Coincidentally I was also looking at $ROOT recently. It does raise too many question marks for me. Some additional thoughts below.

But first, please consider subscribing to @BearCaveEmail @StockJabber. https://twitter.com/StockJabber/status/1334525062268006402

But first, please consider subscribing to @BearCaveEmail @StockJabber. https://twitter.com/StockJabber/status/1334525062268006402

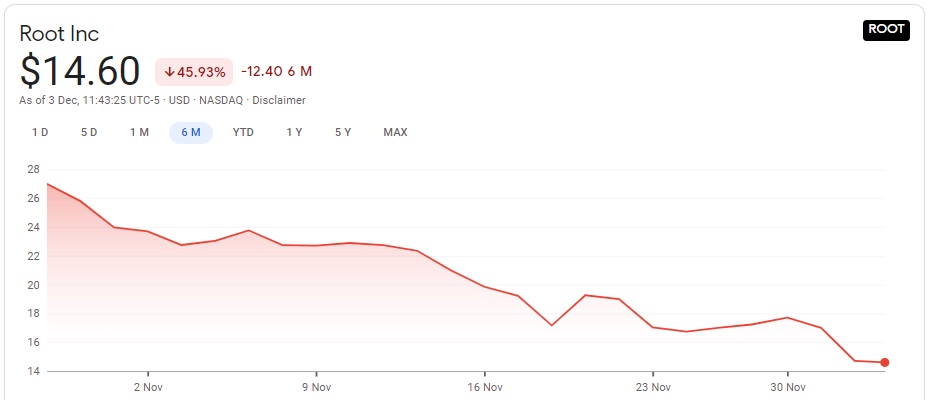

1st of all, not a good look. $ROOT's stock is down 46%!!! from their $27 IPO price (28 Oct). Not a stock price, bro, but didn't even pop on the first day & down 40% in the 1st month + in this crazy Nov 2020 certainly doesn't smell right.

The long thesis of $ROOT is quite straightforward, but each element requires quite a bit of make belief. I sum it as:

- data collection by phone sensors/ mobile app is accurate enough

- third party telematics data is insufficient or fast enough to be integrated into claims data

- data collection by phone sensors/ mobile app is accurate enough

- third party telematics data is insufficient or fast enough to be integrated into claims data

- so $ROOT's model will have the best predictive power based on a PURELY behaviour-based approach

- great pricing + customer claims experience is great enough to retain customers & reduce churn

- get reinsurance to reduce capital requirements & be capital-light

- great pricing + customer claims experience is great enough to retain customers & reduce churn

- get reinsurance to reduce capital requirements & be capital-light

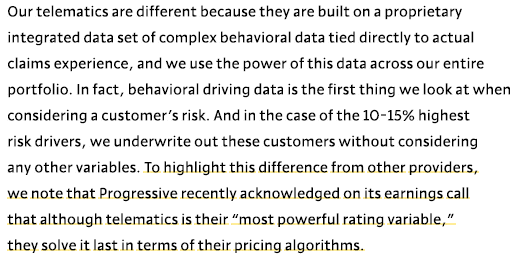

- $ROOT's pure play telematics will beat legacy insurers who are slow to move

- renewal customers will have lower accident loss ratio

- starting renter & homeowners insurance to cross sell (thus directly competing with more legacy P&C & also $LMND)

- renewal customers will have lower accident loss ratio

- starting renter & homeowners insurance to cross sell (thus directly competing with more legacy P&C & also $LMND)

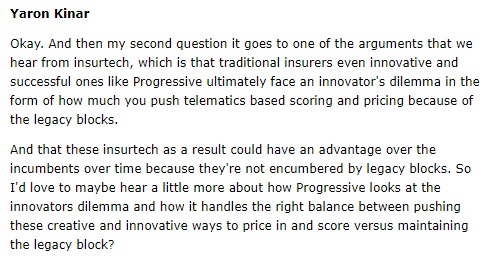

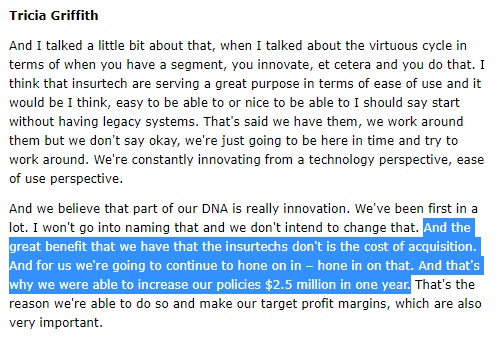

Someone asked $PGR about telematics recently in their earnings call, with the question clearly phrased about $ROOT's claims of an innovator's dilemma.

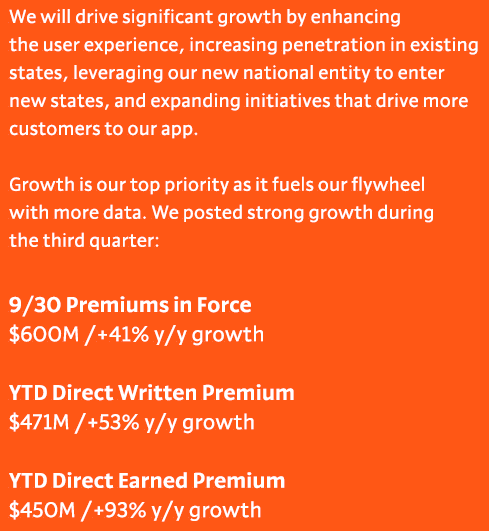

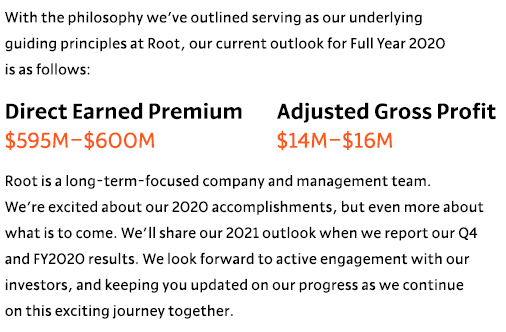

Well, you might say, $ROOT is a young upstart with huge growth right? It's ok to make some claims (pun intended) & incur some losses. Don't look at the profits or GAAP numbers, look at direct earned premium.

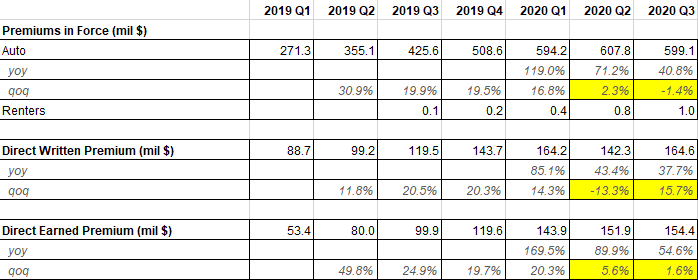

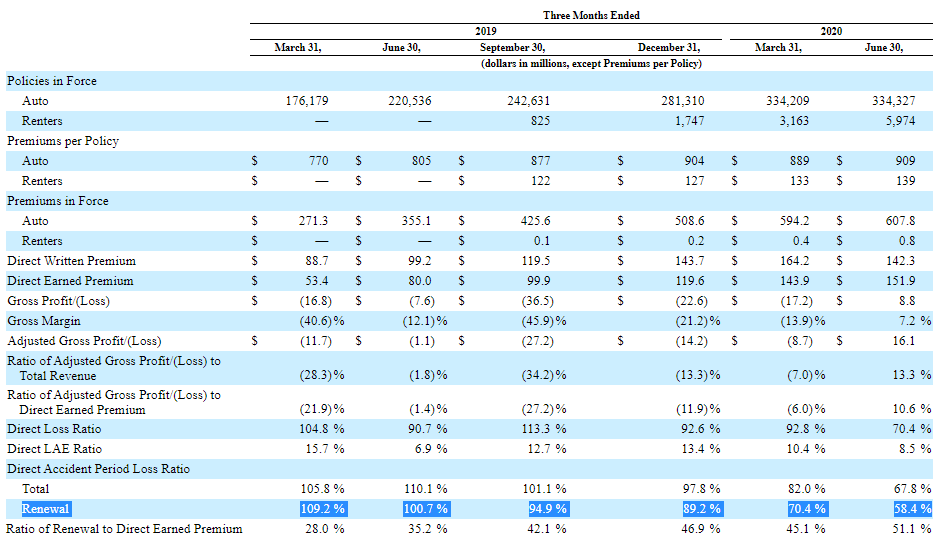

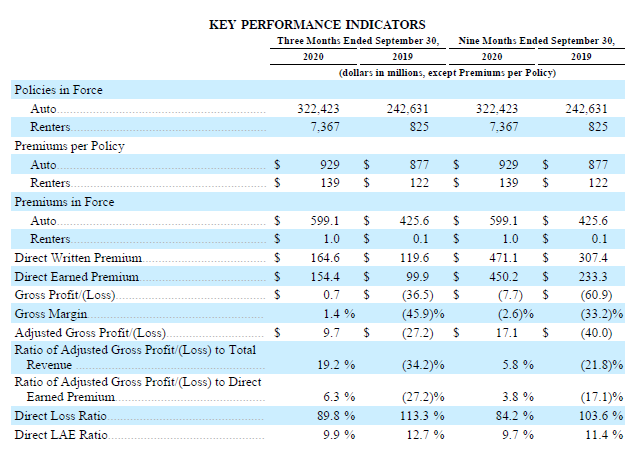

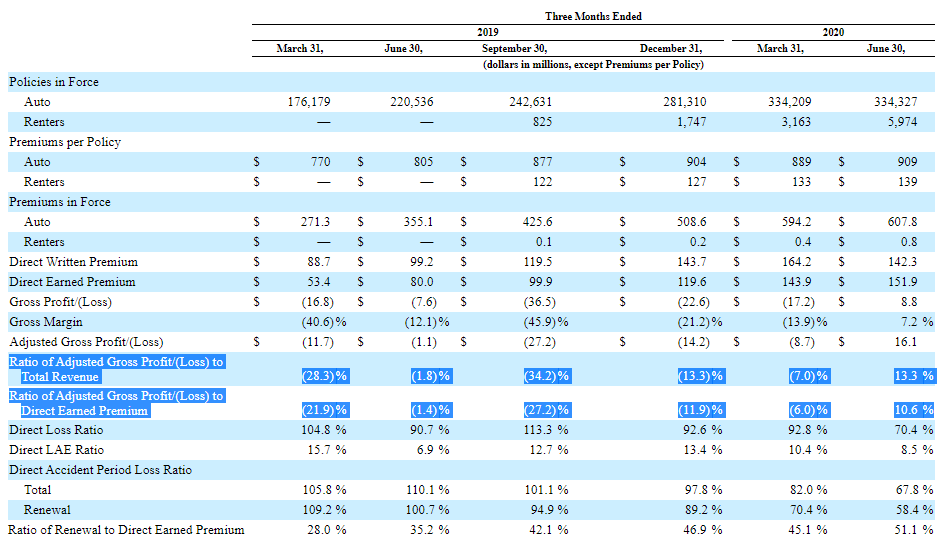

But wait, all these three metrics you just said were important looked terrible on a sequential basis. $ROOT

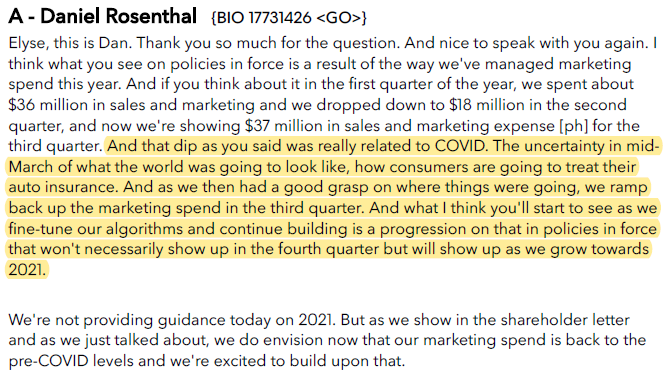

What happened there? Someone asked why $ROOT policies in force slowed sequentially during the earnings call & here's the answer. It's because of "marketing spend".

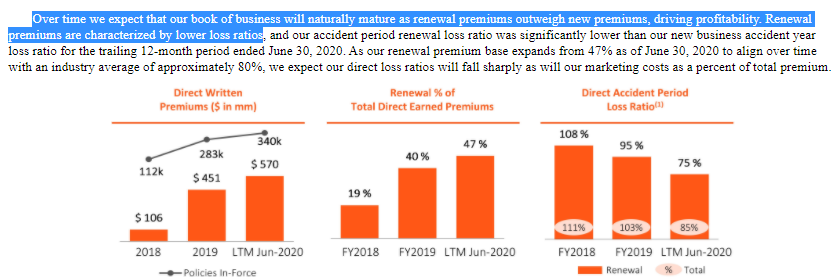

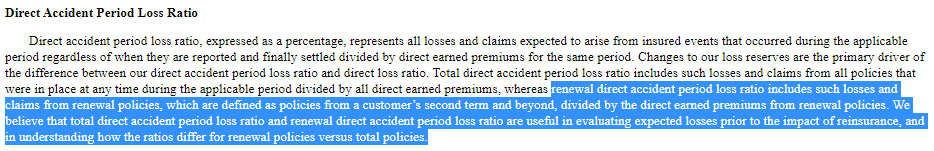

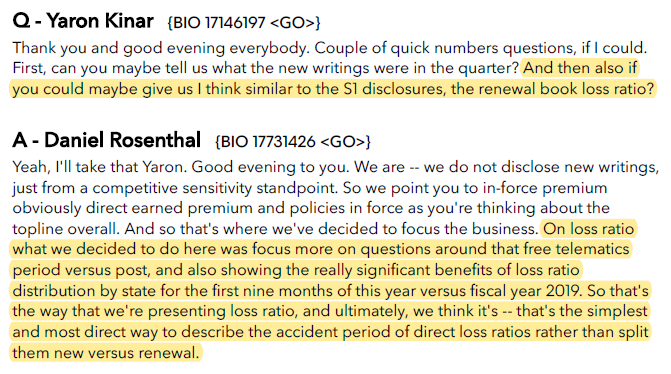

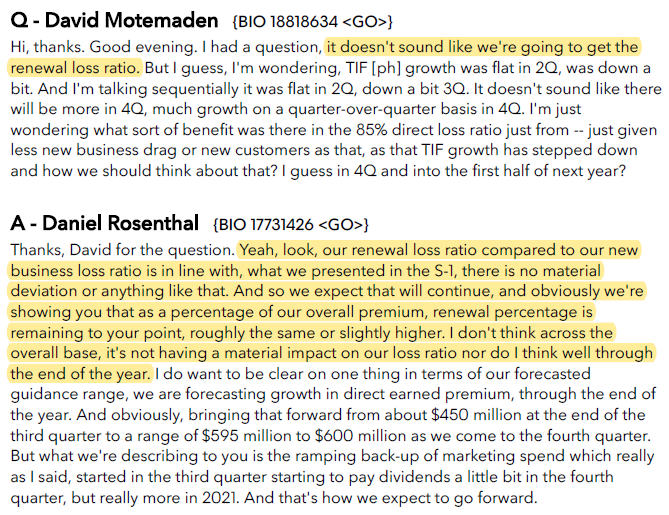

And what about renewal loss ratio, if $ROOT's model is so powerful & your customer retention is great, then renewal loss should be a great metric to demonstrate that. And that's exactly what they claimed in the S-1.

But wait, how come this metric disappeared from $ROOT's 2020 Q3 shareholders' letter?

So my feelings about $ROOT is that

- growth not that fast, TAM not that big, $PGR, Geico/ $BRK not that lousy

- is your model really better? are you a real first mover simply because telematics/ behaviour is the number 1 factor in pricing your insurance offering?

- growth not that fast, TAM not that big, $PGR, Geico/ $BRK not that lousy

- is your model really better? are you a real first mover simply because telematics/ behaviour is the number 1 factor in pricing your insurance offering?

- and does $ROOT deserve a software/ tech valuation instead of a normal P&C insurer valuation (& not even a great P&C at the moment)

- LTM revenue of 400mil, LTM direct earned premium of 570mil vs currently still 3.8bil EV

- LTM revenue of 400mil, LTM direct earned premium of 570mil vs currently still 3.8bil EV

- And great tech company! How do you like our <3% of Adjusted GROSS profit / direct earned premium for this year where accident claims have been historically low?

$ROOT

$ROOT

Maybe I will turn out to be wrong in a few years when their written premiums skyrocket & loss ratios improved dramatically. But otherwise, I really cannot see why $ROOT deserves such a valuation, even after crashing half post IPO.

/END

/END

Read on Twitter

Read on Twitter