Special and rare to see massive companies, with all their institutional inertia, pivot and self-disrupt in real time. $DIS with Disney+ in the spotlight recently. But more under the radar is Philip Morris International self-disrupting in the … tobacco industry! $PM

Five years ago $PM announced an ambitious goal to stop selling combustible cigarettes (its only product!) and focus instead on burn-free products. Enter iQOS, a slick-looking heated tobacco product that they put years of R&D and marketing dollars behind.

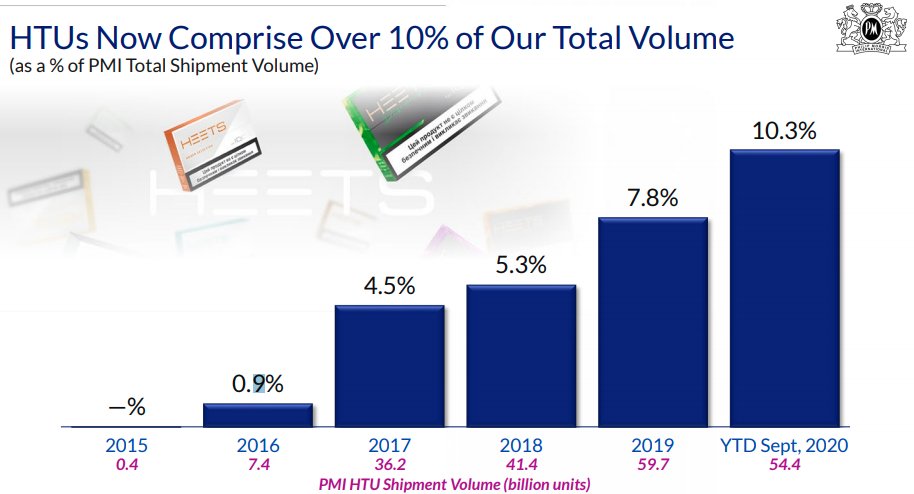

Fast forward to 2020, iQOS has a 60% market share of global “reduced risk products” w/ accelerating growth. It’s cannibalizing $PM's own combustible cigarette sales, to reach 10% of shipment volumes w/ 30% YoY in-market growth as of Q3 2020 while combustible sales drop c. -9%.

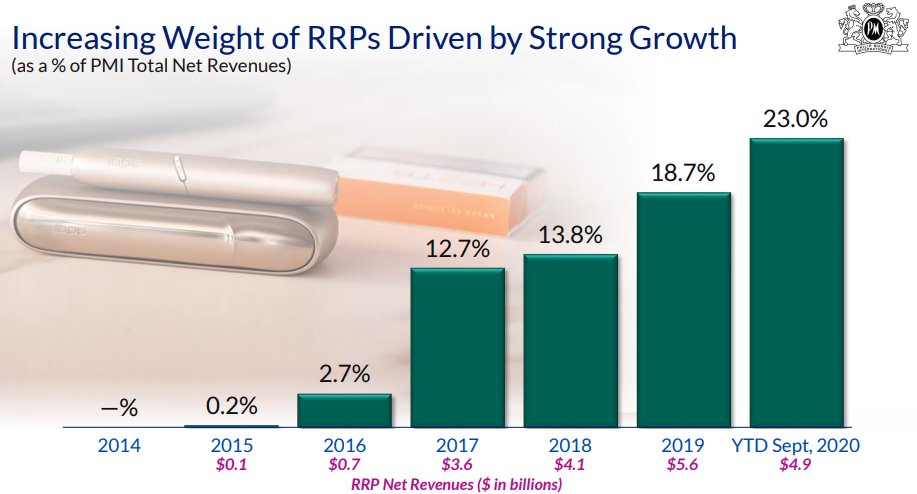

Reduced risk products generate higher sales per unit than conventional cigarettes, so the 10% share of volume translates to a 23% share of net revenue.

Mgmt are only accelerating this self-disruption in the future w/clear ambitions in vaping and nicotine pouches as well as enriching their iQOS offering.

Questions remain abt ultimate market size and true penetration potential of RRP but, so far, the strategy seems to be working. $PM saw the mkt trends early, mgmt acknowledged they were facing their own “Kodak moment”, and made tough decisions to pivot the biz.

Read on Twitter

Read on Twitter