Sometimes, the @GrowthDefi ecosystem might feel too technical or hard to understand.

But in reality It’s very easy and straightforward once you understand the basics.

Let’s talk about gTokens and PMTs.

a $GRO thread:

(get some popcorn)

But in reality It’s very easy and straightforward once you understand the basics.

Let’s talk about gTokens and PMTs.

a $GRO thread:

(get some popcorn)

I will try to explain it in simple words but the really technical stuff is complex, so if you want to learn more here is the link to the very well documented github repository:

https://github.com/GrowthDeFi/growthdefi-v1-core

credits to @raugfer

https://github.com/GrowthDeFi/growthdefi-v1-core

credits to @raugfer

First things first

gTokens are the heart and soul of Growth. Same as cTokens are to @compoundfinance and aTokens are to @AaveAave , gTokens had been developed from scratch by Growth Foundation and are designed to be used by long term oriented investors.

gTokens are the heart and soul of Growth. Same as cTokens are to @compoundfinance and aTokens are to @AaveAave , gTokens had been developed from scratch by Growth Foundation and are designed to be used by long term oriented investors.

gTokens are the top level abstraction of every token on the Growth platform and they all share this properties:

- They own a reserve of an underlying asset (DAI, ETH...)

- They benefit from deposit/withdraw fees.

- They always appreciate in value against the underlying asset.

- They own a reserve of an underlying asset (DAI, ETH...)

- They benefit from deposit/withdraw fees.

- They always appreciate in value against the underlying asset.

Every time you deposit/withdraw a gToken, you pay a fee.

Half of it is distributed to the current holders proportionally and the other half goes to the Locked Liquidity Pools.

Locked Liquidity Pools are swing trading pools intended for arbitrage, we'll talk about that later.

Half of it is distributed to the current holders proportionally and the other half goes to the Locked Liquidity Pools.

Locked Liquidity Pools are swing trading pools intended for arbitrage, we'll talk about that later.

the price of a gToken is calculated as:

( total reserve of a gToken / total supply )

For example, if gDAI has a supply of 1,000 gDAI and a reserve of 1,500 DAI the price of a gDAI is 1.5.

And this is always increasing.

( total reserve of a gToken / total supply )

For example, if gDAI has a supply of 1,000 gDAI and a reserve of 1,500 DAI the price of a gDAI is 1.5.

And this is always increasing.

gTokens are great for long term investments since you'll benefit from deposit and withdraw fees, but this mechanism alone isn't enough to create enough value.

Having the underlying asset (think of DAI, ETH, etc) sitting in the reserve isn't efficient.

Having the underlying asset (think of DAI, ETH, etc) sitting in the reserve isn't efficient.

Thats why gcTokens (aka Type 1 & Type 2 ) exist.

gcTokens are specific STRATEGIES that use the underlying reserve of a gToken to generate yield by lending to other protocols.

right now it's only using @compoundfinance as it's main yield source. That's why the C in gcToken.

gcTokens are specific STRATEGIES that use the underlying reserve of a gToken to generate yield by lending to other protocols.

right now it's only using @compoundfinance as it's main yield source. That's why the C in gcToken.

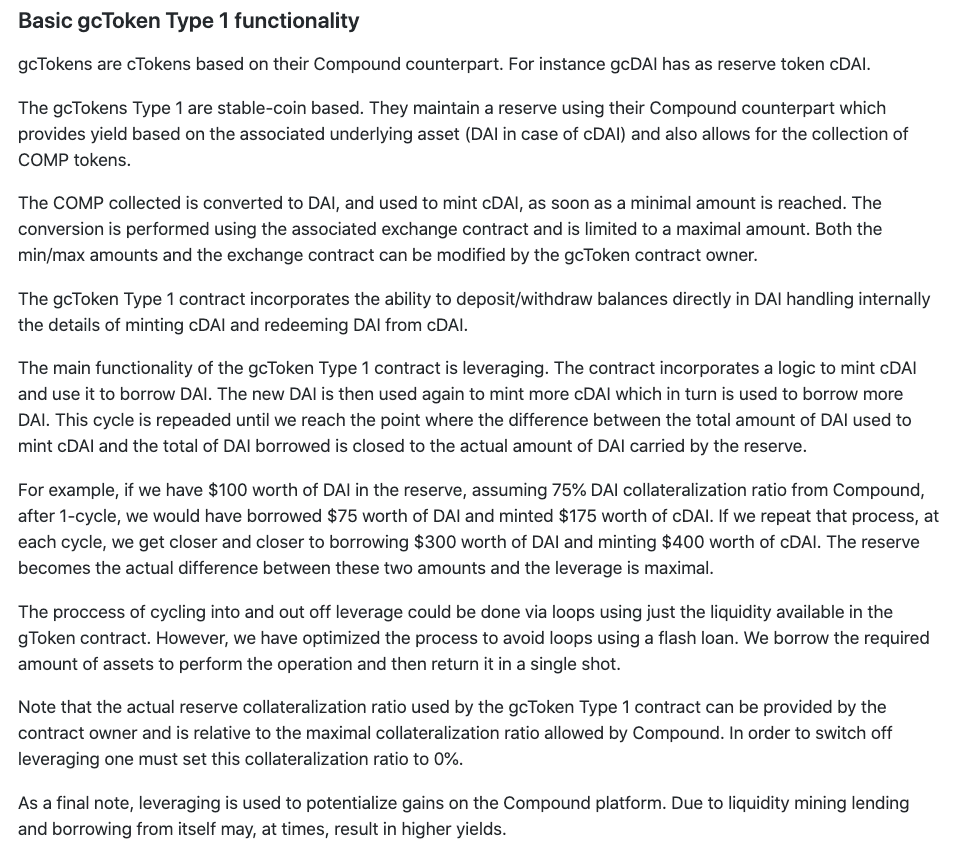

Let's talk about Type 1 first. ( $gcDAI & $gcUSDC )

( gcTokensV1 are now deprecated, so i'll explain gcTokensV2 )

( gcTokensV1 are now deprecated, so i'll explain gcTokensV2 )

Type 1 gcTokens are specific to stablecoins and this is how it works:

1 - Deposit DAI/cDAI/USDC/cUSDC and mint gcTokens

2.1- The contract automagically leverages the deposit by lending cDAI and borrowing DAI, the DAI borrowed is lend again to mint more cDAI

1 - Deposit DAI/cDAI/USDC/cUSDC and mint gcTokens

2.1- The contract automagically leverages the deposit by lending cDAI and borrowing DAI, the DAI borrowed is lend again to mint more cDAI

2.2 - By doing so, the gcToken contract wil hold more cDAI in it that what it was deposited. This is done with a 75% collateralization ratio to avoid liquidation.

3 - Every time a new user deposit / withdraw a gcToken the $COMP farmed is sold and used to mint more gcTokens.

3 - Every time a new user deposit / withdraw a gcToken the $COMP farmed is sold and used to mint more gcTokens.

4 - The new gcTokens minted are proportionally distributed to the current holders, which they can decide if they want to withdraw with a profit or keep holding, compounding their value automatically and benefit from fees from other withdraws.

gcTokens have a threshold of 20 $COMP before they can be sold.

This will be managed and defined by the DAO in the future.

This will be managed and defined by the DAO in the future.

Type 2 are gcTokens for non-stable assets such as ( $gcWBTC and $gcETH )

While they are very similar, they work different than Type 1.

While they are very similar, they work different than Type 1.

The current strategy for Type 2 looks like this:

1 - Deposit ETH/cETH/WBTC/cWBTC and mint gcTokens.

2 - The gcToken contract will lend the assets to Compound and borrow more $DAI .

3 - Here is the magic of Type 2 gcTokens, the $DAI borrowed is used to mint $gDAI

1 - Deposit ETH/cETH/WBTC/cWBTC and mint gcTokens.

2 - The gcToken contract will lend the assets to Compound and borrow more $DAI .

3 - Here is the magic of Type 2 gcTokens, the $DAI borrowed is used to mint $gDAI

$gDAI is a PMT (Portfolio Management Token) we'll talk about it in the next section but for now, all you need to know is that by minting $gDAI we are generating more $gcDAI ( Type 1 )

And yes, all $gcDAI and $gDAI holders benefit from the deposit and redeeming fees.

And yes, all $gcDAI and $gDAI holders benefit from the deposit and redeeming fees.

In conclusion Type 2, lends non-stable assets to Compound, borrows DAI and mint gDAI which mints more gcDAI and leverages Type 1 tokens again.

If it sounds complex, is because it really is.

BUT...

If it sounds complex, is because it really is.

BUT...

while strategies are focused to be used by technical and informed professional investors, everyone can use them.

in the other hand PMT's are designed for non-technical long term investors more interested on maximizing their yield without getting too involved in the specifics.

in the other hand PMT's are designed for non-technical long term investors more interested on maximizing their yield without getting too involved in the specifics.

gcTokens are strategies developed to farm a specific protocol and the APY you get by farming those strategies might change depending on the market conditions.

In the other hand PMT's are designed as indexes or baskets of strategies, but is more than that...

In the other hand PMT's are designed as indexes or baskets of strategies, but is more than that...

PMTs properties share the same as gTokens, deposit/withdraw fee, underlying reserve and always increasing in value.

Where they stand out is that they are managed by the DAO and they keep a reserve of gTokens, farming multiple strategies.

Where they stand out is that they are managed by the DAO and they keep a reserve of gTokens, farming multiple strategies.

Let's talk about $gDAI , the current composition is 10% gDAI and 90% $gcDAI . Which means that the gToken value is collateralized 90% by the reserve and revenue coming from $gcDAI and 10% is collateralized by the value generated by fees coming from the same $gDAI token.

At this point all you need to know for PMT's is that by holding them on the long term you are increasing your value against the underlying asset.

If you can live with that explanation you can stop reading this thread right now. If not, let's continue with the details.

If you can live with that explanation you can stop reading this thread right now. If not, let's continue with the details.

PMT's are self rebalancing, not as other rebalance coins where they rebalance the total supply but they are always rebalancing the composition percentage of their own strategies.

For example:

For example:

If we talk about the current 10/90 composition:

if we have a total of $100k DAI on gDAI reserve.

10k (10%) will stay liquid as DAI in the contract and 90K (90%) will be used on gcDAI strategy.

if we have a total of $100k DAI on gDAI reserve.

10k (10%) will stay liquid as DAI in the contract and 90K (90%) will be used on gcDAI strategy.

Sooner or later the reserve of gcDAI will represent +90% of the rebalancing tokens. Let's say for example that after the farming, the reserve value is 150K and the total reserve of gDAI is 150K+10K = 160k so those 150k now represent 93% of the portfolio instead of the inital 90 %

The PMT will rebalance the portfolio automagically by sending the surplus to gDAI so the new reserves are 144k in gcDAI and 16K in gDAI.

Keeping the composition 10% / 90%

Keeping the composition 10% / 90%

new strategies will be added soon, and that's were the DAO and stkGRO shines in all of this.

By holding $stkGRO you have voting power over rebalancing margins, PMT's composition and adding or removing strategies from a PMT.

By holding $stkGRO you have voting power over rebalancing margins, PMT's composition and adding or removing strategies from a PMT.

If you are wondering about stkGRO and how to obtain it here is a thread I wrote before: https://twitter.com/Irvollo/status/1332750446247768070?s=20

If you have any questions, join the telegram group:

https://t.me/growthdefi

the community is very friendly and always happy to help

https://t.me/growthdefi

the community is very friendly and always happy to help

Read on Twitter

Read on Twitter