I’m 2006, Warren Buffett challenged the Hedge Fund industry.

He publicly stated that...

Over a period of ten years, an S&P 500 index fund would outperform a collection of hedge funds.

He also stated he would bet...

$1 million dollars

He publicly stated that...

Over a period of ten years, an S&P 500 index fund would outperform a collection of hedge funds.

He also stated he would bet...

$1 million dollars

Ted Seidis of Protege Partners accepted the bet.

Ted created a diversified basket of hedge funds...

With five different strategies (quant-trading, long-short, macro, etc.)

Ted was confident they would easily beat the S&P 500 index.

Ted created a diversified basket of hedge funds...

With five different strategies (quant-trading, long-short, macro, etc.)

Ted was confident they would easily beat the S&P 500 index.

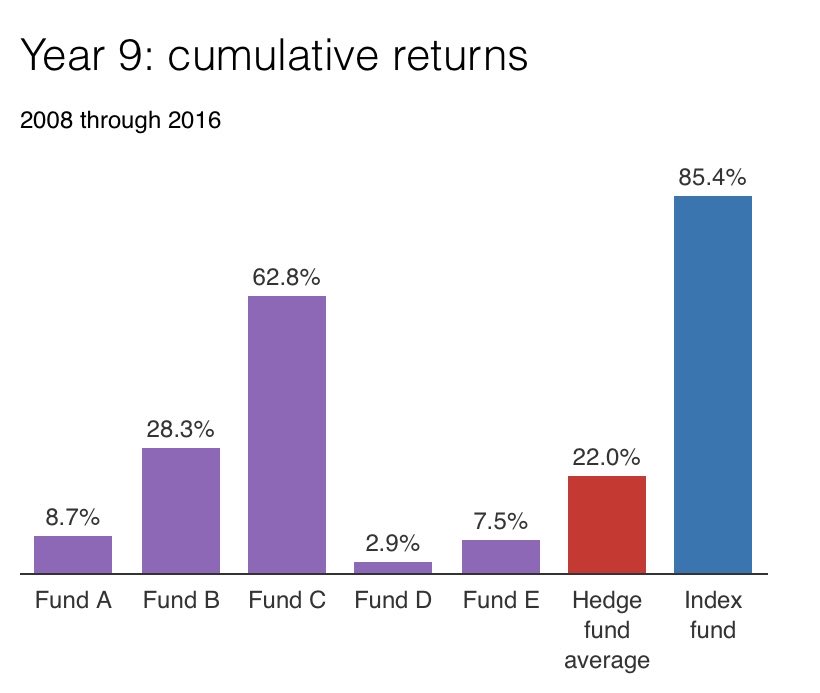

Mind-blowing, right?

The top hedge funds in the world...

With the brightest minds in finance

Along with hundreds of analysts and traders, couldn’t outperform the S&P 500 index.

Do you still think that you can do it?

The top hedge funds in the world...

With the brightest minds in finance

Along with hundreds of analysts and traders, couldn’t outperform the S&P 500 index.

Do you still think that you can do it?

Here are three key takeaways from this $1M bet:

It is extremely tough to outperform the market

It is extremely tough to outperform the market

High trading activity is costly & diminishes your REAL returns

High trading activity is costly & diminishes your REAL returns

Passive investing is the best option for the majority of investors

Passive investing is the best option for the majority of investors

Hope that helps!

It is extremely tough to outperform the market

It is extremely tough to outperform the market High trading activity is costly & diminishes your REAL returns

High trading activity is costly & diminishes your REAL returns Passive investing is the best option for the majority of investors

Passive investing is the best option for the majority of investorsHope that helps!

Read on Twitter

Read on Twitter