1/OK, here's a thread of my latest Noahpinion blog post.

Why macroeconomic policy discussions have become less theoretical and less pro-austerity since the Great Recession: https://noahpinion.substack.com/p/the-new-macro-give-people-money

Why macroeconomic policy discussions have become less theoretical and less pro-austerity since the Great Recession: https://noahpinion.substack.com/p/the-new-macro-give-people-money

2/Back in 2009-13, a fair amount of the fiscal policy discussion was based on theory.

For example, a few top economists invoked the theory of Ricardian Equivalence as a reason stimulus couldn't work (they were wrong):

https://www.bradford-delong.com/2012/01/department-of-hiuh-john-cochrane-and-ricardian-equivalence-ii.html https://delong.typepad.com/sdj/2009/04/the-great-ricardian-equivalence-misunderstanding.html

For example, a few top economists invoked the theory of Ricardian Equivalence as a reason stimulus couldn't work (they were wrong):

https://www.bradford-delong.com/2012/01/department-of-hiuh-john-cochrane-and-ricardian-equivalence-ii.html https://delong.typepad.com/sdj/2009/04/the-great-ricardian-equivalence-misunderstanding.html

3/Back in 2013 the Bank of England even invited me to give a talk about why DSGE models weren't useful.

Things got...interesting. The Swedish central bankers were not happy with my arguments, and the BoE people stepped in to defend me... ;-)

http://noahpinionblog.blogspot.com/2013/05/what-can-you-do-with-dsge-model.html

Things got...interesting. The Swedish central bankers were not happy with my arguments, and the BoE people stepped in to defend me... ;-)

http://noahpinionblog.blogspot.com/2013/05/what-can-you-do-with-dsge-model.html

4/But this time around, things are very different.

Macroeconomists, by and large, aren't even referencing formal theory when they argue about what should be done about the COVID-19 recession.

Macroeconomists, by and large, aren't even referencing formal theory when they argue about what should be done about the COVID-19 recession.

5/In 2008, Olivier Blanchard praised macroeconomics for converging around a set of models that had little role for fiscal policy at all! https://www.nber.org/papers/w14259

6/Today, his policy thinking has shifted toward simple calculations that show that America can afford to borrow and spend a lot more money: https://www.aeaweb.org/articles?id=10.1257/aer.109.4.1197

7/Janet Yellen has worried many times that the national debt was unsustainable: https://www.washingtonexaminer.com/news/seven-times-biden-treasury-pick-yellen-said-the-debt-was-unsustainable

8/Now she says we need massive stimulus!! https://markets.businessinsider.com/news/stocks/economic-outlook-fed-yellen-stimulus-needed-coronavirus-slows-recovery-fiscal-2020-10-1029694850#

9/Ken Rogoff was once a notorious deficit hawk: https://www.newyorker.com/news/john-cassidy/the-reinhart-and-rogoff-controversy-a-summing-up

10/Now his only question is which kind of government spending is best:

11/What happened? Why is no one invoking macroeconomic models as a reason to be worried about spending too much money?

One reason is that last time, the models essentially failed.

One reason is that last time, the models essentially failed.

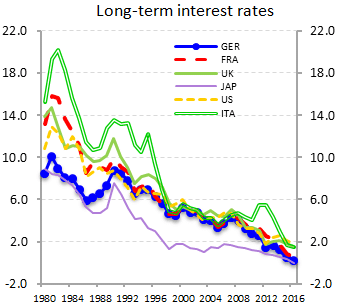

12/Models of debt sustainability typically assume that at some point, interest rates will bounce back from their lows. This leads the models to advocate some degree of austerity. https://www.nber.org/papers/w17305

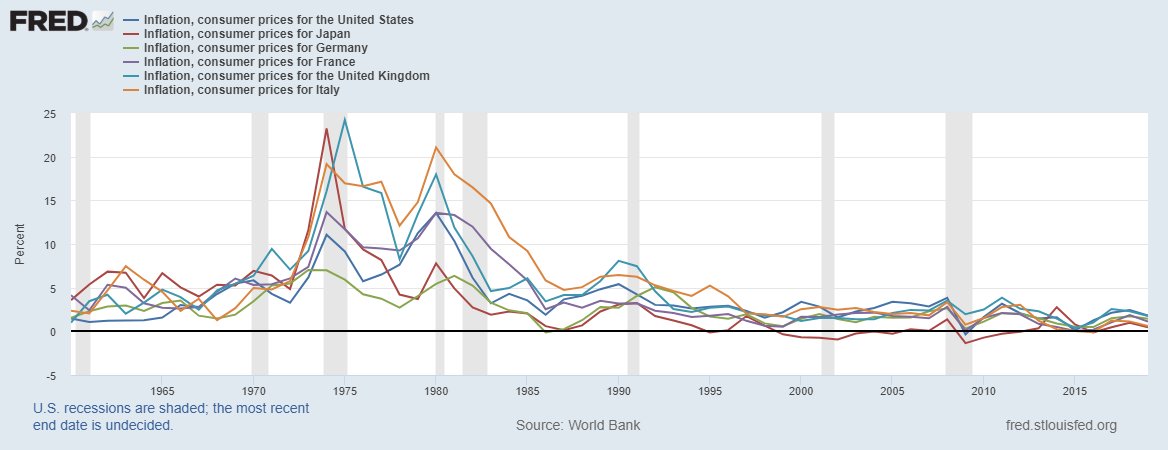

14/Some models predict that high deficits will lead to inflation, but...this just hasn't happened either!

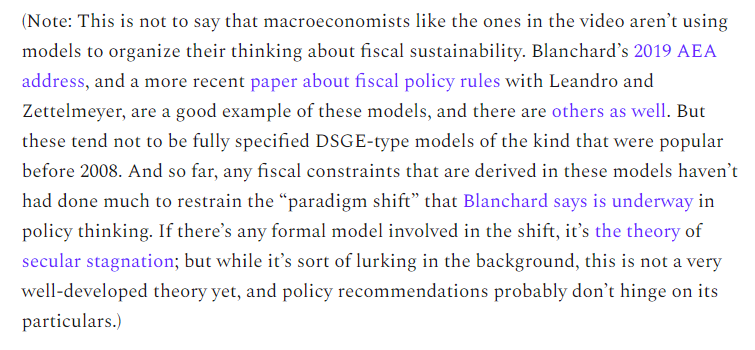

15/Now of course, not all macroeconomic models recommend austerity, and not all predict that interest rates will bounce back!! https://www.aeaweb.org/articles?id=10.1257/mac.20170367

16/But in general, economists like to make their models about tradeoffs and limits. They like to find interior solutions.

And that means most models of fiscal policy will advocate a Goldilocks level of spending, and warn that too much is too much.

And that means most models of fiscal policy will advocate a Goldilocks level of spending, and warn that too much is too much.

17/But now is not the time for such a cautious, not-too-big, not-too-small sort of approach.

The COVID-19 recession has made economists realize that it's time to swing for the fences.

The COVID-19 recession has made economists realize that it's time to swing for the fences.

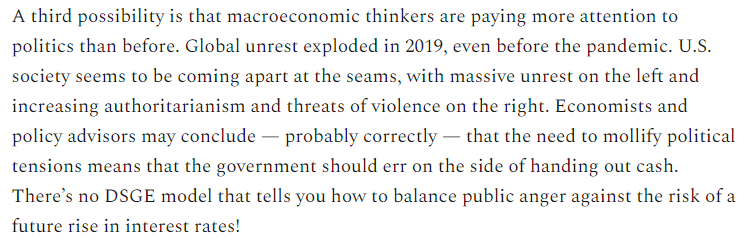

18/And one reason they've realized this might be politics.

We're in an era of global unrest. The risk of fanning those flames with a too-small stimulus must loom large in technocrats' minds right now.

We're in an era of global unrest. The risk of fanning those flames with a too-small stimulus must loom large in technocrats' minds right now.

19/Someday, if and when we have better macro models, and if and when the economic costs of government spending start becoming apparent, this situation may change. But for now, macro in the real world is “GIVE PEOPLE MONEY.”

(end) https://noahpinion.substack.com/p/the-new-macro-give-people-money

(end) https://noahpinion.substack.com/p/the-new-macro-give-people-money

Read on Twitter

Read on Twitter