"90% of the traders lose money, But do they lose it all the time?"

Most of them do make money, its just that they give it all back.

Lets analyze why and how a trader makes and loses money

[Thread]:

Most of them do make money, its just that they give it all back.

Lets analyze why and how a trader makes and loses money

[Thread]:

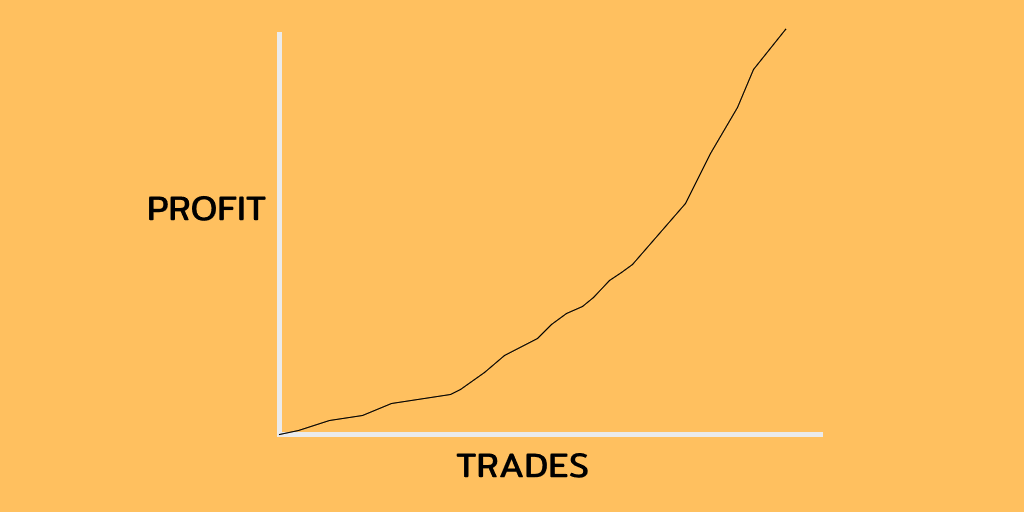

This is equity curve of an average trader:

Most traders do make money, but they give it back to the markets .

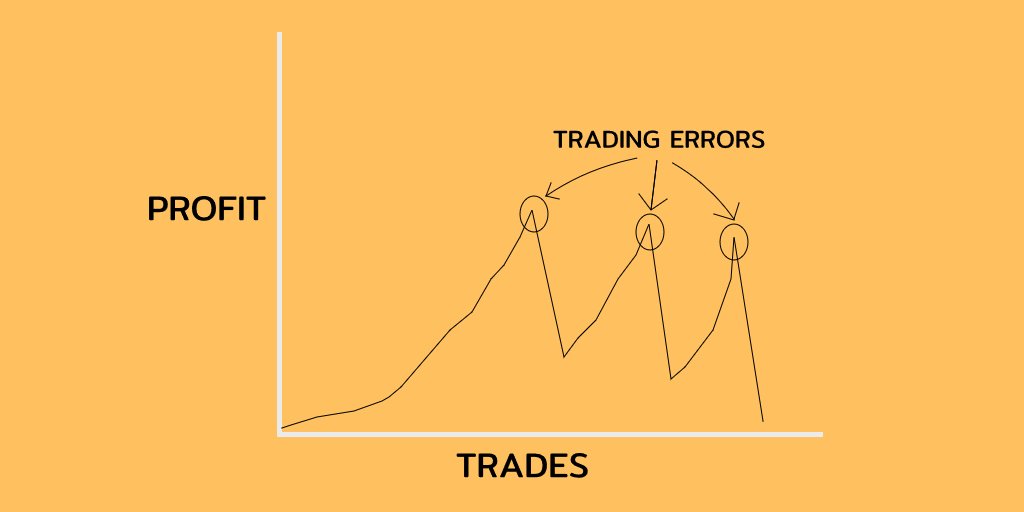

Because of trading errors.

What are trading errors?

Most traders do make money, but they give it back to the markets .

Because of trading errors.

What are trading errors?

Trading errors are those errors which happen because of wrong Position sizing, Leverage , etc.

I am not making this up, check your P&L, 90 % of your losses would have come from less then 10% trades.

Most of these happen because of No knowledge, No plan, bad position sizing .

I am not making this up, check your P&L, 90 % of your losses would have come from less then 10% trades.

Most of these happen because of No knowledge, No plan, bad position sizing .

Now, we know what's the problem, lets talk about the solution.

1. Learn the Basics first-

If you don’t get the basics clear then how can you make money?

Learn How to use Support and resistances

Learn How to use trend lines

Learn about trend, it will solve 90% of your problem

1. Learn the Basics first-

If you don’t get the basics clear then how can you make money?

Learn How to use Support and resistances

Learn How to use trend lines

Learn about trend, it will solve 90% of your problem

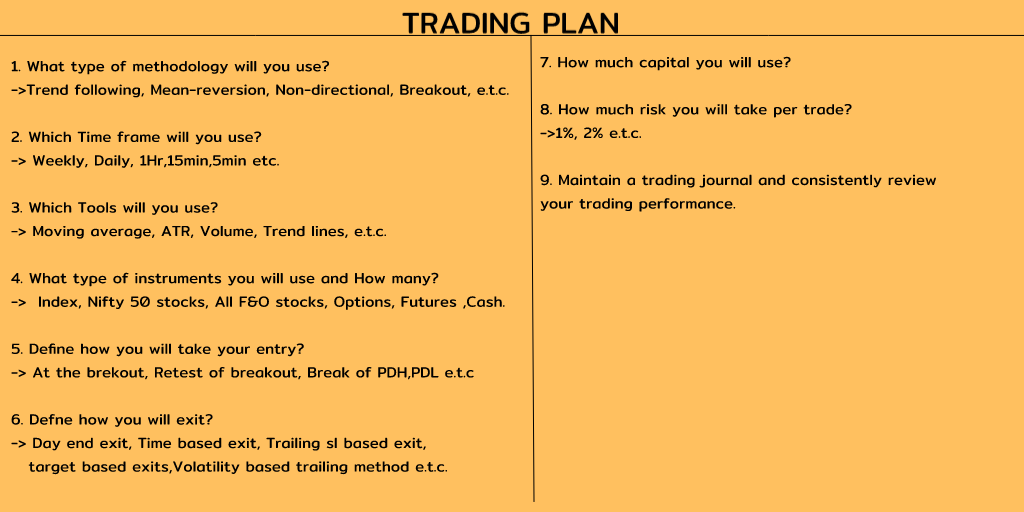

2. Plan-

The number 1 problem is that you don’t have a plan,

And by plan I mean set of written rules.

If you don’t have a plan then you really aren't serious enough to consider making any money.

So, Make a plan.

How does a plan looks like?

The number 1 problem is that you don’t have a plan,

And by plan I mean set of written rules.

If you don’t have a plan then you really aren't serious enough to consider making any money.

So, Make a plan.

How does a plan looks like?

3. Position sizing-

Money management is that part of your system that answers "How much?" throughout the course of the trade.

How much essentially means how big a position you should have at any given time throughout the course of a trade.

Money management is that part of your system that answers "How much?" throughout the course of the trade.

How much essentially means how big a position you should have at any given time throughout the course of a trade.

Attaching a thread on how position sizing affect the account-

https://twitter.com/Traderknight007/status/1333715116945149953?s=20

you can see that risking the appropriate amount of money is necessary for your equity curve growth.

There are two type of position sizing strategies,

1. Martingale

2. Anti-martingale

https://twitter.com/Traderknight007/status/1333715116945149953?s=20

you can see that risking the appropriate amount of money is necessary for your equity curve growth.

There are two type of position sizing strategies,

1. Martingale

2. Anti-martingale

1. Martingale strategies increase the risk per trade when equity decrease.

2. Anti martingale strategies increase risk per trade when equity increases.

There are further many anti martingale strategies

2. Anti martingale strategies increase risk per trade when equity increases.

There are further many anti martingale strategies

I will be explaining this further in upcoming days as this thread will get super long if I do it now.

Tip-

When you start to trade ,trade small for the first 20-30 trade , at-least 1/3rd of the risk what you think you will trade.

Tip-

When you start to trade ,trade small for the first 20-30 trade , at-least 1/3rd of the risk what you think you will trade.

This will give you confidence and you can follow the plan effectively when you do not have fear of losing.

4. Be ready for Black swan events.

What are black swan events?

Big gap-downs, Flash crash, Big news, Market or stock hitting Upper or lower circuit.

4. Be ready for Black swan events.

What are black swan events?

Big gap-downs, Flash crash, Big news, Market or stock hitting Upper or lower circuit.

Think about can your account be wiped in these conditions?

If yes, then correct the parameter due to which you can have big draw-down.

4. Next is psychology, Read the book trading in the zone, that will cover all your psychology related problems.

If yes, then correct the parameter due to which you can have big draw-down.

4. Next is psychology, Read the book trading in the zone, that will cover all your psychology related problems.

Attaching some threads which can help you.

Thread on law of large numbers-

https://twitter.com/Traderknight007/status/1333074133991657472?s=20

Tweets on psychology-

https://twitter.com/Traderknight007/status/1331881851078672385?s=20

https://twitter.com/Traderknight007/status/1333798517618352129?s=20

These are some of the things that can help you become a better trade.

Thank you for reading till here.

Thread on law of large numbers-

https://twitter.com/Traderknight007/status/1333074133991657472?s=20

Tweets on psychology-

https://twitter.com/Traderknight007/status/1331881851078672385?s=20

https://twitter.com/Traderknight007/status/1333798517618352129?s=20

These are some of the things that can help you become a better trade.

Thank you for reading till here.

Tagging some accounts from where you can learn almost everything -

@PharmaBull20_22 - Best short term trader

@sanstocktrader - Most humble person and finest price action trader

@kirubaakaran - one of the Best system trader

@sakuag333 - System trader and rising star

@PharmaBull20_22 - Best short term trader

@sanstocktrader - Most humble person and finest price action trader

@kirubaakaran - one of the Best system trader

@sakuag333 - System trader and rising star

@AnandableAnand - Experienced System and discretionary trader

@sohamtweet - Bade bhai and Finest algo trader

@jitendrajain - All rounder, system trader.

@quatltd - Best algo trader in stocks.

@ST_PYI - Price action master and super humble person.

@sohamtweet - Bade bhai and Finest algo trader

@jitendrajain - All rounder, system trader.

@quatltd - Best algo trader in stocks.

@ST_PYI - Price action master and super humble person.

Read on Twitter

Read on Twitter