Is faster house price growth in the UK just about financial factors such as interest rates, or has it got something to do with real supply constraints? Comparing historic trends across countries sheds some light on this. Thread follows ...

In the following I'm comparing UK/England with France, Germany and Japan. This choice is driven partly by data availability, and partly because all four are very urbanised and at least somewhat land-constrained (compared to US/Australia/Canada, for example).

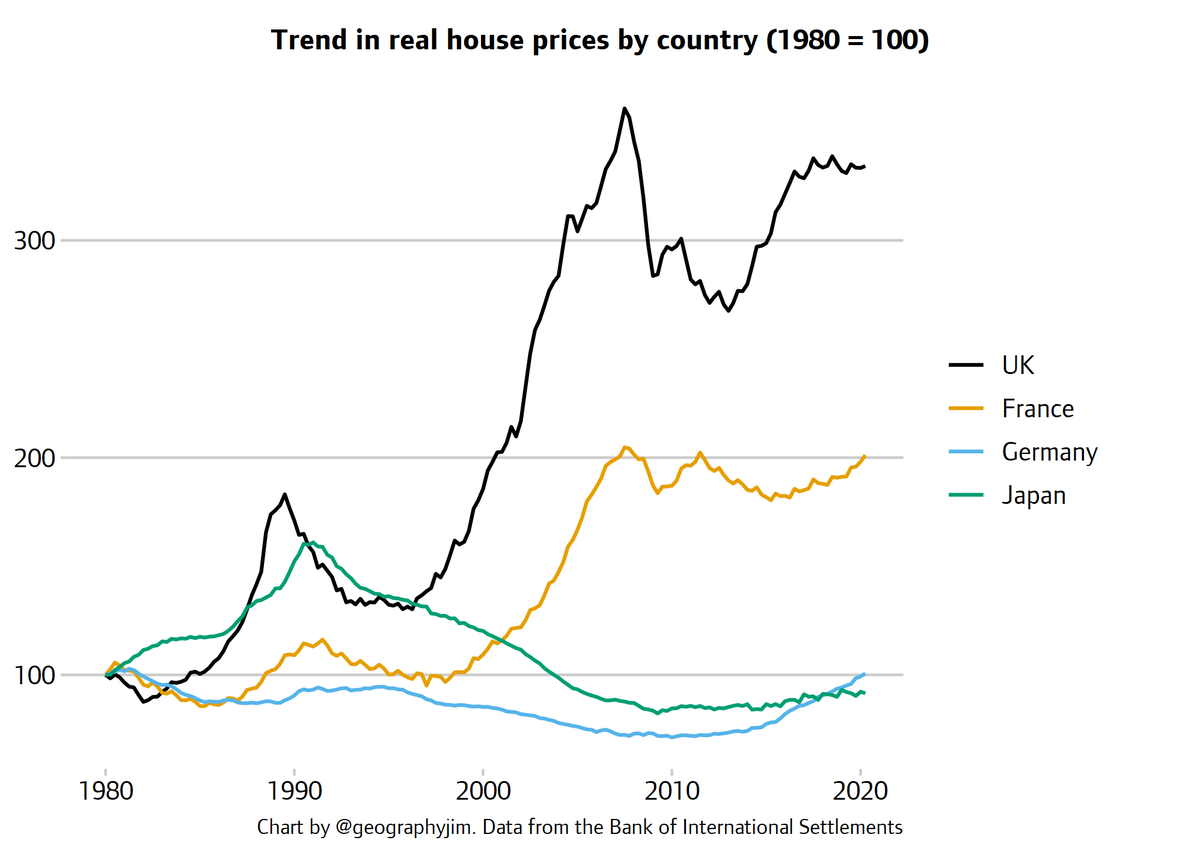

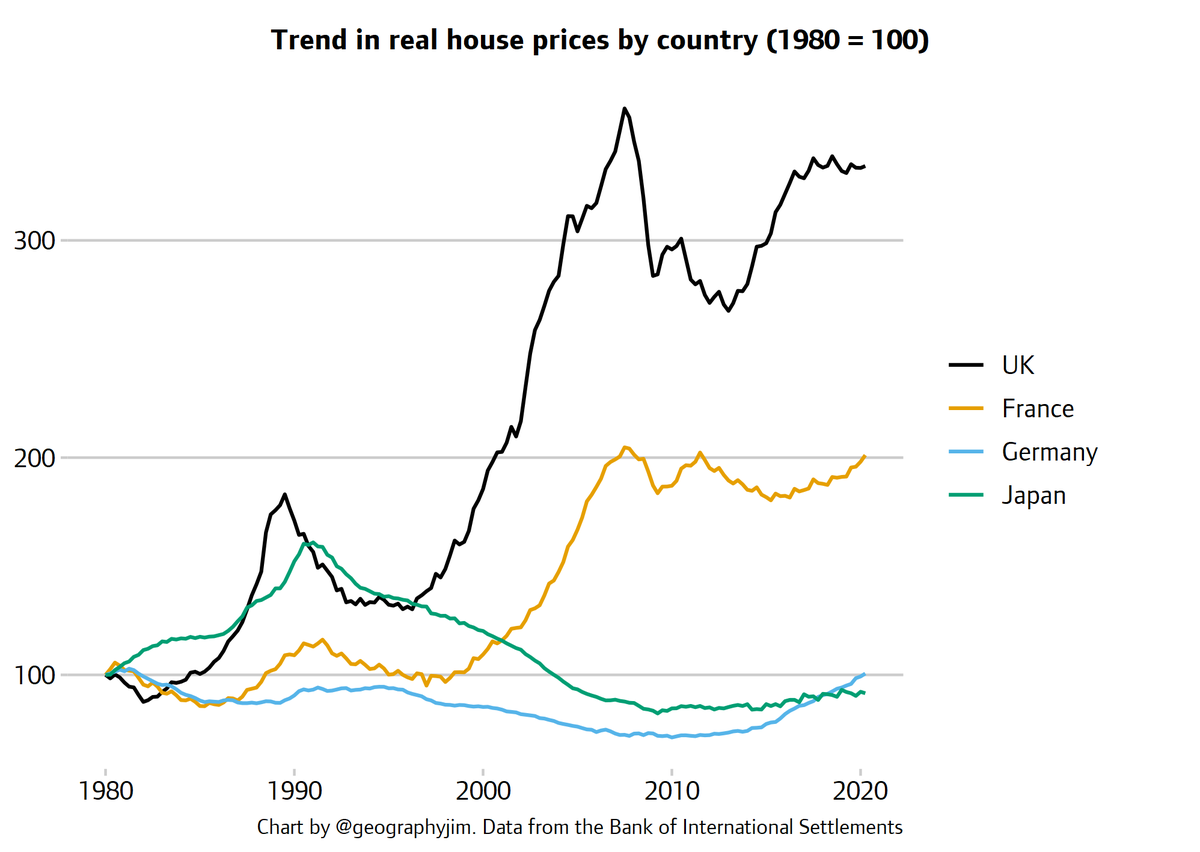

For context, this first chart compares real house price trends since 1980. Over that period, prices more than trebled in the UK, doubled in France and were basically steady (but with some big ups and downs) in Germany and Japan.

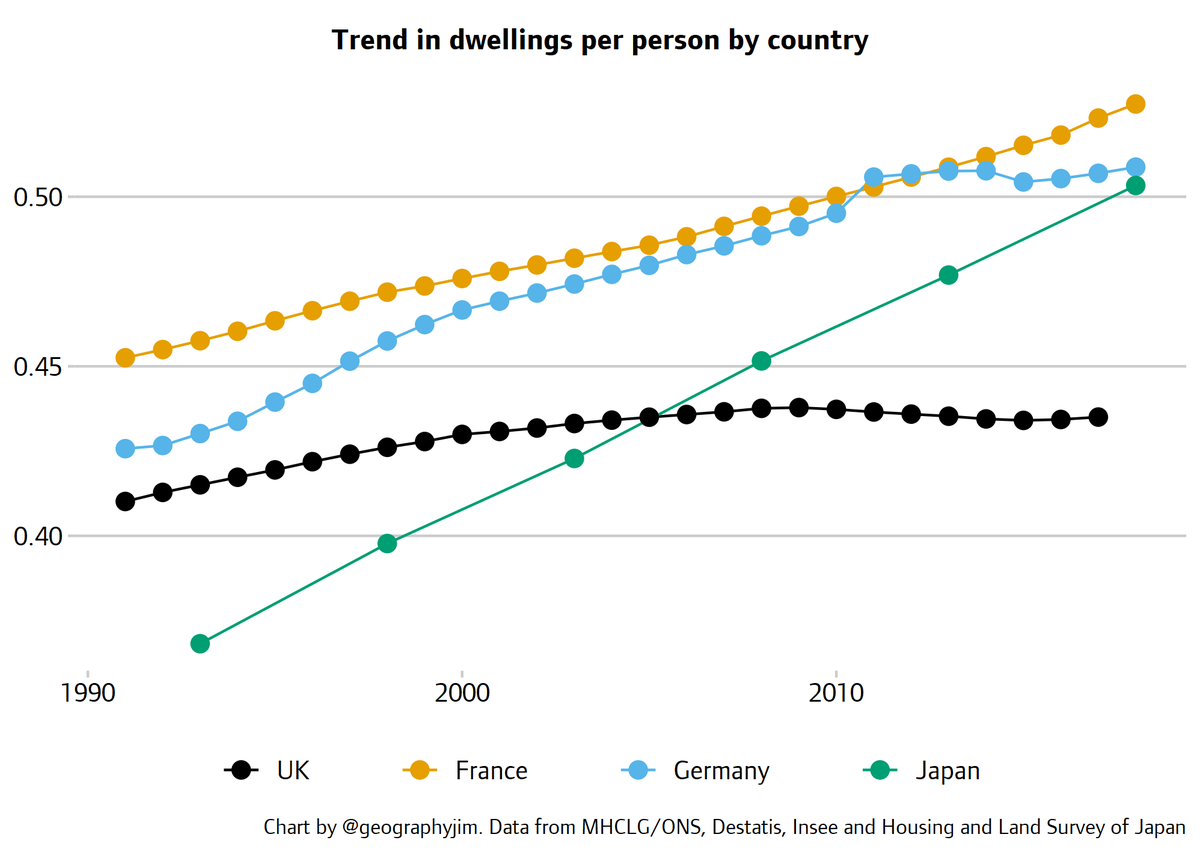

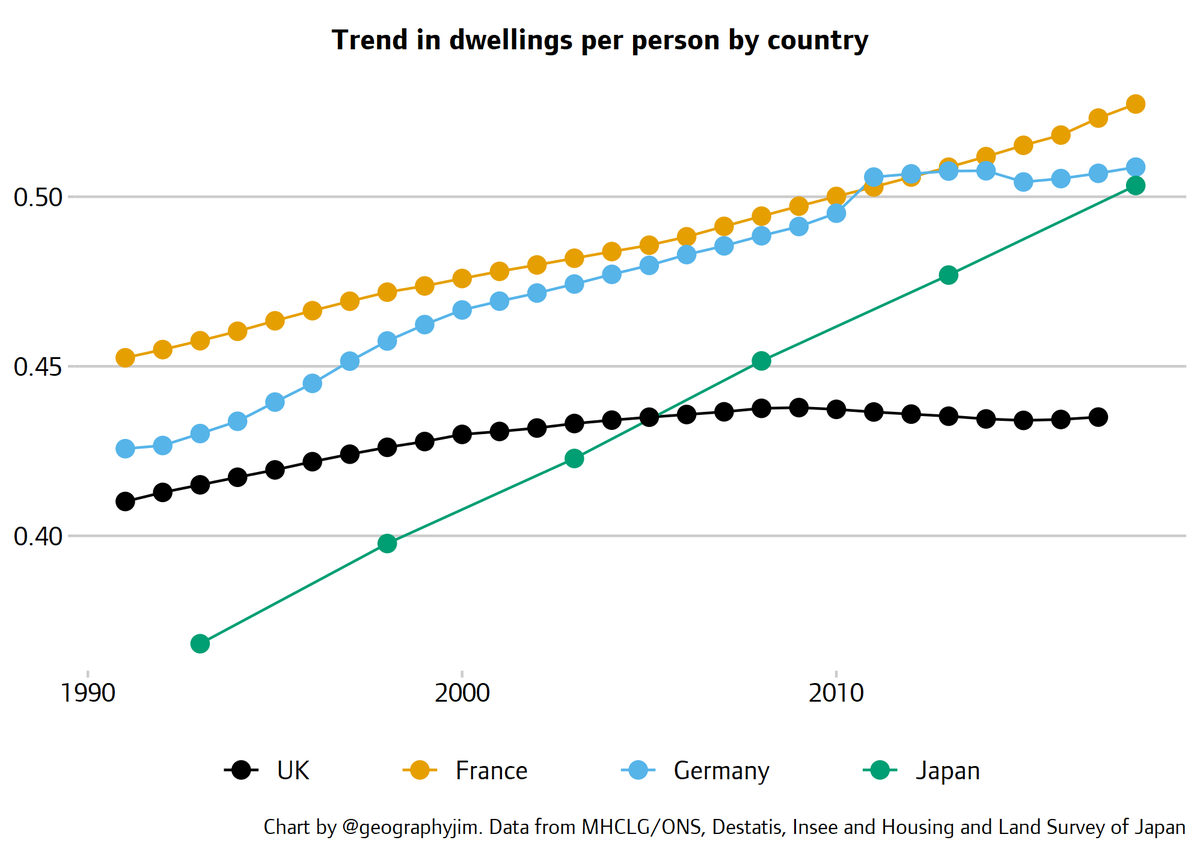

The next simply compares the trend in dwellings per capita in each country. There's a striking divergence between the UK, which has seen no significant change in about 15 years, and the other three countries (although Germany has slowed down recently).

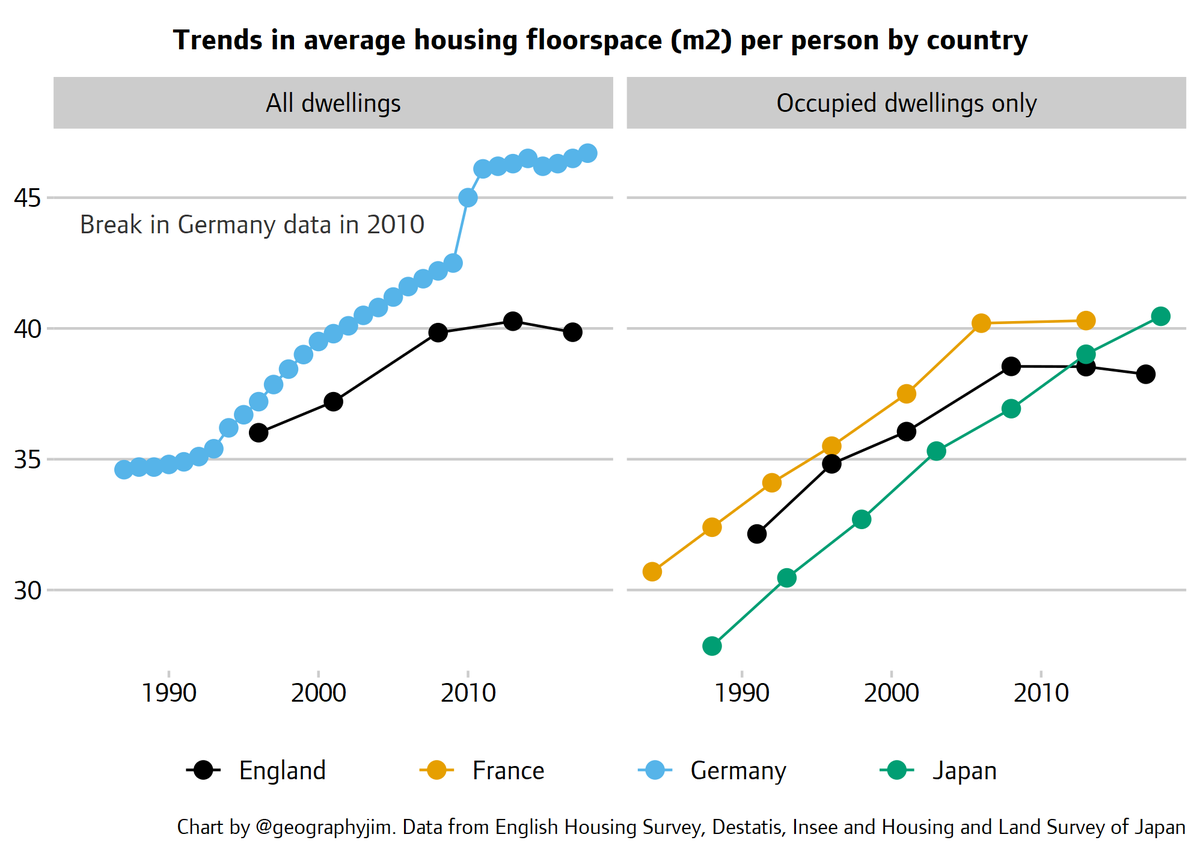

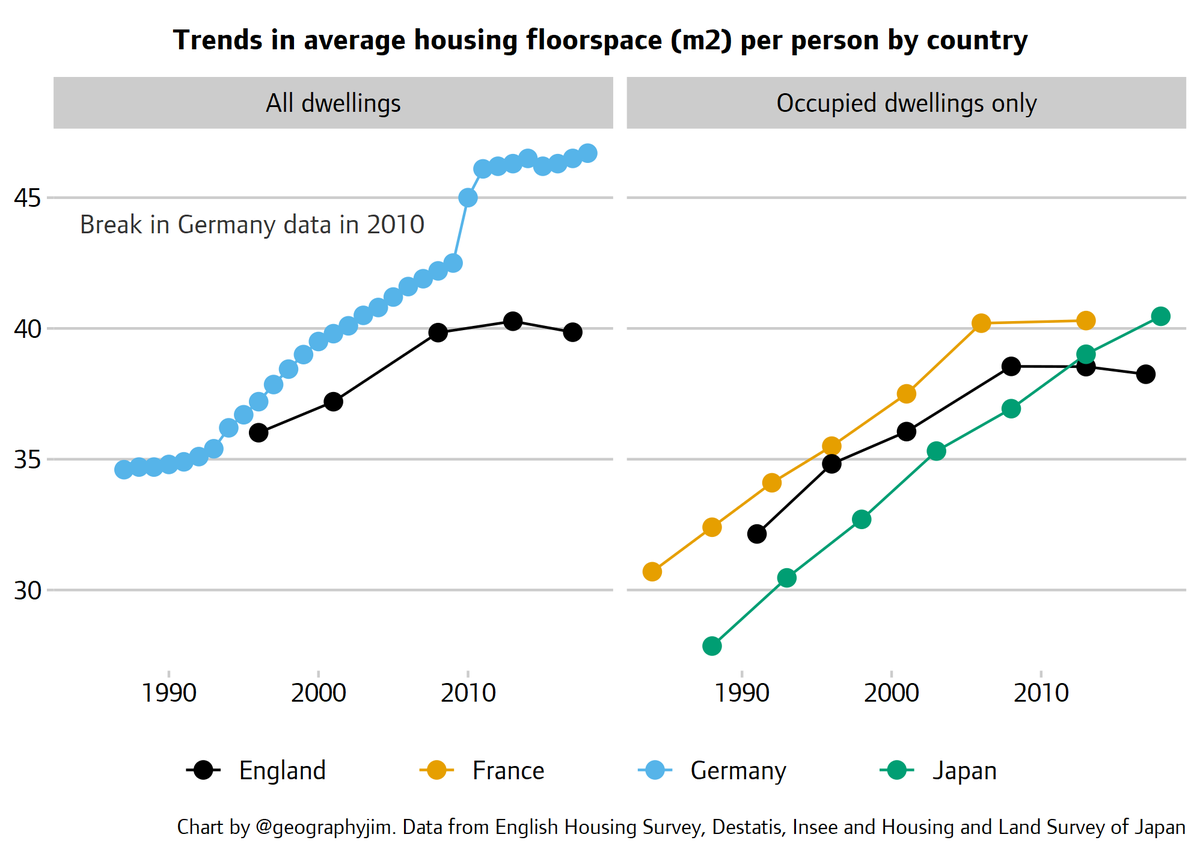

Now let's take dwelling size into account and compare average floorspace per person. Whether looking at all dwellings or just the occupied ones, England has lagged behind its peers on this measure (but note the recent slowdown in France too).

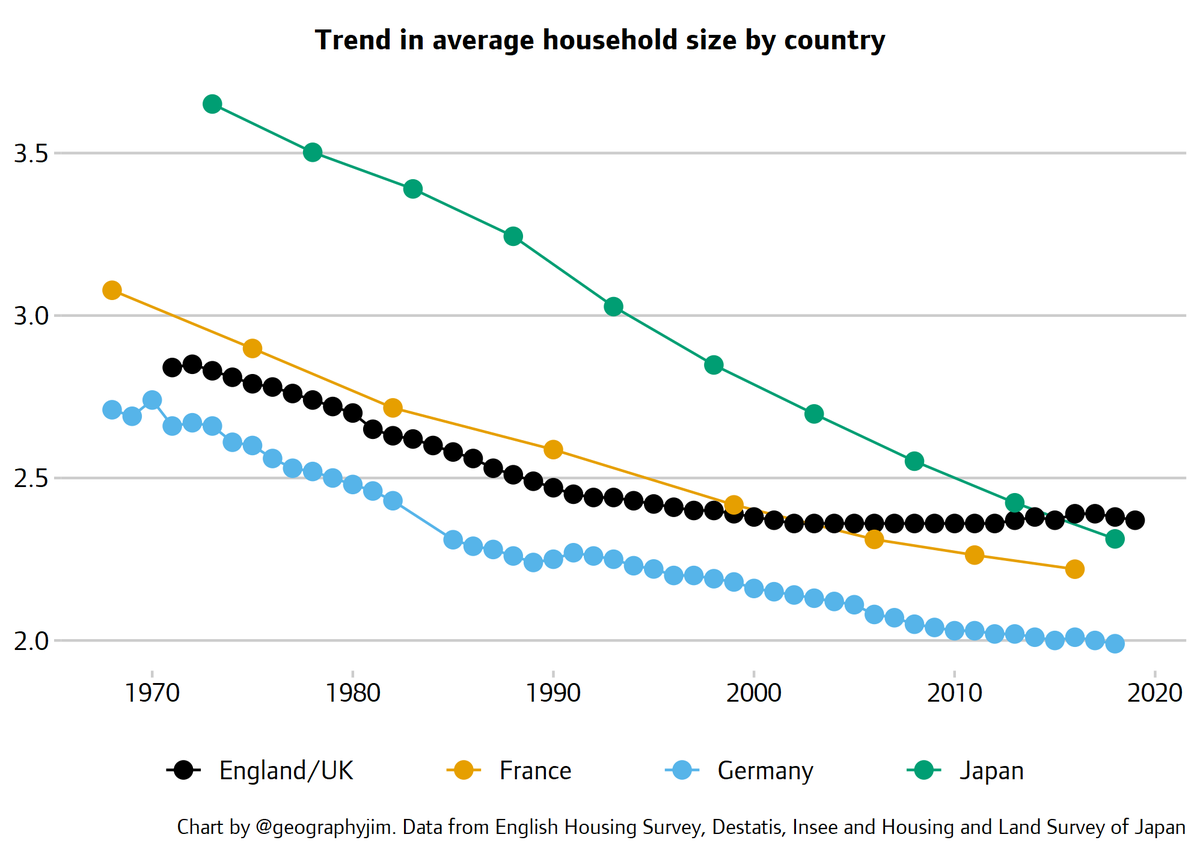

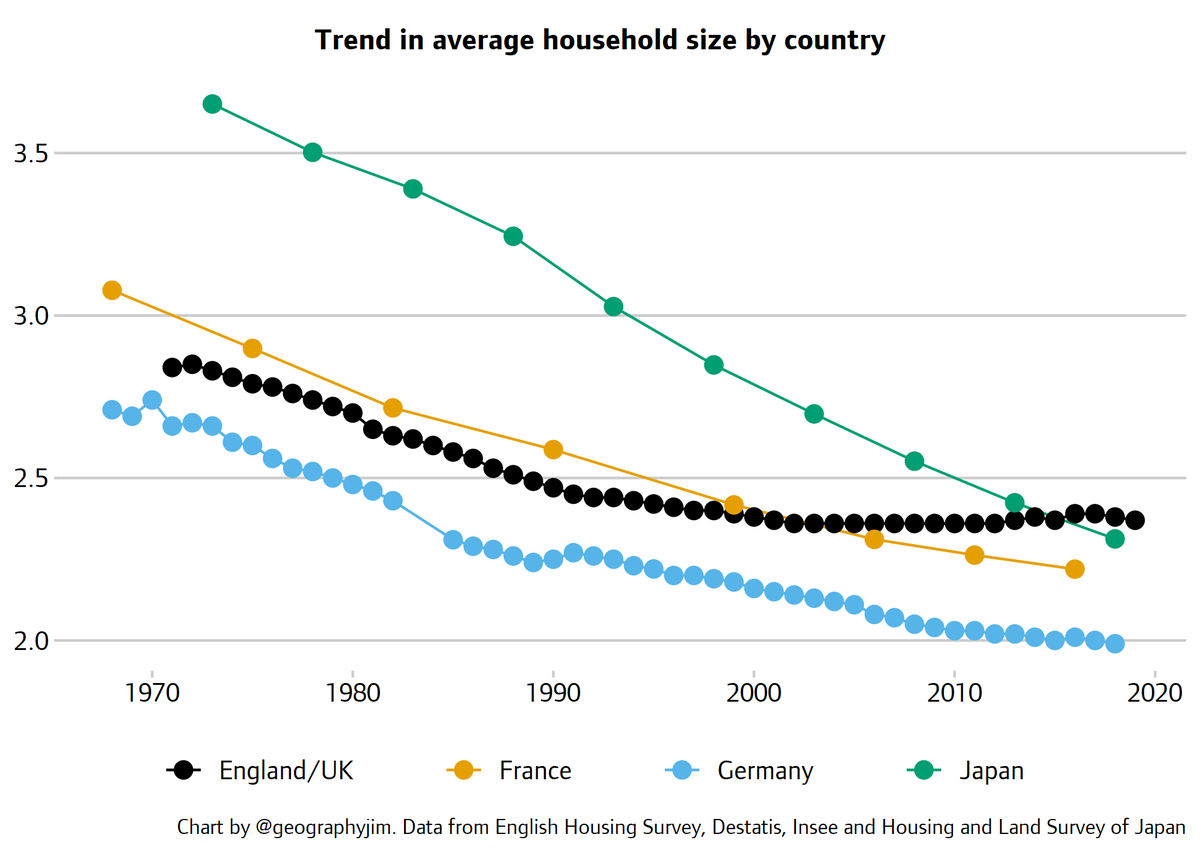

Finally, let's see how household formation has responded to these trends in availability. England/UK used to have the second-lowest average household size of this group, but 20 years of stagnation have left it with the highest.

These trends are all mutually consistent, and tell us that when compared either to other countries or to its own past, housing supply in UK/England has increasingly failed to keep up with real demand for living space from households.

It also highlights the weakness in the argument that any increase, no matter how slow or minor, in dwellings or floorspace per person means there's "no supply problem". In a properly functioning housing system there should be significant growth in these measures over time.

The underlying reason is that incomes tend to grow year on year, and housing demand is highly income-elastic. (Ultimately, the UK's prices have risen so much because growth in incomes outpaced growth in the housing stock. But that's another story).

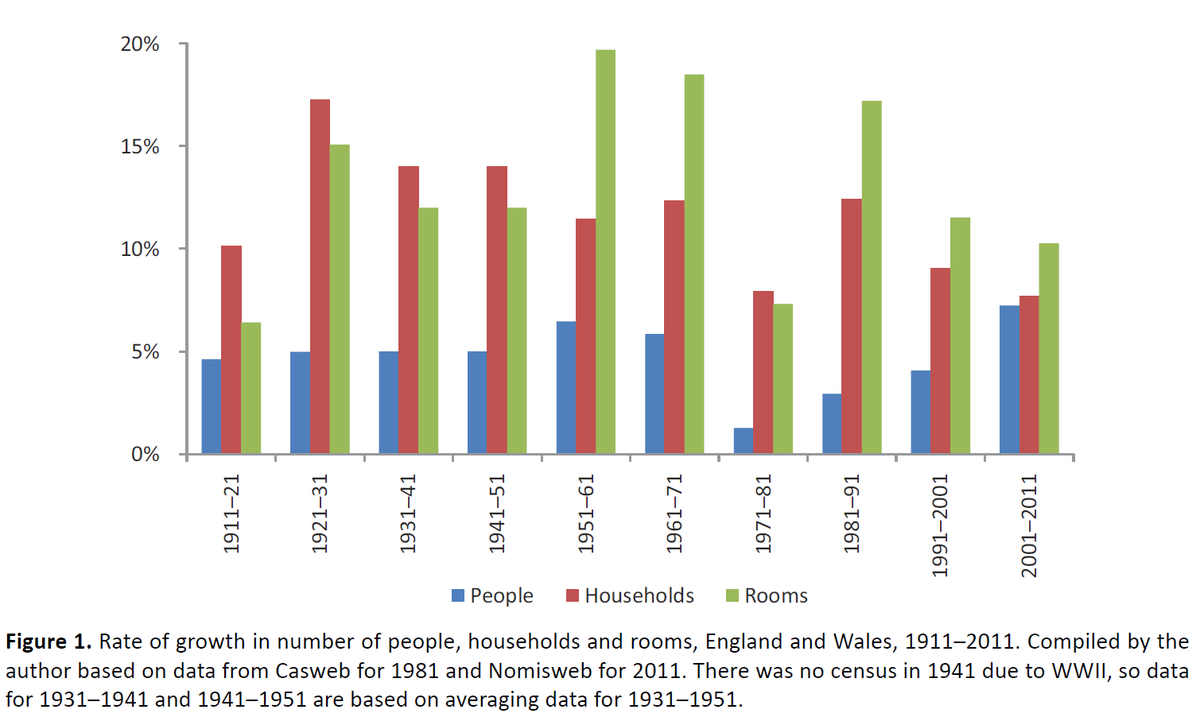

btw, for an even longer perspective on trends in this country, see this chart from a recent Rebecca Tunstall paper. The 2001-11 period apparently saw the slowest growth in rooms per person in England and Wales in almost a century. https://www.cogitatiopress.com/socialinclusion/article/view/2789

Read on Twitter

Read on Twitter