Climate intrapreneurs - a thread. Despite the stereotype there are people working within banks who feel deep concern for our planet and future generations with a sense of urgency to address the climate crisis that threatens them. Here are their stories. https://filab.uk/climateintrapreneurs2020

These insights were generated through the Climate Safe Learning Lab, an initiative of @ClimateLending Network which @TheFinanceLab leads as a network member. We host confidential conversations for banking professionals committed to climate action inside their institutions.

Climate intrapreneurs (noun): Banking professionals who are working to embed climate action within the core strategy, operations and culture of their institution. They can work in any role at any level. There are three broad archetypes, all just as vital as the other:

1. THE PIONEER: Directly develops or implements climate-related strategies, frameworks, methodologies and innovations. Often in sustainability, risk, reporting and strategy roles.

2. THE PATRON: Creates institutional space (resources, relationships, mandates, protection) for colleagues to integrate climate into their work. Often P&L owners, senior leaders or individuals with high levels of informal influence.

3. THE GUIDE: Builds organisational capacity around climate, creates new networks and connections and supports others to embed climate into their day job. Often in support functions such as HR and Transformation or informally supporting colleagues.

At the strategic level there are five things climate intrapreneurs must ensure their banks are doing as outlined in the report, Taking the Carbon Out of Credit by @James_Vaccaro at @ClimateLending:

1. Take responsibility for climate risk

2. Be accountable for both positive and negative climate impact

3. Stop the flow of finance to fossil fuels

4. Decarbonise economies and balance sheets

5. Finance innovation for a sustainable future https://www.climatesafelending.org/taking-the-carbon-out-of-credit

2. Be accountable for both positive and negative climate impact

3. Stop the flow of finance to fossil fuels

4. Decarbonise economies and balance sheets

5. Finance innovation for a sustainable future https://www.climatesafelending.org/taking-the-carbon-out-of-credit

But there are three underlying factors inside a bank that determine whether and how fast these things happen: organisational structures; relationships and power dynamics; and mental models.

There are four areas where climate intrapreneurs are turning challenges into catalysts for accelerated climate action within their banks. This takes courage, resilience and building strong relationships of trust.

1. Personal leadership challenges: Climate intrapreneurs are asked to leave their personal values at the door and put on their 'business hat' at work. This cognitive dissonance drives them to speak out, find allies and model a different way of being a banker in the world.

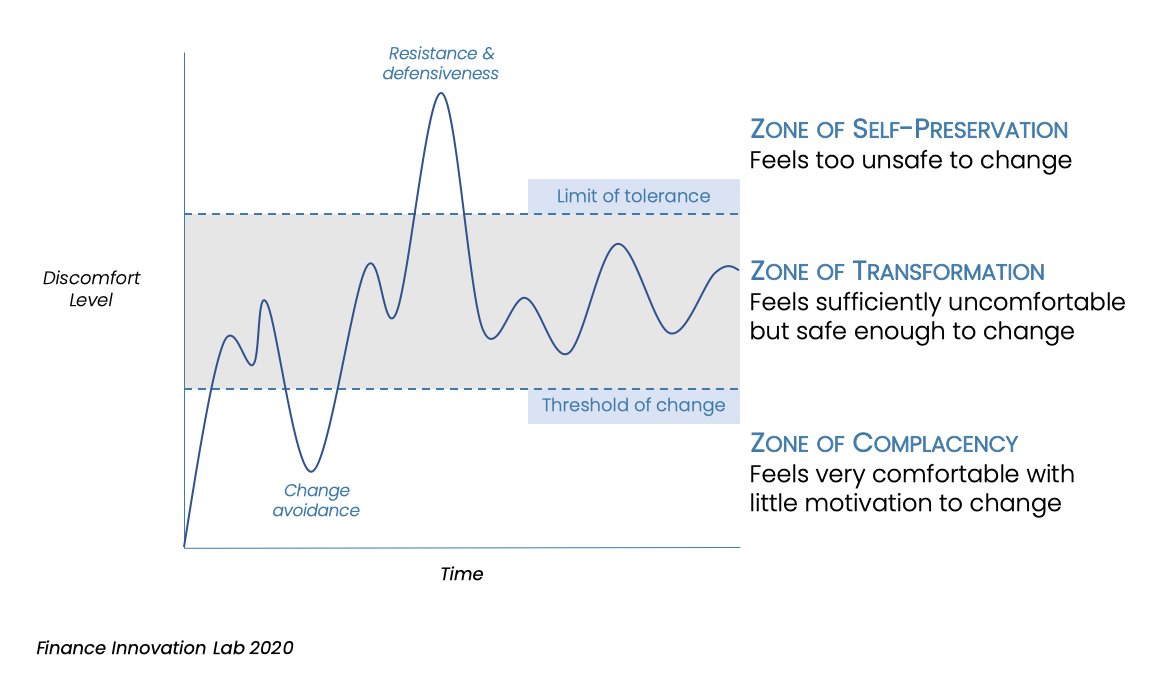

2. Shifting mindsets and building buy-in: Climate intrapreneurs are reframing the role of banks in the transition - to lead clients not follow demand. This requires getting comfortable with being uncomfortable as banks must build the ship while sailing. There's no time to wait.

3. Influencing relationships and navigating power dynamics: Climate intrapreneurs walk a tightrope between pushing too fast they lose their seat at the table and so soft that it's too little too late. They navigate competing agendas and find windows of opportunities to act.

4. Creating enabling organisational structures: Climate intrapreneurs break down organisational silos, making sustainability everyone's job. They push for resource allocation, training and development that grows climate capability in every part of their bank.

Here are three things that external bank influencers (campaigners, investors, regulators) might want to know:

1. Banks are not monoliths: There are people inside who feel more like climate activists than traditional bankers, looking to build relationships with external allies.

1. Banks are not monoliths: There are people inside who feel more like climate activists than traditional bankers, looking to build relationships with external allies.

2. Invisible dynamics shape visible outcomes: External commitments and reporting don't tell the whole story. Knowledge of the internal structures, power dynamics and mindsets can help external stakeholders put pressure in the right places to address root causes of bank inertia.

3. Campaigning pressure is welcomed: Climate intrapreneurs welcome NGO, client and investor pressure on their climate strategies. They leverage this internally to get decision makers to act based on reputational and financial risk drivers.

The Learning Lab is set up as a confidential peer learning space open to banking professionals only. We explicitly explore the underlying factors within banks that impact climate strategies through a lens of systems thinking, collaborative leadership and org transformation.

It's a high trust environment enabling transparent conversations that tend to be much more performative in other settings. This is enabled through careful design and soulful facilitation by people like @thebeccab. "It feels like a sustainability professionals anonymous session."

Banking professionals (climate intrapreneurs) can join the Learning Lab community at: http://www.climatesafelending.org/learning-lab

External bank influencers can join the Climate Safe Lending Network at http://www.climatesafelending.org/contact-us

External bank influencers can join the Climate Safe Lending Network at http://www.climatesafelending.org/contact-us

Thank you for your contributions & support: Amara Gossin, @thebeccab, Celine Suarez, @franboait, @DCIvan, @James_Vaccaro, @JesseLGriffiths, Kimberley Jutze, Lauren Compere, @leslieharroun, Lizzie Flower, @MarloesNicholls, @nainaydoo, @sumner_smith, @t_krumpelman, @Yvdude

Read on Twitter

Read on Twitter