Are you confused about why it is that sometimes nuclear costs seems to increase even though nothing has changed? Alright then. Prepare thyself for a #thread on possibly one of the world’s most confusing subjects - the various ways of reporting nuclear energy costs 1/

Let’s start by saying that this is a very confusing subject. There are many examples of bad reporting and loads of experts occasionally get this wrong. I’ll add myself to that list. Just a reminder that I’m not a nuclear economist. I apologise for any mistakes in what follows 2/

This thread comes to you mostly courtesy of a recent @OECD_NEA report, which does a great job of clarifying this messy subject. It then goes on to describe how nuclear cost reductions can and are being achieved. You might want to read it thrice! 3/ https://www.oecd-nea.org/jcms/pl_30653

To start then, the most common way to compare the costs of different energy projects is via the LCOE (levelized cost of energy/electricity). Here’s a handy definition provided by @ENERGY. 4/

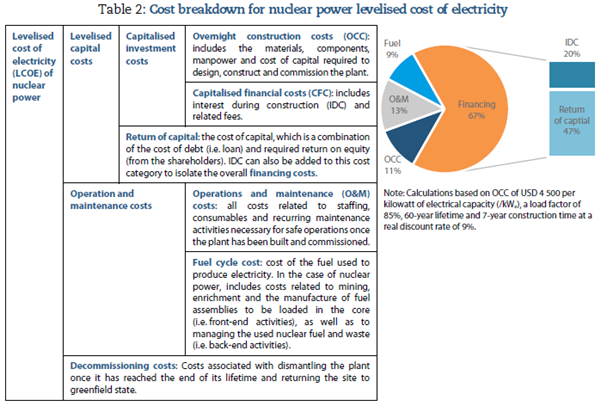

But what goes to make up the LCOE of nuclear energy you ask? The short answer is a lot! Spend some time on this next chart because it shows where most of the money gets spent on a nuclear project as well as describing some of the main cost categories 5/

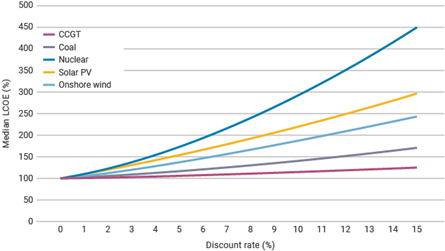

First thing you should notice is that the costs of nuclear energy are dominated by financing. I.e. the competitiveness of nuclear energy is not determined by how much it costs to build or run the plant, but rather how much financiers expect to be paid for it. 6/

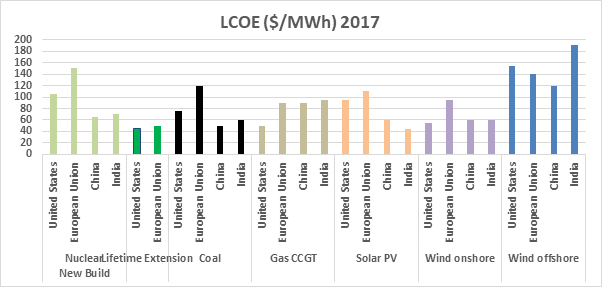

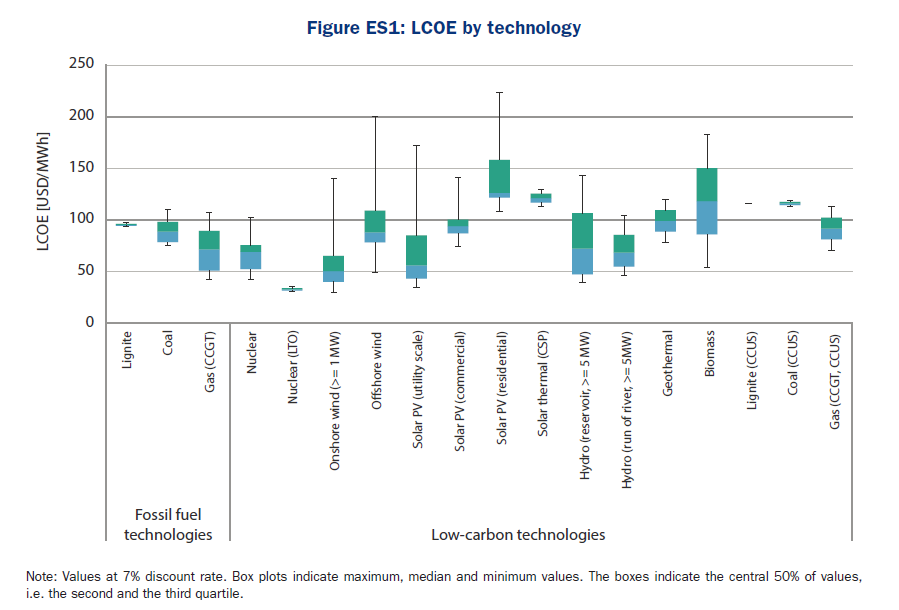

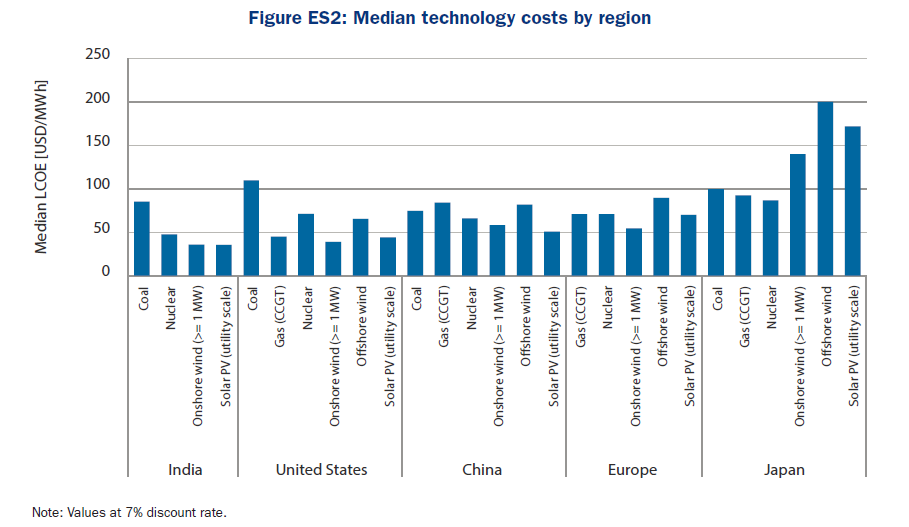

The reported LCOE of nuclear energy (and other techs) varies significantly by project and especially by country. Some of this down to the discount rate, but by no means not all of it. Note, this is IEA data for 2017. Please DO NOT use it for wind and solar today. 7/

Those old bugbears – nuclear waste disposal and decommissioning – are usually accounted for in the fuel cost category. Funds are built up during the operation of plants. An interesting recent trend is private Co.s anticipating declines in decomm costs 8/ https://twitter.com/6point626/status/1333872436887089153

But what I seem to hear just about everywhere these days is that new nuclear is “too expensive”. A quick look at chart above shows this is not true everywhere on an LCOE basis. Although IMHO most of the people saying this are not even really thinking about LCOE 9/

Rather they are referring to the construction costs – the sticker price. But a note of caution here. Nuclear construction costs can be quoted outright or per kilowatt. They will sometimes include financing (capital cost) and sometime exclude them (overnight cost) 10/

In my time I’ve seen a few news story about an apparent massive hike in projected nuclear costs that was actually just a capital cost estimate rather than the overnight cost quoted in an earlier story. This is an easy mistake to make, although somewhat embarrassing 11/

The overnight construction costs (OCC) of a single unit gigawatt-class nuclear power reactor will come to several billions dollars. The global range on current projects is currently 2,000 – 8000 USD per kilowatt, (or alternatively 2 – 8 billion USD per gigawatt) 12/

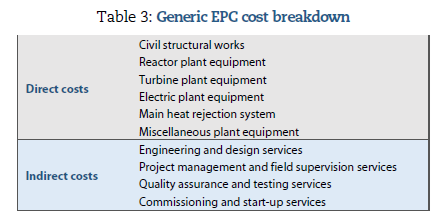

But it doesn’t stop there. OCC can also be broken down into 1) Engineering Procurement and Construction (EPC) costs, 2) owners costs and 3) contingency costs. Put on your hardhats and get ready for more definitions from the report 13/

EPC: This category includes all activities related to project design, procurement, construction, commissioning and handover to the plant operator. Consequently, this category covers the greatest portion of a nuclear project’s OCC and, just as important, most of the risks. 14/

Owners costs include additional things not in EPC scope - like general admin, project management, legal and financial costs, advisory services, site selection and licensing, environmental monitoring and preparatory works, support infrastructure, public relations etc. 15/

“The scope of expenses borne by a project’s owner varies depending on the owner’s capabilities and thus on the extent of EPC works. Various authors suggest that owner costs account for 15-20% of OCC” 16/

Contingency costs is money budgeted in planning n case something does not go according to plan. Of course in mega projects nothing ever goes entirely according to plan. But with experience and mature reactor designs these can be reduced from 50% to 15% of OCC. 17/

Why are owners costs and contingencies important? Well, what should a reactor vendor provide as the general price for its technology? EPC makes sense, but vendors don’t even control all the factors here. Owners costs and contingencies are entirely outside their influence 18/

Confusion over this popped up recently in regard to one new reactor developer. You can bet your bottom dollar that it will happen again. It’s important to remember that this stuff is, unfortunately, complex and to not to jump to conclusions https://twitter.com/6point626/status/1319897480847347718 19/

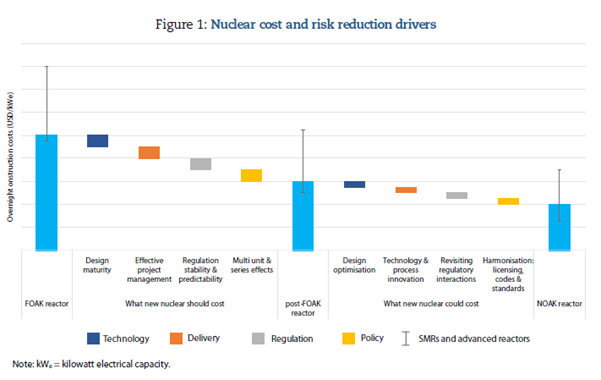

At this level we get a better idea of who needs to do what to reduce nuclear ‘construction’ costs. First govs needs to help lower financing costs!! Also utilities need to work out their own costs and contingencies. Only then do we get to nuclear vendors and constructors 20/

But when I hear ‘nuclear costs too much’ from most people it’s obvious that they think it’s the product that’s too costly. I.e. all the blame is placed upon the vendors and the builders. Yes, it’s important to reduce EPC costs, but we can’t ignore the others 21/

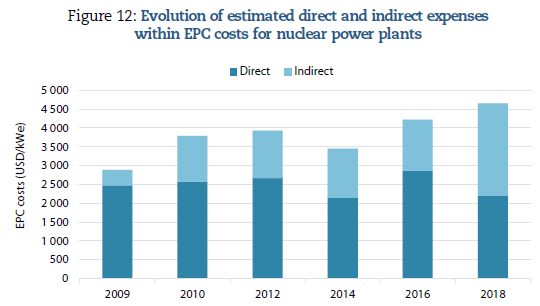

Why does this matter? Because it turns out that what’s really been driving nuclear EPC inflation (where that exists) is the indirect costs. So we also need to ask what the likes of regulators and quality specialists are doing (if anything) to help rein costs in. 23/

When I hear some folks say that a given reactor tech is ‘too expensive’ I confess that my first thought is that they don’t know what they’re talking about. Unless they clarify that changing the design will also somehow help reduce non-equipment costs. Then I listen closely 24/

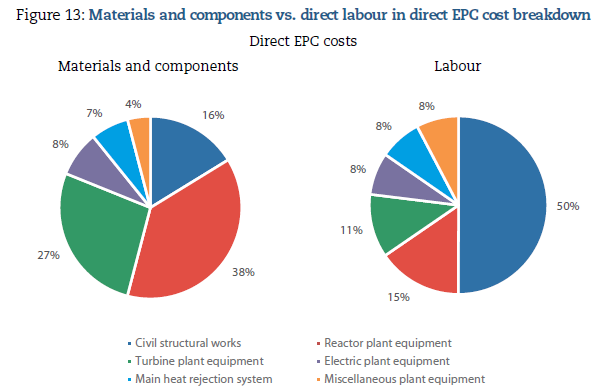

Speaking of equipment, EPC costs can also be broken down according to materials & components and labour if you prefer. But however you break it down, the actual nuclear reactor part doesn’t usually even make up 50%. Are you surprised? 25/

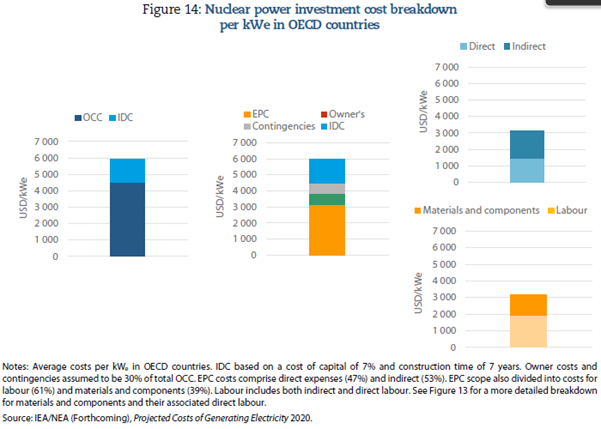

Bring this all together and it looks something like this. Note the charts on the right are pure EPC. This also doesn’t include a ‘return of capital’ component. (I’ll say it again, if you want cheaper nuclear then start with the financing costs!!) 26/

One more thing to clear up, the difference between projected and realized costs for existing projects. While knowing historic costs is important, it’s projected LCOE that arguably matters more for system planning. 27/

For Gen III nuclear costs this will make a big difference. On that note, make sure to tune in for the launch of the new joint OECD NEA and IEA report – the 2020 version of the Projected Costs of Generating Electricity. Join the webinar. 28/ https://twitter.com/OECD_NEA/status/1335226725832282114

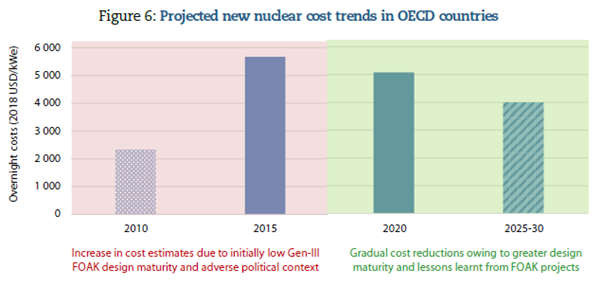

In the past decade or so the leading estimates of large light water reactor projected costs turned out the be far too low. We were simply too optimistic. Going forward with more data and a lot of hard lessons learned we can be hopeful of better forecasting 29/

And by implementing a comprehensive approach we can also be confident of driving down nuclear costs. The NEA report sees the next decade as ‘a window of opportunity’ for cost reductions in both large reactor projects and SMRs. FWIW, I agree. 30/

And that’s all folks. To repeat the key takeaways are that 1) nuclear cost categories are bewildering so always take media reports with a pinch of salt. 2) Nuclear is not uniformly ‘too expensive’. In many places it is actually comparatively low LCOE. 31/

3) Nuclear LCOE varies significantly according to location. In places where it is currently high it can be made significantly lower, but 4) reducing nuclear ‘construction’ costs is a team effort and needs concerted action from gov, industry and others 32/

5) What a vendor quotes as the general cost of its reactor technology will not necessarily be the same as what a utility writes down as the cost of a reactor project. This is in fact normal and not a scandal. And thanks for following me down the rabbit hole 33/

mini update to reflect the just published @iea @OECD_NEA Projected Costs of Generating Electricity. Because data! For those who don't know this only gets updated every five years and is without question the

preeminent report addressing LCOE https://www.iea.org/reports/projected-costs-of-generating-electricity-2020

preeminent report addressing LCOE https://www.iea.org/reports/projected-costs-of-generating-electricity-2020

First off we have new LCOE projections for different energy technologies. This will shock some people, but new nuclear is looking pretty darn competitive.

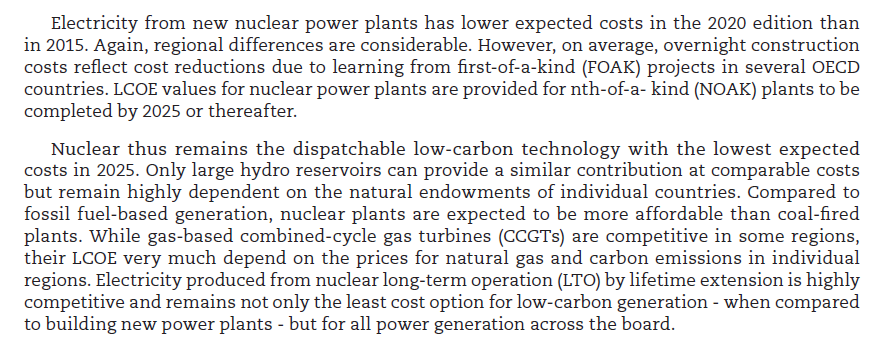

And why is nuclear LCOE looking so low here compared to some other reports. The answer is in the text below. It's not what Gen III has achieved to date, but what the authors expect it to achieve for subsequent units

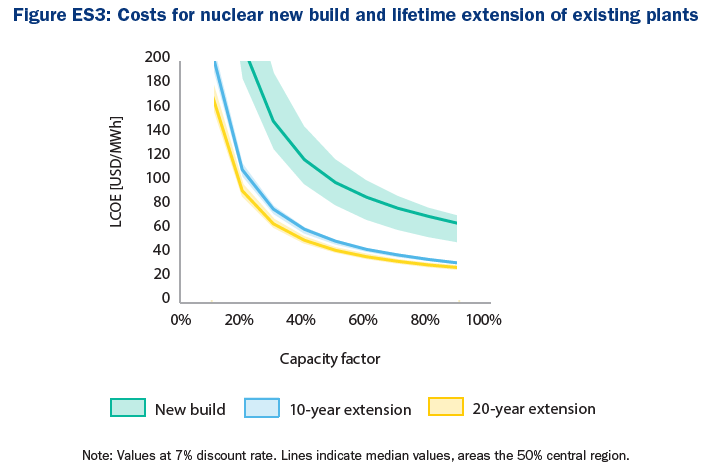

This one is specific to nuclear and highlights something I didn't talk about in the thread - the high sensitivity of nuclear LCOE to assumed capacity factors. This suggests that new plants will benefit more from cogeneration, while existing plants have more scope to load follow

Read on Twitter

Read on Twitter