Ignore the diplomatic angst and wine embargoes. Australia's trade with China is booming, and exports will hit a record (again) next year: https://www.bloomberg.com/opinion/articles/2020-12-03/aussie-is-soaring-despite-australia-china-trade-dispute

That's largely because the two countries are stuck in a codependent relationship with China's dirty industrial stimulus.

As this report from @laurimyllyvirta points out, China's steel-and-cement machine is running as hot as it ever has: https://twitter.com/CarbonBrief/status/1334331784813744135?s=20

As this report from @laurimyllyvirta points out, China's steel-and-cement machine is running as hot as it ever has: https://twitter.com/CarbonBrief/status/1334331784813744135?s=20

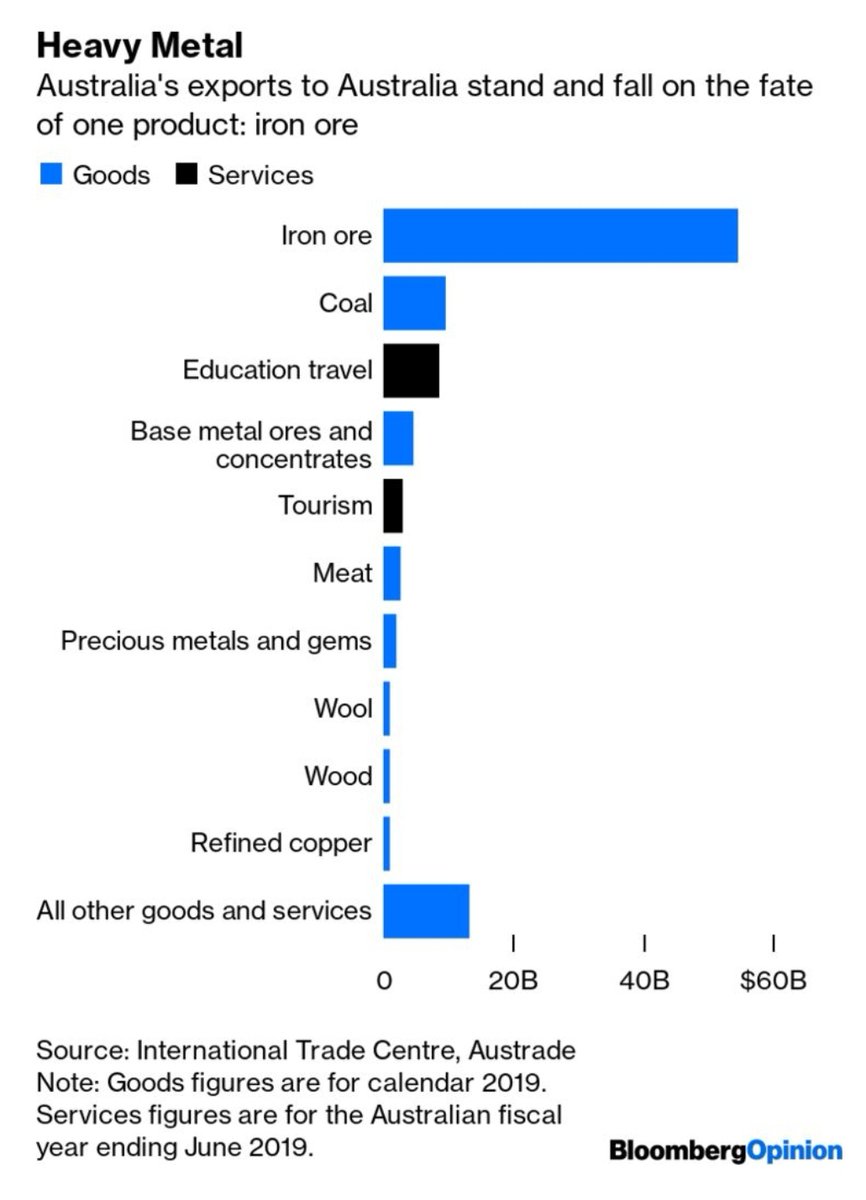

Engineering spending is going to keep accelerating well into next year, according to Fitch, while Vale is forecasting lower-than-expected iron ore output. That's all bullish for steel, which is half of Australia's exports to China.

You can add some other categories of exports there, too. As the coronavirus recedes, international education will recover from a low base. About 25,000 Chinese students who'd normally be in Australia are back home because of the cordon sanitaire:

I have a strong prior that these Chinese trade spats always end up as molehills made into mountains. Here's what I wrote when the latest one was kicking off two months ago: https://www.bloomberg.com/opinion/articles/2020-10-13/china-is-unlikely-to-carry-out-its-threat-to-ban-australian-coal

To be honest, I've started to wonder this time round if this was finally The Real Thing but already we're seeing signs that China is starting to let cargoes through, so IMO the prior still holds for now.

I don't say this with any satisfaction. The thing that's holding the China-Australia trade relationship together is an unbalanced Chinese economic model that's spewing carbon emissions and undermining China's own long-run growth.

It's the opposite of good news. But it is what it is, and I think it gives the lie to fears that diplomatic tensions will kill off Australian exports. There's a reason the Aussie dollar hit a two-year high today.

Read on Twitter

Read on Twitter