The world is on the brink of what may turn out to be its most important energy experiment.

Green hydrogen could be our salvation from devastating climate change, or a very expensive mistake https://trib.al/TdhedOe

Green hydrogen could be our salvation from devastating climate change, or a very expensive mistake https://trib.al/TdhedOe

A viable green-hydrogen industry could balance renewable power grids and power:

Steel production

Steel production

Trains

Trains

Planes

Planes

Ships

Ships

Fuel trucks

Fuel trucks

In the process it would eliminate about 25% of the world’s CO2 emissions http://trib.al/TdhedOe

Steel production

Steel production Trains

Trains Planes

Planes Ships

Ships Fuel trucks

Fuel trucksIn the process it would eliminate about 25% of the world’s CO2 emissions http://trib.al/TdhedOe

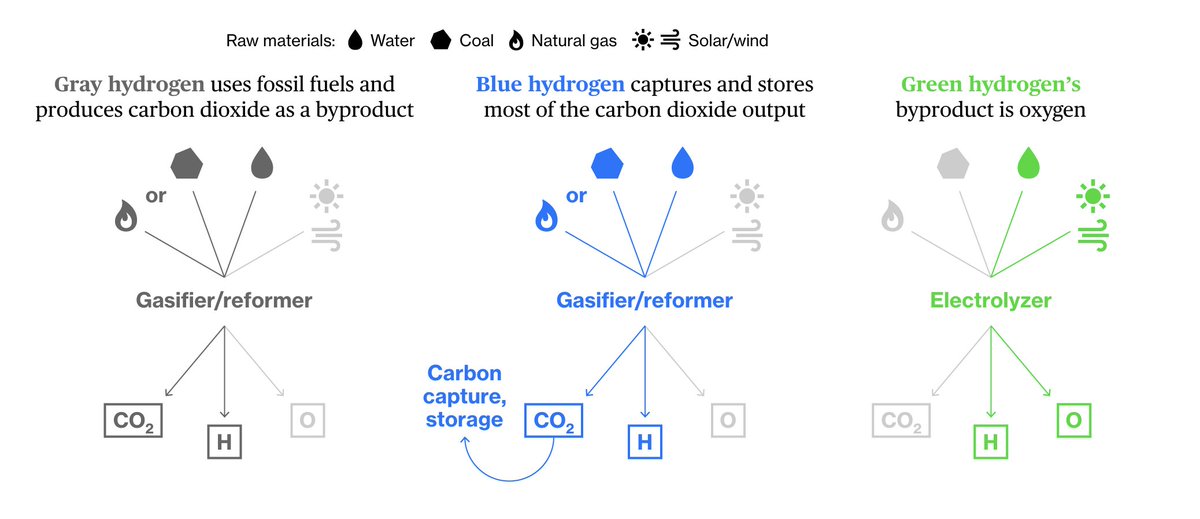

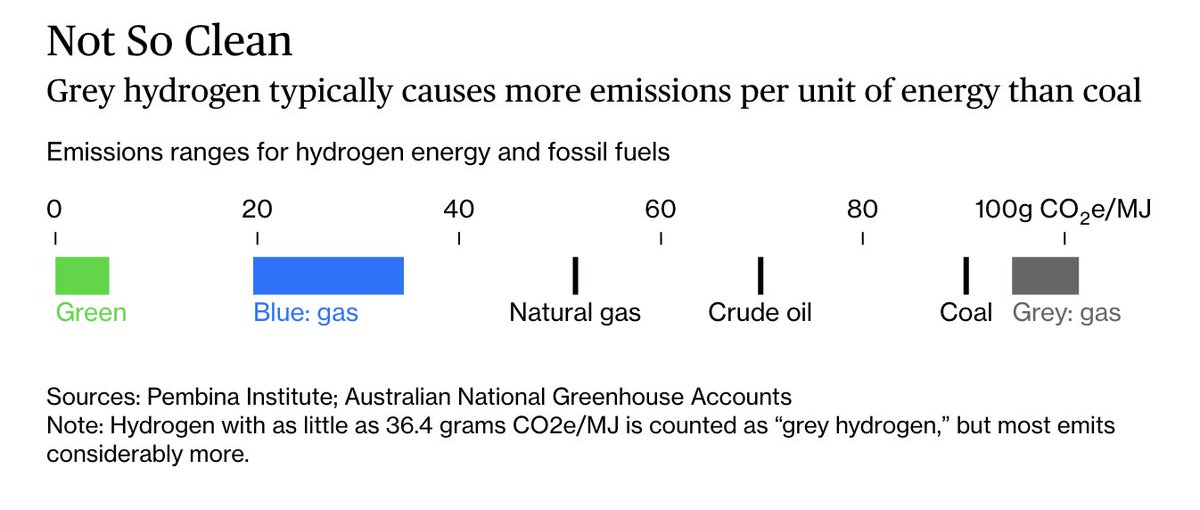

How climate-friendly hydrogen is depends on how the hydrogen is extracted from water:

Gray hydrogen, accounts for 99% of the world’s industrial hydrogen

Gray hydrogen, accounts for 99% of the world’s industrial hydrogen

Blue captures most of the CO2 output

Blue captures most of the CO2 output

Green uses renewables, and the only byproduct is oxygen http://trib.al/TdhedOe

Green uses renewables, and the only byproduct is oxygen http://trib.al/TdhedOe

Gray hydrogen, accounts for 99% of the world’s industrial hydrogen

Gray hydrogen, accounts for 99% of the world’s industrial hydrogen Blue captures most of the CO2 output

Blue captures most of the CO2 output Green uses renewables, and the only byproduct is oxygen http://trib.al/TdhedOe

Green uses renewables, and the only byproduct is oxygen http://trib.al/TdhedOe

Green hydrogen is still barely more than a cottage industry. The biggest producer of electrolyzers, Norway’s Nel ASA, can make 80 megawatts per year.

To put the world on a path to zero emissions, we’ll need to install two million megawatts or more http://trib.al/TdhedOe

To put the world on a path to zero emissions, we’ll need to install two million megawatts or more http://trib.al/TdhedOe

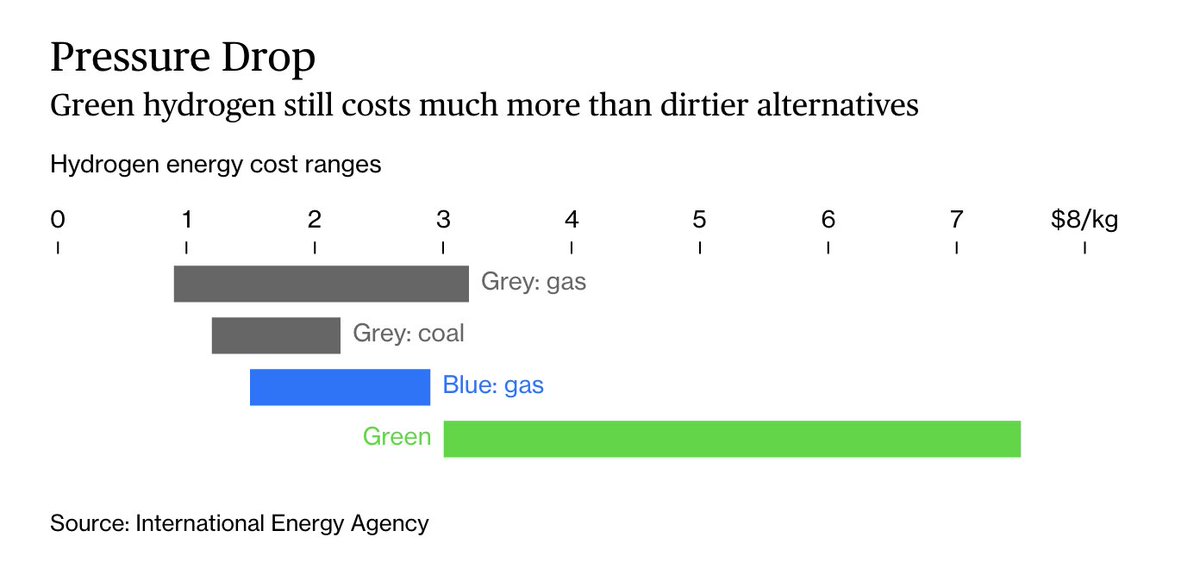

To save the world, the price of green hydrogen needs to come down from $3-8 a kg to $1, which is what gray hydrogen costs.

Can it follow the path taken by wind and solar, whose prices have dropped 70% and 90% respectively? There’s reason to think so http://trib.al/TdhedOe

Can it follow the path taken by wind and solar, whose prices have dropped 70% and 90% respectively? There’s reason to think so http://trib.al/TdhedOe

The cost of water-splitting electrolyzers has already fallen by 40% between 2014 and 2019.

Momentum is picking up: In the 10 months through August, the announced project pipeline for green hydrogen expanded from 3.5 gigawatts to 15 http://trib.al/TdhedOe

Momentum is picking up: In the 10 months through August, the announced project pipeline for green hydrogen expanded from 3.5 gigawatts to 15 http://trib.al/TdhedOe

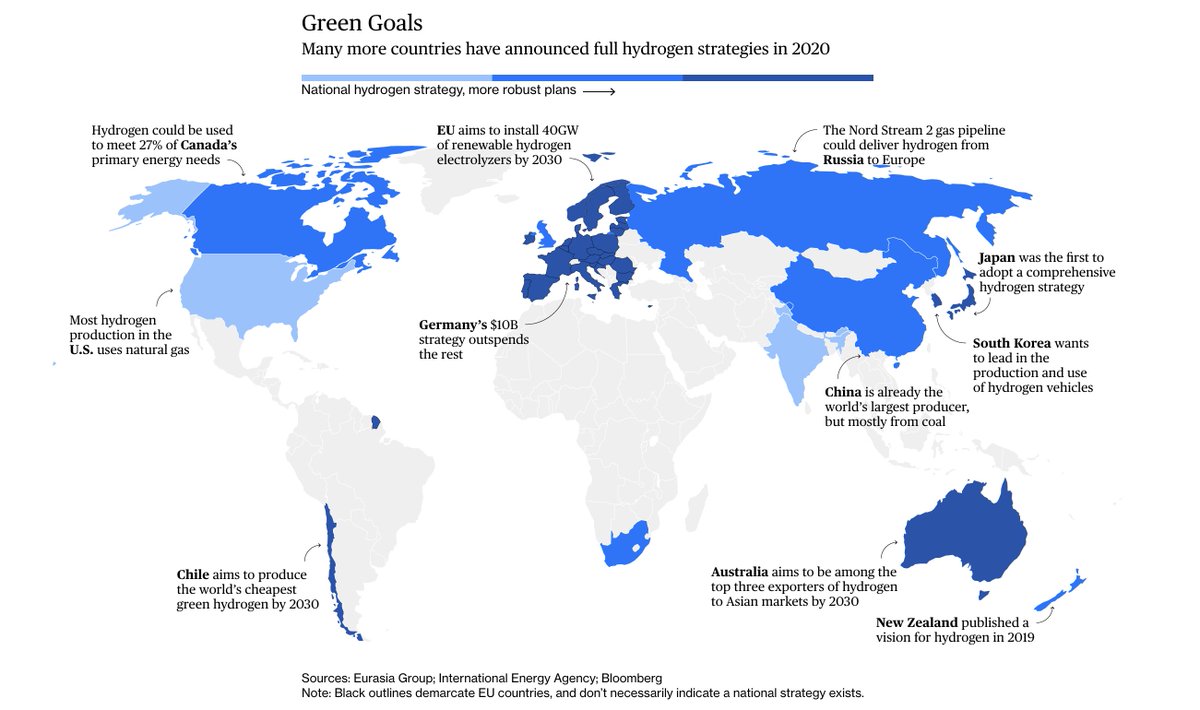

Governments are also redefining energy plans. Countries representing about half of the world’s GDP now have credible hydrogen strategies.

That number rises to 70% once the U.S.,

U.S.,  Canada and

Canada and  Russia finalize their plans. But who's doing it right? http://trib.al/TdhedOe

Russia finalize their plans. But who's doing it right? http://trib.al/TdhedOe

That number rises to 70% once the

U.S.,

U.S.,  Canada and

Canada and  Russia finalize their plans. But who's doing it right? http://trib.al/TdhedOe

Russia finalize their plans. But who's doing it right? http://trib.al/TdhedOe

A coherent blueprint is required that:

Leverages advantages

Leverages advantages

Encourages production with flagship projects, including funding

Encourages production with flagship projects, including funding

Supports the development of transport & storage resources

Supports the development of transport & storage resources

Boosts demand

Boosts demand

The EU’s $558 billion roadmap does much of this https://trib.al/QptHDxC

Leverages advantages

Leverages advantages Encourages production with flagship projects, including funding

Encourages production with flagship projects, including funding Supports the development of transport & storage resources

Supports the development of transport & storage resources Boosts demand

Boosts demandThe EU’s $558 billion roadmap does much of this https://trib.al/QptHDxC

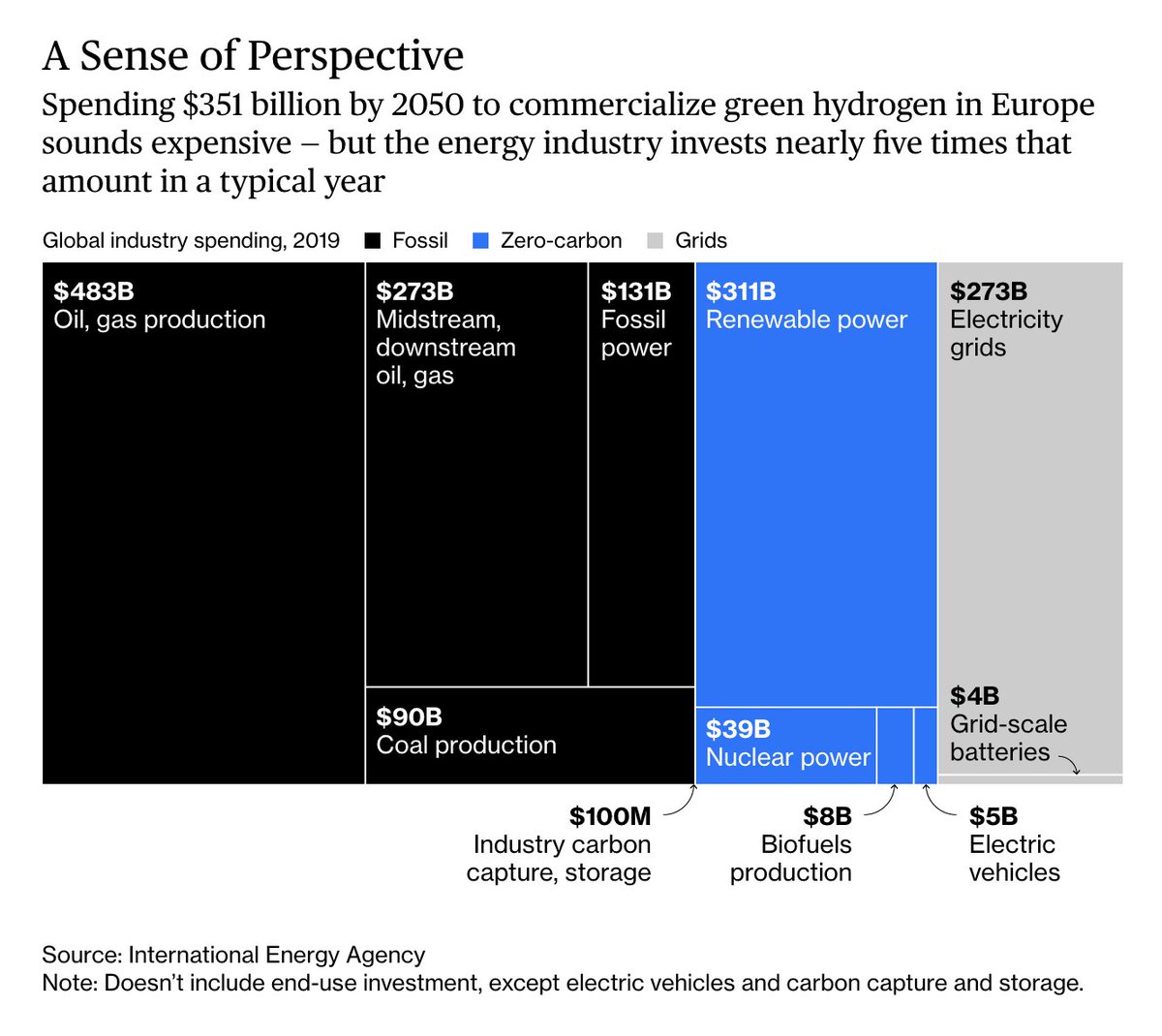

There are still plenty of big questions, not least around funding: It’s estimated the industry will need $150 billion of subsidies by 2030, and far more in investment.

So far, national governments’ pledges - from Portugal to Chile - fall short of this http://trib.al/QptHDxC

So far, national governments’ pledges - from Portugal to Chile - fall short of this http://trib.al/QptHDxC

One solution to funding? Fossil fuel companies.

The oil and gas sector spends around $500 billion developing new fields every year. Shifting just a small share to hydrogen should be enough to drastically increase the technology’s scale and competitiveness https://trib.al/8OexpoU

The oil and gas sector spends around $500 billion developing new fields every year. Shifting just a small share to hydrogen should be enough to drastically increase the technology’s scale and competitiveness https://trib.al/8OexpoU

The risk is that Big Oil doesn’t really have the climate’s interests at heart:

Blue hydrogen may offer an intermediate step toward zero-carbon green hydrogen. But it may end up as a dead end, providing cover for a last burst of coal investment in Asia http://trib.al/8OexpoU

Blue hydrogen may offer an intermediate step toward zero-carbon green hydrogen. But it may end up as a dead end, providing cover for a last burst of coal investment in Asia http://trib.al/8OexpoU

There’s even a chance that we miss strides being made by its highest-emission cousin, grey hydrogen.

That process already accounts for about 5% of China’s coal consumption and India will invest $54 billion in the technology by 2030 http://trib.al/8OexpoU

That process already accounts for about 5% of China’s coal consumption and India will invest $54 billion in the technology by 2030 http://trib.al/8OexpoU

There’s a big opportunity for Big Oil in hydrogen. The key area of overlap between the current petroleum economy and a hydrogen future is likely to be in midstream infrastructure:

Pipelines

Pipelines

Ships

Ships

Storage facilities http://trib.al/8OexpoU

Storage facilities http://trib.al/8OexpoU

Pipelines

Pipelines Ships

Ships Storage facilities http://trib.al/8OexpoU

Storage facilities http://trib.al/8OexpoU

Big Oil’s dominant position in the existing energy system may prove most critical.

84% of the world’s primary energy comes from oil, gas and coal. That gives fossil fuel companies an outsize share of investment dollars — which is what green hydrogen needs http://trib.al/8OexpoU

84% of the world’s primary energy comes from oil, gas and coal. That gives fossil fuel companies an outsize share of investment dollars — which is what green hydrogen needs http://trib.al/8OexpoU

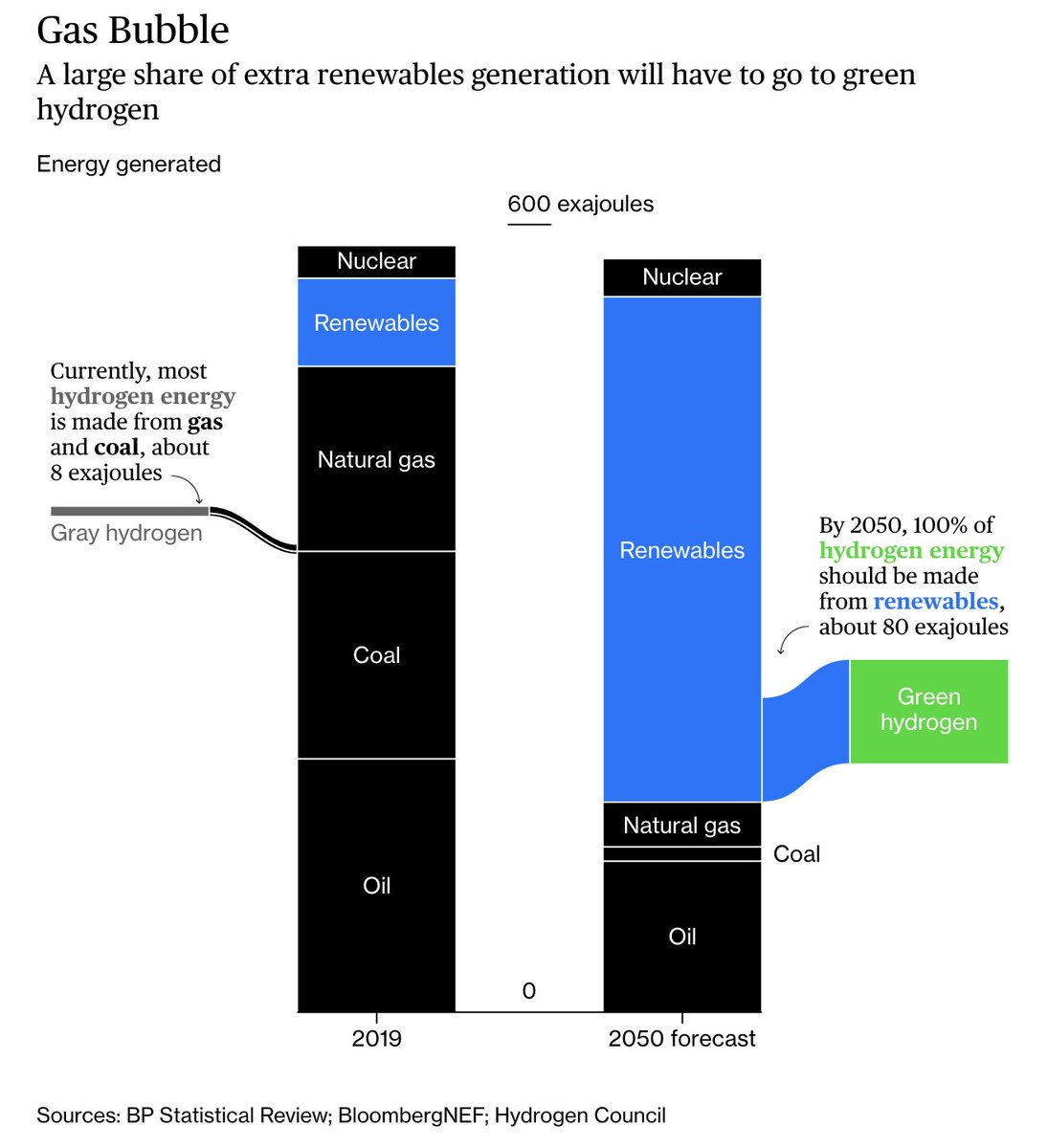

The world needs to produce 80 exajoules of hydrogen a year by 2050.

Doing that with electrolyzers would require more electricity than the world produced in 2019 and that will need about 9 times more wind and solar generators than exist http://trib.al/8OexpoU

Doing that with electrolyzers would require more electricity than the world produced in 2019 and that will need about 9 times more wind and solar generators than exist http://trib.al/8OexpoU

It’s going to prove difficult to do that without a spending boom that will make the past decade’s outlay on renewable power look modest.

Still, if there’s any industry that’s in a place to deliver such a splurge, it’s the oil giants http://trib.al/8OexpoU

Still, if there’s any industry that’s in a place to deliver such a splurge, it’s the oil giants http://trib.al/8OexpoU

Read on Twitter

Read on Twitter