1) Let's talk deferred revenues

Using Crowdstrike as an example

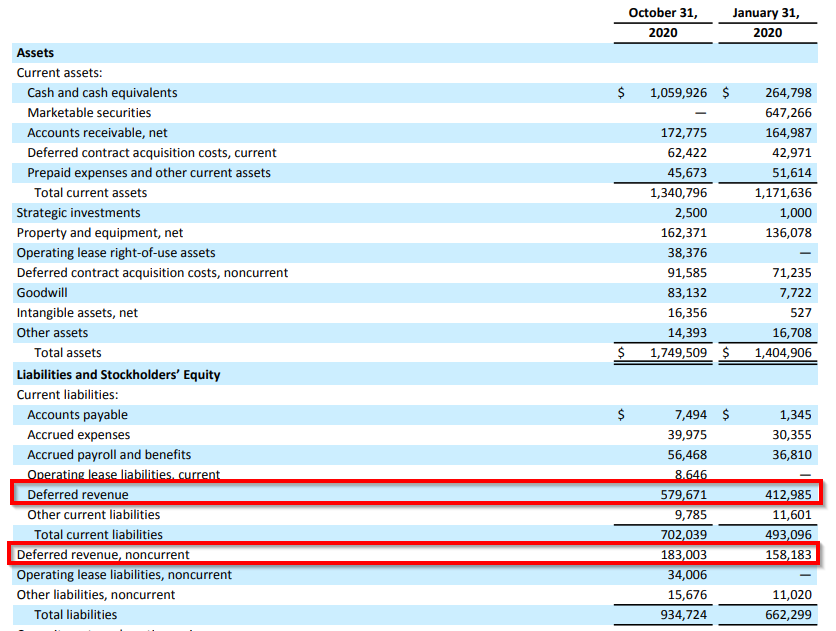

You’ll notice one of the largest current obligations in Crowdstrike’s book is the deferred revenue line-item which stands at $579.67 million as of Q3, or ~82.5% of total current obligations.

Using Crowdstrike as an example

You’ll notice one of the largest current obligations in Crowdstrike’s book is the deferred revenue line-item which stands at $579.67 million as of Q3, or ~82.5% of total current obligations.

2) Well Crowdstrike typically invoice the subscription charges to their subscription customers annually in advance. Thus, a pretty substantial source of their cash is for these prepayments, which are included on the balance sheet as deferred revenues.

3) So, in accounting terms, if the customer pays for the service prior to actually receiving the service, then they have not satisfied the criteria for revenue recognition, which means Crowdstrike can’t report these advance payments as sales. Right?

4) So these payments will be provided to Crowdstrike, and they will receive the cash, but the sums can’t be reported as revenue, instead being placed on the deferred revenue line item as a liability.

5) As of October 31, 2020, Crowdstrike had deferred revenue of $762.7 million, of which $579.7 million was recorded as a current liability and is expected to be recorded as revenue in the next 12 months, provided all other revenue recognition criteria have been met.

6) The remaining $183 million is non-current deferred revenue, in that they don’t expect it to be recognized as revenue within 12 months.

7) Once Crowdstrike deliver the service that the customer has paid for, then they will be able to recognize the deferred revenues as actual revenues. If you are not familiar with this concept, it is quite normal, and does not pose any significant significant issues in my opinion.

8) The onus is on Crowdstrike to deliver the product, the customer has already paid the cash.

Fin.

Fin.

Read on Twitter

Read on Twitter