Are Special situation funds really special?

A thread

Bonus: Comments on Axis Special Situations Fund (NFO)

A thread

Bonus: Comments on Axis Special Situations Fund (NFO)

NFO: New Fund Offer is like an IPO of Mutual Fund Scheme. The scheme issues units to its subscribers at Face Value which is usually Rs. 10 per unit.

Special situations funds fall in the theme-based category of mutual funds hence a Thematic Fund. These funds try to find investment opportunities in areas where there could be mispricing of any stock due to reasons like regulatory issues, policy changes,

management restructuring, disruptions, innovations, or temporary challenges in the operating environment.

Major investments could be in ideas like the shift from unorganized to organized, companies offering premiumization, tech disruptions, business process innovations.

Major investments could be in ideas like the shift from unorganized to organized, companies offering premiumization, tech disruptions, business process innovations.

Basically, any company can form part of the portfolio of such funds depending upon the events. Eg: RIL can be in this portfolio as it led to disruption in the telecom sector in India. Companies enabling and growing their business based on IT can be the heavy bets of such funds.

Taxation: Schemes are thematic with a mandate to invest 80-100% in equities hence treated as equity-oriented funds and liable to tax accordingly.

Dividends are taxed at slab rates, The gains on selling units are taxed at 10% in the case of LTCG (holding period over 1 year) and 15% in the case of STCG (holding period of 1 year or less).

Axis Special Situations Fund is a New Fund Offer in this particular category. I have tried to summarize the details put forth by various communications received from AMC & SID with respect to this scheme:

- Scheme will invest a minimum of 65% of the corpus in stocks where there can be disruption in any sector due to favorable/unfavorable changes.

- Scheme has mandate to invest upto 35% of corpus in foreign cos. Axis is already working with Schroder Investment Management Company (US) for their overseas exposure since October 2018 when they launched their first fund with global exposure: Axis Growth Opportunities Fund.

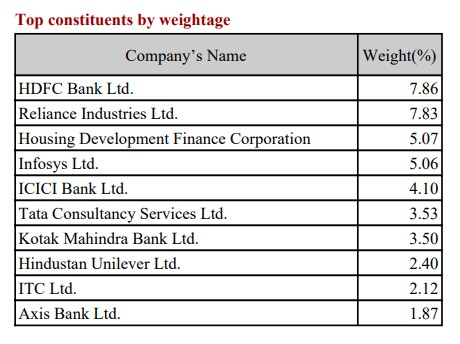

- Benchmark: The scheme is benchmarked against the Nifty 500 index, Here are the top 10 components of the index. These components account for 40% of this index which has 501 companies in it.

- Investments would be in companies that have led to the disruption for eg: Reliance Industries in the case of the telecom sector.

- But it's not just focused on the main disruptor, It will also invest in companies that enables the disruptions. Eg: Infosys/TCS helps these disruptors to scale the transformation by providing IT support.

- It will also look to invest in companies that are quickly adopting these changes and strengthening their dominance. Eg: HDFC Life adopted the distribution of insurance products through various online channels like Paytm & with Airtel recharges.

- Further, it will look for opportunities where there could be a change in management leading to transformation. Eg: WIPRO had a change in management where they announced a new operating business model and structure.

My take on this NFO:

- Portfolio might have high exposure to IT & Financials along with RIL. We may also see names that are investing in startup companies or running on a full platform-based business model like Infoedge.

- Portfolio might have high exposure to IT & Financials along with RIL. We may also see names that are investing in startup companies or running on a full platform-based business model like Infoedge.

- The fund would invest in disruption-based companies hence, it may fully deploy the 35% corpus in overseas IT-based companies like Microsoft/Amazon, etc.

- The fund might have identical names like Axis Growth Opportunities Fund, I personally feel there could be major overlap. However, we need to wait and watch the portfolio when it is released.

- Investing style would be growth-based rather than value-based. This has been the case with almost all the Axis schemes.

- Fund may have lower volatility due to its global diversification.

- Expecting higher weightage to the IT sector on an overall basis.

- Fund may have lower volatility due to its global diversification.

- Expecting higher weightage to the IT sector on an overall basis.

Conclusion:

There is only one other fund in this category: ABSL Special Opportunities Fund launched in October 2020, so performance projections cannot be made as it is a totally new category.

There is only one other fund in this category: ABSL Special Opportunities Fund launched in October 2020, so performance projections cannot be made as it is a totally new category.

However, I don't think there would be much to offer by this category other than the foreign investment mandate and some sectorial allocation strategies. I would wait and watch this category for some time.

Disclaimer: All the information shared is for educational purposes only and may have personal opinions and biases. Do consult your financial advisor before investing.

END.

END.

Read on Twitter

Read on Twitter