There is a lot to admire about @Square's underlying business.

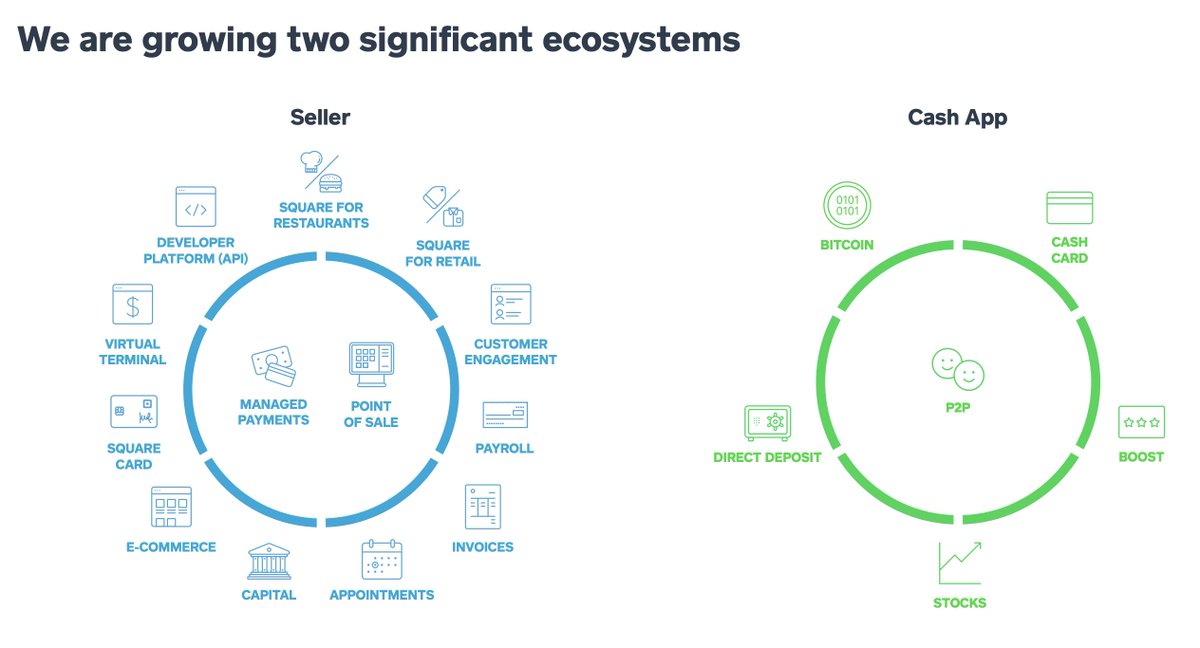

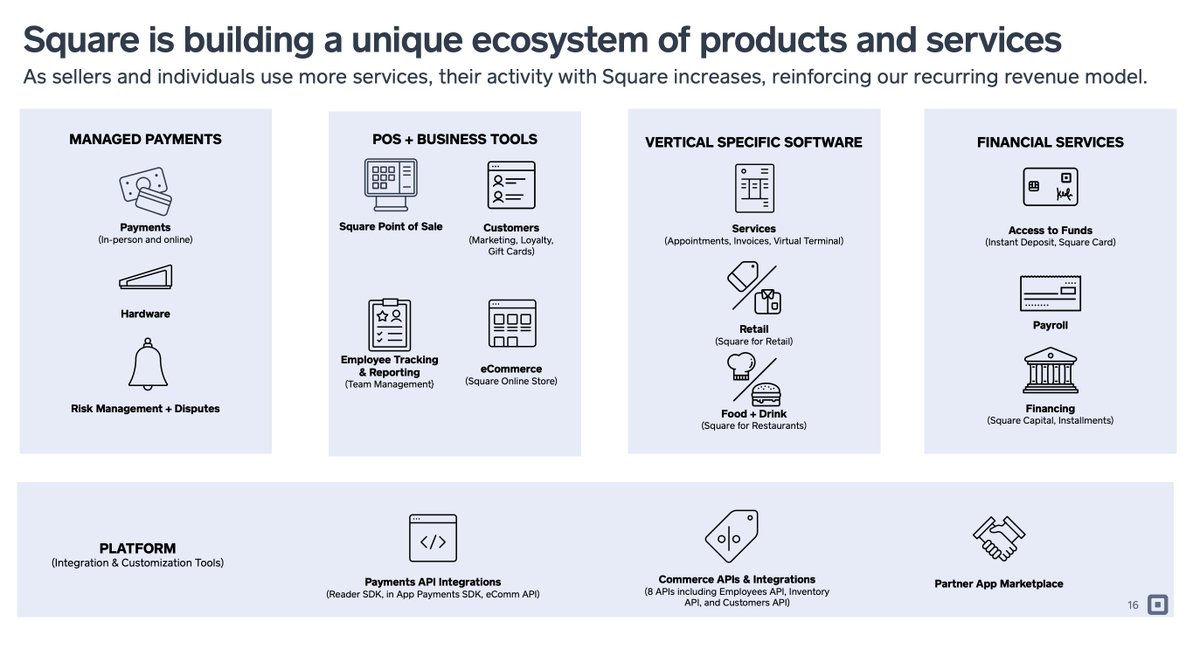

The company started off as a simple payments processor for merchants, but has continued to expand its TAM by also becoming a full-suite SaaS for small businesses, a bank, and a P2P payments app.

The company started off as a simple payments processor for merchants, but has continued to expand its TAM by also becoming a full-suite SaaS for small businesses, a bank, and a P2P payments app.

Square is essentially a full-stack payments ecosystem that aims to solves the entire chain of problems for sellers and users.

And best of all, each of these products reinforce each other.

And best of all, each of these products reinforce each other.

In fact, a lot of their growth comes from this closed loop financial ecosystem.

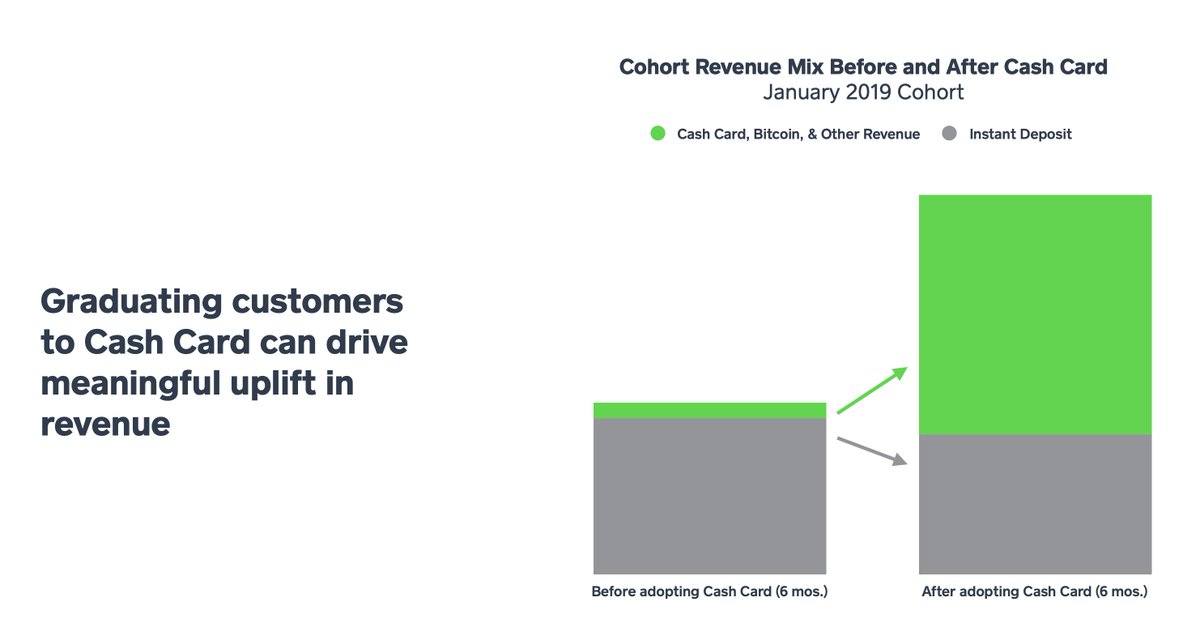

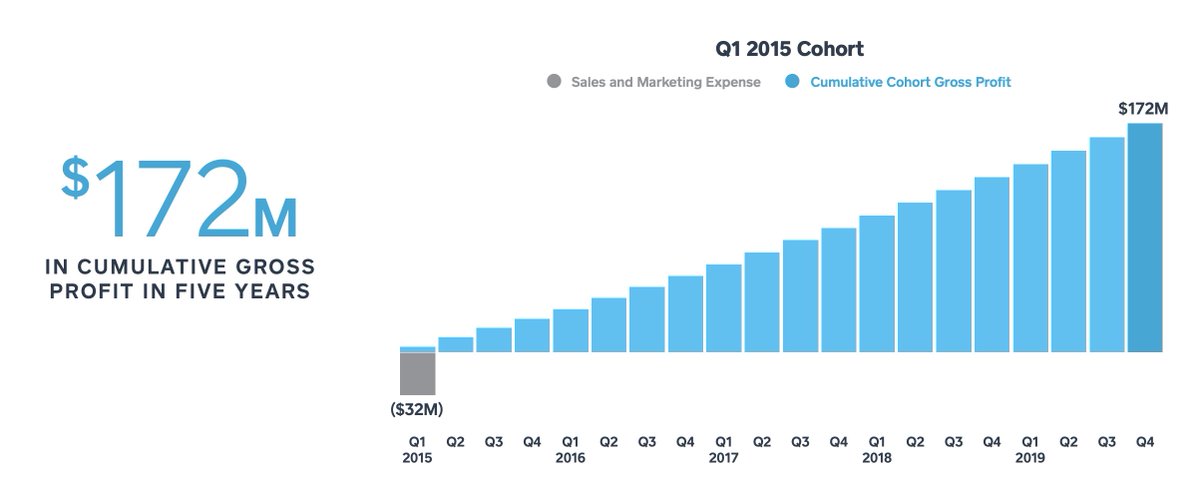

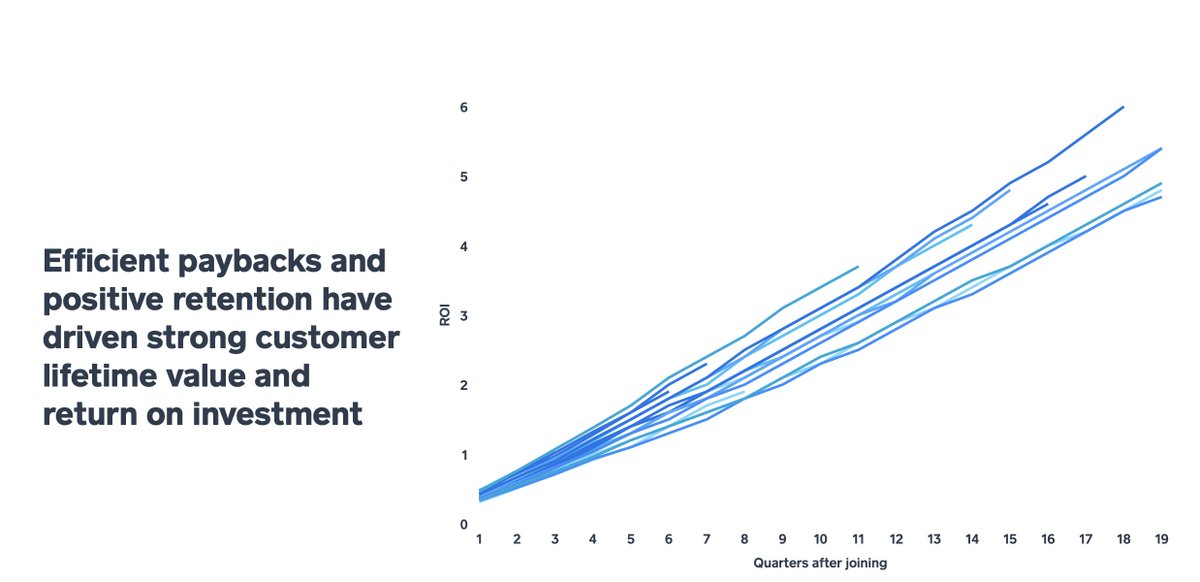

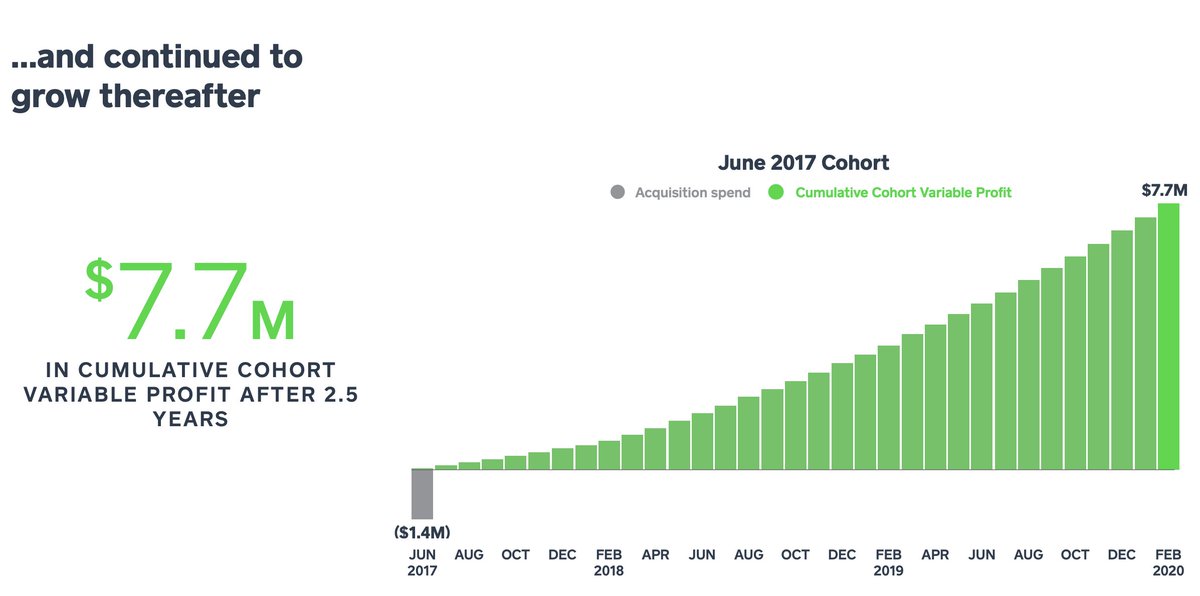

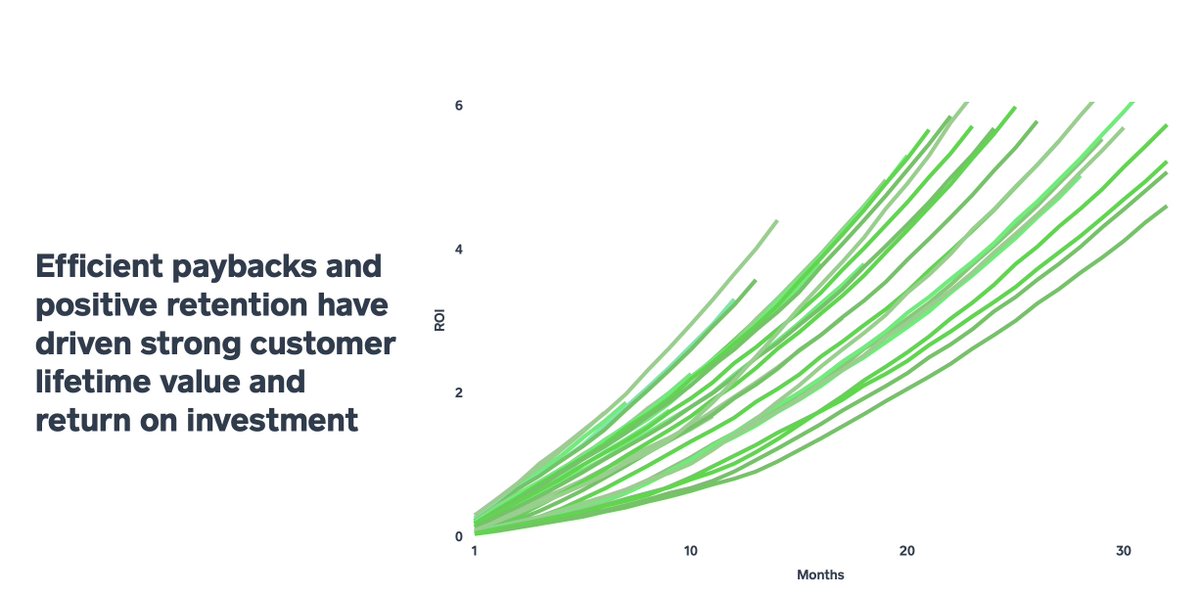

Customers might start with just one product, but over time, they expand into other products. So their gross margins per customer increases over time:

Customers might start with just one product, but over time, they expand into other products. So their gross margins per customer increases over time:

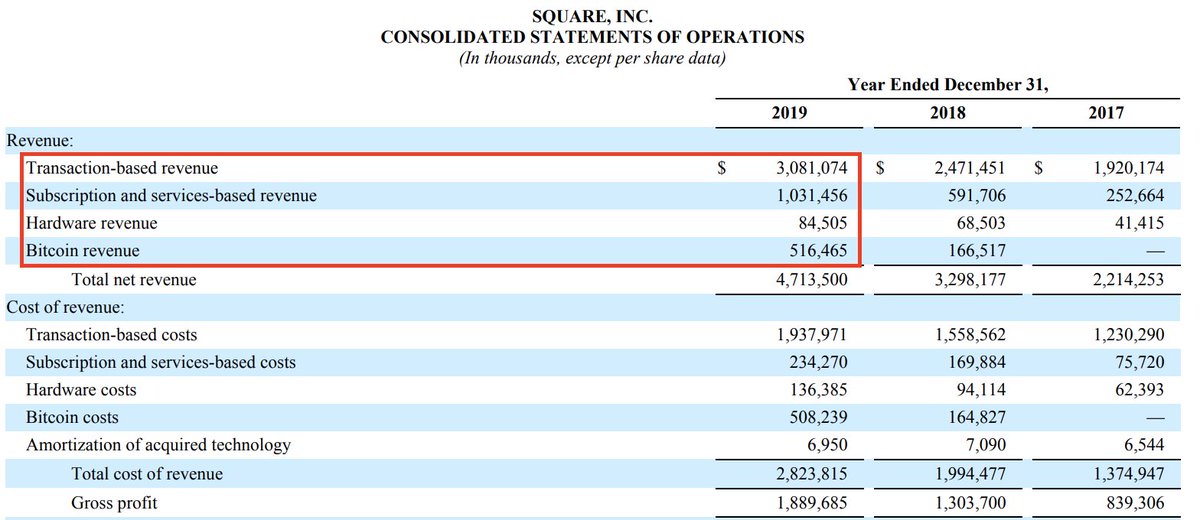

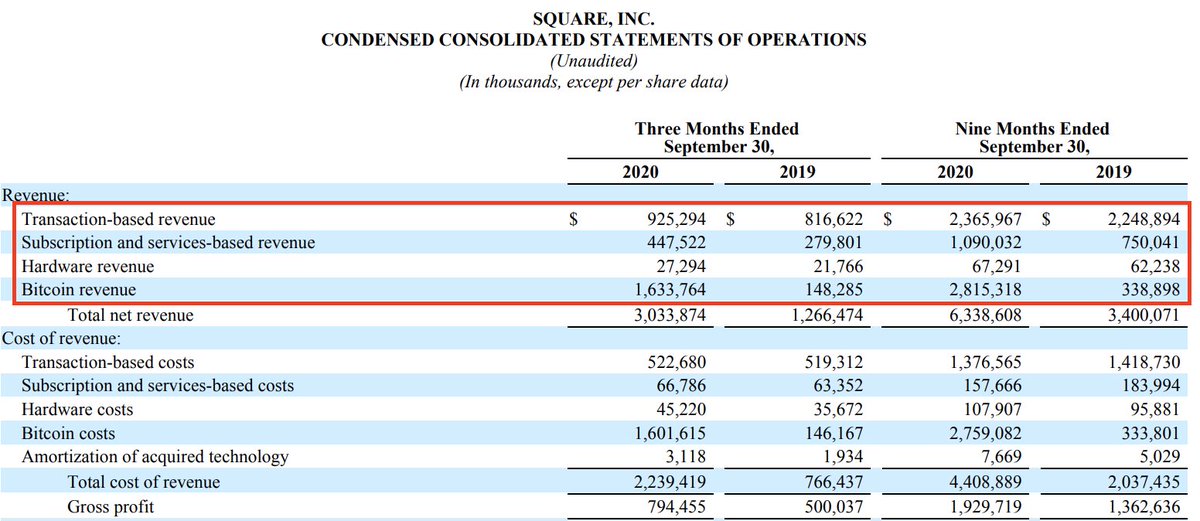

Square’s revenue can be categorized into four buckets:

- Transaction-based

- Subscription and services

- Hardware

- Bitcoin

- Transaction-based

- Subscription and services

- Hardware

- Bitcoin

Gross margins:

Transaction-based: ~40%.

Subscription and services: ~80%

Hardware and Bitcoin: Practically 0%

Net net, their overall gross margins across the two business lines are 30 to 40% (on the lower end this year because of COVID)

Transaction-based: ~40%.

Subscription and services: ~80%

Hardware and Bitcoin: Practically 0%

Net net, their overall gross margins across the two business lines are 30 to 40% (on the lower end this year because of COVID)

ROI on marketing:

Seeing their ROI on marketing was inspiring. They have a payback period of 12 months on the Seller side:

Seeing their ROI on marketing was inspiring. They have a payback period of 12 months on the Seller side:

They have been in full-throttle market capture mode (hence why their EBITDA margins are so low). Given how effective they are with marketing dollars, it makes sense that they would keep pumping money back into the business.

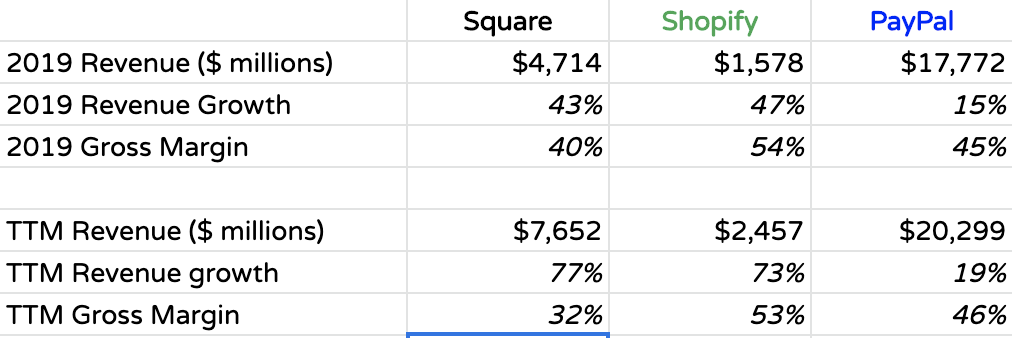

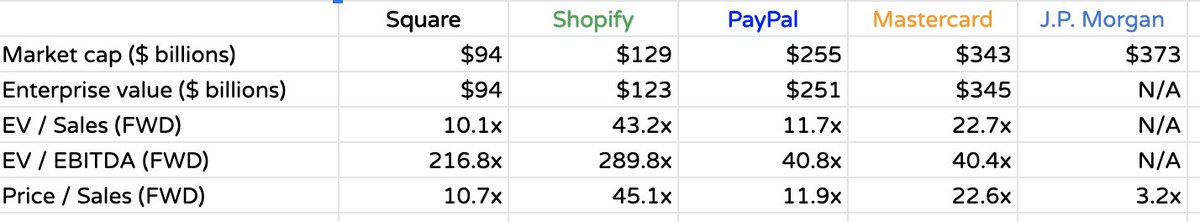

Now, let’s look at Competitors

1) Shopify

Shopify is a direct competitor for the Seller side of the Square’s business. There is a LOT of overlap between the two businesses (e.g. Square capital vs Shopify capital, Square POS vs Shopify POS, Weebly vs Shopify web service)

1) Shopify

Shopify is a direct competitor for the Seller side of the Square’s business. There is a LOT of overlap between the two businesses (e.g. Square capital vs Shopify capital, Square POS vs Shopify POS, Weebly vs Shopify web service)

2) PayPal

Cash App competes directly with Venmo. Square’s seller products compete directly with PayPal for merchants. The advantage PayPal has is that it has an international presence, while Square does not (yet)

Cash App competes directly with Venmo. Square’s seller products compete directly with PayPal for merchants. The advantage PayPal has is that it has an international presence, while Square does not (yet)

3) Stripe

Stripe is an equally innovative company. Currently, Stripe is focused purely on online businesses but I would expect them to compete more directly with Square (brick and mortar) in coming years. Internationally, both Square and Stripe are much weaker than PayPal.

Stripe is an equally innovative company. Currently, Stripe is focused purely on online businesses but I would expect them to compete more directly with Square (brick and mortar) in coming years. Internationally, both Square and Stripe are much weaker than PayPal.

Other competitors include

1) P2P payments apps (e.g. Apple Pay, Google Pay) compete with Cash App

2) Credit cards (e.g. Mastercard, Visa, Apple Card) compete with Square Card and Cash Card

3) Commercial and Retail banks (e.g. JP Morgan) compete with Square Capital

1) P2P payments apps (e.g. Apple Pay, Google Pay) compete with Cash App

2) Credit cards (e.g. Mastercard, Visa, Apple Card) compete with Square Card and Cash Card

3) Commercial and Retail banks (e.g. JP Morgan) compete with Square Capital

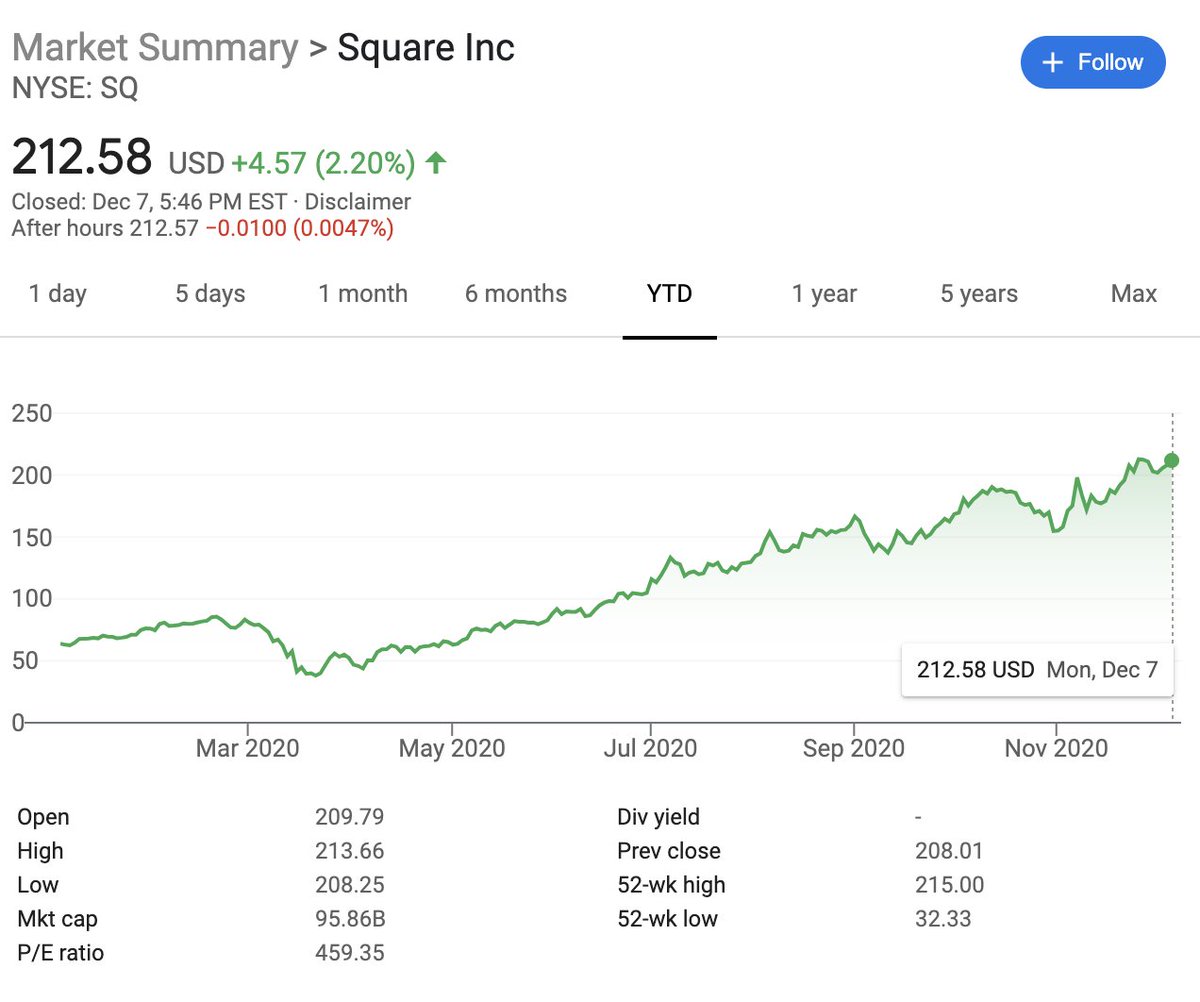

Overall, Square is a lucrative business with incredible execution.

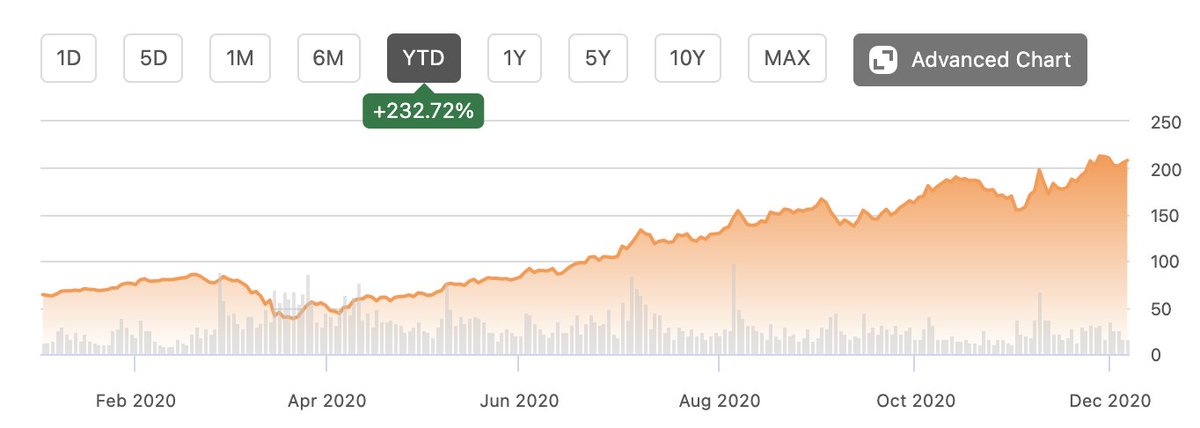

Except, the problem seems to be that everyone (the market) knows it is a great company. So Square’s valuation is through the roof.

Current market cap of Square is $95B

Except, the problem seems to be that everyone (the market) knows it is a great company. So Square’s valuation is through the roof.

Current market cap of Square is $95B

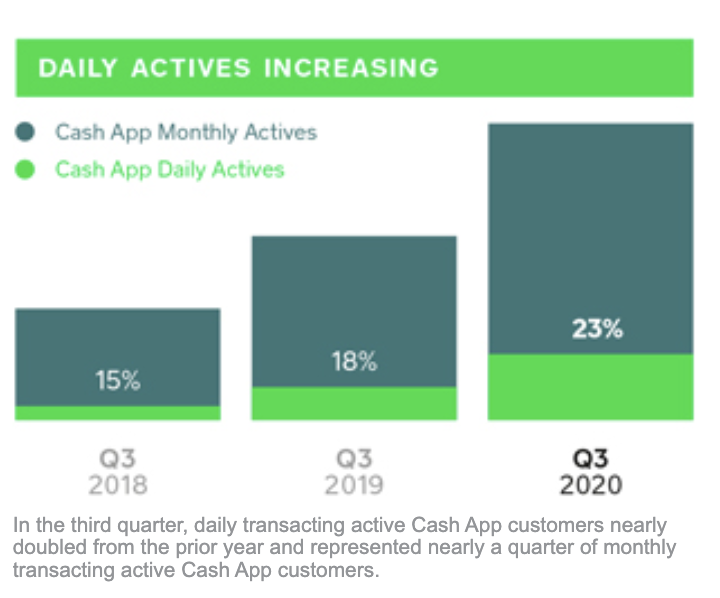

Before COVID, most analysts were not really giving much weight to the Cash App side of the business.

However, Cash App soared this year once they allowed people to receive their stimulus checks through Cash App (brilliant)

However, Cash App soared this year once they allowed people to receive their stimulus checks through Cash App (brilliant)

They went from having 24 million actives in December 2019 to 30 million in June 2020 and continued to grow into Q3.

So even though Square’s gross payments volume (GPV) on the seller side took a hit during COVID, Cash App growth blew up.

In Q3 2020, Cash App generated $2.07 billion of revenue and $385 million of gross profit, which increased 574% and 212% year over year, respectively

In Q3 2020, Cash App generated $2.07 billion of revenue and $385 million of gross profit, which increased 574% and 212% year over year, respectively

Read on Twitter

Read on Twitter