The Fat Ta(i)le of Three Years: a study of returns after high standard deviation events

The characters.

2017: The Year of the Glutton.

2019: The Year of the Butcher.

2020: The Year of the Dip.

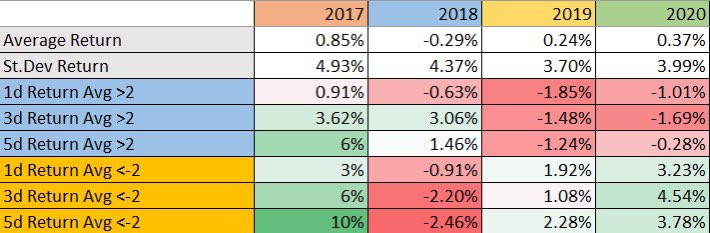

The plot. Measure >2 and <-2 st. dev readings and their 1/3/5 day returns.

The characters.

2017: The Year of the Glutton.

2019: The Year of the Butcher.

2020: The Year of the Dip.

The plot. Measure >2 and <-2 st. dev readings and their 1/3/5 day returns.

The tools.

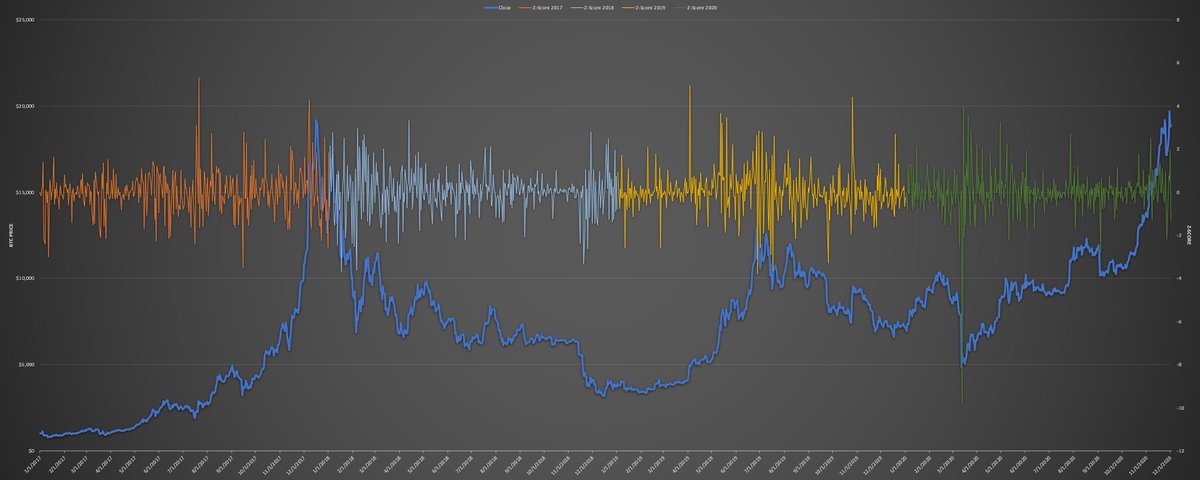

Z-score bucketed by year. What is z-score?

Z-score tells you how far away from the mean the current data point is. For this study we’re looking at instances of >2 or -2, or two standard deviations away.

When crazy shit starts to happen.

Z-score bucketed by year. What is z-score?

Z-score tells you how far away from the mean the current data point is. For this study we’re looking at instances of >2 or -2, or two standard deviations away.

When crazy shit starts to happen.

2017: The Year of the Glutton.

It didn’t really matter what you did in 2017. If you bought after a >2 event and held for one day only, you’d average a 0.91% return. That’s crazy after some of the gains that year.

As you go down the list the stats only get better. Logically...

It didn’t really matter what you did in 2017. If you bought after a >2 event and held for one day only, you’d average a 0.91% return. That’s crazy after some of the gains that year.

As you go down the list the stats only get better. Logically...

...it makes sense. Any flash crashes in 2017 were eagerly bought up. If you bought after every -2 and under stdev event, you’d average between 3-10% gains in under a week hold time. Not bad if you didn’t want to tie up capital for a longer hold.

2018. I didn’t have a great title for 2018, and it was a weird year coming off a euphoric high. Buying after a crash only gave negative returns, and pumps barely gave any follow through. Sad. Let’s forget it happened.

2019: The Year of the Butcher.

What a sexy distribution.

Every pump was sold. Every dump was purchased.

This is what I’d expect from a meat grinder of a year. Despite showing incredible overall returns that year from its lows...

What a sexy distribution.

Every pump was sold. Every dump was purchased.

This is what I’d expect from a meat grinder of a year. Despite showing incredible overall returns that year from its lows...

... any stdev events in 2019 were great opportunities to reduce exposure >2 and buy more <-2.

2020: The Year of the Dip.

Despite the ides of March, this year’s returns are a testimony to strong hands. Any >2 days barely sold off on average, and <-2 were gobbled up, showing immediate and steady returns of ~4% across the 1/3/5d follow up.

Despite the ides of March, this year’s returns are a testimony to strong hands. Any >2 days barely sold off on average, and <-2 were gobbled up, showing immediate and steady returns of ~4% across the 1/3/5d follow up.

Despite being just an average of returns after a specific event, this study does a good job describing the tempo and mood of each year, and even the risk appetite of its participants. I know we talk a lot about institutional presence and see a lot of chatter on Twitter...

Read on Twitter

Read on Twitter