1/ $GS, "the great vampire squid wrapped around the face of humanity," now says $TSLA is worth $740BN, or 3.5x the value of Toyota (whose CEO was never charged for stock manipulation).

"Prostitution is the oldest profession in the world." $GS proves it w/ this $TSLA report.

"Prostitution is the oldest profession in the world." $GS proves it w/ this $TSLA report.

2/ $GS logic for $TSLA's $740bn fair value:

Tesla's 2040 deliveries = 15m units/yr via 15-20% share of the global EV market.

Fact check:

-No carmaker has 15% share of the global market

-Tesla's China EV mkt share = only 16% YTD

-China had less EV competition than EU in 2020

Tesla's 2040 deliveries = 15m units/yr via 15-20% share of the global EV market.

Fact check:

-No carmaker has 15% share of the global market

-Tesla's China EV mkt share = only 16% YTD

-China had less EV competition than EU in 2020

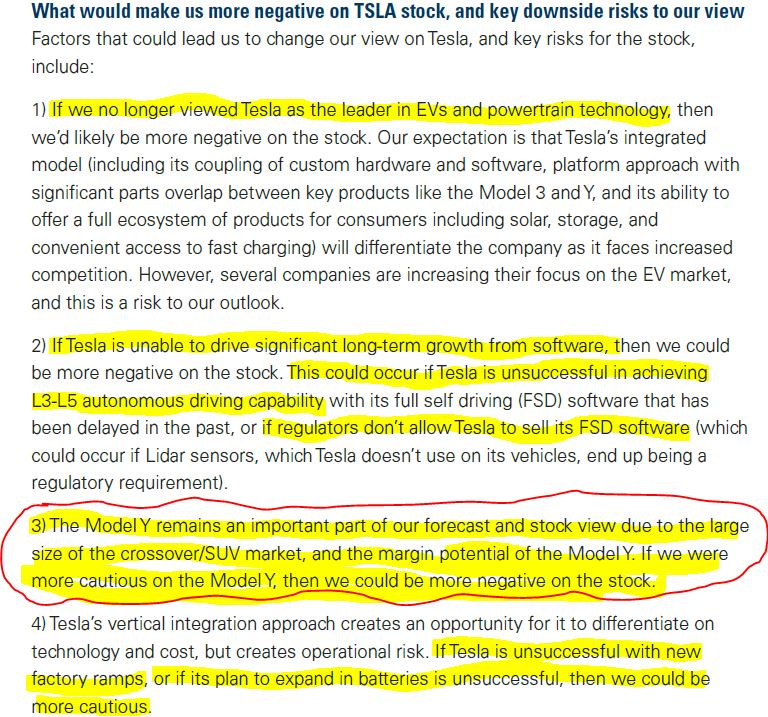

3/ Always read the "Risk" section:

-$GS views the Model Y as the biggest risk

-Tesla cut the MY price by $3K only 3 months post launch

-$GS applauds Tesla's EV & powertrain tech. Rivals laugh

-If FSD doesn't reach L3-L5 capability, $GS says "risk"

Sounds like my "short" thesis

-$GS views the Model Y as the biggest risk

-Tesla cut the MY price by $3K only 3 months post launch

-$GS applauds Tesla's EV & powertrain tech. Rivals laugh

-If FSD doesn't reach L3-L5 capability, $GS says "risk"

Sounds like my "short" thesis

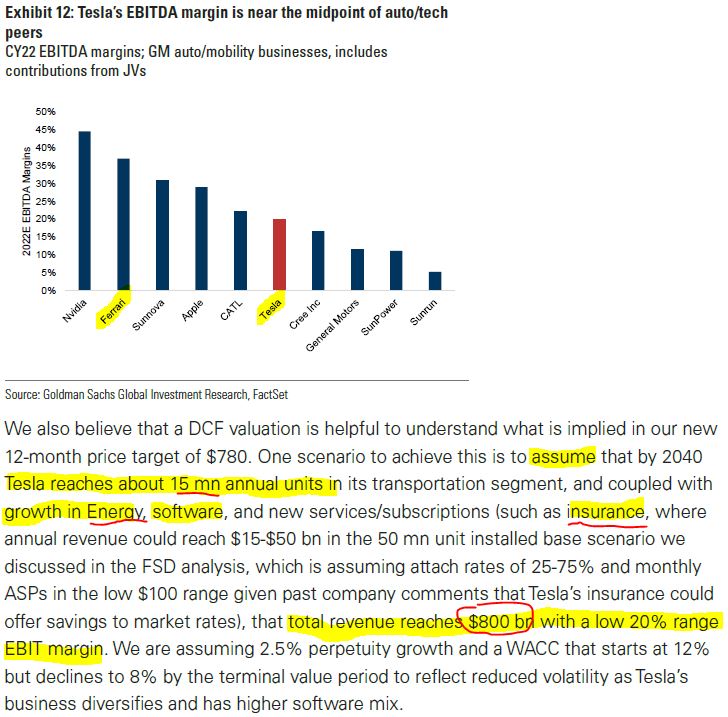

4/ When you have to use DCF for cyclical stocks, you're grabbing for straws.

Especially so when it includes "Frankenstein" divisions like Tesla's "Energy" & "Insurance" businesses.

$GS obviously can't find enough value in Tesla's auto business.

Especially so when it includes "Frankenstein" divisions like Tesla's "Energy" & "Insurance" businesses.

$GS obviously can't find enough value in Tesla's auto business.

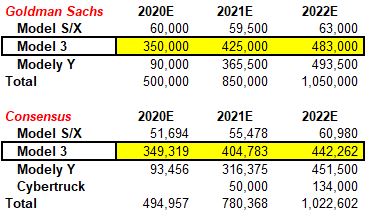

5/ $GS is telling clients to buy $TSLA after it's up 800% in the past 12 months.

Yet, they don't publish their earnings model.

I had to extrapolate their delivery estimates via the text.

Note the Model 3 assumptions. That's every bull's downfall in 2021.

$TSLAQ

Yet, they don't publish their earnings model.

I had to extrapolate their delivery estimates via the text.

Note the Model 3 assumptions. That's every bull's downfall in 2021.

$TSLAQ

Read on Twitter

Read on Twitter