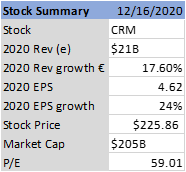

1. $CRM: Overview: Salesforce (NASDAQ: CRM) is a leading Software-as-a-Service (SaaS) company, with a 20-year history of cloud-based customer relationship management (CRM) delivery. For FY21 CRM will post ~$21B in revenue (+17.6%YoY) and earnings of $4.62 (+24% YoY).

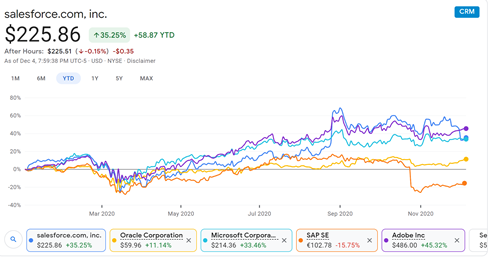

2. $CRM: Stock Perf this year: The stock price (12/6/2020) is $225, valuing the company at $205B (+38.8% YTD, vs NASDAQ 43.9%).

3. $CRM: Forecast: With growth in cloud driven by Covid and digital transformation efforts, I see it continuing to be a leader in the market, growing to over $100B in revenue by 2027 and over $1 Trillion in market capitalization, reflecting a stock price of ~$1020 (+450%).

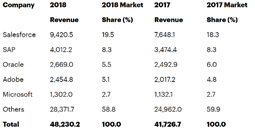

4: $CRM: Market: Market: Customer experience and relationship software market size: $193B, growing 18% annually. $CRM currently owns 18.6% of the market according to Gartner and is growing faster than the market (14% YoY) taking share from older systems that are home-grown.

5. $CRM: Market has 3 segments – Enterprise: 5000+ emp (~39% of $CRM rev 2020), Mid-market – 500+ emp, (35% of rev) and SMB - 10+ emp, (26% or rev).

6. $CRM: Opportunities a) Enterprises migrating from in-house, custom, on-premises and older CRM systems to cloud, e.g., Oracle Sibel ($20B opportunity by 2027), b) Mid-market companies moving away from spreadsheets) and c) SMBs adopting CRM software ($31B opportunity by 2027).

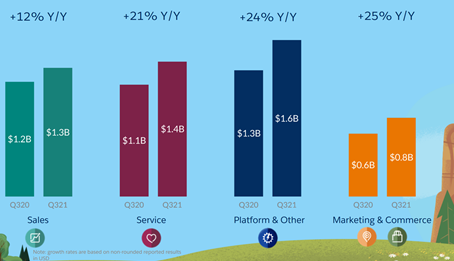

7. $CRM: Product: 4 primary reporting segments: 1) Sales automation ($5.5B 21E +16% YoY), 2) Service automation, Customer support and service ($5.9B, 21E, +18% YoY), 3) Marketing automation ($3.4B 21E, +24% YoY) and 4) Platform ($6.4B 21E, +26% YoY).

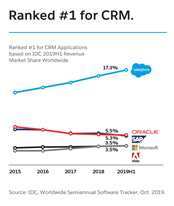

8. $CRM: Competition: Key competitors in each segment are: $MSFT Dynamics, $SAP and $ORCL in sales automation, $ZEN and $ORCL in service automation, $HUBS, $ORCL and $ADBE in Marketing automation, and $MSFT PowerBi, $AMZN AWS QuickSight in Analytics.

9. $CRM: Competitors: n the SMB segment, $CRM has hundreds of small companies as competitors and the market is very fragmented. $CRM has been consistently taking share from the competitors, growing faster than all the other competitors per Gartner’s annual market share analysis.

10. $CRM: Stock Ownership and Analysts: 29 analysts cover $CRM with an average EPS estimate (increased Dec 2020) of $4.63. Of 45 recommendations, 15 are strong buy, 25 are buy and 5 are sell. The average analyst price target is $275 by Dec 2021.

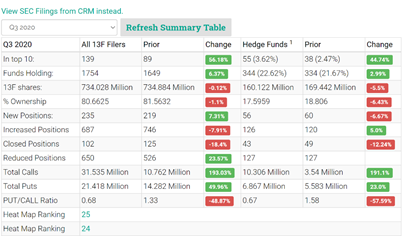

11. $CRM: Institutional: 3065 funds and institutional investors own a total of 83.6% of the company. In Q320, institutional buying in $CRM has increased by 6.37% and hedge funds by 44.7%.

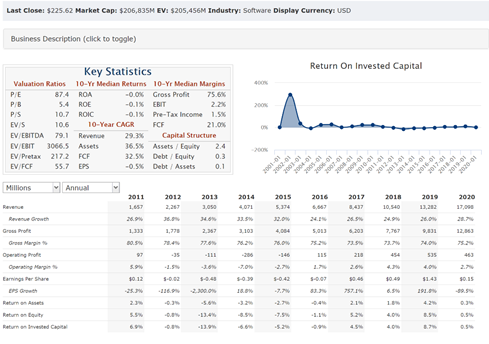

12: $CRM: Financials: $CRM has been a consistent performer with 24.7% revenue each of last 5 years, (10 Year CAGR is 29.3%) and EPS growth of 189%. It has take $10B in additional debt (existing debt is $2.7B) to finance the Slack acquisition, and has over $10B cash in balance.

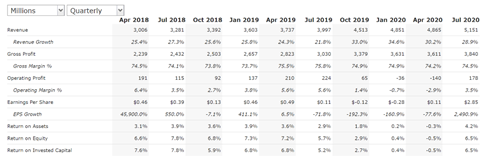

13: $CRM: Financials '20: Revenue growth for 3Q 2020 has been slowing from 34% to 28% but still higher than any of its peers. Gross Margins have been consistently strong at over 74%.

14: $CRM: Customers and Industry analysts: $CRM has consistently been a leader in the Gartner magic quadrant for 7 years for cloud based CRM.

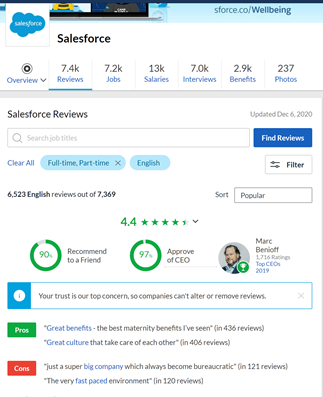

15. $CRM: Employee culture and CEO reputation. @Benioff is a rockstar among CEO's. His employees rate him among the top 10 public CEO's according to Glassdoor

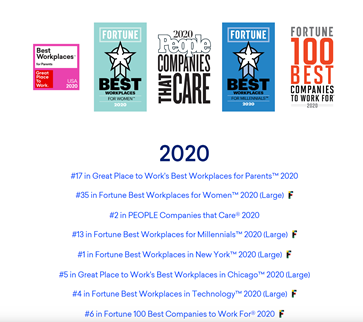

16. $CRM has been the #1 best places to work for many years.

17. $CRM: My financial model has $CRM doing $25.5B - $26.7B in CY2021 revenues, with an EPS of $5.4. This would be an implied valuation of $304B (+45% stock price increase) in 2021. I expect NASDAQ to be at +19% in 2021

Read on Twitter

Read on Twitter