**Thread**

The Chop.

The chop is brutal and I want to discuss more about what goes on inside a Traders mind when we form a choppy range and when we're inside a choppy range.

I hope you can take some lessons from this to adapt to these situations in the future.

RTs appreciated

The Chop.

The chop is brutal and I want to discuss more about what goes on inside a Traders mind when we form a choppy range and when we're inside a choppy range.

I hope you can take some lessons from this to adapt to these situations in the future.

RTs appreciated

The chop usually forms after strong moves in one direction or another, for this we'll keep the focus on BTC and use "up" as our direction for discussion.

So, $BTC rips higher, we're approaching ATH, you can't go wrong being long, then something changes.

So, $BTC rips higher, we're approaching ATH, you can't go wrong being long, then something changes.

As we move higher, as we approach key levels, your mindset changes. Sometimes you can feel invincible, you've simply had to push the green button for 2 weeks and you've been in profit.

Anticipation grows and dreams of smashing through ATH into new territory continue to build.

Anticipation grows and dreams of smashing through ATH into new territory continue to build.

This is where the first issue comes in to play.

1. Overconfidence and the assumption that you have to be correct.

Your mindset begins to look like this. Everything is now skewed towards your confidence in breaking through $20,000. Everything sets up as an ATH break.

1. Overconfidence and the assumption that you have to be correct.

Your mindset begins to look like this. Everything is now skewed towards your confidence in breaking through $20,000. Everything sets up as an ATH break.

2. Absorption of Information.

At the same time as your own mind racing to higher targets. Twitter begins pouring fuel on the fire.

"Retail isn't even here yet!"

"Impulse from $20k could lead to $30k!"

"Can you imagine the liquidations above $20k?"

You're fed more information.

At the same time as your own mind racing to higher targets. Twitter begins pouring fuel on the fire.

"Retail isn't even here yet!"

"Impulse from $20k could lead to $30k!"

"Can you imagine the liquidations above $20k?"

You're fed more information.

This information continues to perpetuate the feelings of:

1. Being correct.

2. Being assured that the breakout comes soon.

3. Panicking and positioning to ensure you don't miss the upcoming move

And point 2. leads us to the next important point of time.

1. Being correct.

2. Being assured that the breakout comes soon.

3. Panicking and positioning to ensure you don't miss the upcoming move

And point 2. leads us to the next important point of time.

3. Time

Because of the volatility, the good feelings, fear of missing out, you begin to anticipate everything as "the move."

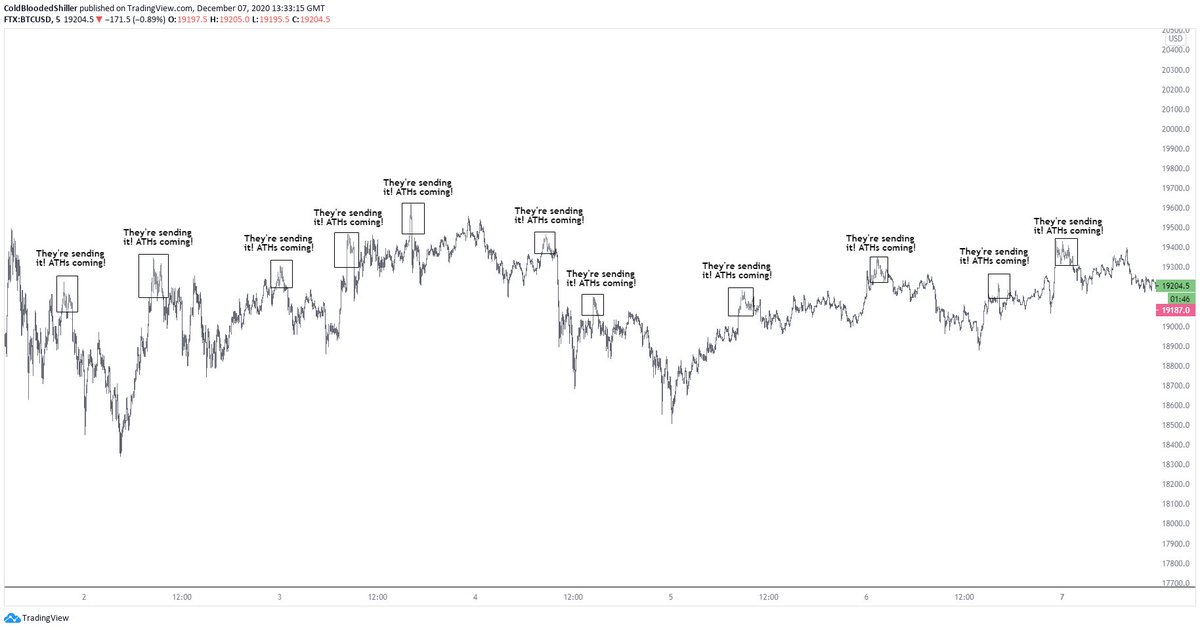

As a result you tend to shift your focus to LTF and your mindset and trading begins to look a lot like this.

Because of the volatility, the good feelings, fear of missing out, you begin to anticipate everything as "the move."

As a result you tend to shift your focus to LTF and your mindset and trading begins to look a lot like this.

This is how the majority of traders lose money inside the chop.

Anticipating moves.

Stubbornly holding.

Overleveraging.

Poor positioning.

Adding to losers because we'll go up eventually!

Anticipating moves.

Stubbornly holding.

Overleveraging.

Poor positioning.

Adding to losers because we'll go up eventually!

So let's put it together:

1. You convince yourself ATHs are imminent

2. Twitter fuels the prospect of smashing through to huge upside targets

3. You've been right on the run up

4. You move to LTF to try and anticipate the move because you have 1. and 2. in your mind.

5. FOMO

1. You convince yourself ATHs are imminent

2. Twitter fuels the prospect of smashing through to huge upside targets

3. You've been right on the run up

4. You move to LTF to try and anticipate the move because you have 1. and 2. in your mind.

5. FOMO

All of this together leads to:

A narrowed field of view.

Overtrading.

Inability to execute any trades aside from "the one that's going to ATH."

A narrowed field of view.

Overtrading.

Inability to execute any trades aside from "the one that's going to ATH."

When you see this image you can see the way your mindset and approach will impact the moves you can play and what the wider range looks like for us in this region.

Without the stubborn holding of ideas and anticipation of an imminent ATH smash you can perform differently.

Without the stubborn holding of ideas and anticipation of an imminent ATH smash you can perform differently.

Chops form after strong moves. It allows informed bodies to position accordingly and to manage for the next leg or reversal.

Chop will destroy most traders and it's largely for the reasons I covered in this thread.

Chop will destroy most traders and it's largely for the reasons I covered in this thread.

When you find yourself going down this path:

1. Zoom out do not zoom in

2. Learn to adapt to the range

3. Do not allow your thoughts to influence targets

4. Do not hold trades past invalidation or past original targets.

5. Do not let outside influence fuel heightened emotions

1. Zoom out do not zoom in

2. Learn to adapt to the range

3. Do not allow your thoughts to influence targets

4. Do not hold trades past invalidation or past original targets.

5. Do not let outside influence fuel heightened emotions

Very often ranges like this form clear breakout moments so you actually have a signal from a break of a range vs needing to position inside it. And if your assumptions are correct then the resulting move should be significant regardless.

Remember:

"Legendary trader Bill Williams, an early pioneer of market psychology, follows the premise that financial markets and individual securities trend just 15% to 30% of the time while grinding through sideways ranges the other 70% to 85% of the time."

"Legendary trader Bill Williams, an early pioneer of market psychology, follows the premise that financial markets and individual securities trend just 15% to 30% of the time while grinding through sideways ranges the other 70% to 85% of the time."

So, you have to get used to chop, you have to get used to sideways, you have to learn to either ignore it or adapt your trading to work inside it.

And let's face it, if the market is sideways for 70%+ of the time, your best bet is mastering the chop.

And let's face it, if the market is sideways for 70%+ of the time, your best bet is mastering the chop.

Read on Twitter

Read on Twitter