Do you support #Bitcoin  $BTC?

$BTC?

Then participate in this thought experiment!

Let's begin...

There are currently 6.25 #BTC being produced per block -- blocks are on average every 10 minutes, 1440 minutes in a day meaning 144 blocks.

being produced per block -- blocks are on average every 10 minutes, 1440 minutes in a day meaning 144 blocks.

6.25 * 144 = 900 BTC produced per day

$BTC?

$BTC? Then participate in this thought experiment!

Let's begin...

There are currently 6.25 #BTC

being produced per block -- blocks are on average every 10 minutes, 1440 minutes in a day meaning 144 blocks.

being produced per block -- blocks are on average every 10 minutes, 1440 minutes in a day meaning 144 blocks. 6.25 * 144 = 900 BTC produced per day

At a value of $19,000 per BTC, that is:

900 * $19,000 = $17,100,000

17.1 million dollars per day in revenue for miners.

900 * $19,000 = $17,100,000

17.1 million dollars per day in revenue for miners.

With an average of 10-20% profit margin -- and decreasing, as hash rate increases, that percentage decreases more. Eventually profit margins will be in the low single digits.

Profit margin of 10% for miners will be used for this calculation:

10% of $17,100,000, yields you $15,390,000.

Miners' daily $BTC mining expense is $15,390,000

10% of $17,100,000, yields you $15,390,000.

Miners' daily $BTC mining expense is $15,390,000

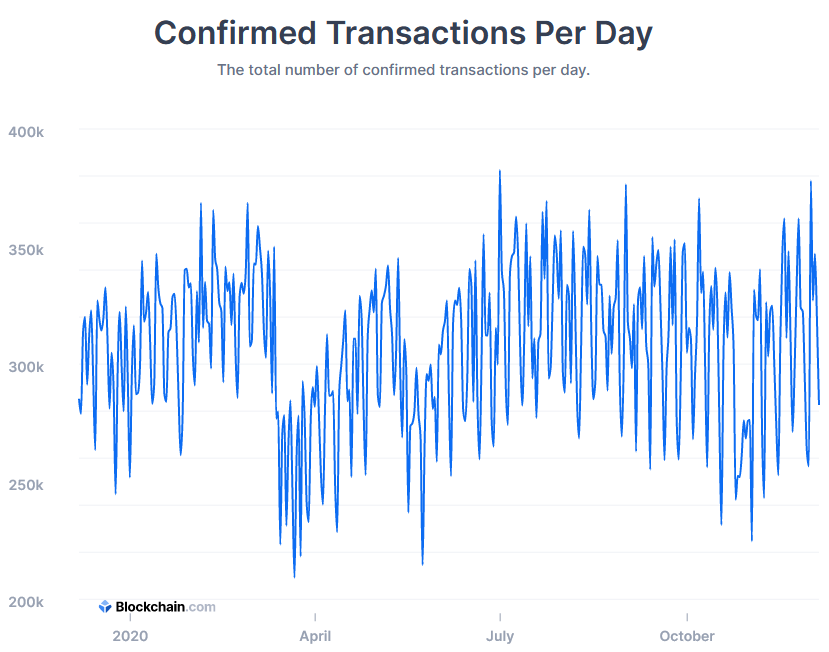

The average transactions per day on $BTC oscillate around the mean of 300,000.

300,000 transactions per day.

300,000 transactions per day.

Now, let's assume a hypothetical scenario, that the block reward subsidy, the 6.25 BTC per block, ends this second.

Where will the miners get their revenue from?

Where will the miners get their revenue from?

$15,390,000 revenue is required to break even.

There are 300,000 transactions per day.

$15,390,000/300,000 = $51.3

Users must pay an average of $51.3 per transaction, just for the miners to break even.

There are 300,000 transactions per day.

$15,390,000/300,000 = $51.3

Users must pay an average of $51.3 per transaction, just for the miners to break even.

If $BTC goes up, this number goes up.

Every 4 years, the block reward halves, meaning this number doubles.

The more hash rate there is, the less profitable it is for miners.

Every 4 years, the block reward halves, meaning this number doubles.

The more hash rate there is, the less profitable it is for miners.

Now do you see why the narrative is for BTC to "hodl?"

Because you literally cannot do anything else.

The bigger it gets, the more people that will lose everything.

The narrative is changed, instead of using BTC you are now a BTC supporter if you are just exposed to price.

Because you literally cannot do anything else.

The bigger it gets, the more people that will lose everything.

The narrative is changed, instead of using BTC you are now a BTC supporter if you are just exposed to price.

Paypal doesn't allow you to move your coins on-chain.

Robin Hood is just like holding a derivative.

500,000 unredeemable coins sit on Grayscale and people act like it's a good thing.

Robin Hood is just like holding a derivative.

500,000 unredeemable coins sit on Grayscale and people act like it's a good thing.

Every 4 years the $BTC chain becomes less and less usable to the average person and people act like that's a good thing.

It's not for regular people anymore, it's for "institutional investors."

And some institutional investors have instead been suckered by the scarcity meme.

It's not for regular people anymore, it's for "institutional investors."

And some institutional investors have instead been suckered by the scarcity meme.

#Bitcoin  was never about cryptography. Cryptography is just the way the chain is secured.

was never about cryptography. Cryptography is just the way the chain is secured.

Bitcoin is an economic system. The reason Bitcoin works and scales, is because of economic incentives.

Every single participant on the Bitcoin network benefits.

was never about cryptography. Cryptography is just the way the chain is secured.

was never about cryptography. Cryptography is just the way the chain is secured. Bitcoin is an economic system. The reason Bitcoin works and scales, is because of economic incentives.

Every single participant on the Bitcoin network benefits.

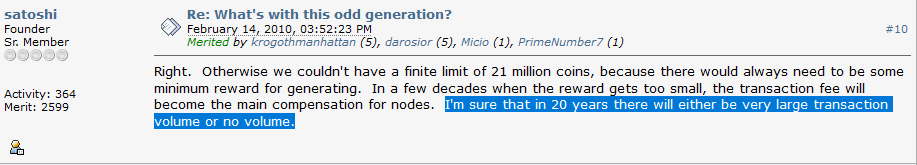

Honest miners get rewarded—not from fee subsidies, which will end soon—but from fee revenue. Revenue from the billions and billions of transactions that will be present on the network, at less-than-penny transaction fee each.

Multitude of industries will benefit from immutable records of data. No more data altering scandals, and for just a fraction of the cost.

Examples for on-chain storable data include: seismic tracking data, traffic tracking, contracts, etc.

For pennies, externalities are removed

Examples for on-chain storable data include: seismic tracking data, traffic tracking, contracts, etc.

For pennies, externalities are removed

Next time you think Bitcoin is a speculative asset, please read the whitepaper again - onchain link: https://media.bitcoinfiles.org/cb3bcf870035dc0e5719bbd271507df33905a707cdd241cca6acedfc852d0dbf

Please find where it talks about: speculation, store of value, fixed supply/inflation, scarcity. (nowhere)

Please find where it talks about: speculation, store of value, fixed supply/inflation, scarcity. (nowhere)

Then, understand that it talks about: instant payments, micropayments, immutable ledger to store information on.

If you take one thing out of this, let it be this point:

Bitcoin $BTC economics were altered after Satoshi's departure in 2011. They were altered (probably) in good faith but the developers did not understand the long term consequences on the protocol.

Bitcoin $BTC economics were altered after Satoshi's departure in 2011. They were altered (probably) in good faith but the developers did not understand the long term consequences on the protocol.

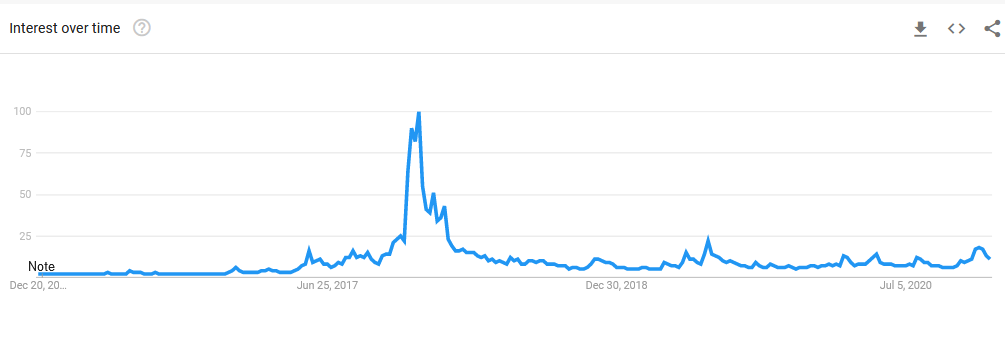

Due to an increase in popularity, the price greatly appreciated, and people tried to assign narratives to it. Those were greatly propagated on websites such as BitcoinTalk and Reddit, and dissenters banned.

If the price was rising, something is clearly working right?! (wrong)

If the price was rising, something is clearly working right?! (wrong)

Please use your own critical thinking and come to your own conclusion.

If Bitcoin $BTC didn't implement anti-scaling measures, none of these other coins would exist, because the original Bitcoin can do almost everything they suggest...

If Bitcoin $BTC didn't implement anti-scaling measures, none of these other coins would exist, because the original Bitcoin can do almost everything they suggest...

There is only one blockchain that is realizing the original Bitcoin protocol, and it's one that all the people that have everything to lose from it succeeding are trying to suppress.

Follow-up:

The vast majority of people that got into Bitcoin do not know its history.

They saw a price chart, and some prediction of millions, and thought “OK, that’s good risk-to-reward.”

The vast majority of people that got into Bitcoin do not know its history.

They saw a price chart, and some prediction of millions, and thought “OK, that’s good risk-to-reward.”

Now here’s the problem: The economics of that system simply do not work. Bitcoin was built with very specific economics in mind.

By changing the economics, Bitcoin Core (BTC) has changed the Bitcoin from the whitepaper. This happened in 2016 and before, prior to discovery boom

By changing the economics, Bitcoin Core (BTC) has changed the Bitcoin from the whitepaper. This happened in 2016 and before, prior to discovery boom

Can you imagine if you have a Gold traded as an asset, the atomic number 79 (what defines Gold, its number of protons), then the exchanges start selling Mercury, atomic number 80, as the Gold?

“It’s still very similar, only one proton difference” Then, Gold would be forced to change its ticker and chart history to something else. That is what happened with Bitcoin.

An all-out propaganda war emerged, and people who are not informed obviously go with the asset that has the price going up (collusion by exchanges).

Because the price kept going up from both new discovery and unregulated, fraudulent manipulation, this allowed exchanges to ramp up the marketing and suck new people into the system.

And, this is how the technology aspect of Bitcoin was "lost." Because of greed.

And, this is how the technology aspect of Bitcoin was "lost." Because of greed.

Because of greed "alternative" coins popped up that do things "Bitcoin can't do."

Bitcoin can do all those things, it was just intentionally crippled. Those same people who crippled it, are now building for-profit solutions that "fix Bitcoin."

(You heard that right, not joking)

Bitcoin can do all those things, it was just intentionally crippled. Those same people who crippled it, are now building for-profit solutions that "fix Bitcoin."

(You heard that right, not joking)

Read on Twitter

Read on Twitter