Every year, I'm eagerly awaiting the results from @atomico's State of European Tech report, as it's also one of the most comprehensive data dives into the state of purpose-driven tech investments. This year's results are fascinating. [A thread]

Small caveat - methodology from @dealroom is aligned with the SDG framework and while it serves as blueprint to define outcomes for a better world for people + planet, it does still come with it's flaws. eg. SDGs massively neglect LGBTQ+ issues, which comes as no surprise /2

as a large number of UN member states still criminalise LGBTQ+ folk. We can argue all day long about the value of SDGs in imp measurement. I highly encourage people to read Stonewall's SDG guide for LGBTQ+ inclusion. For now, we start with them & look at levels of investment /3

So building on their dataset @dealroom the number of venture-backed, purpose-driven tech companies grew from 528 analysed in the 2019 report to over 3,000 in this year's report. https://impact.dealroom.co/intro /4

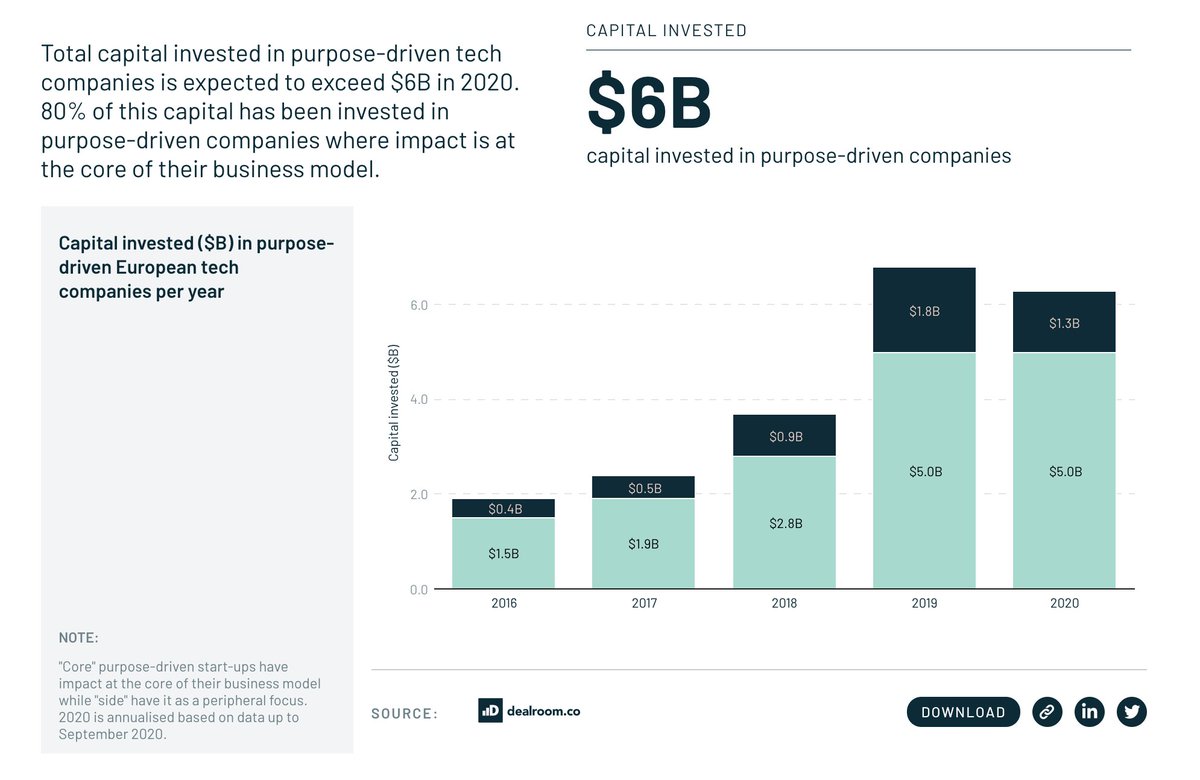

"Total capital invested in purpose-driven tech companies is expected to exceed $6B in 2020."

"80% of this capital has been invested in purpose-driven companies where impact is at the core of their business model."

/5

"80% of this capital has been invested in purpose-driven companies where impact is at the core of their business model."

/5

Over $20B has been invested in purpose-driven tech companies over the last 5 years across 3,000+ rounds.

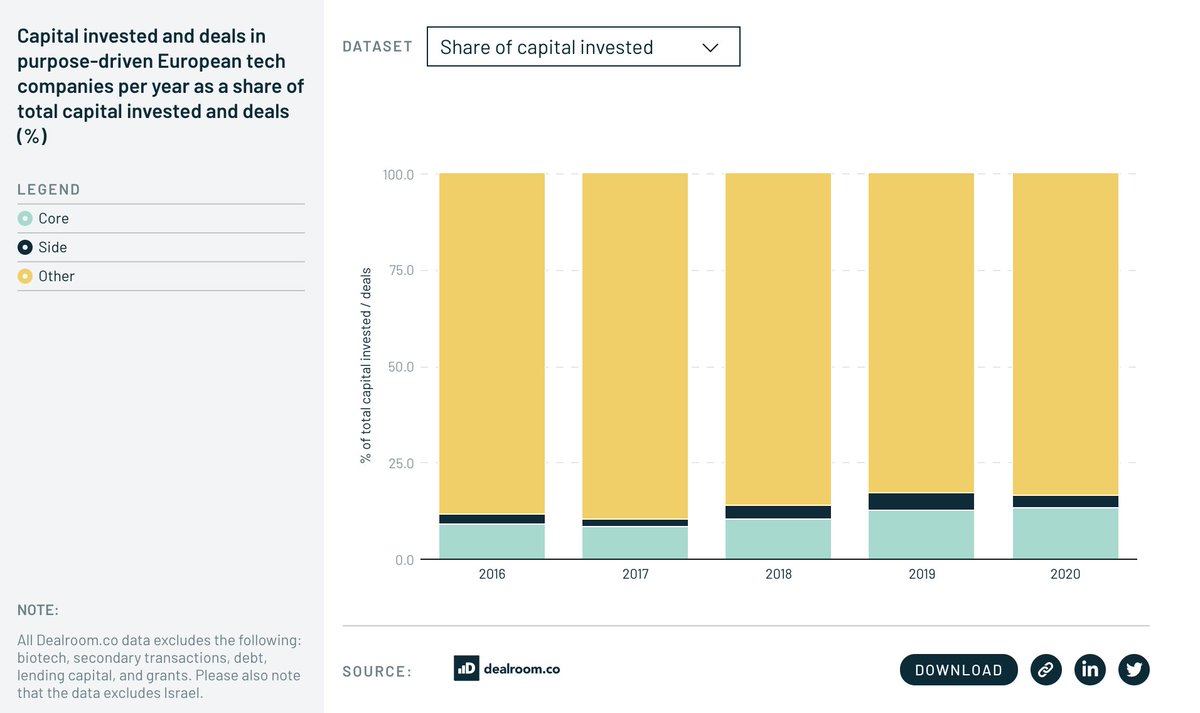

~17% of 2020 capital invested went to purpose-driven companies - which shows more people care and want to put their money where their mouth is. /6

~17% of 2020 capital invested went to purpose-driven companies - which shows more people care and want to put their money where their mouth is. /6

#ClimateTech is getting by far the most action: $11B capital invested into companies targeting climate action since 2016. And we'll only see more of this - 542 investors with nearly $52 trillion AUM signed on to @ActOnClimate100 pledging to drive action on climate change /7

And the emergence of early-stage investors such as @palebluedotvc @AstanorVentures and more is crucial to help more early-stage founders scale. At the same time, I wish there were more pre-seed options for founders or R&D pockets for more #ClimateTech, but hey we'll get there /8

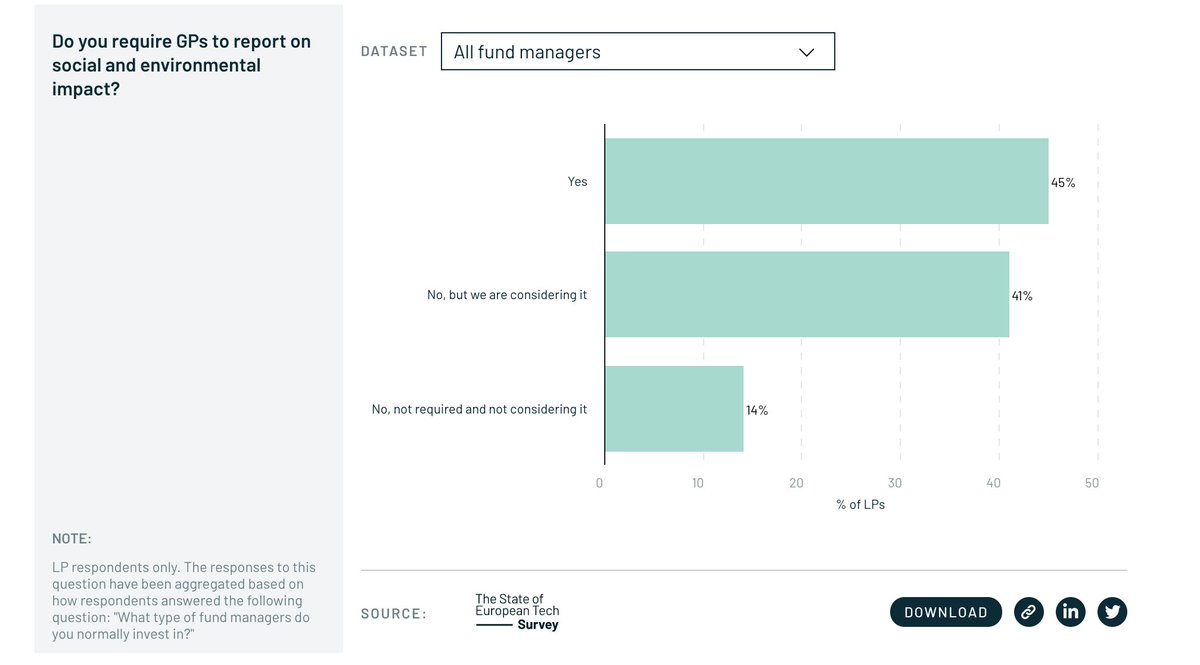

Last but not least, LPs are a major force to reckoned with and the data suggests that more LPs are considering to or already require GPs to report on the social and environmental impact of their portfolio /9

At @bg_ventures we're certainly lucky to have @BigSocietyCap as one of our LPs. They've been incredible helping our ventures on the programme with impact measurement and support us in shaping our impact methodology across the portfolio. Find yourself more LPs like them :)

/10

/10

Also generally, check out their blog - the latest on @AscensionGrp impact strategy and best practice for their Fair by Design Fund is a fascinating read https://bigsocietycapital.com/latest/impact-best-practice-venture-fair-design-fund/

/11

/11

Well that's it on purpose-driven tech investment from this year's report - but do make sure to check out the full report https://2020.stateofeuropeantech.com/ and join the launch event later today https://hopin.to/events/2020-state-of-european-tech-report-3751c1d6-fa9e-4c59-ae0a-353d07b28465 [end]

Read on Twitter

Read on Twitter