1/ Algorithmic stablecoins seem primed to explode this coming year similar to how oracles ( $LINK, $BAND, etc) had a great past year

2/ Stablecoins have achieved product-market fit at a mind-blowing scale - with demand for stables pushing total supply into the tens of billions and still exponentially expanding

They're used as SOVs (Eurodollar 2.0) and MoEs in & outside crypto https://twitter.com/Rewkang/status/1331358994884034560

They're used as SOVs (Eurodollar 2.0) and MoEs in & outside crypto https://twitter.com/Rewkang/status/1331358994884034560

3/ The issue with current stablecoins is that they are not truly censorship-resistant. They can be shut down & represent a weak link in our DeFi ecosystems.

What's desperately needed are truly decentralized stablecoins. These can make DeFi applications truly unstoppable

What's desperately needed are truly decentralized stablecoins. These can make DeFi applications truly unstoppable

4/ There are a few projects already live on mainnet - notably

@AmpleforthOrg - Rebasing

@BasisCash - Seignorage Shares + Bond

@emptysetdollar - Hybrid Stablecoin/Share + Coupons; V2 = partial collateralization

@AmpleforthOrg - Rebasing

@BasisCash - Seignorage Shares + Bond

@emptysetdollar - Hybrid Stablecoin/Share + Coupons; V2 = partial collateralization

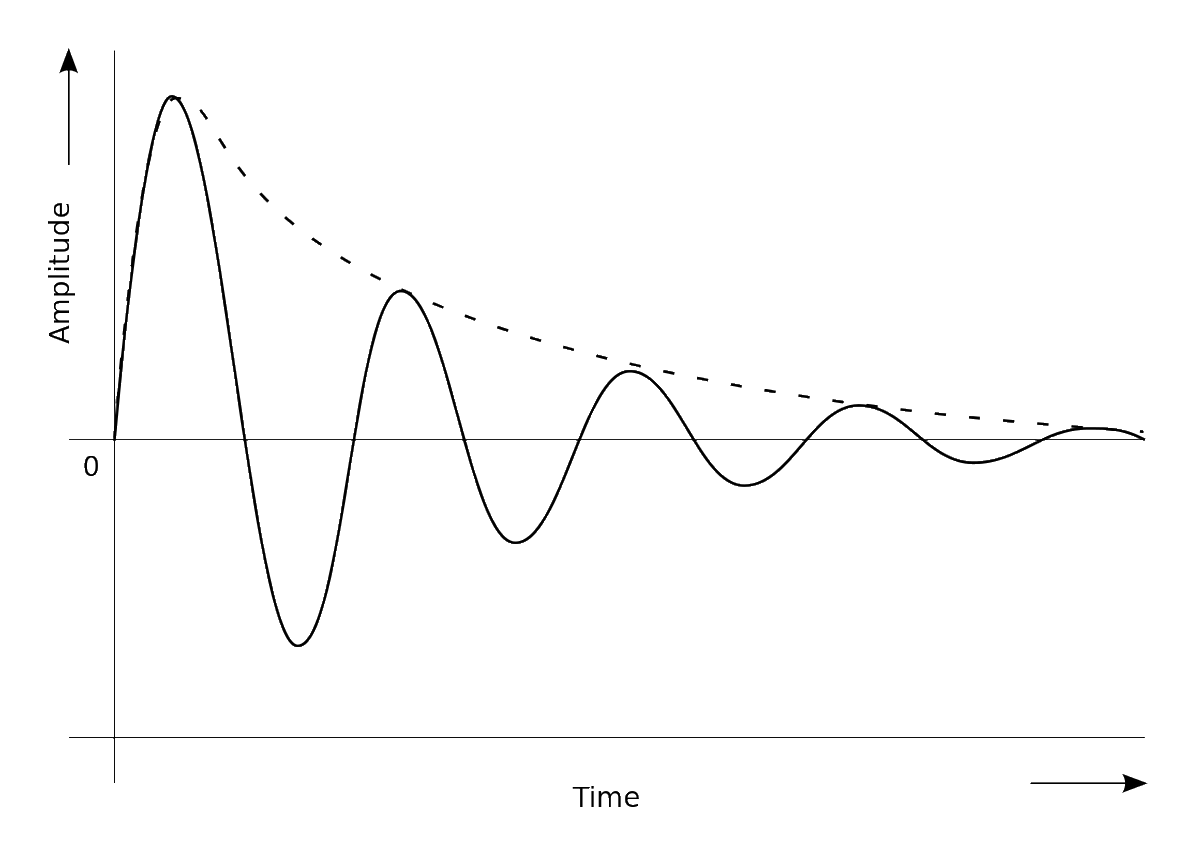

5/ The key factor with these algorithmic stablecoins is that they need to reach scale ($1-10B+) in order to effectively function as really stable stablecoins and to be liquid enough to be useful on mass scale

6/ That leads to a bit of a conundrum - how do you create enough demand to expand supply if the system hasn't reached threshold stability/liquidity yet?

This is actually the exact same problem Bitcoin faces

This is actually the exact same problem Bitcoin faces

7/ The elegant solution? Ponzify it

By entitling the early speculators to greater economic gain, the system is able to bootstrap itself

Those that speculate have an incentive to draw in more speculators. And the more that are drawn in, the more legitimate the systems become

By entitling the early speculators to greater economic gain, the system is able to bootstrap itself

Those that speculate have an incentive to draw in more speculators. And the more that are drawn in, the more legitimate the systems become

8/ Going from millions to billions to trillions turns Bitcoin from a purely speculative asset to a real store of value and potential global reserve asset

The same is true for algorithmic stablecoins

The same is true for algorithmic stablecoins

9/ The stablecoins in these systems when young have little normal demand so by making the holders of the stablecoins the recipients of supply expansion/yield, the projects can harness the power of speculation to create demand

This is otherwise known as the pool2 effect

This is otherwise known as the pool2 effect

10/ As the supply for these stablecoins expand, stability & liquidity increases, confidence in the system increases and more conservative speculators are drawn in

This is how $AMPL reached $1B FDV and how $ESD and $BAC probably reach billions

There's too much hot money not to

This is how $AMPL reached $1B FDV and how $ESD and $BAC probably reach billions

There's too much hot money not to

11/ The verdict is still out on whether these algorithmic stablecoins actually work. $ESD has been holding stability but only a few months young

The amazing thing is that they will gain value whether they work or not

A traders dream, especially ones that understand reflexivity

The amazing thing is that they will gain value whether they work or not

A traders dream, especially ones that understand reflexivity

Read on Twitter

Read on Twitter