DoorDash is expected to IPO next Wednesday. The S-1 Club dug in.

- $1.9B revenue YTD

- 18M customers

- Contribution margin positive

H/t @ranjanxroy @cristinagberta @averyklemmer @thenewb @daveambrose @nanduanilal @michaelxbloch

@d_mccar https://thegeneralist.substack.com/p/doordash-the-value-of-speed

- $1.9B revenue YTD

- 18M customers

- Contribution margin positive

H/t @ranjanxroy @cristinagberta @averyklemmer @thenewb @daveambrose @nanduanilal @michaelxbloch

@d_mccar https://thegeneralist.substack.com/p/doordash-the-value-of-speed

1

$DASH in 1 minute.

- Insane revenue growth (+226% YTD)

- Expected valuation of $32B

- Highly-capitalized with $2.5B raised

- Exceptional management, led by Tony Xu

- Fierce competitive dynamics could cause trouble

- Concerns over market

$DASH in 1 minute.

- Insane revenue growth (+226% YTD)

- Expected valuation of $32B

- Highly-capitalized with $2.5B raised

- Exceptional management, led by Tony Xu

- Fierce competitive dynamics could cause trouble

- Concerns over market

2

Beginnings.

It all starts with Tony Xu. His family emigrated from China when he was 5. His mother worked in restaurants. He gained an understanding of the business at a young age.

Beginnings.

It all starts with Tony Xu. His family emigrated from China when he was 5. His mother worked in restaurants. He gained an understanding of the business at a young age.

3

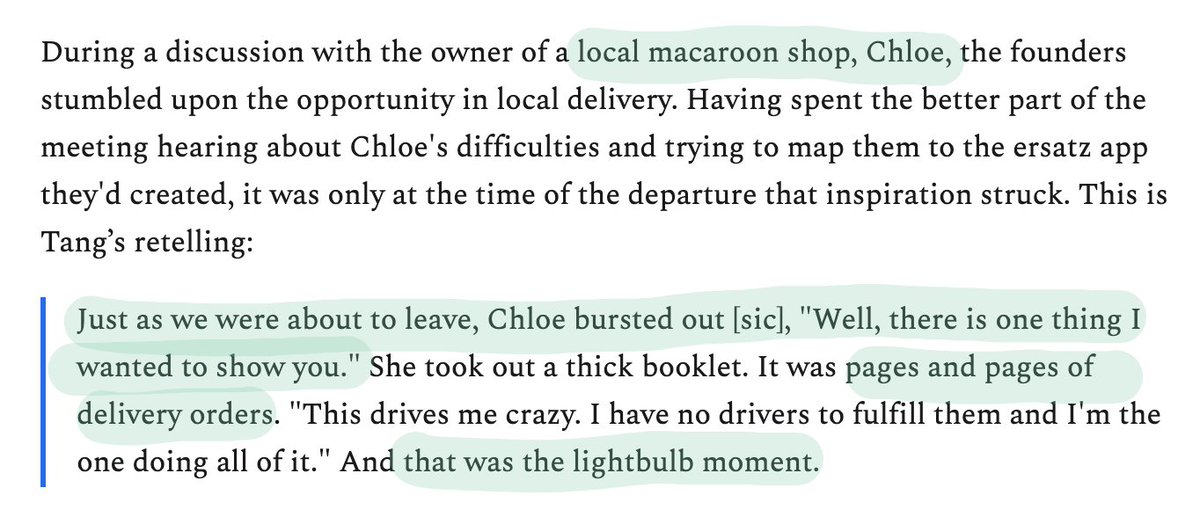

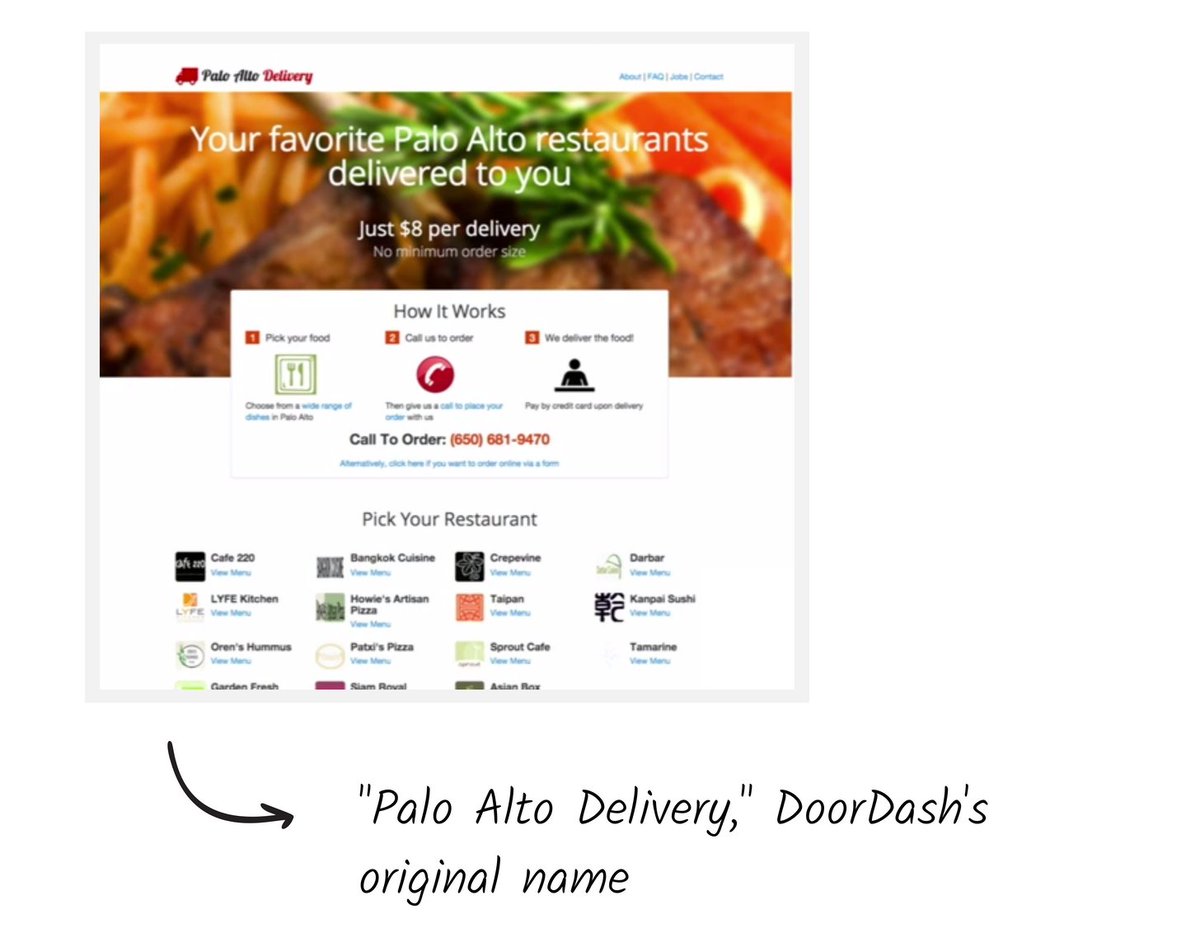

Stanford.

DoorDash's four founders met through "Startup Garage," a famous entrepreneurship class at the university. The recognized the opportunity in delivery after the owner of a macaroon store showed her binder full of delivery orders.

Palo Alto Delivery was born.

Stanford.

DoorDash's four founders met through "Startup Garage," a famous entrepreneurship class at the university. The recognized the opportunity in delivery after the owner of a macaroon store showed her binder full of delivery orders.

Palo Alto Delivery was born.

4

Pad thai.

It took less than an hour for Palo Alto Delivery to receive it's first order. Forty-five minutes after launching their website, they got an order for thai food.

The founders hopped into their car and dropped it off.

Pad thai.

It took less than an hour for Palo Alto Delivery to receive it's first order. Forty-five minutes after launching their website, they got an order for thai food.

The founders hopped into their car and dropped it off.

5

Momentum.

The orders kept growing. One phone call became two, which became 10.

I imagine these early days in montage: answering phones during lectures, noting orders in a Google Doc, flyering University Avenue.

Momentum.

The orders kept growing. One phone call became two, which became 10.

I imagine these early days in montage: answering phones during lectures, noting orders in a Google Doc, flyering University Avenue.

6

Money.

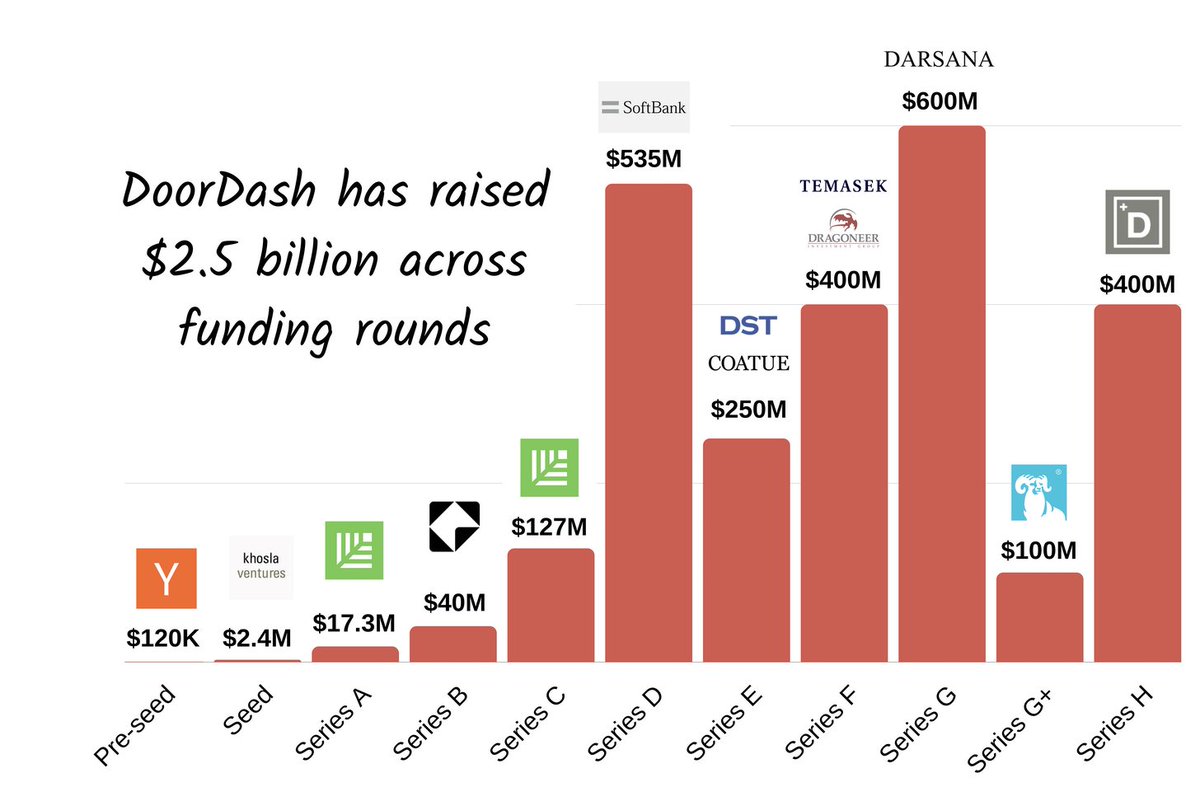

Within a couple months, DoorDash was accepted into YC. More funding followed. Kholsa led the seed with participation from CRV.

In total, DoorDash would raise $2.5 billion.

Money.

Within a couple months, DoorDash was accepted into YC. More funding followed. Kholsa led the seed with participation from CRV.

In total, DoorDash would raise $2.5 billion.

7

Trouble.

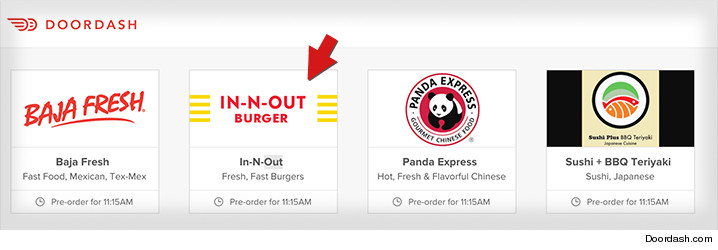

DoorDash's rise was not without its problems. In 2015, merchants got angry over being listed on the platform without their permission.

In-N-Out was one of them. They didn't want DoorDash to deliver their food. They sued.

Trouble.

DoorDash's rise was not without its problems. In 2015, merchants got angry over being listed on the platform without their permission.

In-N-Out was one of them. They didn't want DoorDash to deliver their food. They sued.

8

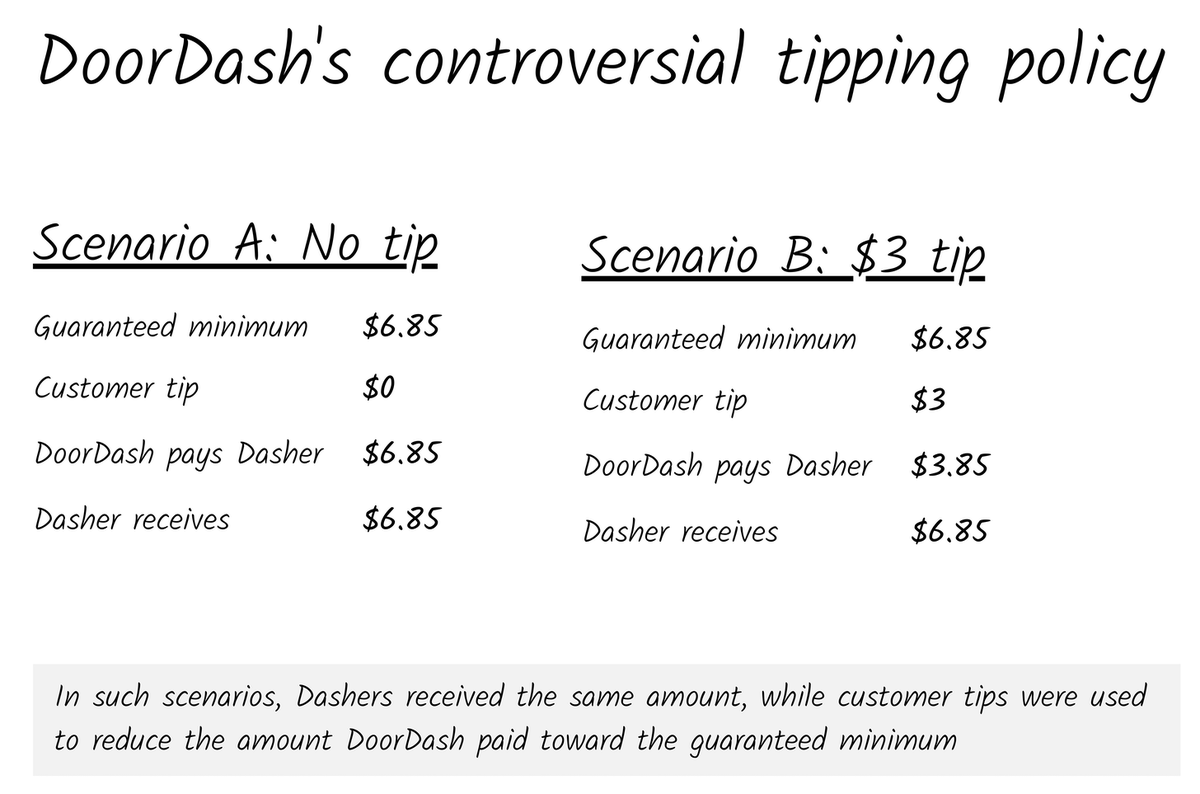

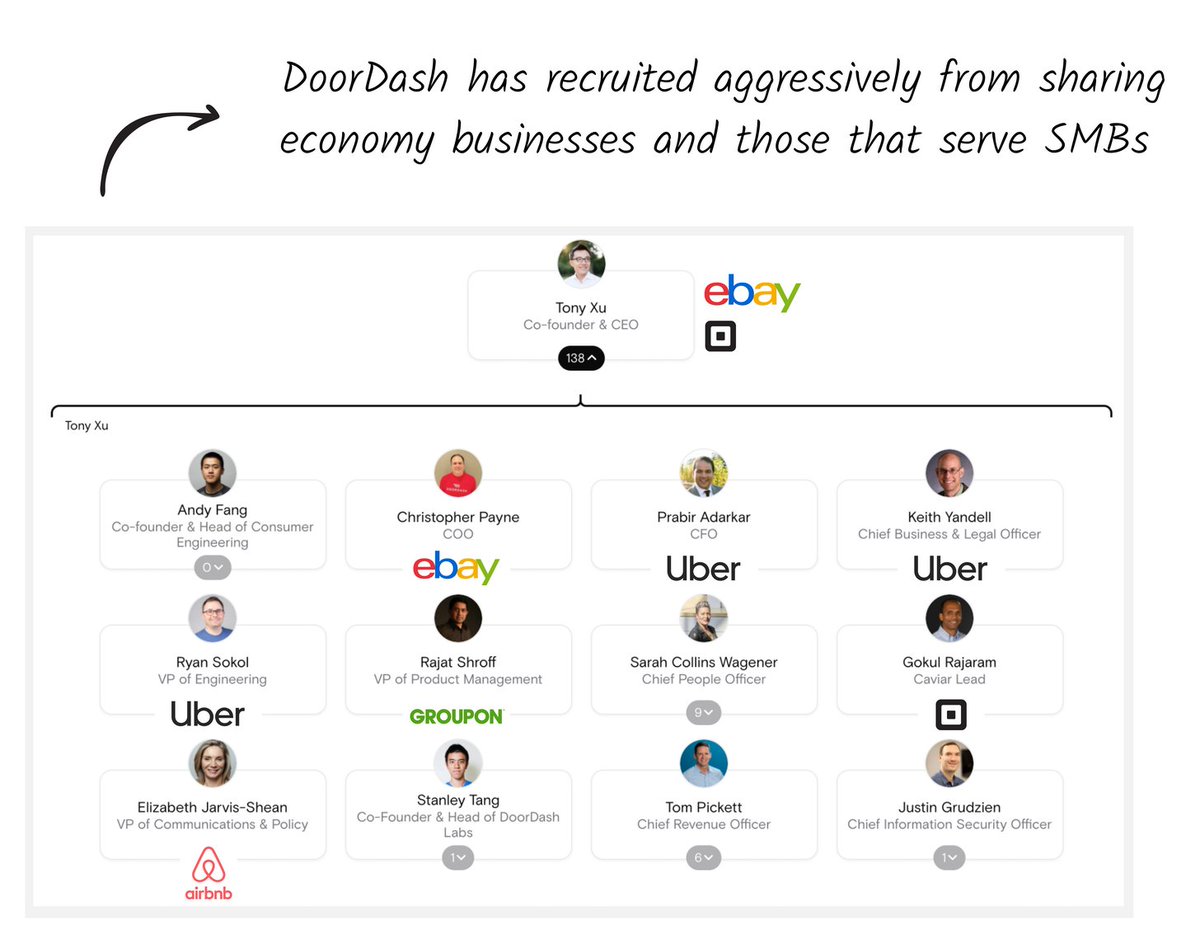

Tipping.

Another controversy was $DASH's tipping policy. When a consumer decided to add a tip, that $$ often didn't end up in a Dasher's hands.

$DASH changed the policy. But it can still be hard to make a living as a Dasher. One study suggests average pay is $1.45/hr.

Tipping.

Another controversy was $DASH's tipping policy. When a consumer decided to add a tip, that $$ often didn't end up in a Dasher's hands.

$DASH changed the policy. But it can still be hard to make a living as a Dasher. One study suggests average pay is $1.45/hr.

9

Pandemic.

$DASH was already crushing it. But c-19 hasn't hurt. Revenue has jumped 226% YoY over the first 9 months of 2020.

It also recalibrated DoorDash's narrative. Suddenly, a luxury service felt increasingly essential.

Pandemic.

$DASH was already crushing it. But c-19 hasn't hurt. Revenue has jumped 226% YoY over the first 9 months of 2020.

It also recalibrated DoorDash's narrative. Suddenly, a luxury service felt increasingly essential.

10

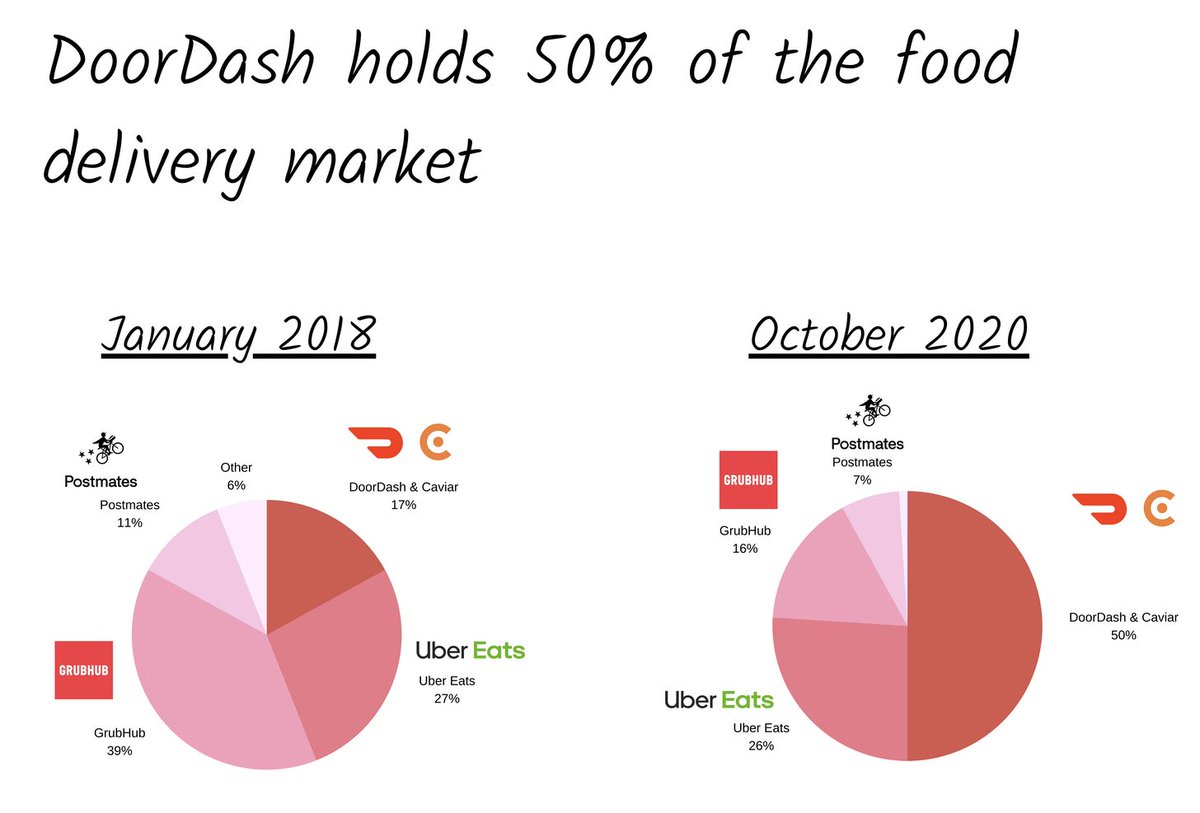

Market.

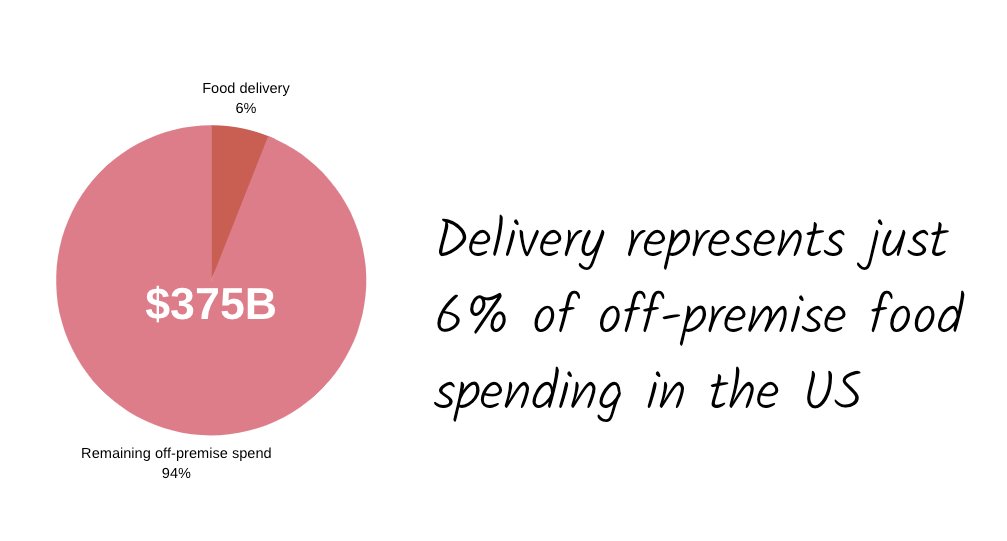

The pandemic may have temporarily pulled forward food delivery usage. As it stands delivery represents 6% of the $375B spent on food "off-premises."

This implies a US market size of $22.5B for DoorDash's core product.

Market.

The pandemic may have temporarily pulled forward food delivery usage. As it stands delivery represents 6% of the $375B spent on food "off-premises."

This implies a US market size of $22.5B for DoorDash's core product.

11

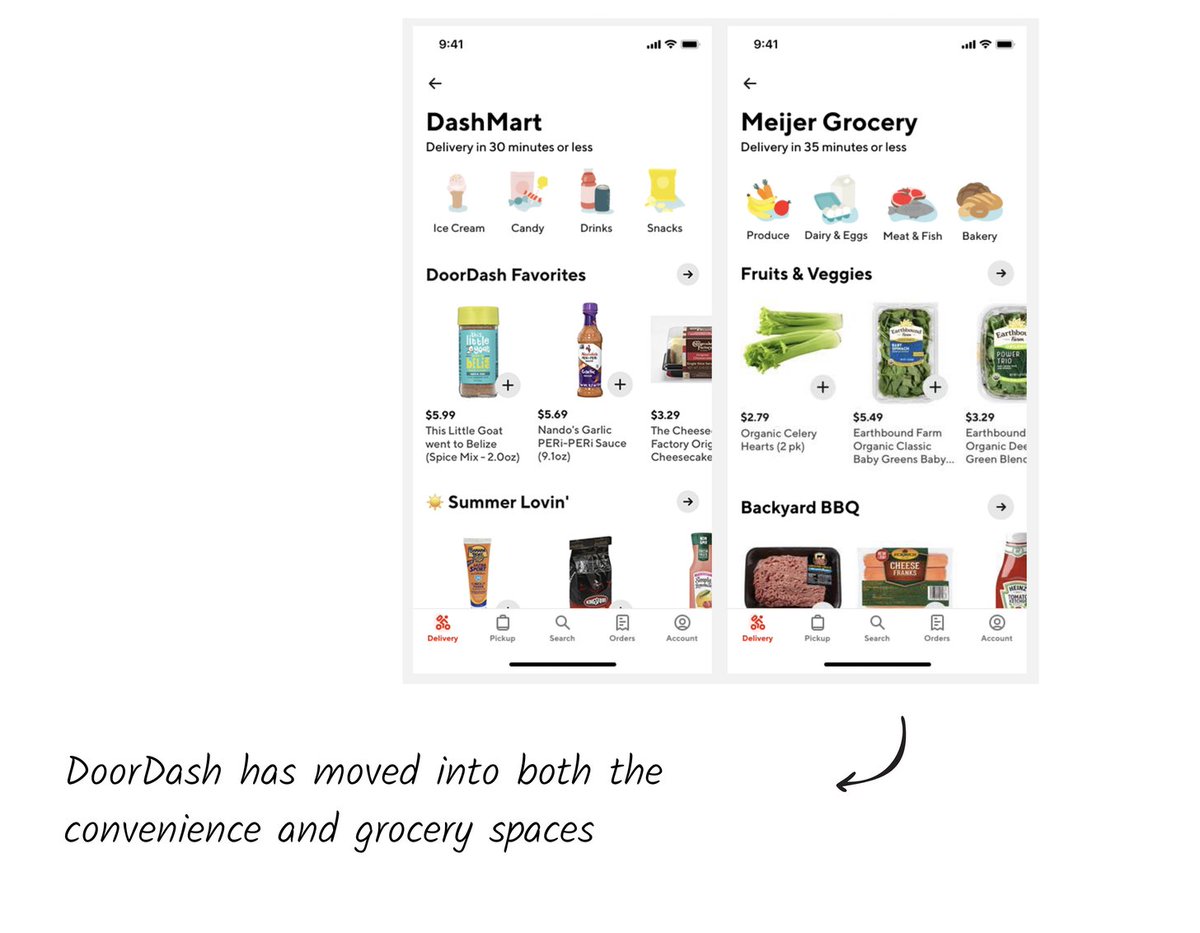

Saturation.

DoorDash is the biggest US player, with 50% share. It's expected to be valued at $32B, significantly more than the total food delivery market...

This explains why DoorDash has moved beyond its core product, edging into convenience + grocery.

Saturation.

DoorDash is the biggest US player, with 50% share. It's expected to be valued at $32B, significantly more than the total food delivery market...

This explains why DoorDash has moved beyond its core product, edging into convenience + grocery.

12

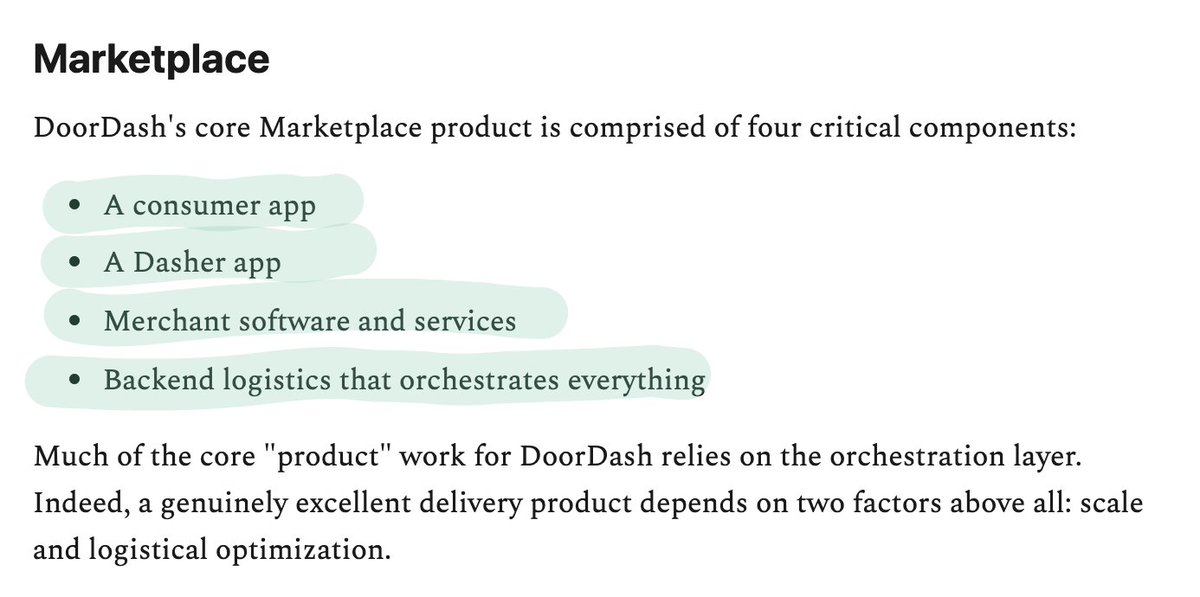

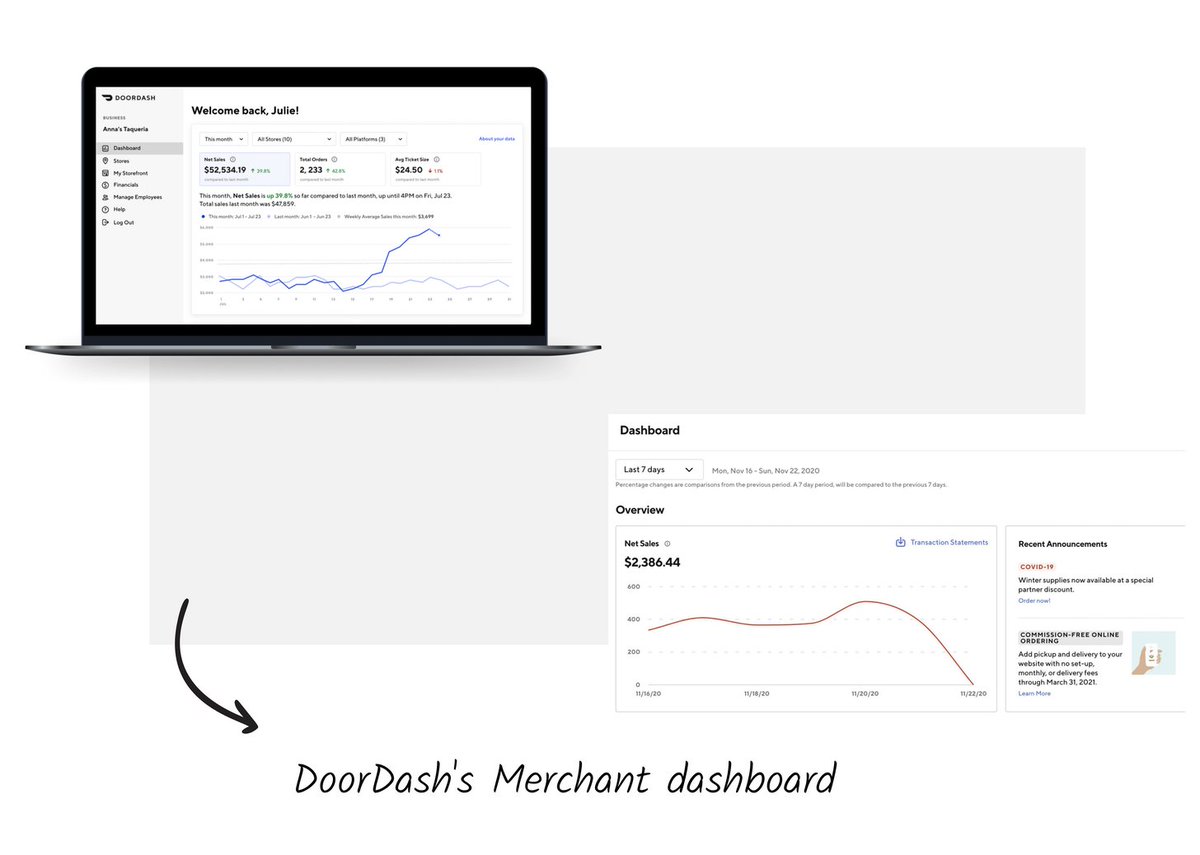

Core product.

The core product is food delivery. Of course. This entails:

- A consumer app

- A Dasher app

- Merchant software and services

- Backend logistics

The logistics are what matter most. Without an efficient backend, DoorDash couldn't deliver a good experience.

Core product.

The core product is food delivery. Of course. This entails:

- A consumer app

- A Dasher app

- Merchant software and services

- Backend logistics

The logistics are what matter most. Without an efficient backend, DoorDash couldn't deliver a good experience.

13

Other products.

DoorDash offers a range of products beyond food delivery.

- Drive: Order fulfillment (just logistics)

- Storefront: White-label ordering software

- DashMart: Access to convenience store items

- Grocery: Delivery via partners

Other products.

DoorDash offers a range of products beyond food delivery.

- Drive: Order fulfillment (just logistics)

- Storefront: White-label ordering software

- DashMart: Access to convenience store items

- Grocery: Delivery via partners

14

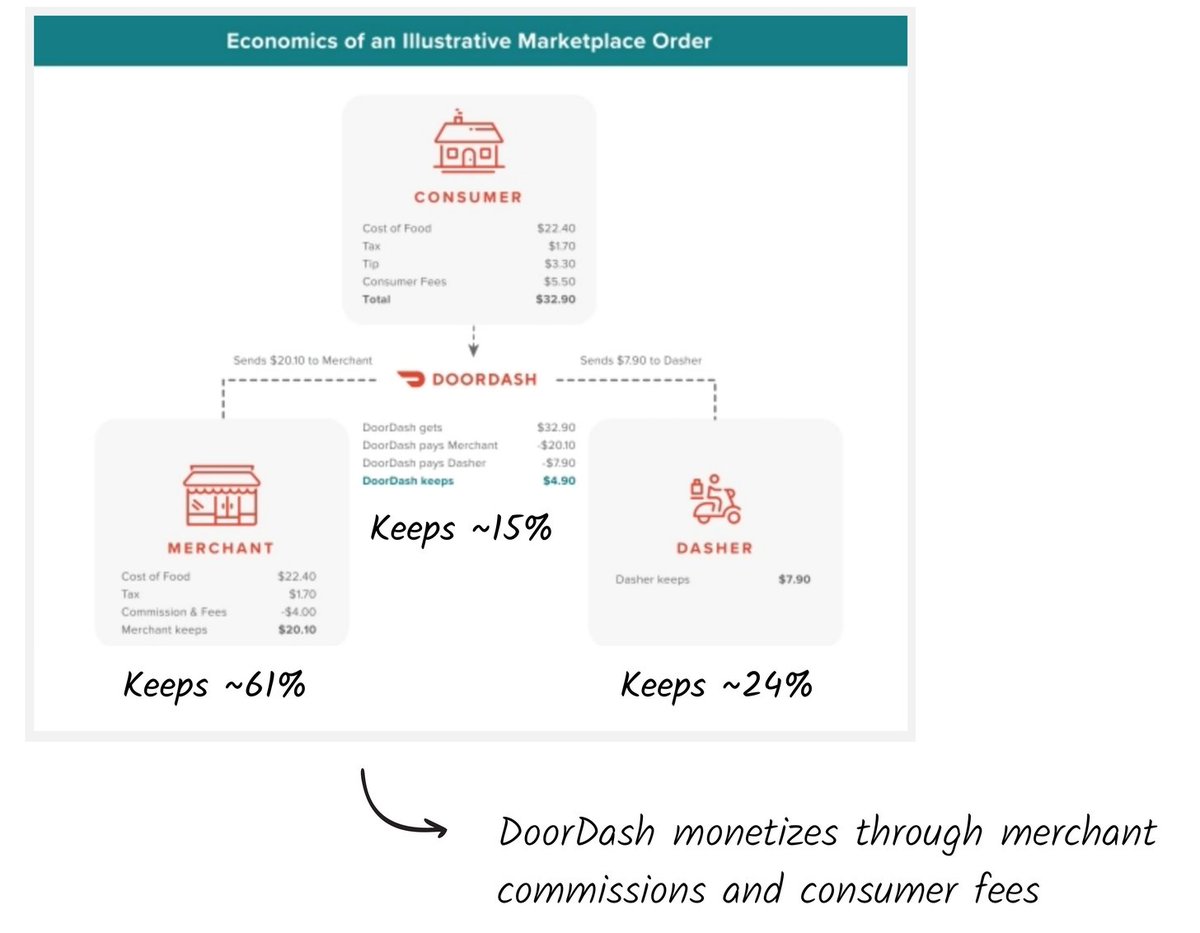

Business model.

$DASH makes money from consumer fees, and merchant commissions. An example:

- Consumer pays: ~$33

- Merchant gets: ~$20 (61% of total)

- Dasher gets: ~$8 (24%)

- DoorDash gets: ~$5 (15%)

Merchants give up ~40% on orders through the platform.

Business model.

$DASH makes money from consumer fees, and merchant commissions. An example:

- Consumer pays: ~$33

- Merchant gets: ~$20 (61% of total)

- Dasher gets: ~$8 (24%)

- DoorDash gets: ~$5 (15%)

Merchants give up ~40% on orders through the platform.

15

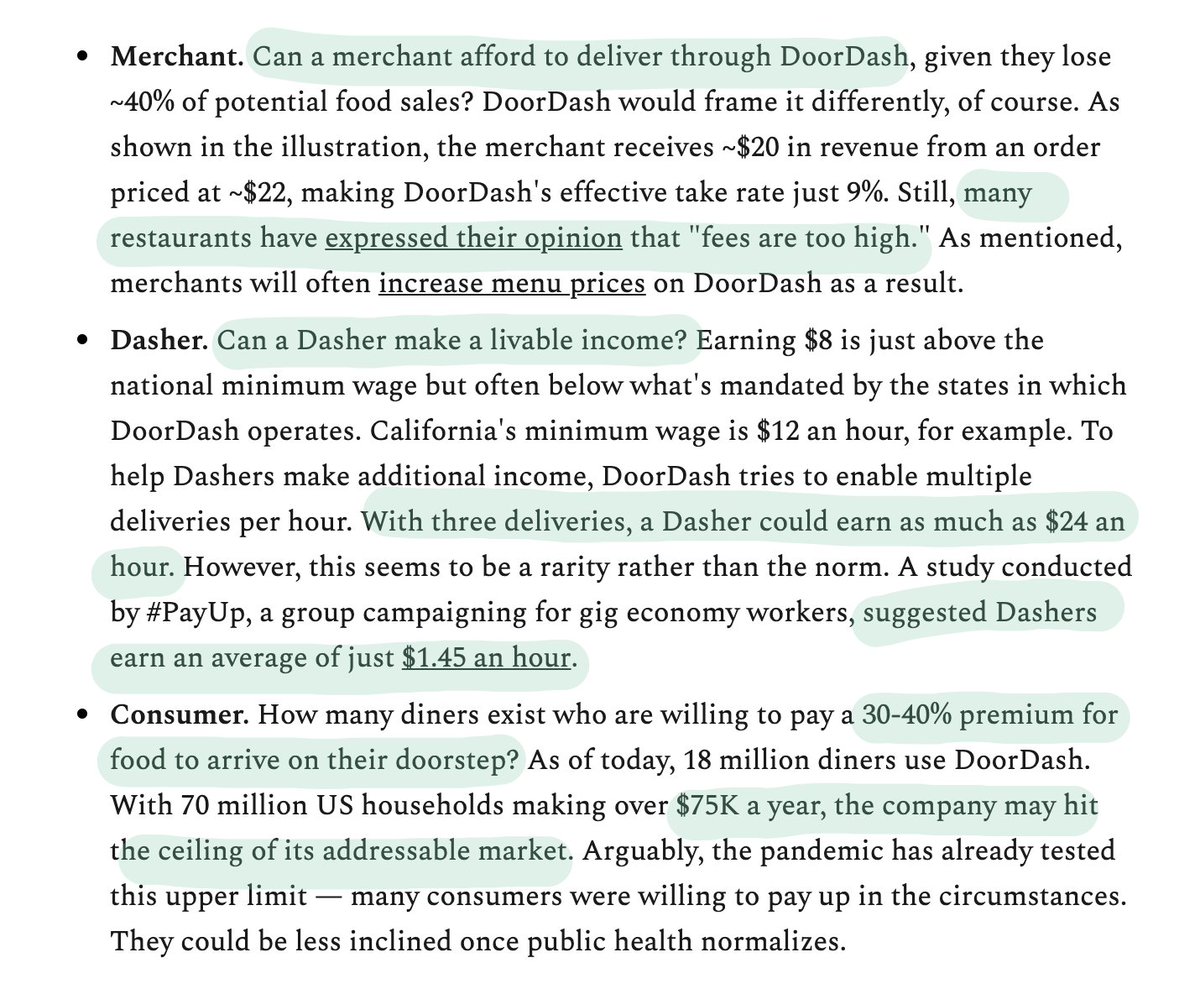

Xu.

By all accounts, Xu is an impressive CEO. He's overseen extraordinary growth and seems to be well-liked.

GlassDoor data suggests he compares favorably to other food delivery CEOs.

Xu.

By all accounts, Xu is an impressive CEO. He's overseen extraordinary growth and seems to be well-liked.

GlassDoor data suggests he compares favorably to other food delivery CEOs.

16

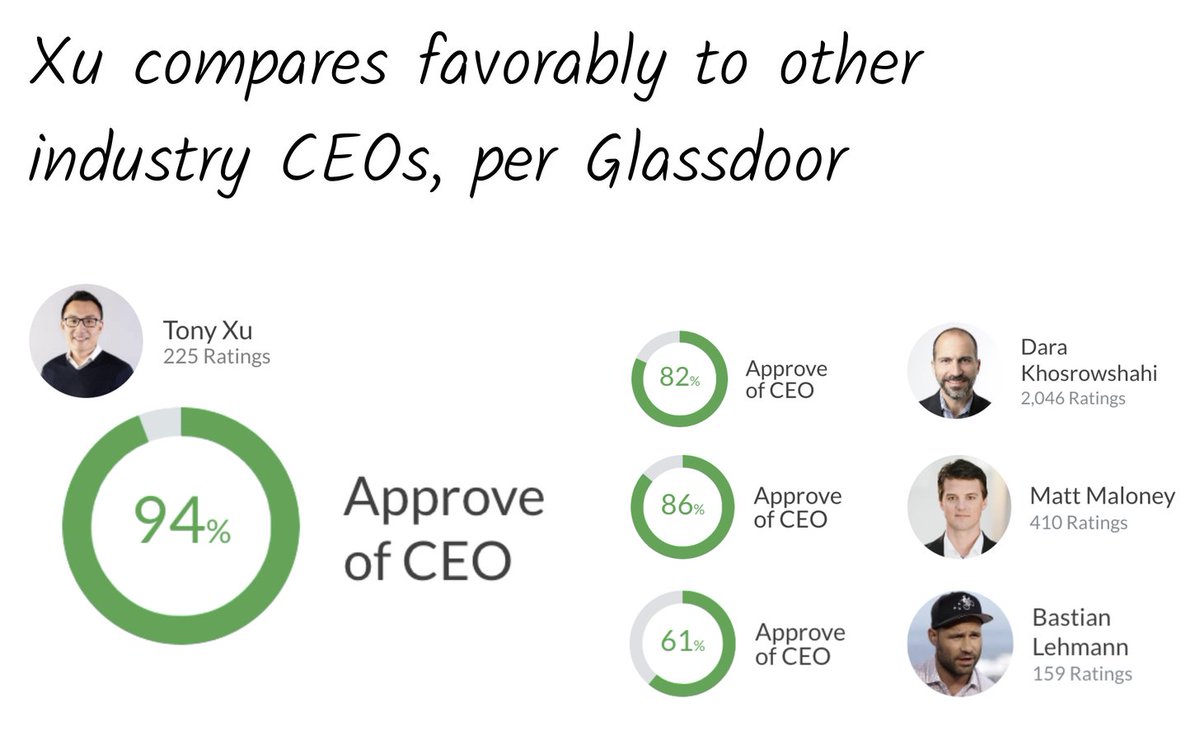

Management.

Xu worked at eBay and Square before DoorDash. He's assembled lieutenants from his old haunts, plus other large marketplaces serving SMBS.

Management.

Xu worked at eBay and Square before DoorDash. He's assembled lieutenants from his old haunts, plus other large marketplaces serving SMBS.

17

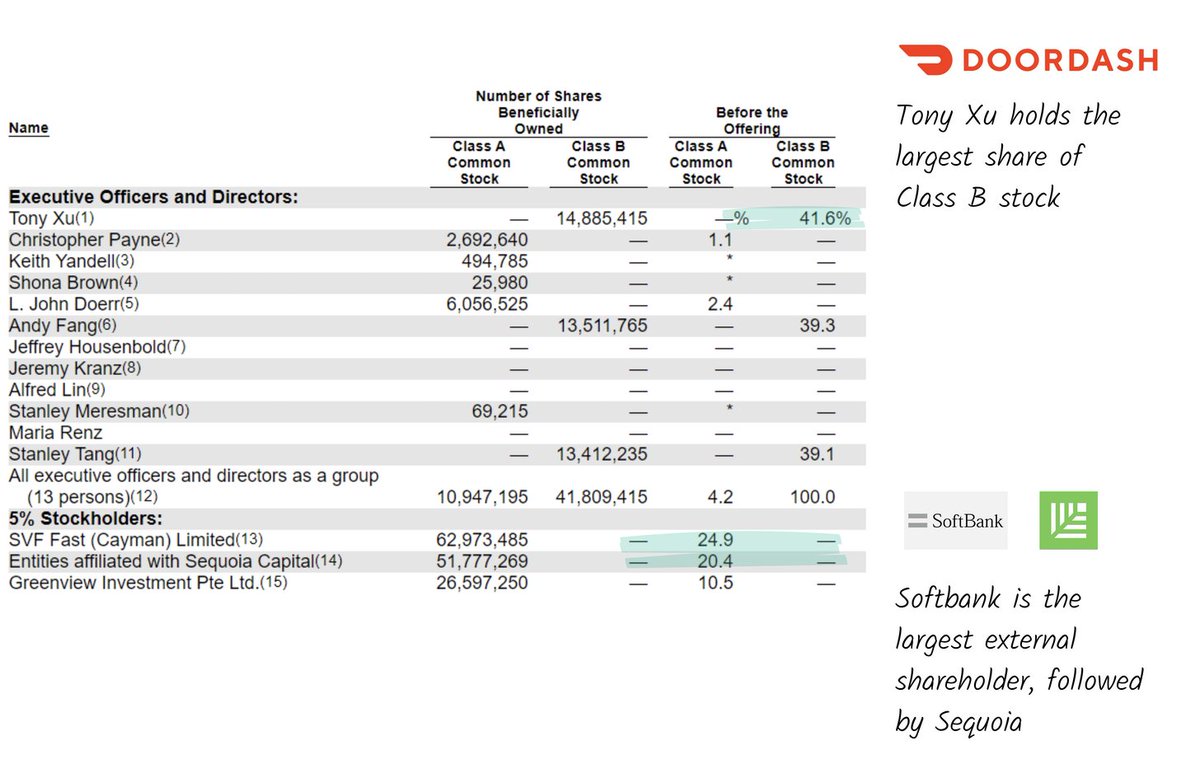

Investors.

As mentioned, DoorDash is highly-capitalized. That means that its earliest investors have been heavily diluted. Not that they'll mind too much.

The biggest external shareholders are SoftBank, Sequoia, and Singapore's sovereign wealth fund.

Investors.

As mentioned, DoorDash is highly-capitalized. That means that its earliest investors have been heavily diluted. Not that they'll mind too much.

The biggest external shareholders are SoftBank, Sequoia, and Singapore's sovereign wealth fund.

18

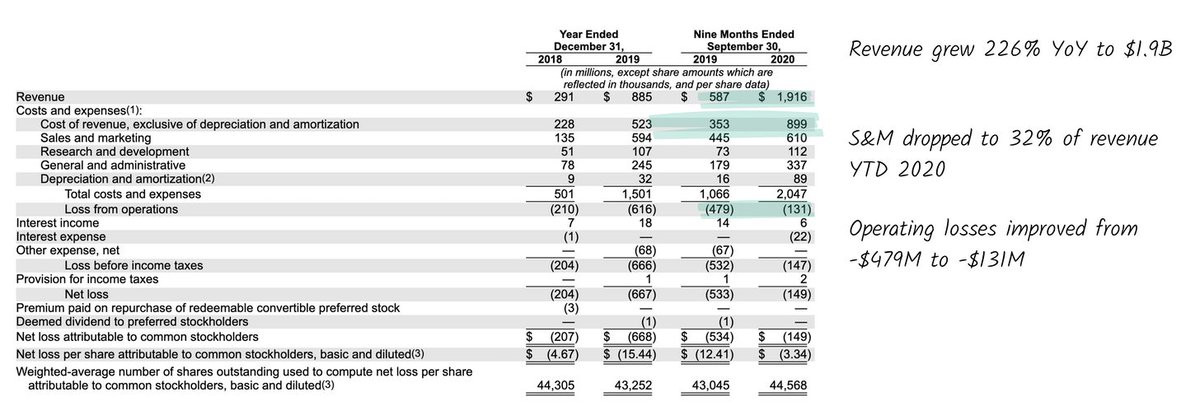

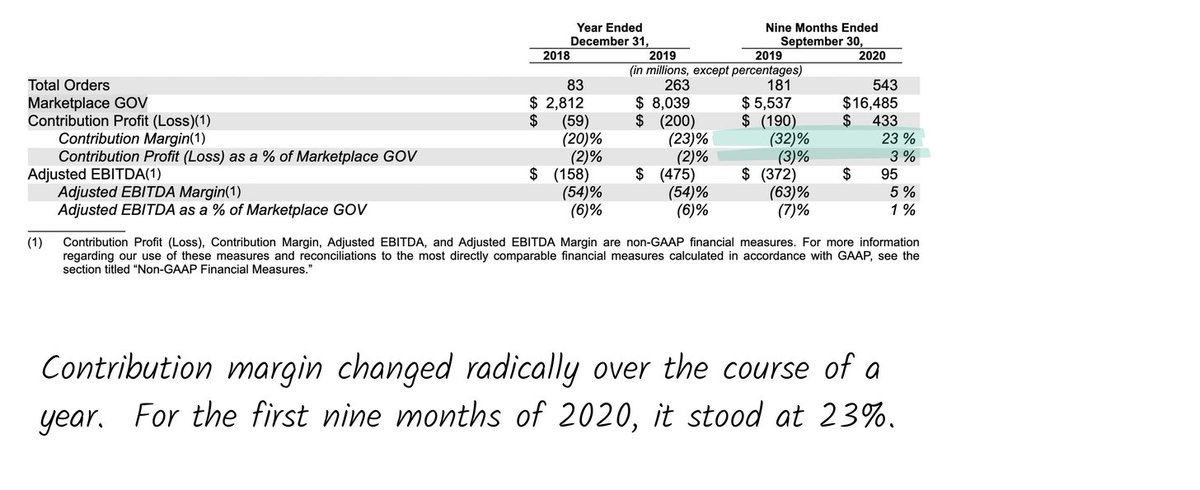

Financials.

Lots to go into here. At a very high-level:

- Revenue growing fast

- S&M and cost of revenue dropping as a % of rev

- Operating losses shrinking

- Contribution margin positive

Financials.

Lots to go into here. At a very high-level:

- Revenue growing fast

- S&M and cost of revenue dropping as a % of rev

- Operating losses shrinking

- Contribution margin positive

19

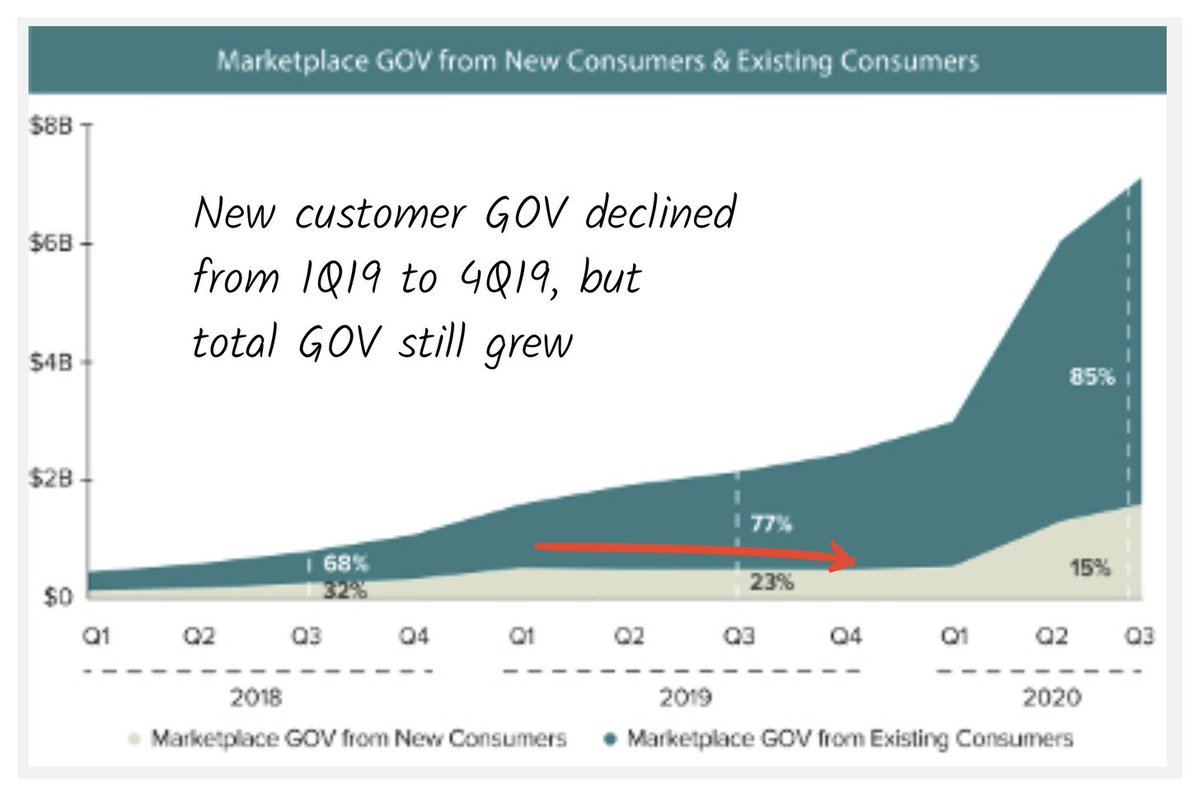

Unit economics.

Some remarkable work from @d_mccar allowed us to triangulate likely unit economics.

- CAC: $6

- AOV: $30

- LTV: $60 (over 5 years)

Lots more context in the piece. But the high-level picture is of a company with a healthy CAC/LTV.

Unit economics.

Some remarkable work from @d_mccar allowed us to triangulate likely unit economics.

- CAC: $6

- AOV: $30

- LTV: $60 (over 5 years)

Lots more context in the piece. But the high-level picture is of a company with a healthy CAC/LTV.

20

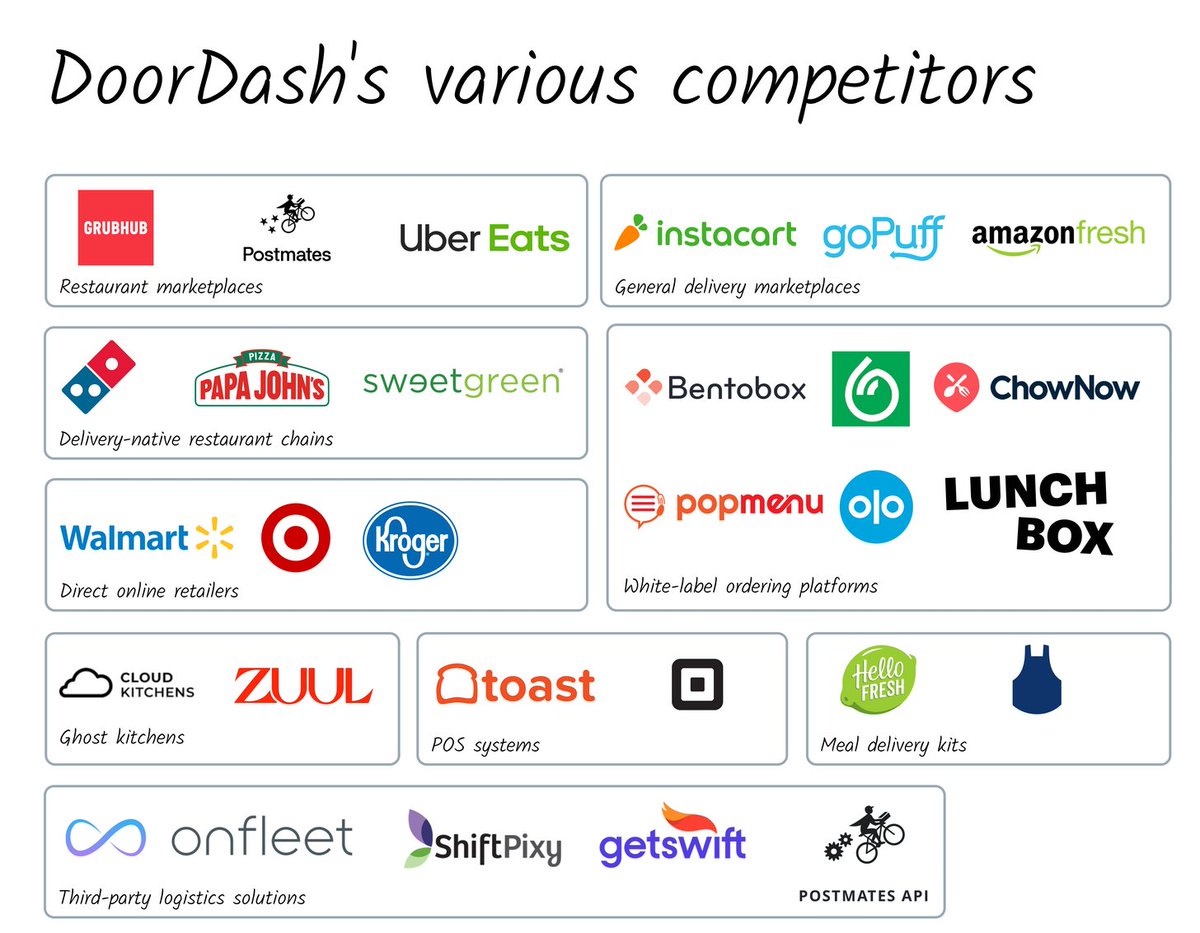

Competition.

In so much as DoorDash wants to capture *all* off-premise food spend, plus grocery and local delivery, it competes with a wide range of businesses.

Competition.

In so much as DoorDash wants to capture *all* off-premise food spend, plus grocery and local delivery, it competes with a wide range of businesses.

21

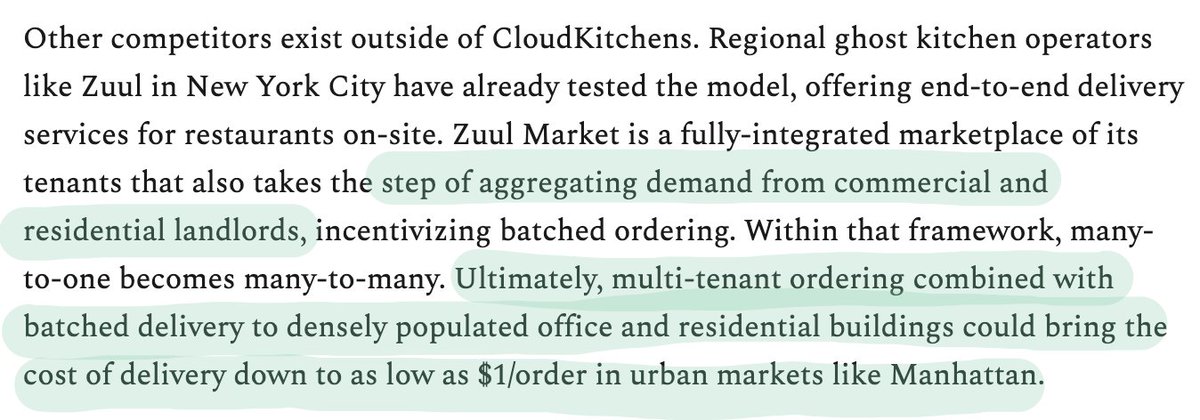

Ghosts.

Businesses like Uber Eats are the more immediate threat, ghost kitchens represent a long term concern.

Co.'s like TK's CloudKitchens change the delivery model. Instead of one-to-one (restaurant-to-customer), ghost kitchens are many-to-one, or even many-to-many.

Ghosts.

Businesses like Uber Eats are the more immediate threat, ghost kitchens represent a long term concern.

Co.'s like TK's CloudKitchens change the delivery model. Instead of one-to-one (restaurant-to-customer), ghost kitchens are many-to-one, or even many-to-many.

22

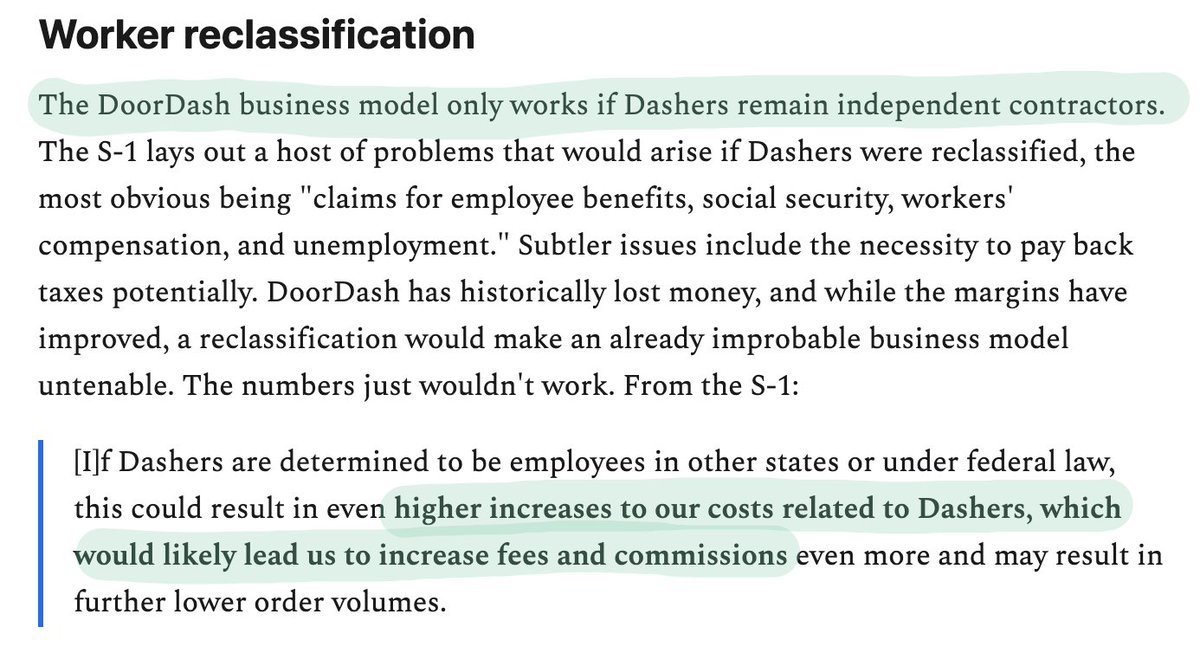

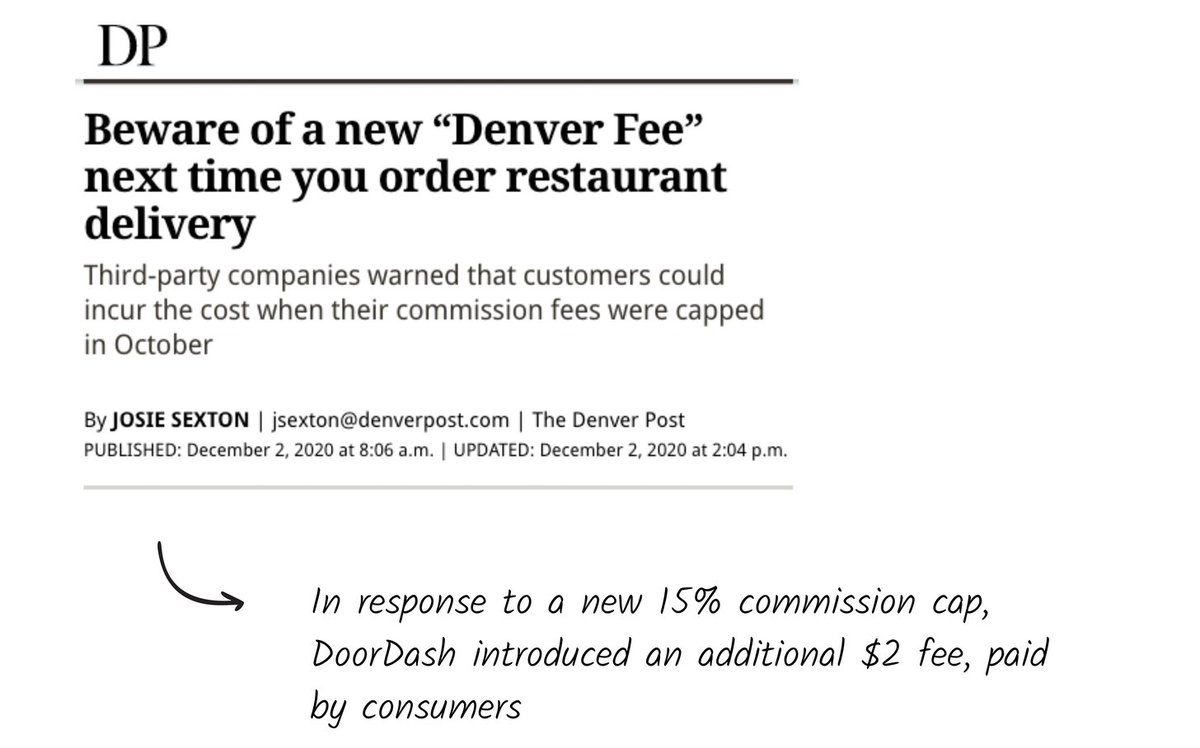

Existential risk.

If $DASH's delivery force are reclassified as employees, the company would suffer. It might even meet its demise. The fundamental cost structure would change massively.

Commission caps, like those imposed in Denver, are another thorny regulatory issue.

Existential risk.

If $DASH's delivery force are reclassified as employees, the company would suffer. It might even meet its demise. The fundamental cost structure would change massively.

Commission caps, like those imposed in Denver, are another thorny regulatory issue.

23

Why now?

The stars have aligned. DoorDash has $1.6B in cash on the balance sheet, but they couldn't have planned for better circumstances.

- Absurd revenue growth

- Pandemic-aided narrative shift

- A market incandescing over IPOs

- Passage of Prop 22

Why now?

The stars have aligned. DoorDash has $1.6B in cash on the balance sheet, but they couldn't have planned for better circumstances.

- Absurd revenue growth

- Pandemic-aided narrative shift

- A market incandescing over IPOs

- Passage of Prop 22

There's a lot more to dig into, including DoorDash's geographical weaknesses, challenges from businesses like ChowNow, and the sleeping threat of drive-through.

Check out the full briefing.

https://thegeneralist.substack.com/publish/post/21778836

Check out the full briefing.

https://thegeneralist.substack.com/publish/post/21778836

Read on Twitter

Read on Twitter