Although I’m super bullish uranium & oil/gas i think there is a reckoning that will occur in the not too distant future. Right now there is a trifecta of +ve news with stimulus news, vaccine, etc etc. You can see this with inflation gauges perking up and yields rising. At some

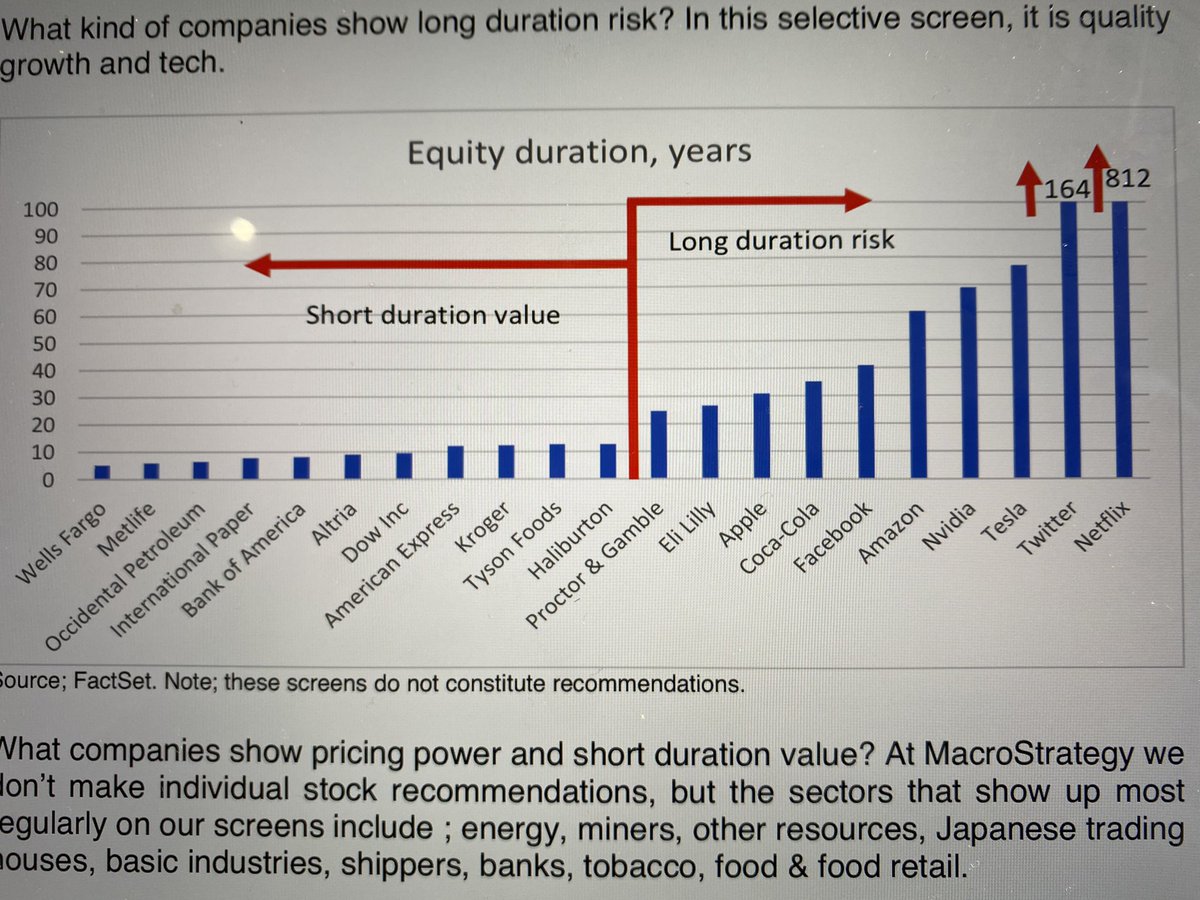

Point this will become a problem for the markets. As macro strategy points out, the duration of the stocks on the right hand side are highly susceptible to rising yields (hence the massive bull mkt over the years with falling yields). Commodities & financials are on the opposite

End as represented by $oxy on the left. I would expect a surprise to the markets is that the reopening actually isn’t that positive for the indices itself (eg with Tesla and other long duration assets now being such a large %). Thus, although this year has been an everything

Read on Twitter

Read on Twitter