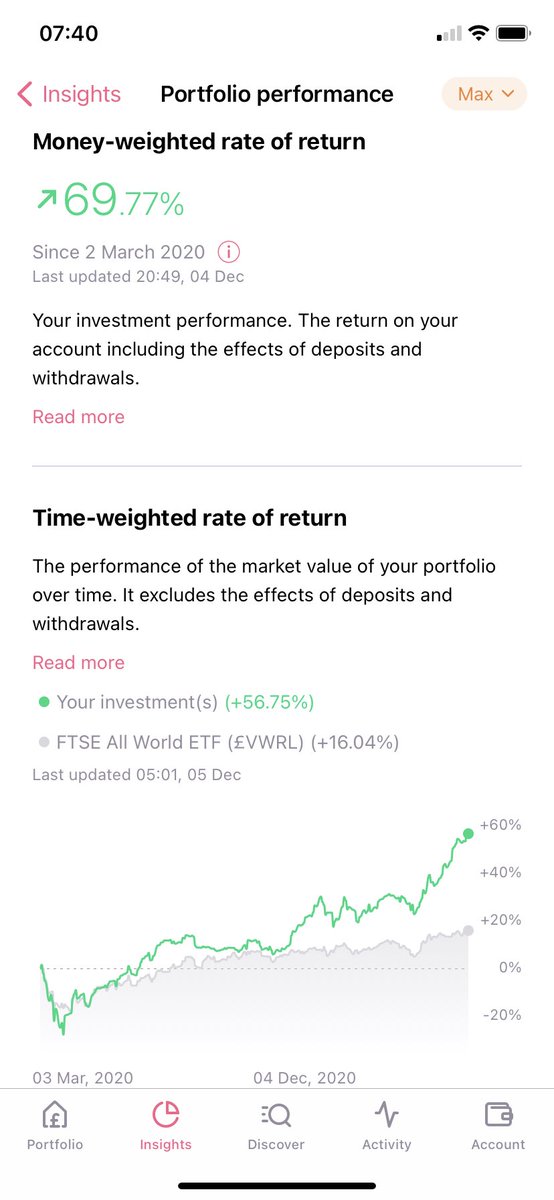

The time-weighted rate of return sits at 56%

Vs the markets 16% return for the same time period

The portfolio is actually up 61% since its inception over 18 months ago

My strategy is working very well!

Let’s see what I bought last week...

Vs the markets 16% return for the same time period

The portfolio is actually up 61% since its inception over 18 months ago

My strategy is working very well!

Let’s see what I bought last week...

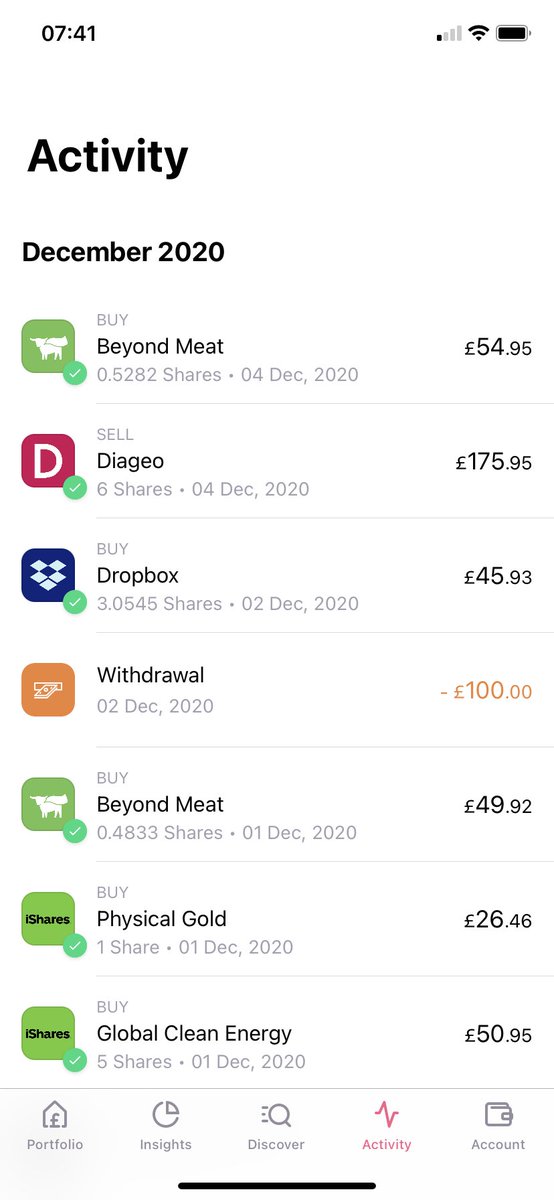

I actually SOLD a position

I moved out of my position in Diageo

It was only ever a ‘safe’ bet to put some reserve cash as it’s a solid company with a decent dividend return

But I had other positions I see greater opportunity with now so it was time to move on

I moved out of my position in Diageo

It was only ever a ‘safe’ bet to put some reserve cash as it’s a solid company with a decent dividend return

But I had other positions I see greater opportunity with now so it was time to move on

I also BOUGHT more $BYND $DBX and some gold and clean energy ETF’s

The withdrawal was to transfer to my 212 account to buy some $JMIA which you can’t buy via an ISA for tax reasons...

So, my positions overall...

The withdrawal was to transfer to my 212 account to buy some $JMIA which you can’t buy via an ISA for tax reasons...

So, my positions overall...

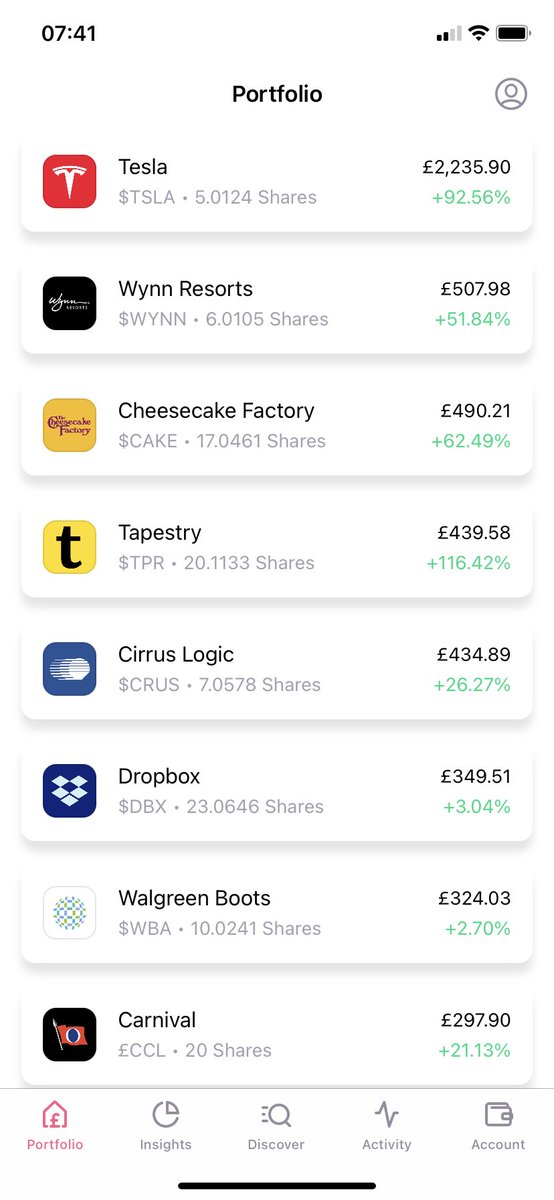

This is what my complete list of holdings in the public account look like as of last week

$TSLA $WYNN $CAKE $TPR $CRUS $DBX $WBA £CCL.L £IITU.L $RVLV £INRG.L $BYND £VHYL.L $AAPL $GOOGL $UPWK $SFIX £LSE.L £IH2O.L £SGLN.L £HMCH.L

$TSLA $WYNN $CAKE $TPR $CRUS $DBX $WBA £CCL.L £IITU.L $RVLV £INRG.L $BYND £VHYL.L $AAPL $GOOGL $UPWK $SFIX £LSE.L £IH2O.L £SGLN.L £HMCH.L

What stocks are you watching/holding/buying/selling that I should know about?

Let me know on the comments

And if you want to learn my strategy

You can get it here: https://gum.co/Nqyej

Let me know on the comments

And if you want to learn my strategy

You can get it here: https://gum.co/Nqyej

Read on Twitter

Read on Twitter