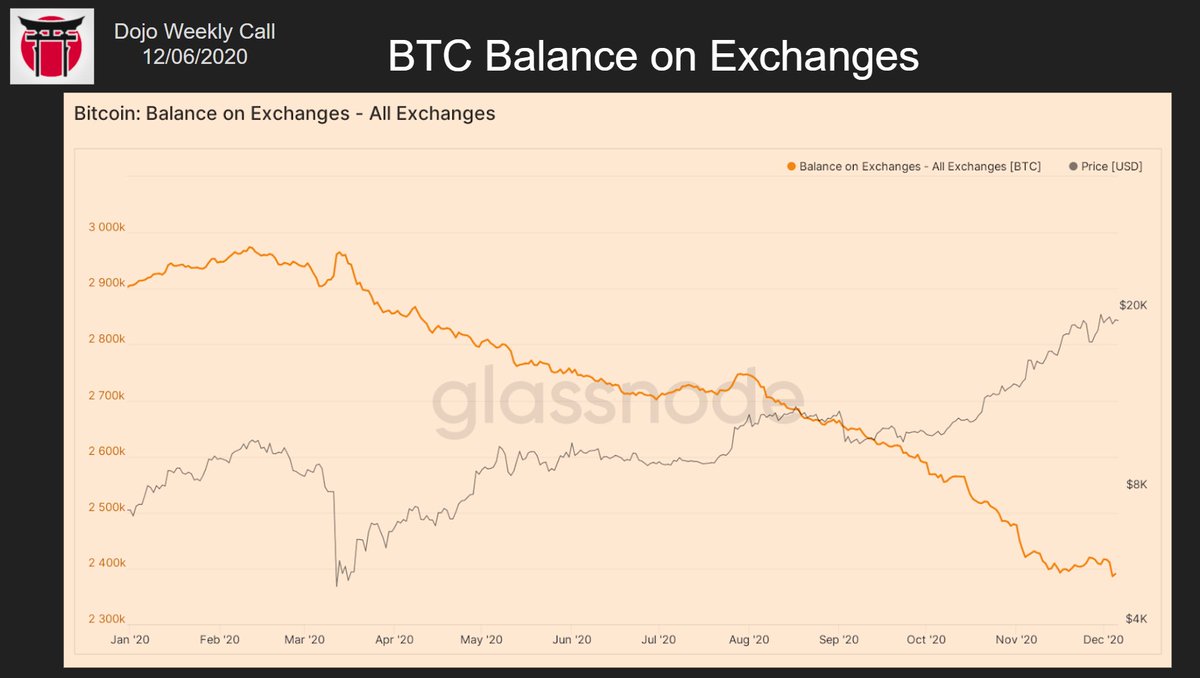

1/ Bit of macro data from this morning's dojo call: Surprisingly (?) the trend of BTC leaving exchanges is continuing:

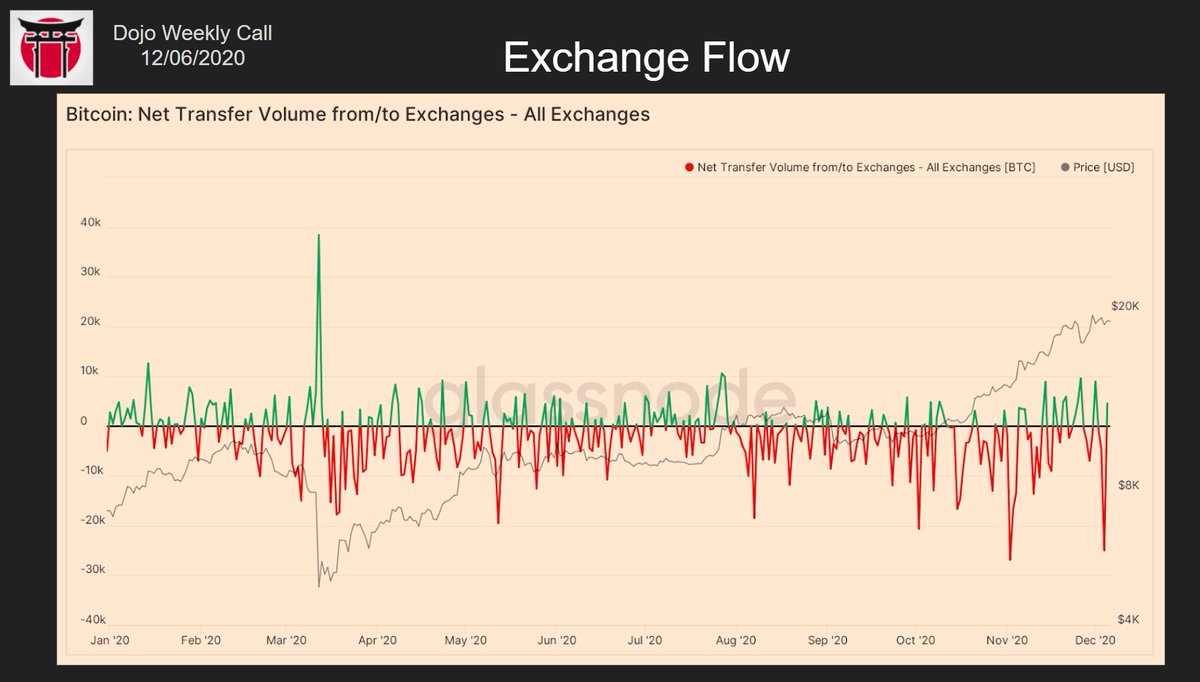

2/ We can also see this on the net flow volume which actually had one of the largest outflow spikes since the March dump in this ongoing consolidation:

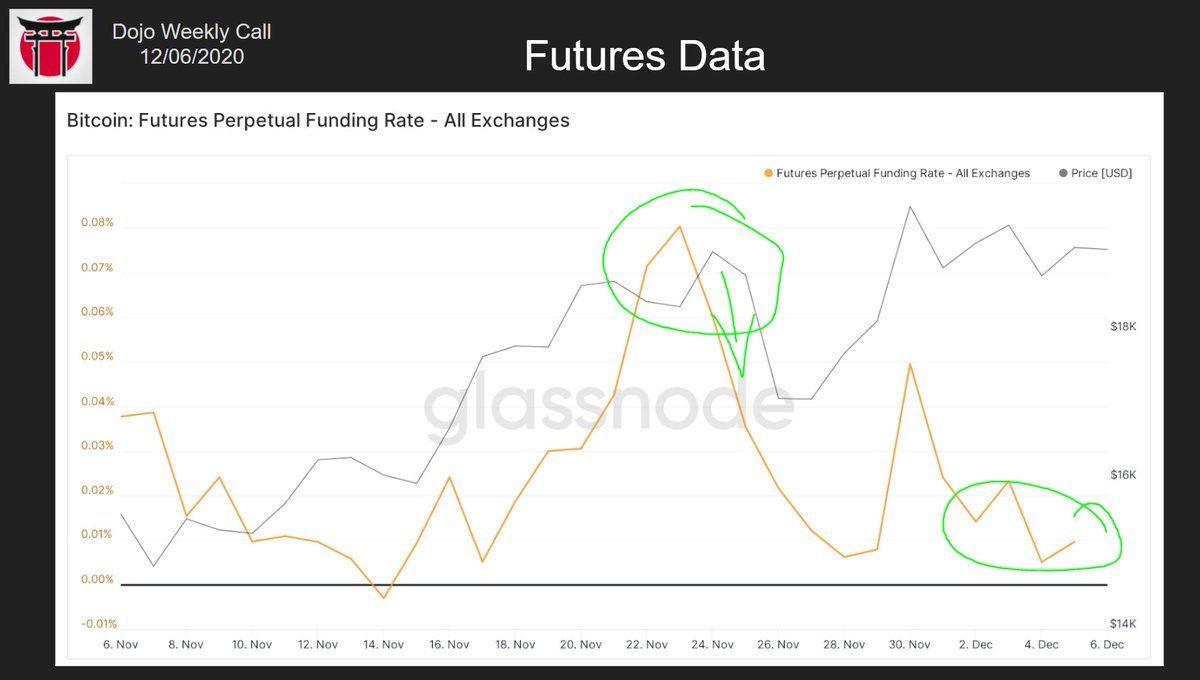

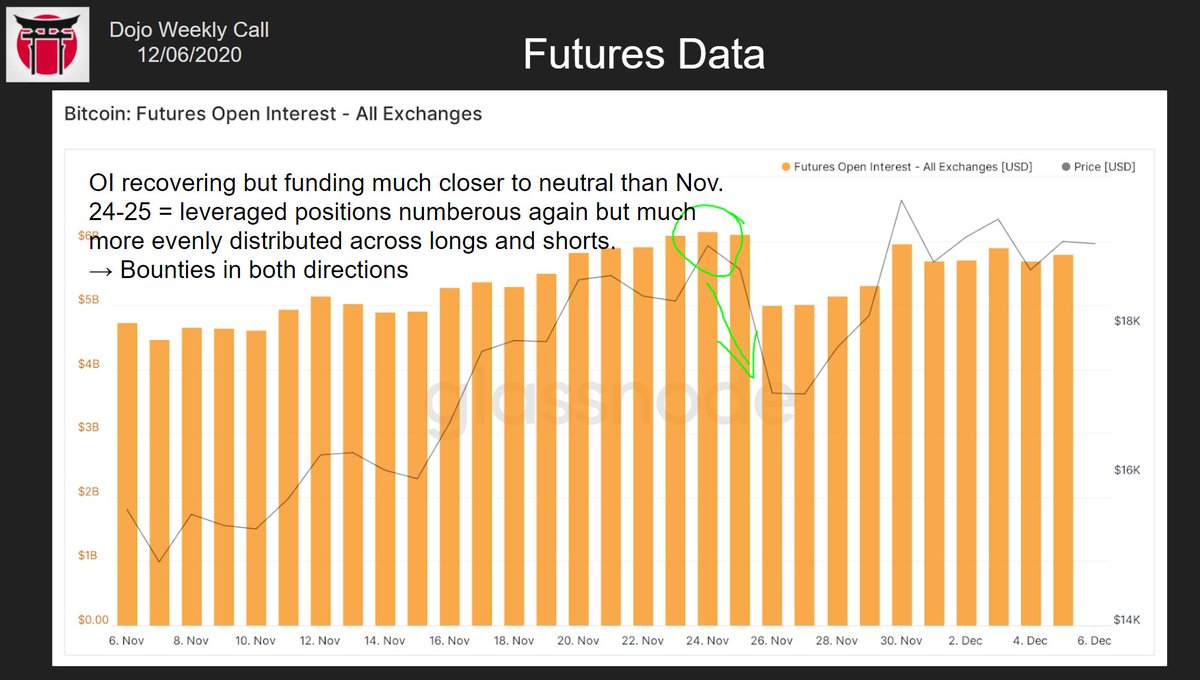

3/ Compared to the situation prior to the 16% Nov 25 dump, funding is much closer to neutral now. OI, however, has almost recovered. So traders are putting leverage on the table but are way less sure about direction. Bounties on both sides.

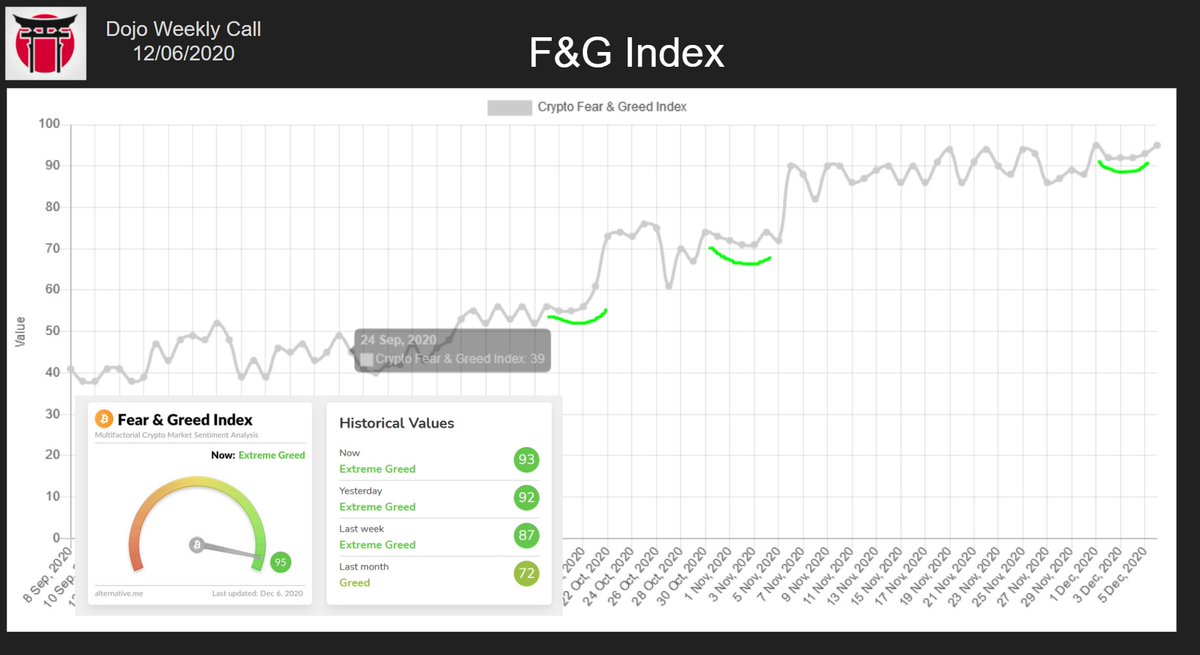

4/ The signals I am reading are very mixed and its hard to decide on direction based on them. So the rather neutral funding makes sense. One potential upwards indicator that I've learned to respect over the year is the F&G index which is curving up nicely (noted that yesterday).

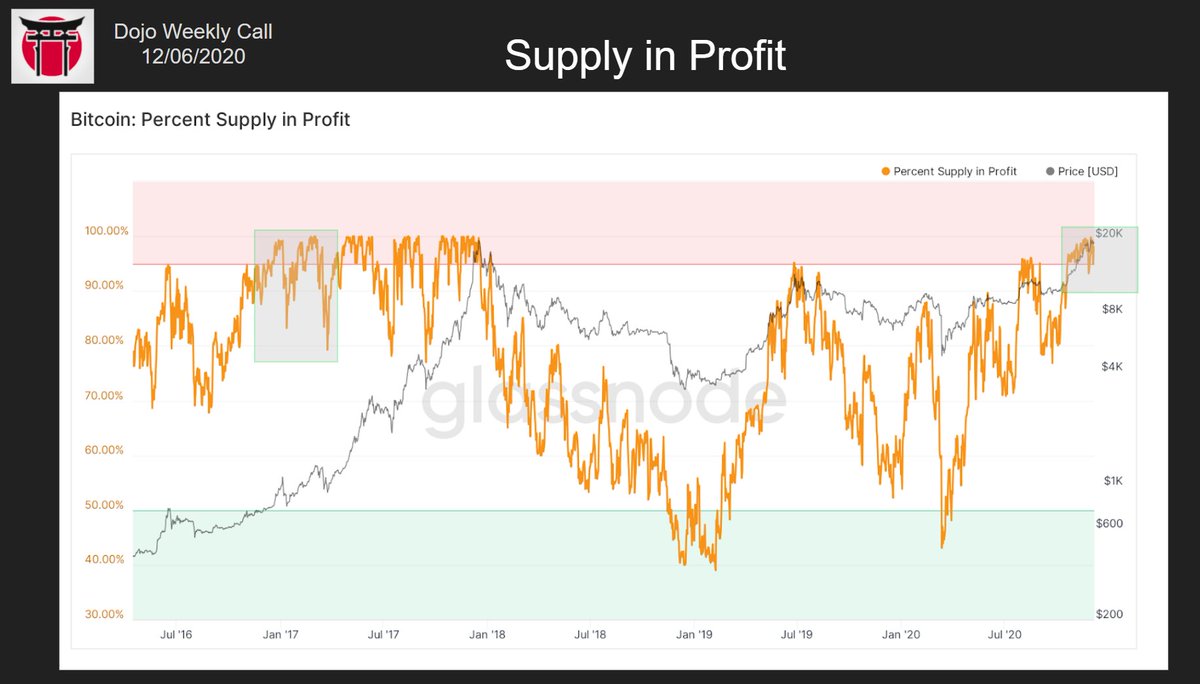

5/ We are ranging very high on the F&G but that doesn't necessarily equals immediate top. Emotions are peaking which is going to result in a high volatility move soon. We've entered the full blown bull market region on the supply in profit chart now which lines up well with that.

Read on Twitter

Read on Twitter