seems to be a number of questions related to how commercial bank-backed "stablecoins" actually work.

this thread is a short briefing that illustrates how cryptocurrencies (DeFi in particular) is relatively reliant on the US banking system for liquidity and pricing (U-of-A).

this thread is a short briefing that illustrates how cryptocurrencies (DeFi in particular) is relatively reliant on the US banking system for liquidity and pricing (U-of-A).

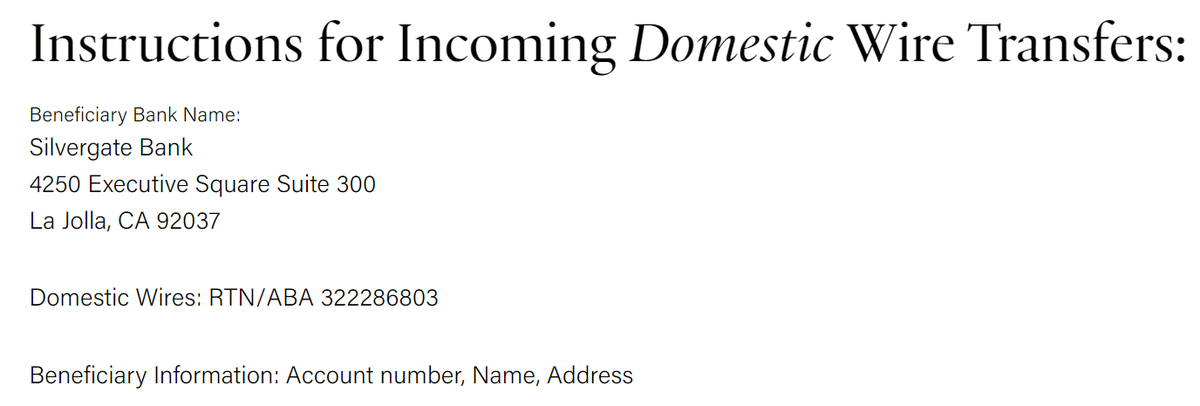

USDC is a "stablecoin" issued through Centre and backed by Circle, Coinbase, and others. while the ERC20 token can be moved around the Ethereum network, the backend on-and-off ramps are fully powered by US commercial banks such as Silvergate (see wiring instructions below):

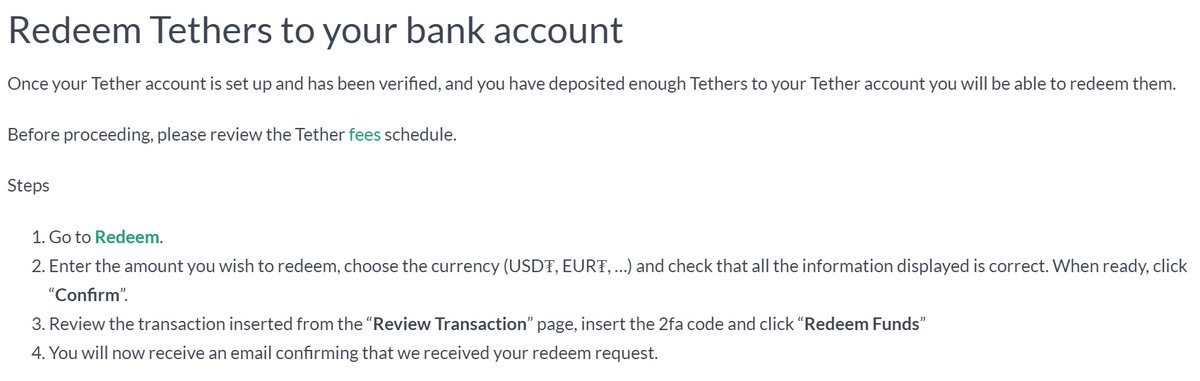

USDT is issued by Tether Inc. Customers that want to use USDT sign up and link their bank account, then using the traditional financial system, wire cash to Tether's partner banks. Tether and its parent company (iFinex) have been debanked multiple times: https://www.ofnumbers.com/2017/05/01/how-newer-regtech-could-be-used-to-help-audit-cryptocurrency-organizations/

Tether are also under investigation from several regulators and law enforcement for activities, including lying about their collateralization levels: https://www.coindesk.com/tether-lawyer-confirms-stablecoin-74-percent-backed-by-cash-and-equivalents

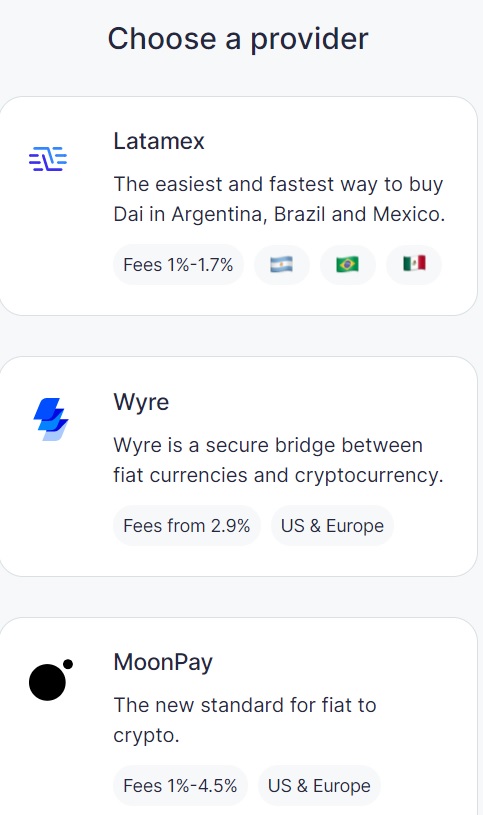

when it was initially launched, DAI was collateralized only with ETH. about 18 months ago, the transition to "multi-collateral" expanded to include other types of coins, such as commercial bank-backed "stablecoins." you can also buy DAI via other 3rd party partners (below):

depending on the day of the week, the proportion of US commercial bank-backed "stablecoins" can comprise more than 50% of the collateral backing DAI (which is why it was identified by authors of the STABLE Act): https://twitter.com/jp_koning/status/1308926346815512577

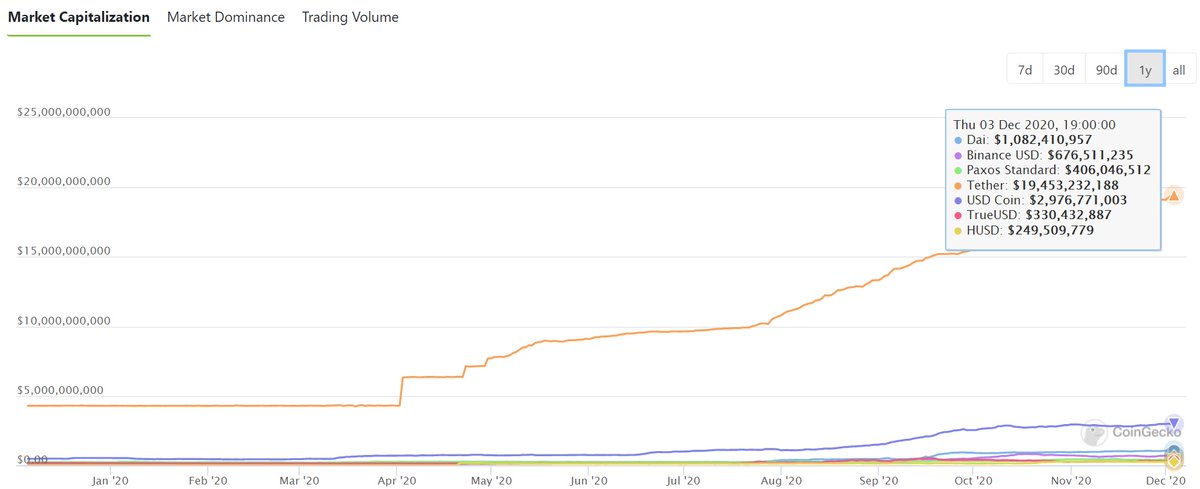

@coingecko shows (below) the growth (measured by 'marketcap') of the most popular collateral-backed "stablecoins" this past year. this is increase in USD deposits sitting in banks on behalf of "stablecoin" issuers.

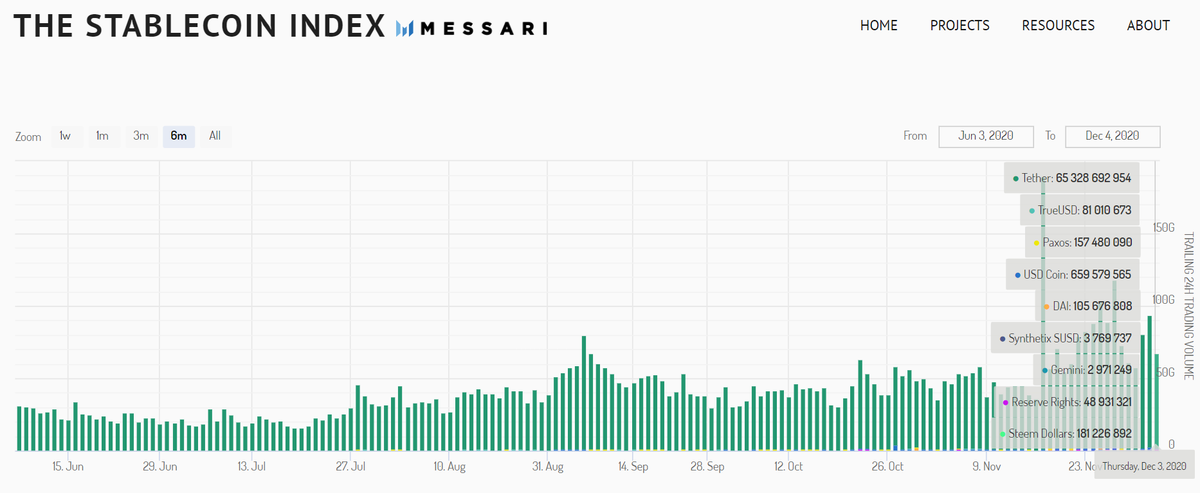

@MessariCrypto shows (below) the daily trading volume of roughly the same collateral-backed "stablecoins" over the past 6 months:

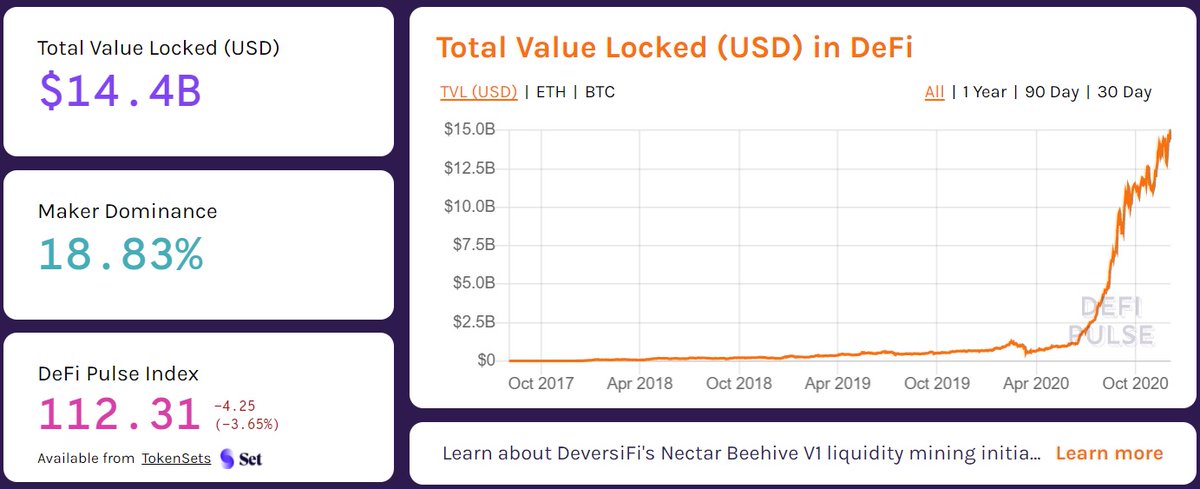

@defipulse shows (below) the total value of tokens that are locked up in DeFi-related projects (over the past ~3 years):

there are other bits and bobs that we can dive into - such as algorithmically "stabilized" coins Nubits or BitUSD - but that's a separate, mostly irrelevant category of faux "stablecoins."

what would happen if issuers of collateral-backed "stablecoins" had to get a bank charter?

what would happen if issuers of collateral-backed "stablecoins" had to get a bank charter?

you should ask @rohangrey or @RaulACarrillo who were involved in the drafting of the STABLE Act (i wasn't).

while there may be rigorous surveillance at the on-and-off ramps of USDC or USDT today, the same cannot be said for on-chain activity where the "Travel Rule" is ignored.

while there may be rigorous surveillance at the on-and-off ramps of USDC or USDT today, the same cannot be said for on-chain activity where the "Travel Rule" is ignored.

either way, it is clear that from trading activity and TVL, that the DeFi ecosystem (and all coin worlds really), are reliant on US banking access.

is this DeFi-in-name-only (DeFi-ino)? w/o the on-and-off ramps, perhaps the middle (TVL) activity would be a lot less than it is.

is this DeFi-in-name-only (DeFi-ino)? w/o the on-and-off ramps, perhaps the middle (TVL) activity would be a lot less than it is.

if the (end) goal of the DeFi world -- and broader anarchic cryptocurrency universe - is to be self-sovereign and self-reliant and not reliant on US banks, the exact opposite seems to be occurring.

note: here's what led to this particular thread above https://twitter.com/mdudas/status/1334908543393271818

note: here's what led to this particular thread above https://twitter.com/mdudas/status/1334908543393271818

Read on Twitter

Read on Twitter