My new lock-down pal & I are psyched that we finally got a copy of "The Politics of Bad Options" @OUPPolitics with @stefwalter__ & @ariray_

Since all our data is now also available online, here is a bit more on the content of the book and why you might want to check the data.

Since all our data is now also available online, here is a bit more on the content of the book and why you might want to check the data.

. @stefwalter has already superbly summarized the book's arguments on the politics of the Eurozone crisis. So, I will focus on what I think are the main takeaways of our findings for some current developments in EU politics. https://twitter.com/stefwalter__/status/1327196564377530368?s=20

All of this is based on new survey data from about 700 economic interest groups and interviews with around 50 policymakers and group representative in six EU countries. I will focus on the findings from Northern or “core” countries here. For the rest, @ariray_ is your expert!

1) Lately, many wondered about what seems like a sudden fiscal shift in DE. During the Eurozone crisis, DE resisted all calls to increase spending, spur domestic demand & bring down its export surplus. Now, DE has one of the most generous fiscal support programs. What changed?

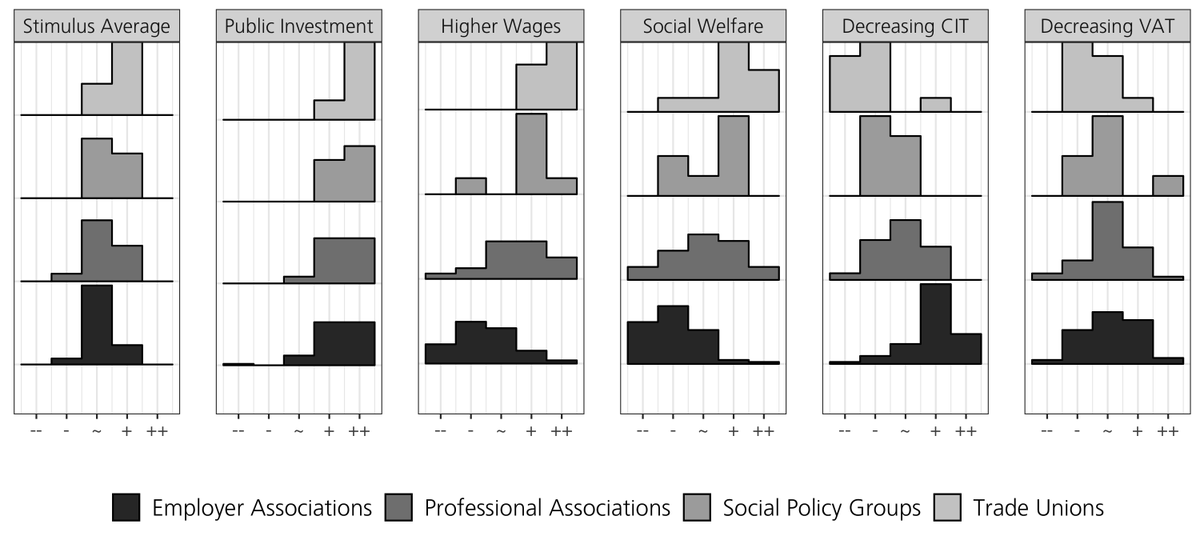

We show that domestic support for policies to strengthen demand was already quite large during the EZ crisis. Most econ groups in DE would have welcomed some expansionary policies. BUT, they also opposed others. The central conflict was not *whether* to stimulate but *how* to.

In the light of our data, the recent German fiscal shift thus seems much less surprising. There was always a groundswell of support for expansion, but in the benign context of the 2010s, distributional conflicts about specific policies prevented a push for domestic spending.

Now, during COVID this calculation appears to have changed. The crisis increases the costs of inaction and forces everyone into compromises. Does this mean that DE’s macroeconomic role in the EMU has changed for good? Based on our findings from the book, I'd say probably not.

More likely that DE will keep spending domestically as long as a recession looms. After that, policy conflicts will return and DE is unlikely to reduce its export surplus for the sake of reducing global imbalances, the stability of the EMU or its direct trade partners.

However, our book also suggests that European imbalances are less structural than often assumed and that there is room for compromises. For example, more than 90% of our interest groups would support more public investment in DE. So, in the end, it all depends on politics.

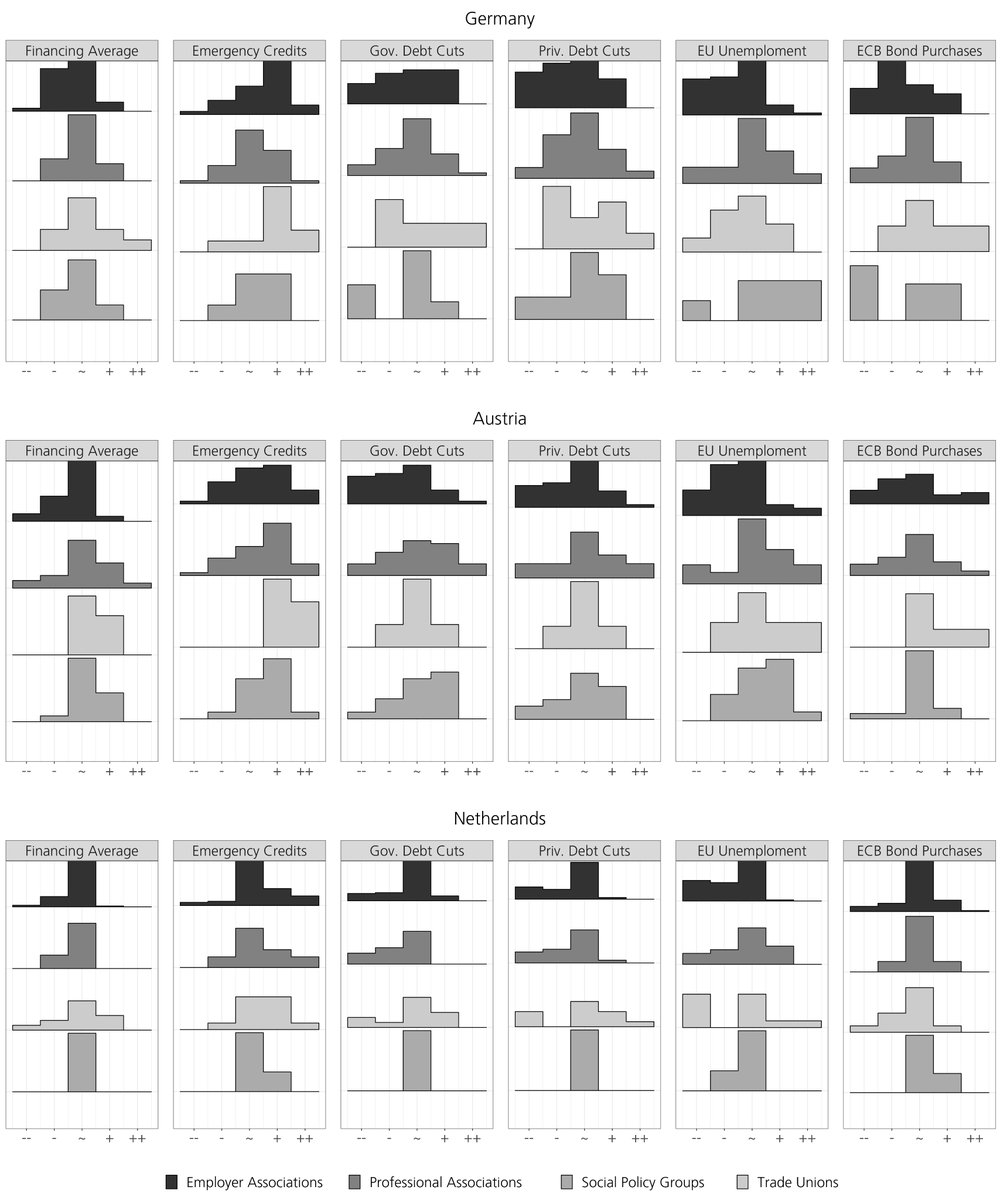

COVID has also reopened the issue of transfers and financial support amongst EU members. In the book, we spend a lot of time exploring what drives support for such measures, especially amongst economic interest groups AND we have data on two of the famous Frugal Four (AT & NL).

We find that opposition towards financial support was surprisingly low amongst econ groups. In general, most trade unions, employer associations and business groups did not reject the idea of transfers during the EZ crisis. We interpret this as good news for further integration.

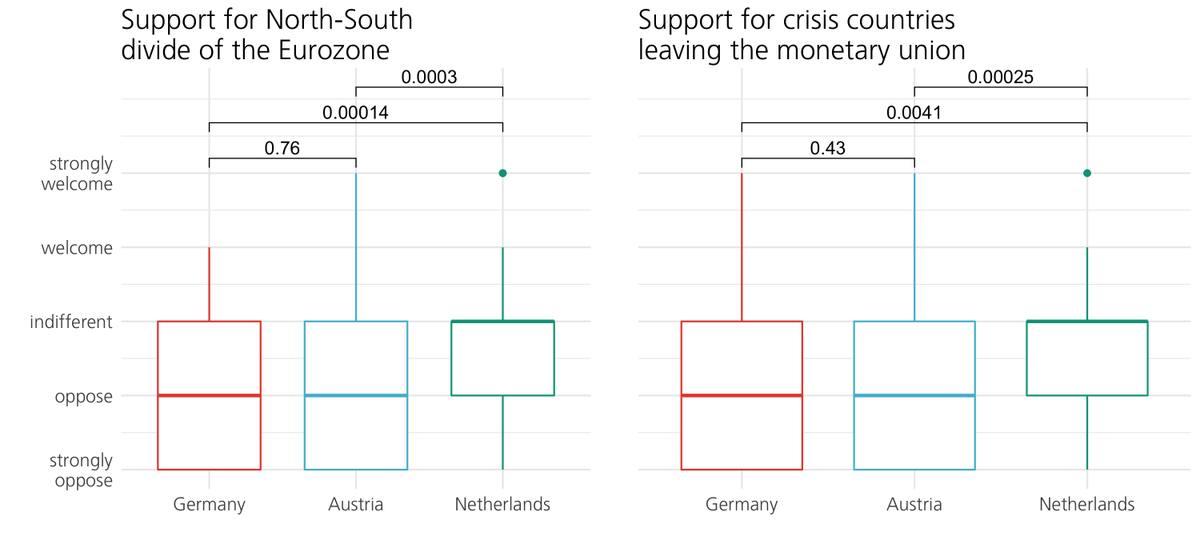

In light of recent events, it, however, is interesting that Dutch groups were already more skeptical towards financing and less opposed to the idea of a break-up of the EMU during the last crisis. This may point towards a more general divide amongst core European countries.

There are a lot of interesting differences across policies, interest groups, sectors etc. that we look into. If you are interested, check out the book

https://bit.ly/3okkhzS

or take a look at our data.

https://bit.ly/37uEjAW

https://bit.ly/3okkhzS

or take a look at our data.

https://bit.ly/37uEjAW

Also, I only covered surplus countries here and there is A LOT of data on Spain, Greece & Ireland in the book as well. On that @ariray_ is the person to turn to.

Read on Twitter

Read on Twitter