On Thursday I posted a proposal to the PowerPool community to create a Yearn Ecosystem Token Index (YETI).

One common question about the proposal was about CVP’s presence in the index.

TL;DR: CVP is an integral part of each PowerPool Index.

1/ https://twitter.com/ryanwatkins_/status/1334636917971955713

One common question about the proposal was about CVP’s presence in the index.

TL;DR: CVP is an integral part of each PowerPool Index.

1/ https://twitter.com/ryanwatkins_/status/1334636917971955713

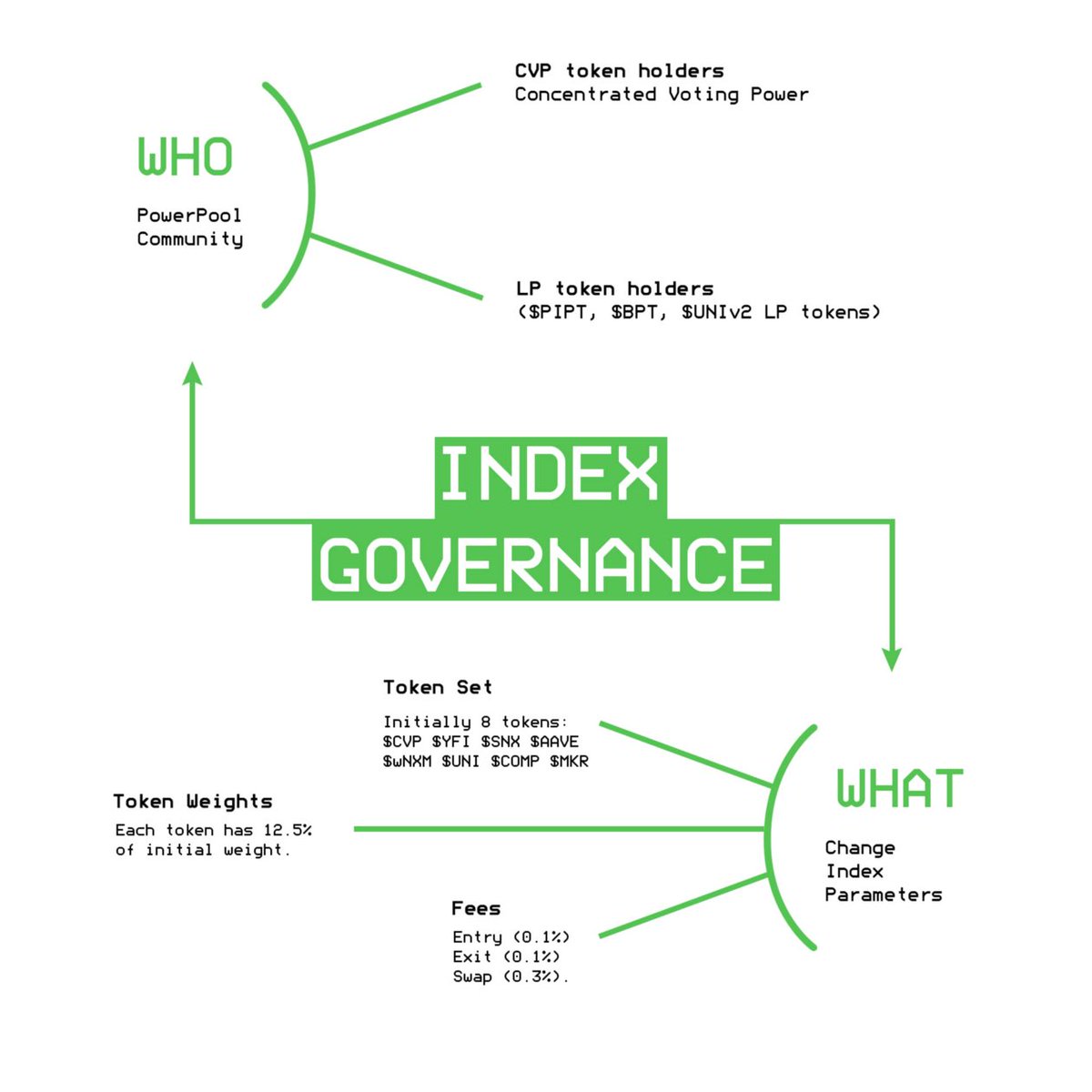

CVP is included in each PowerPool index for two reasons.

The first is to enable index holders to participate in PowerPool governance.

Each index holder's voting power will be a function of their share of CVP locked in the index. https://messari.io/article/understanding-cvp-s-role-in-powerpool-indices

The first is to enable index holders to participate in PowerPool governance.

Each index holder's voting power will be a function of their share of CVP locked in the index. https://messari.io/article/understanding-cvp-s-role-in-powerpool-indices

Index token holders will be able to vote on all proposals and collect rewards using this CVP locked in the index.

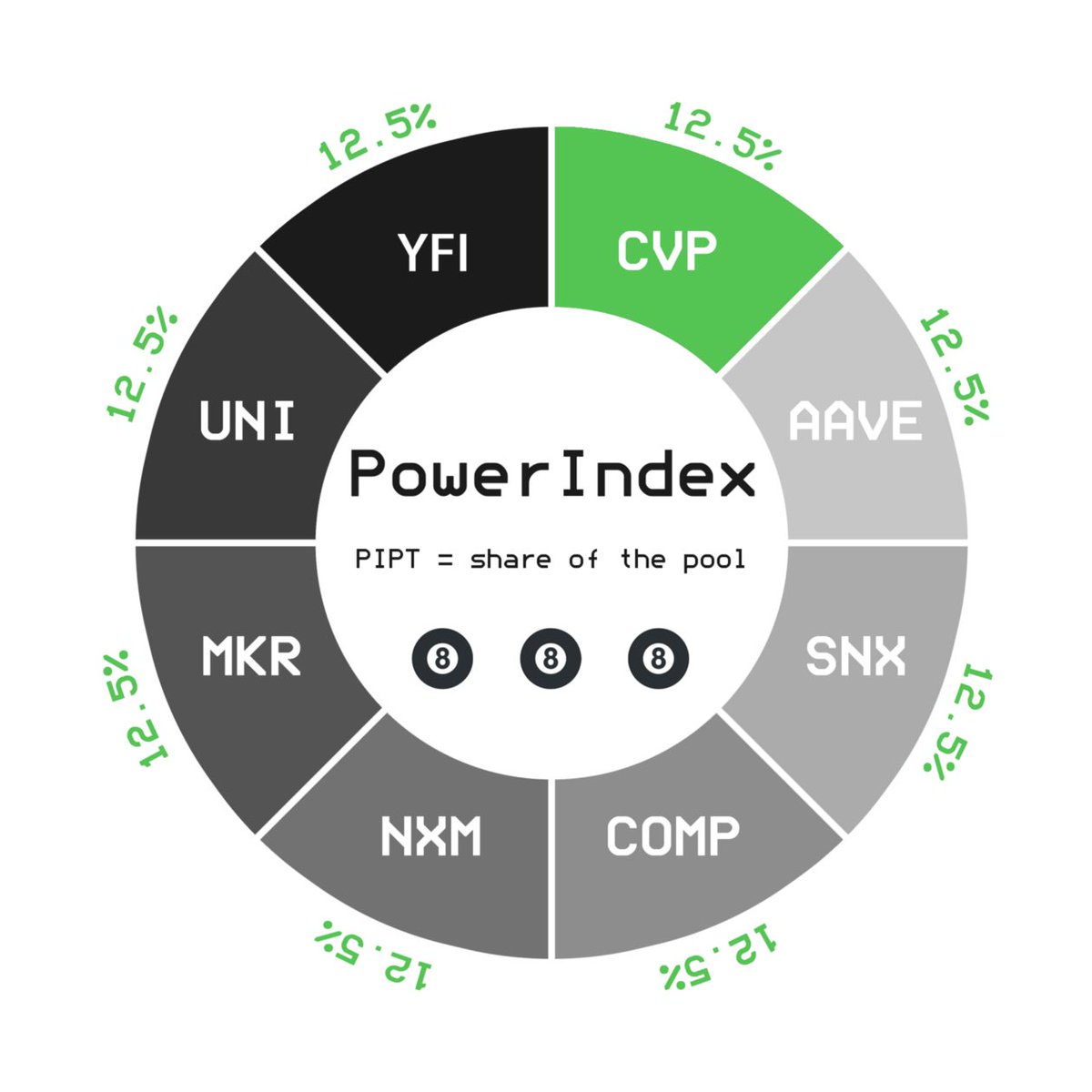

For example each PIPT (PowerPool’s first index) holder's voting power will be a function of their share of the 12.5% of CVP in the PowerIndex pool.

For example each PIPT (PowerPool’s first index) holder's voting power will be a function of their share of the 12.5% of CVP in the PowerIndex pool.

PowerPool’s governance system was designed so that users providing liquidity can simultaneously use their CVP to participate in governance.

The second and perhaps more important reason why CVP is included in each index is to align incentives between PowerPool and the underlying tokens (protocols) in its indices.

For example, based on the initial weightings for PIPT, CVP must make up 12.5% of the total value locked in the PowerIndex pool.

What this does is create skin in the game for CVP holders to ensure they are aligned with the governance of underlying DeFi tokens in PowerIndex.

What this does is create skin in the game for CVP holders to ensure they are aligned with the governance of underlying DeFi tokens in PowerIndex.

If CVP holders do their job well, more users will supply their governance tokens to the index, increasing the total value locked in PowerIndex and positively influencing the CVP token price.

If CVP holders do their job poorly (making clearly bad decisions for index composite protocols), users will withdraw their governance tokens from the index, decreasing total value locked in PowerIndex and negatively influencing CVP token price.

These CVP price movements will occur deterministically based on the TVL in the pool because CVP must account for a fixed percentage of the pool.

This dynamic provides strong incentives for CVP holders to do what's best for the composite protocols of each index.

This dynamic provides strong incentives for CVP holders to do what's best for the composite protocols of each index.

This dynamic also provides the ancillary benefit of scaling Index liquidity mining rewards with total value locked (TVL increases --> higher CVP price --> higher CVP rewards).

In short, meta-governance for each PowerPool index is not just a feature of PowerPool indices, it’s at the core of what PowerPool indices do.

This is why it presented itself as the best solution to use to launch YETI.

This is why it presented itself as the best solution to use to launch YETI.

Having CVP in each index, ensures that index holders have a voice in PowerPool governance and ensures that PowerPool will only be successful if it does its job well.

Thus CVP is included in YETI not to “ride the Yearn merger hype wave,” rather its included because it economically aligns PowerPool with the underlying protocols in YETI. https://messari.io/article/understanding-cvp-s-role-in-powerpool-indices

Read on Twitter

Read on Twitter