Dear @shazbkhanzdaGEO giving fact is not character assassination,playing victim card on a hypothesis would get woke club attention but that’s about it.

Your calculations on losses are purely hypothetical claiming,had The Govt imported LNG in time,there would be no loss of 122 Bn https://twitter.com/shazbkhanzdageo/status/1334945059515592704

Your calculations on losses are purely hypothetical claiming,had The Govt imported LNG in time,there would be no loss of 122 Bn https://twitter.com/shazbkhanzdageo/status/1334945059515592704

But you fail to understand Our LNG terminals (one runs full capacity & other close to full) are operational.

The government has been striving to boost gas supply by incentivising indigenous production with other efforts to import gas by pipeline and as LNG.

The government has been striving to boost gas supply by incentivising indigenous production with other efforts to import gas by pipeline and as LNG.

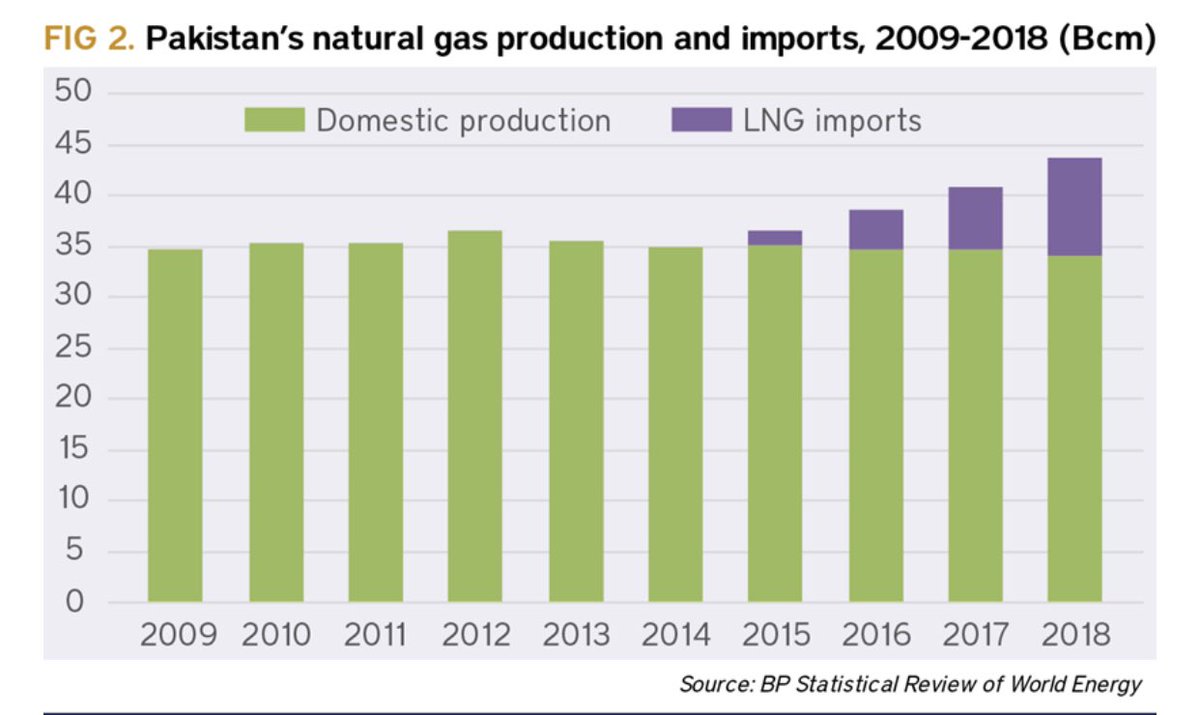

However, OGRA predicts an inexorable decline in indigenous production, from 3.3bn ft³/d in FY2018 to 1.7bn ft³/d by FY2028.

LNG projections at arnd 1.2bn ft³/d for FY2020, rising to 1.8bn ft³/d in FY2021 and beyond cos ministry counts LNG projects that have received licences.

LNG projections at arnd 1.2bn ft³/d for FY2020, rising to 1.8bn ft³/d in FY2021 and beyond cos ministry counts LNG projects that have received licences.

All the growth in Pakistan’s gas consumption since 2015 has come from LNG imports, with domestic gas production remaining stubbornly flat at around 35bn m³/yr (3.4bn ft³/d)

without imports by LNG and pipeline the demand-supply gap would rise to 6.7bn ft³/d by FY2028 resulting turning to increasingly to coal and oil so it all depends on how much Pak can import with one terminal working full capacity & 2nd one under-utilised

Cos of LNG price and the availability of access to downstream pipeline infrastructure. Pakistan is a price-sensitive LNG market and this sensitivity will increase as import volumes grow beyond those needed to push fuel oil out of electricity generation.

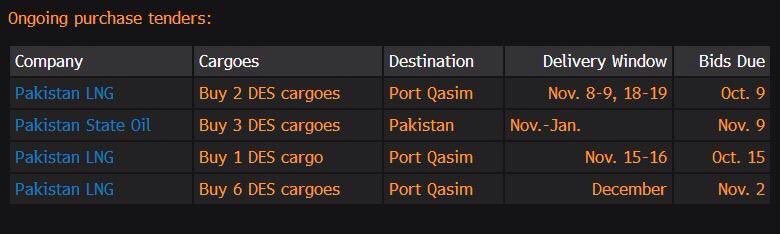

You had a segment 16th Nov Prog saying Pak went ahead with expensive LNG deal when it could’ve been cheaper as rates offered to Pakistan for a record 6 LNG spot cargoes for December are well above the rates in the long term LNG deals.

As high as 16. 97% but you fail to gather.

As high as 16. 97% but you fail to gather.

Those oil link prices are lower or equal to existing LNG spot prices (which had been trading around high-$6 and low-$7/mmbtu)

The reason why % are so high is because oil prices have been slumping to very low levels. Brent was at a 5-month low then.

The reason why % are so high is because oil prices have been slumping to very low levels. Brent was at a 5-month low then.

As The long term deals take into account the ebb and flow of Brent and an average long-term price.

Pls read this piece published by UR own Media House claiming Pak started imported as demand rose & also that country saved $5 Bn by importing LNG over time https://www.google.com.pk/amp/s/www.thenews.com.pk/amp/683123-pakistan-resumes-lng-spot-buying-as-demand-surges

Pls read this piece published by UR own Media House claiming Pak started imported as demand rose & also that country saved $5 Bn by importing LNG over time https://www.google.com.pk/amp/s/www.thenews.com.pk/amp/683123-pakistan-resumes-lng-spot-buying-as-demand-surges

Pls try understanding @shazbkhanzdaGEO LNG imports are directly related to the level of industrial activity, the amount of gas consumed in the domestic & commercial sectors, as well as the amount of agricultural production and then add Covid19 impact while implying delayed import

Pls also understand the growth in LNG import would depend on infrastructure not just utilising the floating storage & regasification units expanding it means financing & off take guarantees, it’s more of a structural issue than the administrative on top of coping Gas shortage.

As for winters which you mentioned towards the end of segment Pakistan is already into the spot LNG market.

PSO and Pakistan LNG are currently seeking 12 cargoes for delivery between Nov-Jan (the most ever for this period) but it all depends on demand & storage capacity.

PSO and Pakistan LNG are currently seeking 12 cargoes for delivery between Nov-Jan (the most ever for this period) but it all depends on demand & storage capacity.

It would be nice to watch you talk infrastructure problems Pak faces given our Gas Shortage & supply provided by the provinces where demand is surged regardless of ownership of Gas Reserves,instead you call Imports a scandal which is purely intellectual dishonesty.

Read on Twitter

Read on Twitter