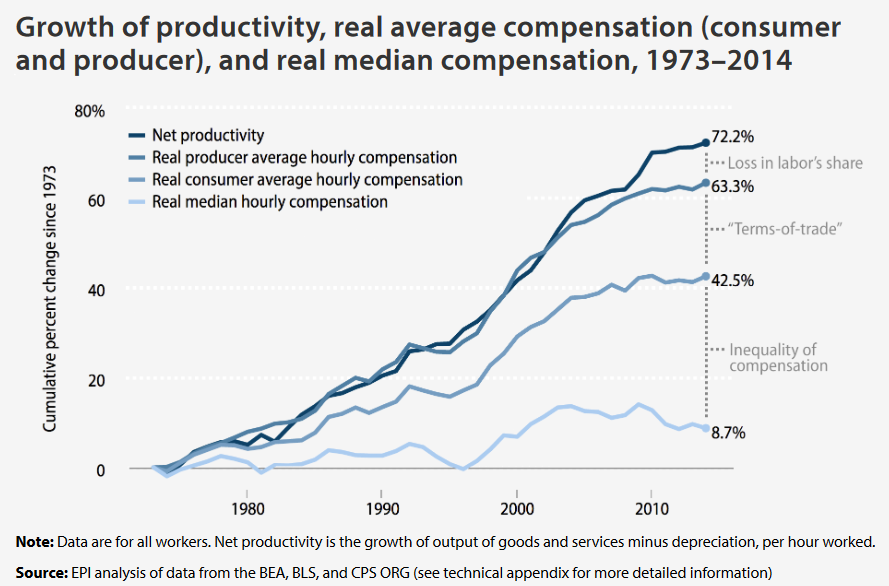

Setting aside the big measurement issues, the EPI chart shown here is actually not about rising payments to capital (they acknowledge small role for decline of labor share) really this is all about inequality. This distinction is crucial for your paper

https://twitter.com/Andrew___Baker/status/1335700185926647809?s=20

https://twitter.com/Andrew___Baker/status/1335700185926647809?s=20

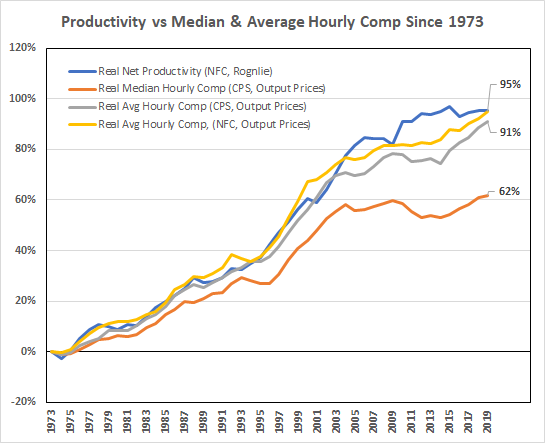

When you clean up the measurement issues like using different deflators and a measure of compensation that uses pay for a different subset of workers than the output series reflects you get no cumulative gap from the decline in labor share... but you do see median/avg inequality

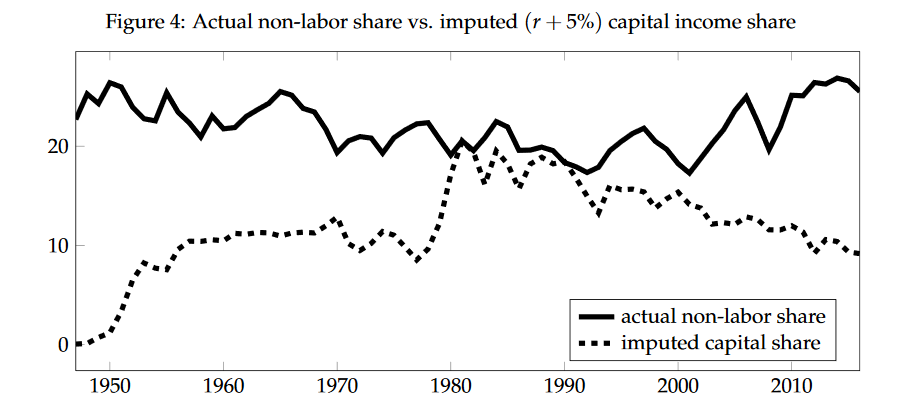

As I highlight here, citing Rognlie's great work there is no postwar trend in the labor share and therefore no trend in the capital share

http://mattrognlie.com/kn_comment_rognlie.pdf https://twitter.com/DonFSchneider/status/1303767554800996354

http://mattrognlie.com/kn_comment_rognlie.pdf https://twitter.com/DonFSchneider/status/1303767554800996354

In other words I think it will be difficult to demonstrate rising payments to capital coming at the expense of labor as implied here when the capital share is flat over the long run. https://twitter.com/Andrew___Baker/status/1335699785655828480

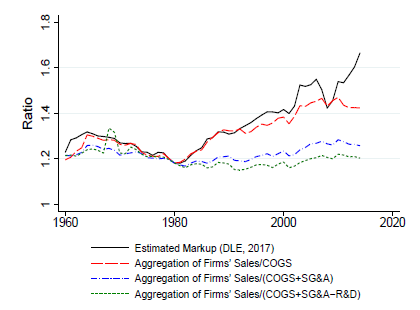

If you @andrew___baker want to argue for an exclusively post 2000 rise of economic profits that's a different story but I think it would benefit from grappling with Karabarbounis & Neiman who reject the pure profits story https://www.nber.org/papers/w24404

Using some simple calculations to derive an imputed capital share (and those who imply the residual is pure economic profits) it can look like there's a post 2000 story

Read on Twitter

Read on Twitter