Using the additional Jul & Aug data from the 2021 Budget presentation, my FY2020 deficit “no frills” forecast stays flat at 5.59 Tn (previously 5.62 Tn).

Using the more optimistic numbers from CBN’s August 2020 economic report implies a slightly more rosy forecast of 5.37 Tn. https://twitter.com/seunsmith/status/1314268436743311360

Using the more optimistic numbers from CBN’s August 2020 economic report implies a slightly more rosy forecast of 5.37 Tn. https://twitter.com/seunsmith/status/1314268436743311360

The FAAC numbers for Sep, Oct, Nov are only slightly below the Jan - Aug average.

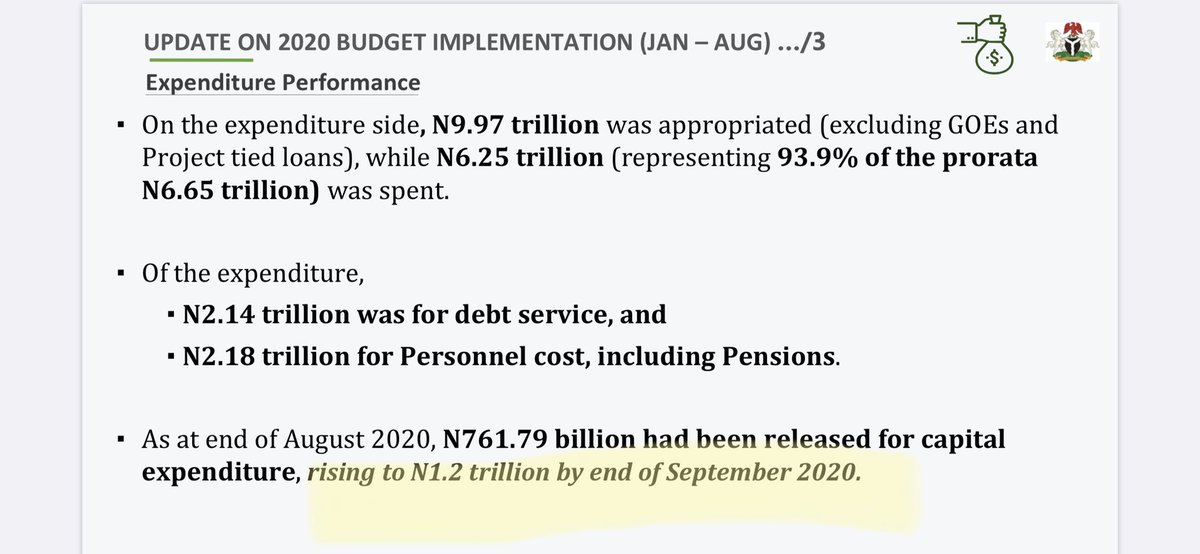

Finance Minister said additional CAPEX of 439 Bn was released in September.

So if I adjust the forecast slightly to accommodate this, deficit will tip to over 6 Tn.

Finance Minister said additional CAPEX of 439 Bn was released in September.

So if I adjust the forecast slightly to accommodate this, deficit will tip to over 6 Tn.

Now given that next years deficit could well be between 7 Tn and 8 Tn it’s not hard to see why the multilaterals are “strongly encouraging” the fiscal authorities to securitize all the money printed for them by the central bank and prime markets for record debt issuance in 2021. https://twitter.com/seunsmith/status/1327198212768346113

These days I find myself less apprehensive about the deficit/debt levels.

Yes - tax revenues need to go up and structural changes are required ASAP to allow earning and payment of those taxes - but there is sufficient fiscal space today (~30% Debt/GDP) that I am less anxious.

Yes - tax revenues need to go up and structural changes are required ASAP to allow earning and payment of those taxes - but there is sufficient fiscal space today (~30% Debt/GDP) that I am less anxious.

But to have the CBN print another 3 - 4 Tn next year while also carrying the existing 5 Tn or so in previously printed cash for the FG (some say it’s as high as 10 Tn, others say it’s only 3 Tn - I don’t know) will make me very anxious about inflation - which is already very bad.

So this move to securitize the printed cash comes at a good time.

Hopefully it goes through seamlessly.

And hopefully the CBN will be able to focus on its core role - fighting inflation - going forward after its dalliance with all the wrong things.

Hopefully it goes through seamlessly.

And hopefully the CBN will be able to focus on its core role - fighting inflation - going forward after its dalliance with all the wrong things.

Read on Twitter

Read on Twitter