1/ $AFRM On the surface, there's plenty going for only the second BNPL play to go public ( $AFTPY down under being the first)

Ultimately, after taking a closer look, the positives are shrouded by some lingering concerns that we'll explore briefly:

Ultimately, after taking a closer look, the positives are shrouded by some lingering concerns that we'll explore briefly:

2/ An iconic founder/CEO is one of the best attributes a company can have. Max Levchin is one of those once-in-a-generation founders with a glowing track record.

Born in Ukraine, Levchin emigrated to the US shortly after the Chernobyl debacle (no, really).

Born in Ukraine, Levchin emigrated to the US shortly after the Chernobyl debacle (no, really).

3/ He studied CS at the University of Illinois, where he founded his first company: SponsorNet New Media.

In 1998, things got a lot more interesting. Along with Peter Thiel, they founded Fieldlink, now $PYPL.

In 2002, $PYPL was sold to eBay mere months after going public.

In 1998, things got a lot more interesting. Along with Peter Thiel, they founded Fieldlink, now $PYPL.

In 2002, $PYPL was sold to eBay mere months after going public.

4/ Now, you've probably heard of the "PayPal Mafia".

If not, this group of former $PYPL employees has become notorious for founding multiple billion-dollar companies in the succeeding years.

These include: $TSLA, LinkedIn, $PLTR, and YouTube, to name a few.

If not, this group of former $PYPL employees has become notorious for founding multiple billion-dollar companies in the succeeding years.

These include: $TSLA, LinkedIn, $PLTR, and YouTube, to name a few.

5/ This is important because Levchin stands out even among this impressive bunch.

He was basically a founder of Yelp, being a key early investor, serving as the company's chairman, and owning the most amount of shares.

He also started Slide, which was sold to Google.

He was basically a founder of Yelp, being a key early investor, serving as the company's chairman, and owning the most amount of shares.

He also started Slide, which was sold to Google.

4/ Having served as CTO and co-creating one of the first CAPTCHA implementations, Levchin clearly knows his way around payments.

This, coupled with almost 100% of his compensation being comprised of equity incentives, definitely bodes well for $AFRM.

This, coupled with almost 100% of his compensation being comprised of equity incentives, definitely bodes well for $AFRM.

5/ $AFRM has two customers: merchants and consumers.

Consumers are offered POS financing, with the optionality of spreading out their payments over 3,6, or 12 months.

$AFRM's mission is to foment transparency, and thus consumers know exactly what they owe from the get-go.

Consumers are offered POS financing, with the optionality of spreading out their payments over 3,6, or 12 months.

$AFRM's mission is to foment transparency, and thus consumers know exactly what they owe from the get-go.

6/ With both true 0% APR financing and simple interest only (no compounding), Affirm believes it has revolutionized the legacy payment model. What's more, as opposed to other BNPL lenders, the company doesn't charge any late fees.

7/ Merchants, on the other hand, are sold on the idea of increasing their average order value and conversion rates, all while receiving their money up front, bearing no credit risk and simply paying $AFRM a fee for sales financed through them.

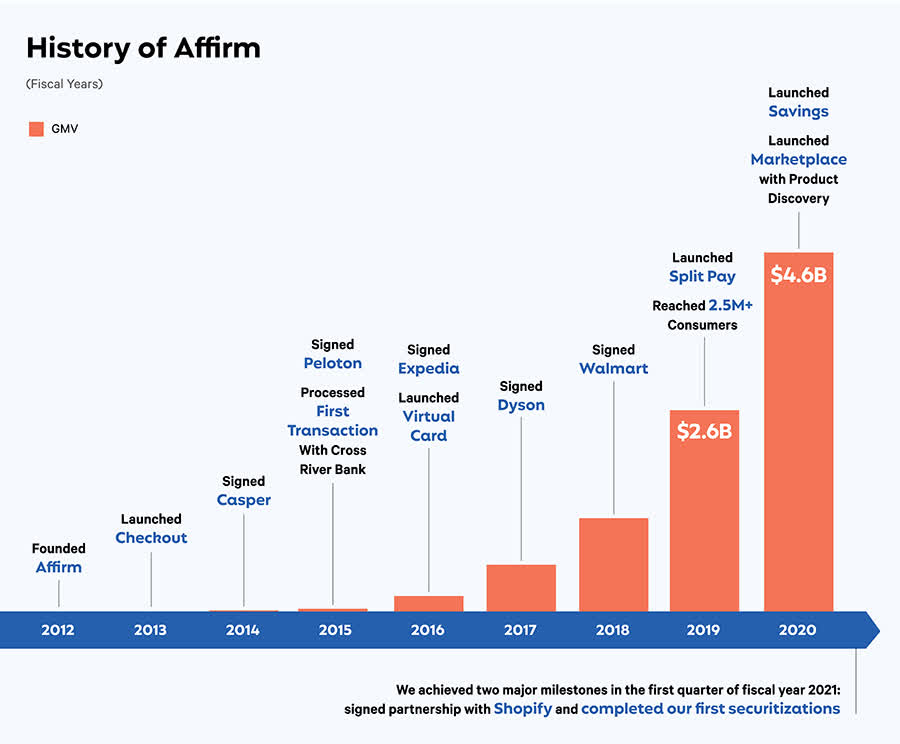

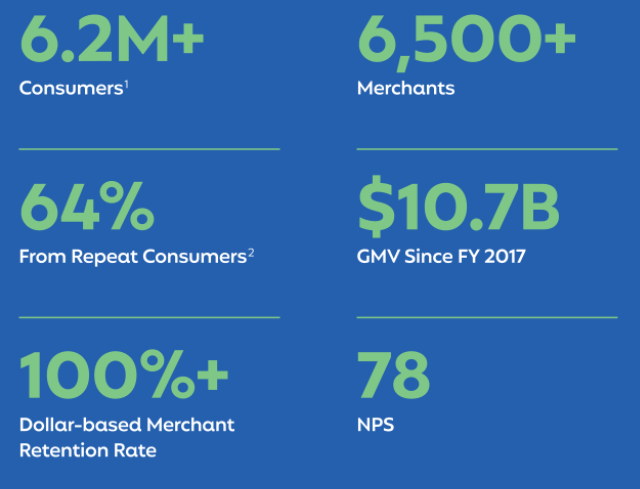

8/ From 2016 till FY20, over 6.2M customers completed 17.3M transactions across 6,500 merchants, accounting for $10.7B in GMV.

8/ $AFRM, however, is not yet profitable, incurring a $120M and $112M loss for FY 2019 and 2020, respectively.

9/ Two significant milestones achieved by the company this year were partnering with $SHOP and $ADYEY. With both, they can access huge merchant bases virtually overnight and with a single integration.

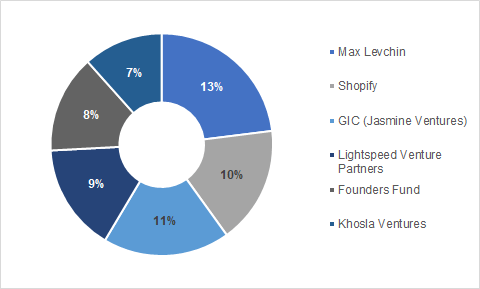

10/ Fun fact: Shopify is an investor in $AFRM. This will certainly help once their exclusivity agreement expires as their interests are aligned.

If they exercised their warrants, they'd own a ~10% of the company.

If they exercised their warrants, they'd own a ~10% of the company.

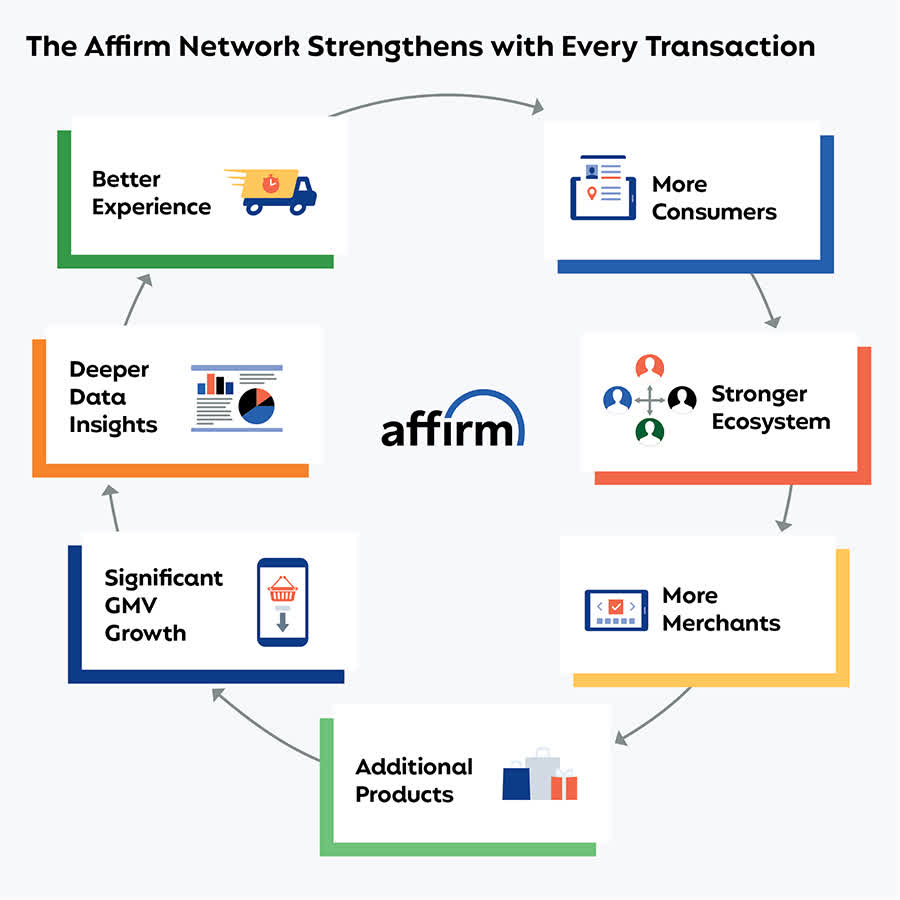

11/ The $AFRM flywheel is predicated on traditional marketplace network effects.

i.e. the more merchants and consumers use the platform, the more valuable it becomes.

i.e. the more merchants and consumers use the platform, the more valuable it becomes.

12/ There's a concentration risk on two fronts: $PTON (merchant) and Cross River Bank (banking partner).

As of 3 months ended Sept. 30, $PTON makes up 30% of $AFRM's revenue, up from 14% last year.

Affirm has been critiqued for this, but $PTON is the one who has kept it secret

As of 3 months ended Sept. 30, $PTON makes up 30% of $AFRM's revenue, up from 14% last year.

Affirm has been critiqued for this, but $PTON is the one who has kept it secret

13/ Nonetheless, while mutually beneficial, $PTON is the clear winner here.

They take on none of the consumer credit, incur zero balance sheet risk, and gain access to Affirm's user base.

Plus, with large merchants like these most purchases are 0% APR.

They take on none of the consumer credit, incur zero balance sheet risk, and gain access to Affirm's user base.

Plus, with large merchants like these most purchases are 0% APR.

14/ The problem with these loans is that they essentially function as zero coupon bonds, wherein $AFRM recognizes the discount upfront as revenue and cannot sell along without giving back a cut of its merchant fee to finance partners.

15/ Simply put, administrative costs are recurring while revenue is a one-time occurrence. These loans make up 46% of the total loan portfolio and could become a huge burden as the company grows.

Its solution, for now, is a batch of securitizations.

Its solution, for now, is a batch of securitizations.

16/ Competition is obviously an issue. Klarna is already the dominant player in Europe, while $AFTPY has established a foothold in the Pacific. Both companies are expanding—and growing—rapidly. https://twitter.com/saxena_puru/status/1333190384910958592?s=20

17/ And there's obviously regulation to contend with. In the US alone, compliance varies from state to state. Overseas, each market has an entirely different set of laws that govern the financial services industry.

18/ All in all, while the company has been buoyed by growth, strong partnerships, and a legendary CEO, the underlying fundamentals don't support and out-of-this-world valuation.

Its Series G valued the company at $5B, which will inevitably pale with its market cap.

Its Series G valued the company at $5B, which will inevitably pale with its market cap.

19/ Again, there are some things to like, but we don't see any differentiating factors yet.

While descriptions like these are harsh, there's a grain of truth in every joke. https://twitter.com/MarcRuby/status/1333067658145767428?s=20

While descriptions like these are harsh, there's a grain of truth in every joke. https://twitter.com/MarcRuby/status/1333067658145767428?s=20

20/ Catch the entire breakdown here: https://seekingalpha.com/article/4392869-affirm-be-cheering-on-sidelines-for-this-one

Read on Twitter

Read on Twitter