#weekly #Review

1.

The Big Illusion

Driven by the vaccine and stimulus news some analysts already expect a huge rebound in global growth. Morgan Stanley projects that the pre-pandemic global GDP path is likely to be reached in Q2 2021.

1.

The Big Illusion

Driven by the vaccine and stimulus news some analysts already expect a huge rebound in global growth. Morgan Stanley projects that the pre-pandemic global GDP path is likely to be reached in Q2 2021.

2. Investors are fully in risk-on mode as Goldman Sachs' sentiment indicators show. Markets expect the economies going back to normal and thus dumping their safe haven assets like US-treasuries which also puts pressure on the dollar.

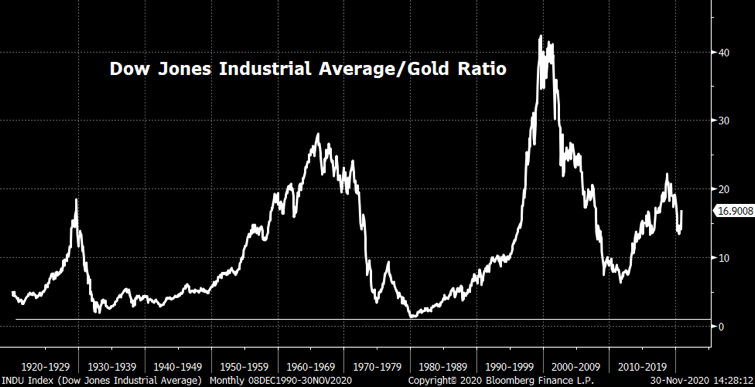

3. However, as mentioned one week before last, stocks are overvalued already with 92.5% of all S&P 500 stocks above their 200 DMAs.

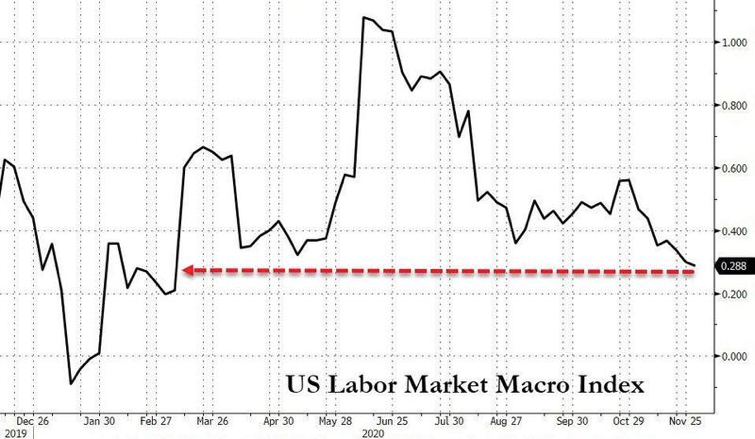

Fundamental data shows a different picture: The ADP US Labor Market Macro Index hit its weakest level since February (h/t @zerohedge)

Fundamental data shows a different picture: The ADP US Labor Market Macro Index hit its weakest level since February (h/t @zerohedge)

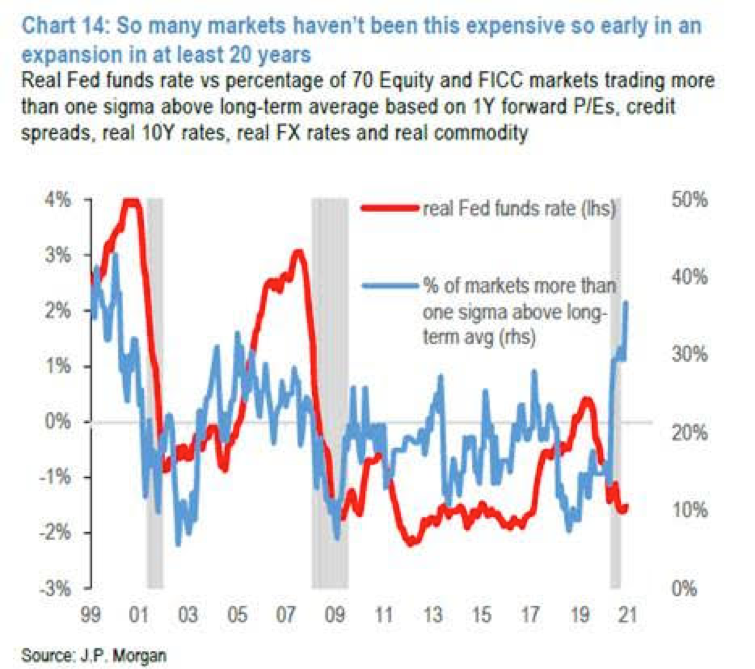

4. Nevertheless investors buy call-options as if there was no tomorrow: Last week (Thanksgiving) an all time record of 35 million call options were traded. As a result many markets haven't been this expensive so early in an expansion in at least 20 years.

5. Hardly anyone believes that there's a chance that stock prices may fall as everyone speculates that CBs will keep the bubble going.

But economic data shows the opposite & as @LanceRoberts has put it: Bad economic data leads to a shortfall in earnings estimates.

But economic data shows the opposite & as @LanceRoberts has put it: Bad economic data leads to a shortfall in earnings estimates.

6. Monetary expansion has side effects: As a result of the Feds' heavy bond buying, corporate bond yields are now lower than inflation expectations. This has never been the case at any other given date in history.

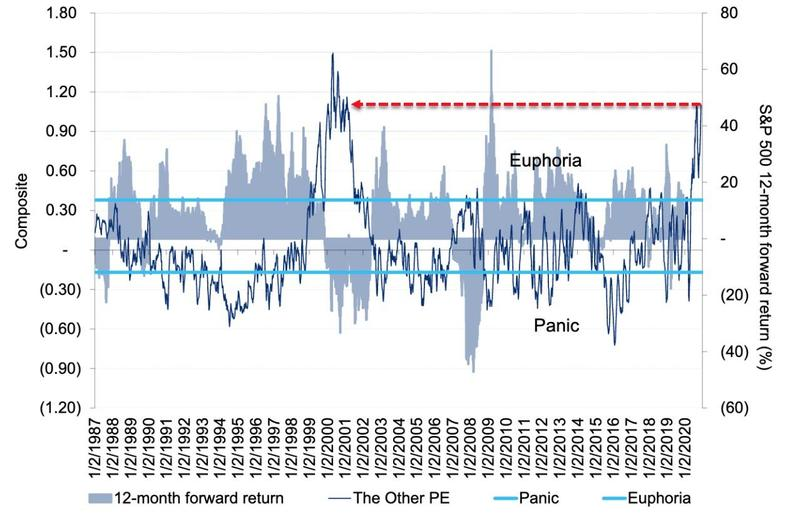

7. CITI's Fear and Greed Index has now reached dot-com era levels: "Current euphoric readings signal a 100% probability of losing money in the coming 12 months if we study historical patterns"

https://www.zerohedge.com/markets/citi-warns-100-probability-loss-most-euphoric-market-dot-com-bubble

https://www.zerohedge.com/markets/citi-warns-100-probability-loss-most-euphoric-market-dot-com-bubble

8. With no bears left @pboockvar correctly stated: "The Bull boat right now is standing room only."

One feels reminded of Economist Irving Fisher in early October of 1929: "Stock prices have reached what looks like a permanently high plateau". The rest is history...

One feels reminded of Economist Irving Fisher in early October of 1929: "Stock prices have reached what looks like a permanently high plateau". The rest is history...

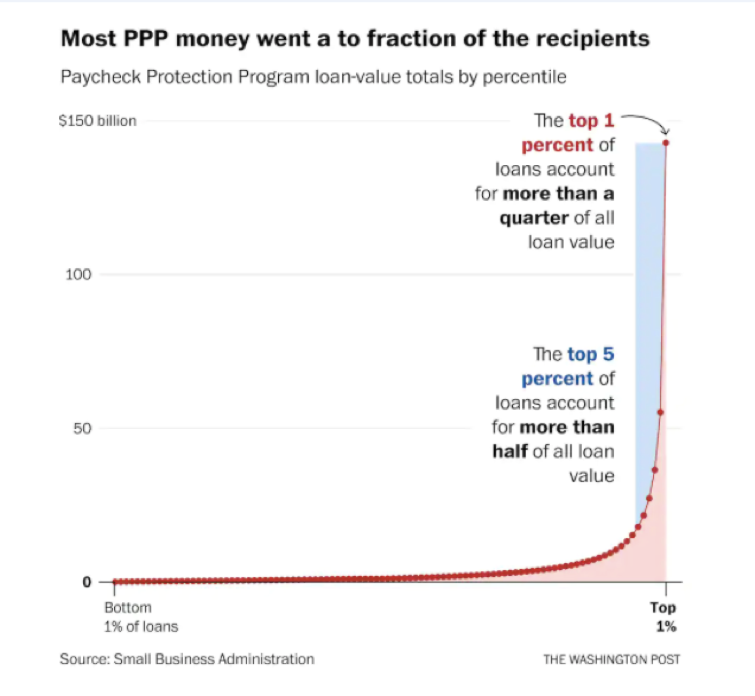

9. Even though central banks all around the world acted quickly in this crisis signs are strengthening that lots of SMEs will close their doors permanently as only a few benefited from aid programs. For example, US PPP was for the few instead of the many:

(h/t @AlessioUrban)

(h/t @AlessioUrban)

10. There's no doubt that monetary policy will not return to normal for a very long time.  hotel room rates fell 60% this year & "won't get back to '19 prices before '23."

hotel room rates fell 60% this year & "won't get back to '19 prices before '23."

In the Jerome Powell said: "There's no rush to taper"

Jerome Powell said: "There's no rush to taper"

https://www.bloomberg.com/news/articles/2020-12-03/deflation-alarm-in-spain-tests-lagarde-s-optimism-on-prices?sref=Ph1h0ZqE https://www.bloomberg.com/news/articles/2020-12-02/powell-says-no-rush-to-taper-bond-purchases-mum-on-doing-more?srnd=markets-vp&sref=Ph1h0ZqE

hotel room rates fell 60% this year & "won't get back to '19 prices before '23."

hotel room rates fell 60% this year & "won't get back to '19 prices before '23."In the

Jerome Powell said: "There's no rush to taper"

Jerome Powell said: "There's no rush to taper"https://www.bloomberg.com/news/articles/2020-12-03/deflation-alarm-in-spain-tests-lagarde-s-optimism-on-prices?sref=Ph1h0ZqE https://www.bloomberg.com/news/articles/2020-12-02/powell-says-no-rush-to-taper-bond-purchases-mum-on-doing-more?srnd=markets-vp&sref=Ph1h0ZqE

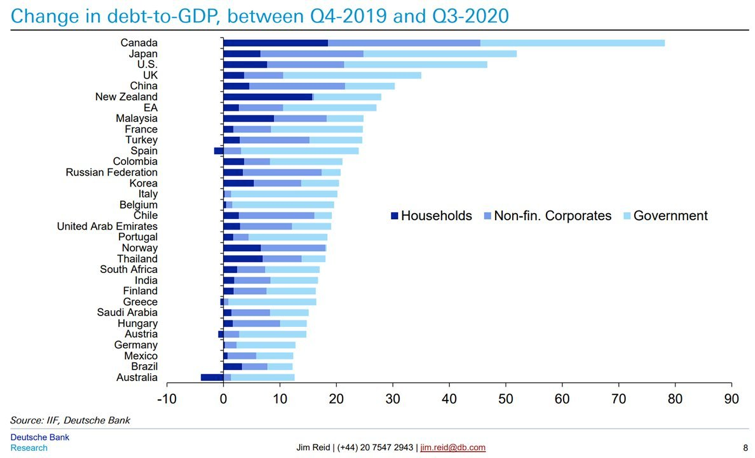

11. Indeed it is in everyone's interest that rates remain near zero or in negative territory. Neither governments nor households or businesses could afford a normalization of rates, they're already too much indebted, especially since this crisis started.

Read on Twitter

Read on Twitter