This piece harshes on target-date funds, which is kind of unfortunate. TDFs aren't *perfect* products, but why should perfect be the enemy of good when good is an excellent outcome for defined-contribution investors? https://www.wsj.com/articles/the-high-cost-of-target-date-funds-11607101200?reflink=desktopwebshare_twitter

TDFs are all-in-one solutions that automate important tasks that experience and research has shown a lot of investors can't handle if left on their own. Namely, adopting a suitable asset allocation; diversifying widely; rebalancing; adjusting the asset mix; etc.

Cutting to the chase, the article references a paper that slags TDFs because they're reproducible at lower cost and those cheaper replicas would have outperformed. It's essentially a lowest-cost vs. not-lowest-cost argument. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3707755

The paper makes some questionable assertions like that TDFs are costly b/c they levy fees at two levels--the FoF and the underlying funds. That used to be true but is far less common now, especially among the big suites that dominate the market (VG, Fidelity, TRP, etc.).

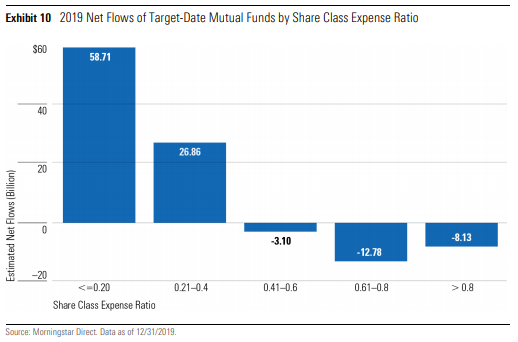

Moreover, money is flowing disproportionately to the cheapest series. Maybe not as ultra-low-cost as these academics could mock-up on a spreadsheet, but it's a far cry from the picture they paint in the paper of TDFs larded up with fees. Low-cost is dominating in the TDF market.

Do all these series beat their blended benchmarks? No. Could some have done better if invested strictly in low-cost ETFs? Yes. Does that make it logical to conclude target-date funds aren't succeeding and investors would be better off building do-it-yourself TDFs using ETFs? No.

Read on Twitter

Read on Twitter