1/ Important thread from @TheBMA pensions re @NHSEngland Wales 19/20 AA compensation scheme

Every @BMA_Consultants @BMA_GP & SAS NEEDS to understand this

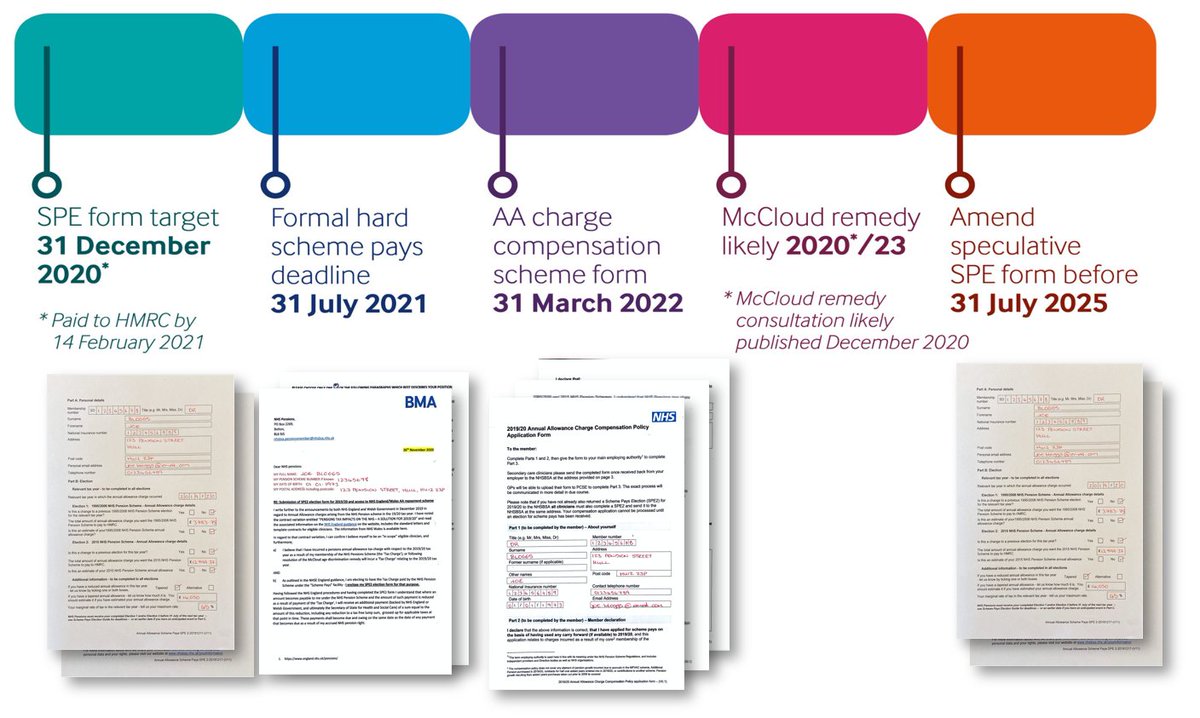

Important deadlines to note- if you don't apply on time, you WONT be eligible.

#UseItOrLoseIt

Read carefully & share RT!

Every @BMA_Consultants @BMA_GP & SAS NEEDS to understand this

Important deadlines to note- if you don't apply on time, you WONT be eligible.

#UseItOrLoseIt

Read carefully & share RT!

2/ @NHSEngland & Wales announced 12 months ago that the government would essentially compensate "eligible clinicians" for AA charges in England & Wales (despite our efforts not Scot/NI).

Read about the scheme in England ( http://bit.ly/TGAA1 ) & Wales ( http://bit.ly/TGAA2 )

Read about the scheme in England ( http://bit.ly/TGAA1 ) & Wales ( http://bit.ly/TGAA2 )

3/ If you worked clinically in 19/20 in England/Wales & you have AA charge from @nhs_pensions you will be eligible. You should have received a letter like  consultants/SAS ( http://bit.ly/TGAA3 ) / GPs ( http://bit.ly/TGAAA4 ) in England, or Wales ( http://bit.ly/TGAA5 )

consultants/SAS ( http://bit.ly/TGAA3 ) / GPs ( http://bit.ly/TGAAA4 ) in England, or Wales ( http://bit.ly/TGAA5 )

consultants/SAS ( http://bit.ly/TGAA3 ) / GPs ( http://bit.ly/TGAAA4 ) in England, or Wales ( http://bit.ly/TGAA5 )

consultants/SAS ( http://bit.ly/TGAA3 ) / GPs ( http://bit.ly/TGAAA4 ) in England, or Wales ( http://bit.ly/TGAA5 )

4/ Basically if you have an AA charge (even from "tapering" - and you apply for "scheme pays" to pay it off - government will then compensate you in retirement so your net position is the same. That's basically what  is saying, and @TheBMA lawyers had it scrutinised by 3 QCs

is saying, and @TheBMA lawyers had it scrutinised by 3 QCs

is saying, and @TheBMA lawyers had it scrutinised by 3 QCs

is saying, and @TheBMA lawyers had it scrutinised by 3 QCs

5/ Annual allowance is hideously complicated - one of the key reason @TheBMA pensions is campaigning hard for it be removed #ScrapAAinDB. Consequently, the process of working out if you have an AA liability & applying for a "scheme pays" loan can be both daunting & complicated.

6/ So you are going to have to jump through some hoops, at the right time, to get this compensation.

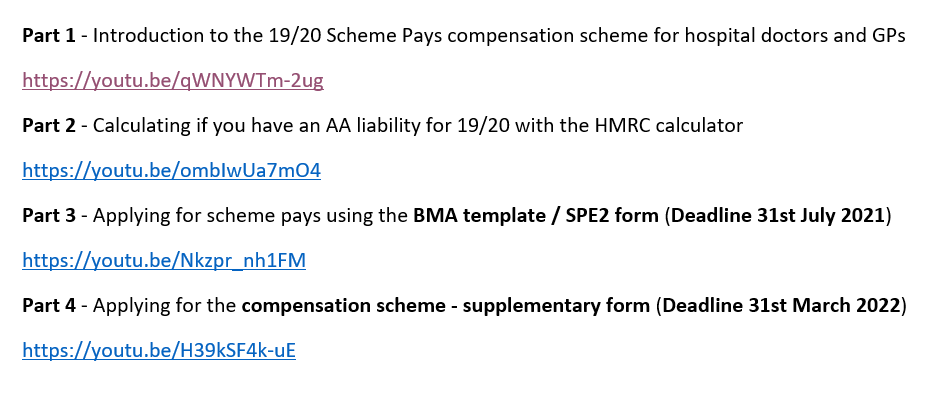

This is Part 1 - Introduction to the 19/20 Scheme Pays compensation scheme for hospital doctors and GPs

- Introduction to the 19/20 Scheme Pays compensation scheme for hospital doctors and GPs

This is Part 1

- Introduction to the 19/20 Scheme Pays compensation scheme for hospital doctors and GPs

- Introduction to the 19/20 Scheme Pays compensation scheme for hospital doctors and GPs

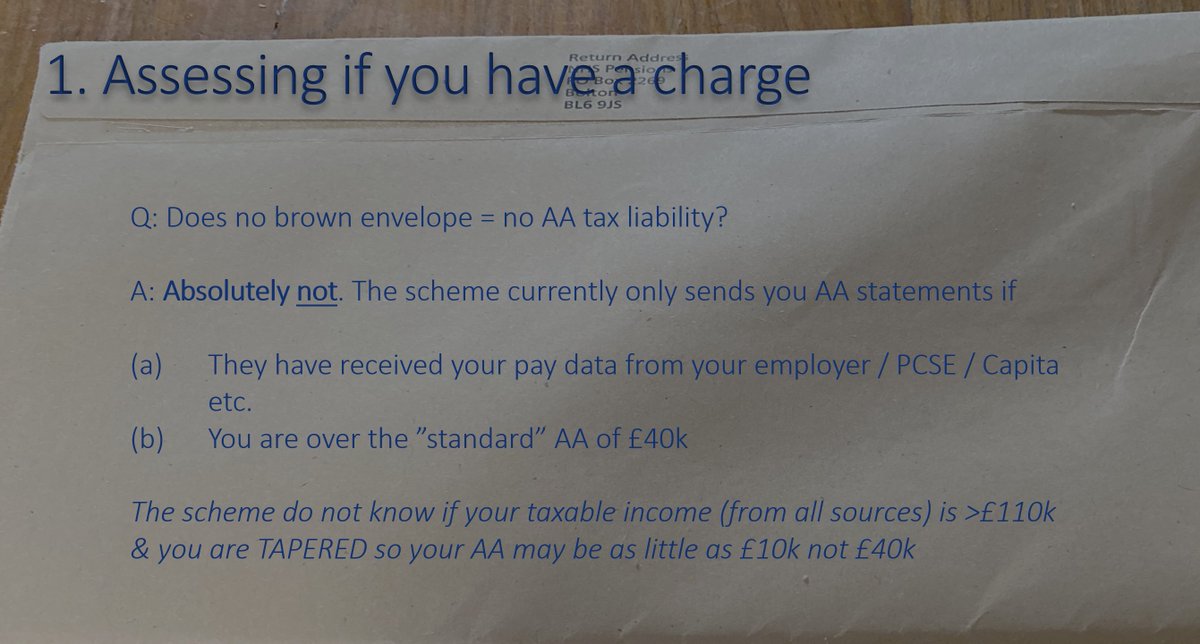

7/ Now you understand the basics of the scheme. You need to work out if you have an AA charge. REALLY important to realise if you havn't had a "brown envelope" from the scheme, you may still be tapered (taxable income > £110k in 19/20) and have a charge. You need to request one

8/ You will need to calculate if you have an AA liability for 19/20 with the HMRC calculator ( http://bit.ly/TGAA7 ). We have provided a free little tool ( http://bit.ly/TGAA6 ) to help you do this and recorded a new video below

Part 2 -

Part 2 -

9/ To use the HMRC calculator and tool you will need to understand "threshold income". Lots of people (incl some accountants / IFAs) get this wrong. I like to start with

Taxable pay (payslip/P60)

ADD taxable pay from elsewhere

ADD some salary sacrifice

DEDUCT certain reliefs

Taxable pay (payslip/P60)

ADD taxable pay from elsewhere

ADD some salary sacrifice

DEDUCT certain reliefs

10/ So hopefully now you will have calculated if you have a charge in 19/20. You must report this to HMRC by 31/1/20 via self assessment. BUT

DO NOT PAY THE CHARGE YOURSELF (or you WONT be compensated)

You MUST use scheme pays. Let's talk you through that step by step...

DO NOT PAY THE CHARGE YOURSELF (or you WONT be compensated)

You MUST use scheme pays. Let's talk you through that step by step...

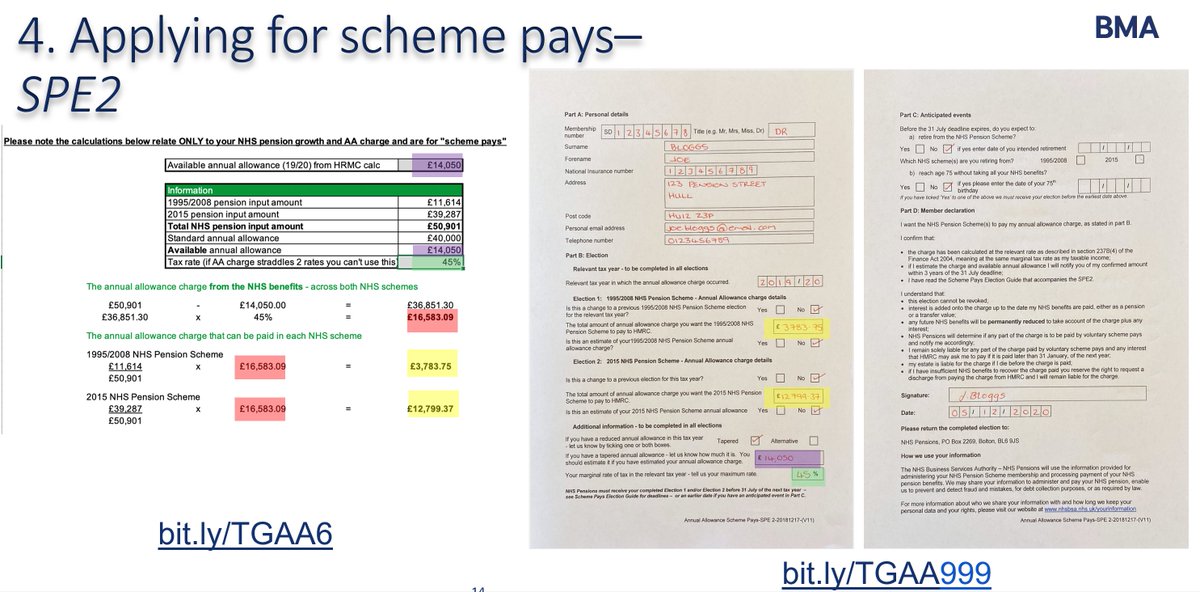

11/ To apply for scheme pays you need to complete a SPE2 form. This MUST be received by @nhs_pensions by 31st July 2021. You NEED to apply by then EVEN if you can't recalculate your AA charge in time. The form looks pretty benign but the figures are a bit tricky to work out!

12/ You can read the scheme guide here (http://TGAA8) & the tool we provided you to use the HMRC calculator (bit/ly/TGAA6) will allow you to work out how much to put in each pension scheme

13/ You can watch our video video applying for scheme pays using the BMA template / SPE2 form (deadline 31st July 2021) here

Applying for scheme pays (Deadline 31st July 2021)

You MUST meet that deadline - even if you CANT calculate your charge

Applying for scheme pays (Deadline 31st July 2021)

You MUST meet that deadline - even if you CANT calculate your charge

14/ If you are planning on retiring before 31st July 2021 you must complete a SPE2 form and have it accepted prior to your pension being in payment.

15/ Please dont' ignore your 19/20 AA tax liability because of the McCloud case - even if you think your AA tax charge may dissapear if you revert to the old schemes. Apply for scheme pays as normal - by 31st July 2021 - or you might lose out #UseitOrLoseIt!

16/ So you have worked out your liability, applied for scheme pays (before 31st July 21), you now need to apply for the compensation scheme.

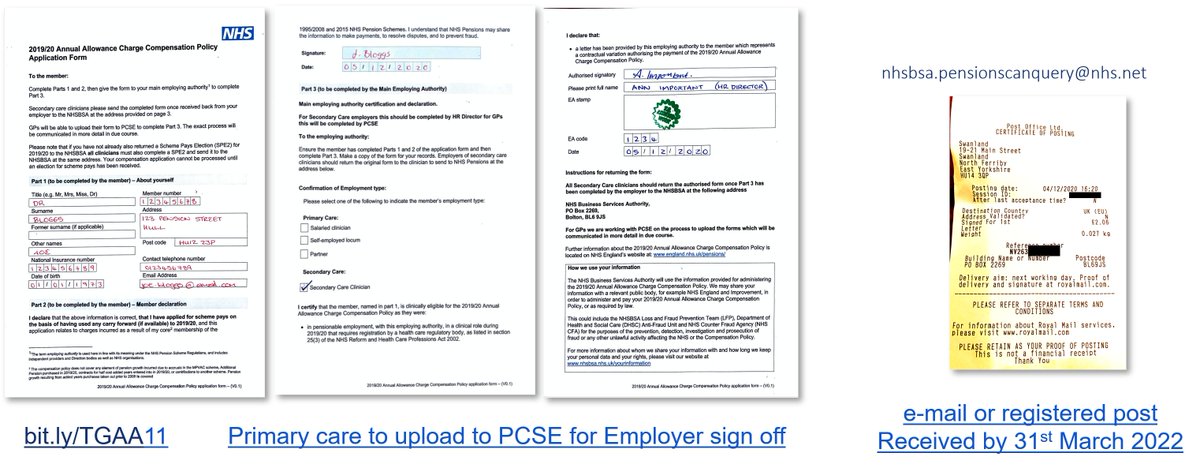

A simple form like the draft below will be needed. In England this will be at http://bit.ly/TGAA11 (Dec 20). A different form expected

A simple form like the draft below will be needed. In England this will be at http://bit.ly/TGAA11 (Dec 20). A different form expected

17/ in Wales. The forms have simple demographics, a member declaration that you have used any available carry forward to minimise your AA charge, and will need your employer (?HR director)/PCSE (Eng GPs) to sign that you were clinical in 19/20. Wales signatories to be confirmed.

18/ Like scheme pays there is a strict deadline - this mustbe received by NHSBSA by 31st March 2022.

This is covered in the final video here

Part 4 - Applying for the compensation scheme - supplementary form (Deadline 31st March 2022)

This is covered in the final video here

Part 4 - Applying for the compensation scheme - supplementary form (Deadline 31st March 2022)

19/ In summary- no-one is going to magically send you a bill nor pay your AA

YOU need to request a savings statement if you dont have one (NOT TRS)

YOU need to calculate if you have a charge

YOU need to tell HMRC you have a charge (31st Jan 2021)

YOU need to request a savings statement if you dont have one (NOT TRS)

YOU need to calculate if you have a charge

YOU need to tell HMRC you have a charge (31st Jan 2021)

20/

YOU must apple for Scheme Pays (deadline 31st July 21)

YOU must apply for the compensation scheme (deadline 31st May 2022)

You must do this even if you CANNOT calculate your charge (no statement) - submit an estimate.

If you DONT do all this, you WON'T get the compensation

YOU must apple for Scheme Pays (deadline 31st July 21)

YOU must apply for the compensation scheme (deadline 31st May 2022)

You must do this even if you CANNOT calculate your charge (no statement) - submit an estimate.

If you DONT do all this, you WON'T get the compensation

21/ Lots of people @TheBMA worked very hard to secure this & make sure it is robust inlcuding the Pensions Committee @Vish_Sharm @Krishanx @goldstone_tony & secretariat / legal team.

This compensation is very valuable, pls don't lose out missing the deadlines

#UseItorLoseIt

This compensation is very valuable, pls don't lose out missing the deadlines

#UseItorLoseIt

22/ This thread is complex because AA is thoroughly stupid. It's completely innapropriate in the context of a DB scheme, and must be scrapped, as per OTS recommendation. @TheBMA will continue to highlight this to gvmnt @RishiSunak

#ScrapAAinDB

Please RT/share with colleagues

#ScrapAAinDB

Please RT/share with colleagues

We at @TheBMA asked @nhs_pensions to change the SPE2 scheme pays application process so it could be emailed (so you have proof of sending by deadlines)

They have kindly obliged and the new form is here

http://bit.ly/TGAA999b

They have kindly obliged and the new form is here

http://bit.ly/TGAA999b

Read on Twitter

Read on Twitter