1/14

Having a strong interest in crypto derivatives, I've been following this project closely and have found its design very fascinating

However after doing some research, I believe there are several issues with its tokenomics and insurance mining program https://twitter.com/DDX_Official/status/1334899766757560321

Having a strong interest in crypto derivatives, I've been following this project closely and have found its design very fascinating

However after doing some research, I believe there are several issues with its tokenomics and insurance mining program https://twitter.com/DDX_Official/status/1334899766757560321

2/14

Before getting into the details, how can a project have DEX in their name and geofence users?

I understand the need for regulatory compliance but this is directly at odds with DeFi

Before getting into the details, how can a project have DEX in their name and geofence users?

I understand the need for regulatory compliance but this is directly at odds with DeFi

3/14

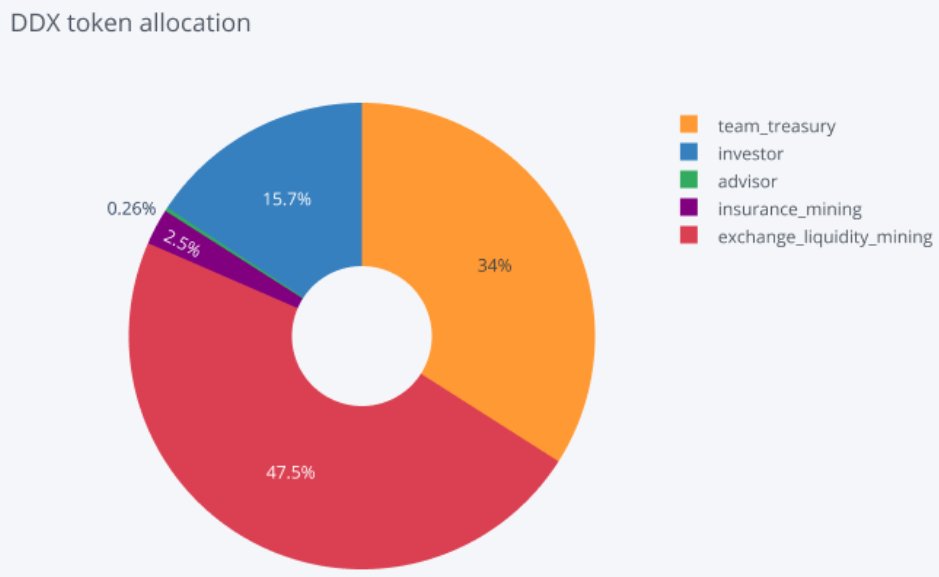

Their approach to building an insurance fund via insurance mining is an interesting concept, but to me the tokenomics don’t make sense

While 50% of DDX is vested with their team and investors, only 2.5%(!) will be rewarded to insurance stakers (orange + red vs. purple)

Their approach to building an insurance fund via insurance mining is an interesting concept, but to me the tokenomics don’t make sense

While 50% of DDX is vested with their team and investors, only 2.5%(!) will be rewarded to insurance stakers (orange + red vs. purple)

4/14

Their website states investors have 1 year vesting and team is subject to industry standard (I'm assuming 4 years from genesis emission, as a conservative underestimate)

So these emissions equate to 8.3%*15.7M + 2.07%*34M = 2M DDX going to investors & team *every month*

Their website states investors have 1 year vesting and team is subject to industry standard (I'm assuming 4 years from genesis emission, as a conservative underestimate)

So these emissions equate to 8.3%*15.7M + 2.07%*34M = 2M DDX going to investors & team *every month*

5/14

Hence, each month the team/investors get 80% of the tokens *all* insurance stakers get in year 1

This issuance begins at the genesis token emission, and is not subject to a lockup(?), which will create downward pressure on DDX and reduce the incentive for insurance mining

Hence, each month the team/investors get 80% of the tokens *all* insurance stakers get in year 1

This issuance begins at the genesis token emission, and is not subject to a lockup(?), which will create downward pressure on DDX and reduce the incentive for insurance mining

6/14

The insurance fund itself is designed with two tranches, which I really like

The first layer is capitalized from liquidations and fees via users of DerivaDEX (the latter is a nice addition, since exchanges typically only rely on liqs for building their fund)

The insurance fund itself is designed with two tranches, which I really like

The first layer is capitalized from liquidations and fees via users of DerivaDEX (the latter is a nice addition, since exchanges typically only rely on liqs for building their fund)

7/14

As with CEXs, if a position is liquidated beyond its bankruptcy price, the difference is covered by the insurance fund

This format protects insurance stakers, since their capital is haircut only once the first tranche is depleted

As with CEXs, if a position is liquidated beyond its bankruptcy price, the difference is covered by the insurance fund

This format protects insurance stakers, since their capital is haircut only once the first tranche is depleted

8/14

However, this design creates a chicken and egg problem - the exchange needs volume to generate fees/liquidations to capitalize its first tranche and protect the stakers

But that won’t happen without an insurance fund that can support sufficient volume and liquidity

However, this design creates a chicken and egg problem - the exchange needs volume to generate fees/liquidations to capitalize its first tranche and protect the stakers

But that won’t happen without an insurance fund that can support sufficient volume and liquidity

9/14

In the event of high volatility and the risk of undercollaterization for its users' positions, the penalty for insurance stakers withdrawing is likely way too low (only 0.5%)

As long as the expected losses are greater than 0.5%, it make sense to pull your liquidity

In the event of high volatility and the risk of undercollaterization for its users' positions, the penalty for insurance stakers withdrawing is likely way too low (only 0.5%)

As long as the expected losses are greater than 0.5%, it make sense to pull your liquidity

10/14

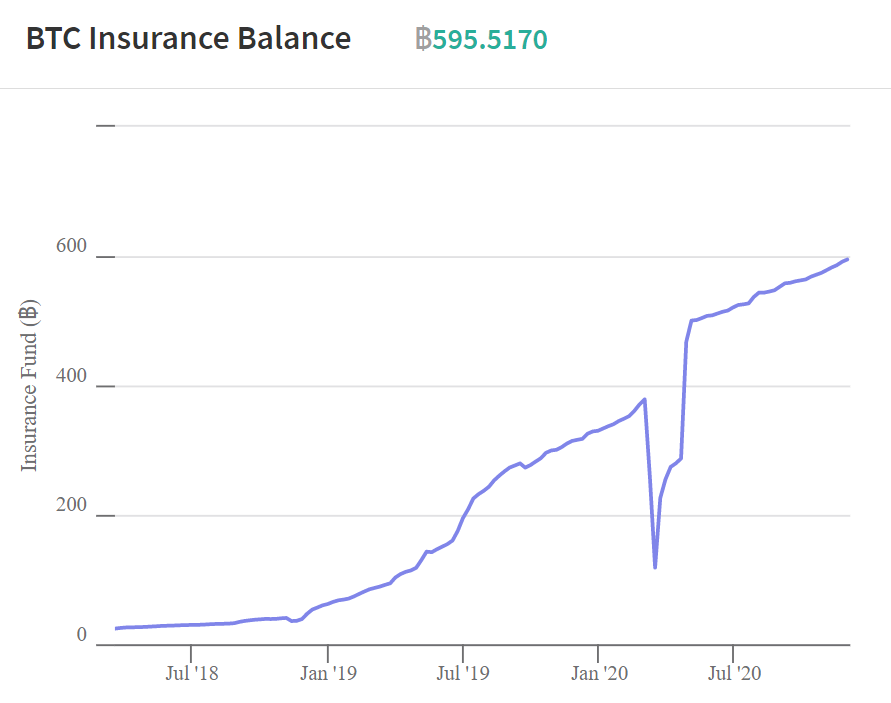

The risk of undercollateralization and an insurance fund bearing losses is a very real concern

During the March 12th crash, Deribit, which is much more liquid and less likely to experience undercollateralization, had to recapitalize its own insurance fund

The risk of undercollateralization and an insurance fund bearing losses is a very real concern

During the March 12th crash, Deribit, which is much more liquid and less likely to experience undercollateralization, had to recapitalize its own insurance fund

11/14

To offset withdrawing capital, stakers are incentivized to stay with recapitalization via future liquidations and fees

However, this assumes the platform will retain activity after experiencing undercollateralization (which is not guaranteed, esp if its a severe drawdown)

To offset withdrawing capital, stakers are incentivized to stay with recapitalization via future liquidations and fees

However, this assumes the platform will retain activity after experiencing undercollateralization (which is not guaranteed, esp if its a severe drawdown)

12/14

Moreover, the DDX rewarded as an incentive is likely to deteriorate in value if such an event occurs, which also reduces the incentive to remain staking

This is a form of wrong-way risk, since the incentive to remain is adversely correlated with the solvency of DerivaDEX

Moreover, the DDX rewarded as an incentive is likely to deteriorate in value if such an event occurs, which also reduces the incentive to remain staking

This is a form of wrong-way risk, since the incentive to remain is adversely correlated with the solvency of DerivaDEX

13/14

To summarize, I think this is project has significant promise, as it has an experienced team, top-tier investors backing it and went through the DeFi Alliance accelerator

Undeniably, its push for governance and transparency over an insurance fund is a big step forward

To summarize, I think this is project has significant promise, as it has an experienced team, top-tier investors backing it and went through the DeFi Alliance accelerator

Undeniably, its push for governance and transparency over an insurance fund is a big step forward

14/14

I believe the project can be improved via governance changes by:

- Increasing the withdrawal penalty significantly

- Addressing its skewed tokenomics

- Adding a token lockup for the team and investors

- Capping the available leverage, at least until first tranche grows

I believe the project can be improved via governance changes by:

- Increasing the withdrawal penalty significantly

- Addressing its skewed tokenomics

- Adding a token lockup for the team and investors

- Capping the available leverage, at least until first tranche grows

Read on Twitter

Read on Twitter